SCA, invoicing, and tax tools for Stripe Billing

Since our launch last April, we’ve seen a wide range of businesses use Stripe Billing to manage their recurring revenue and send invoices, including European businesses like Deliveroo, Front, Channel 4, Shadow, and Typeform. Today, we’re launching new features for Stripe Billing to help recurring revenue businesses in Europe expand internationally and minimise the impact of upcoming Strong Customer Authentication (SCA) regulatory requirements.

Minimise churn with SCA-ready tools

SCA requirements go into effect in September 2019 and will require additional authentication for many European online payments. This will be particularly challenging for recurring revenue businesses because most subscription payments are processed automatically using stored payment information. When these payments require SCA, businesses will need to contact their subscribers and ask them to provide two-factor authentication (i.e. they