The corporate chart of accounts is an important document that helps record business transactions within Italy’s accounting system. Setting the document up correctly ensures transparent and accurate accounting records, making financial management and regulatory compliance easier. This article explains what a corporate chart of accounts is, what its benefits are, and how it is structured.

What’s in this article?

- What is a corporate chart of accounts?

- What is the purpose of the corporate chart of accounts?

- How are corporate charts of accounts structured?

- Considerations before creating a corporate chart of accounts

What is a corporate chart of accounts?

The corporate chart of accounts is a list of items the business uses to record transactions throughout the fiscal year. Transactions include activities such as recording purchase and sales invoices, receipts, payments, depreciation, salary payments, and similar information. Businesses document these items using a double-entry system. The corporate chart of accounts is important for a business because it forms the basis of its accounting system.

The tax authority does not regulate corporate charts of accounts, unlike financial statements, which must follow the same rules for all businesses, governed by Article 2423 and the following ones of the Italian Civil Code. As a result, a business can customise a corporate chart to meet the needs of each business, which can differ based on:

- Legal form

- Economic activity

- Size

However, the corporate chart of accounts must align with the specific structure of the European Union’s balance sheet format, as Directive 2013/34/EU requires.

What is the purpose of the corporate chart of accounts?

The main purpose of the corporate chart of accounts is to give the entrepreneur detailed analytical information about the business’s economic and financial activities, which can be elaborated on if needed. This information is useful mainly to:

- Enable double-entry bookkeeping

- Simplify the preparation of the annual financial statements

- Calculate income

- Manage the obligations related to tax returns and tax payments

- Carry out operational reconciliations

How are corporate charts of accounts structured?

As stated, there is no universally standardised chart of accounts, so it might vary for each business; however, there are general principles for establishing a proper accounting structure.

Corporate charts of accounts can be organised into two main categories:

- Balance sheet accounts: To manage capital and financial transactions, which the business will reflect in the balance sheet. Examples include accounts receivable, accounts payable, cash, bank accounts, fixed assets, and inventories.

- Income accounts: To manage economic transactions, which a business will record in the income statement. Examples include production costs such as raw materials, service and personnel costs, depreciation and amortisation, and revenue from the sale of goods and services.

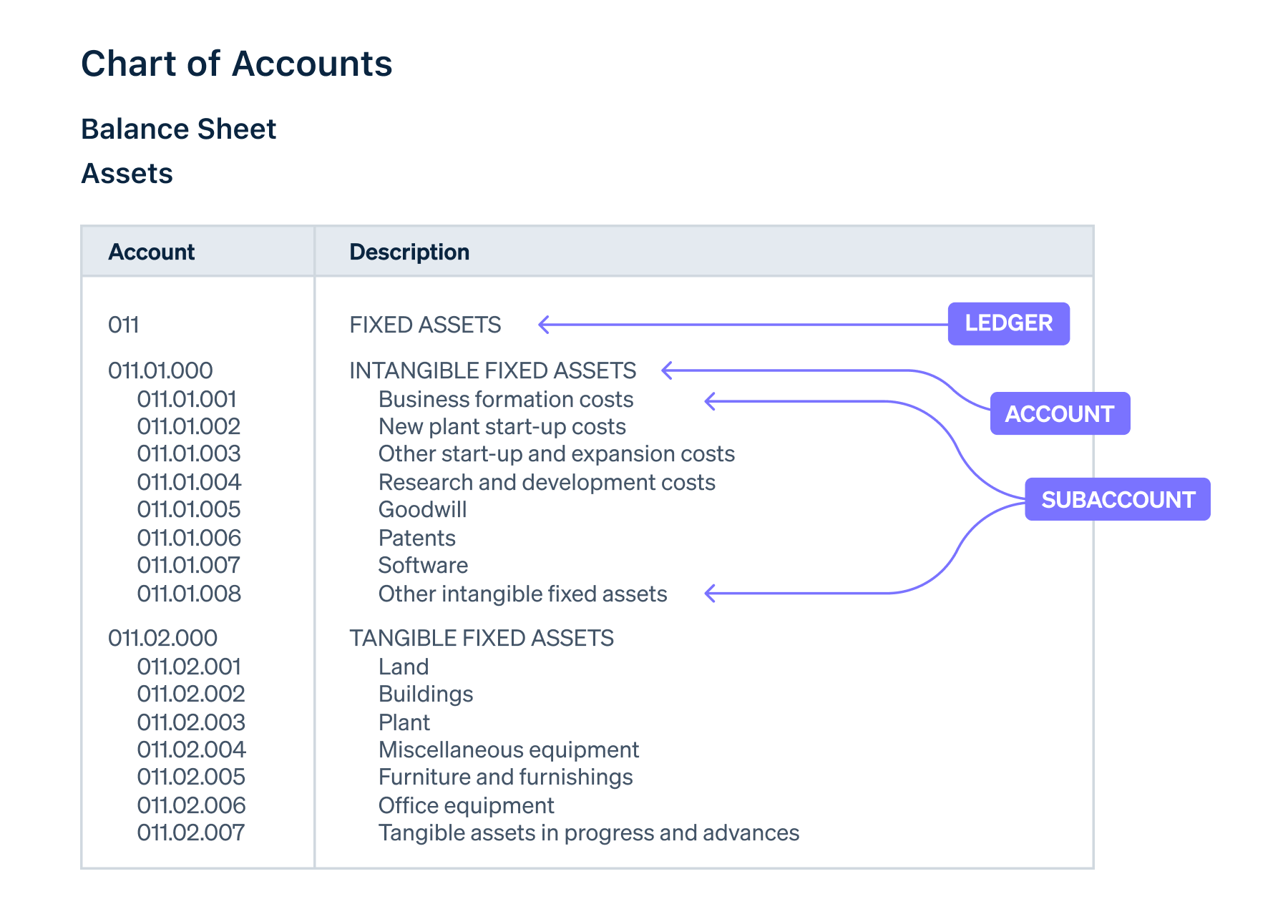

In the document, businesses organise accounts in a hierarchy, starting at the broadest level and going to more detailed levels. Typically, business use a structure with at least three levels:

- Ledger: The first level, grouping together accounts that are similar.

- Accounts: The second level of grouping, which includes summary accounts.

- Sub-accounts: The third level, consisting of detailed and analytical accounts used in the accounting records.

Each item in the chart of accounts gets assigned a title that describes its purpose, along with a unique accounting code (numeric, alphabetical, or alphanumeric) to make identification within the corporate accounting system easier.

Example of a corporate chart of accounts

Here is an example of a chart of accounts with its breakdown into ledger, accounts, and sub-accounts:

Another component of a corporate chart of accounts are explanatory notes, which offer clarification on how the sub-accounts function and explain the meaning of the values they hold.

Inputs for the corporate chart of accounts

It is also important to consider the two ways in which a business can populate its chart of accounts:

- Transaction input: The business updates the account each time an accounting event takes place.

- Balance input: The business updates the account based on inventory assessments at a specified date.

A range of software tools can help businesses manage their accounting. Some tools help you automate the invoicing process, such as Stripe Invoicing, a comprehensive and flexible invoicing platform that lets you create and send one-time and recurring payment invoices without writing a single line of code. With Stripe Invoicing, you can save time and get faster payments – 87% of Stripe invoices are collected within 24 hours. Thanks to collaboration with third-party partners, you can also use Stripe Invoicing for electronic invoicing.

Considerations before creating a corporate chart of accounts

Before creating the chart of accounts, assess several factors to ensure you are able to tailor the structure to your business’s needs. The structure should be flexible enough to accommodate changes in your business, allowing for the addition of accounts if needed. Properly structuring a chart of accounts helps minimise errors and ensures the accuracy of financial statements.

There are various options for creating a chart of accounts, largely depending on the size of the business. For small businesses, a standard chart of accounts is usually sufficient, whereas larger businesses might require a customised chart of accounts to meet their needs.

Before creating your corporate chart of accounts, be sure to analyse your business to determine, for example:

- What does your business do? Do you sell products, services, or both?

- What are the characteristics of your products/services? Can you divide them into categories? Or by customer type (business-to-consumer [B2C] or business-to-business [B2B])?

- What are your business costs?

- How is your business structured? Do you have outlets?

- Do you have employees? How many? Do they belong to different categories?

Then it’s important to understand your business’s information needs, such as identifying who (e.g., administrative and budget offices) receives accounting information and how they will use it, whether for statutory financial statements, consolidated financial statements, tax compliance, or operational balances. Only after you have determined these aspects can you define the structure of your chart of corporate accounts, including the types of accounts you will use, their grouping, and the methods for populating them.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.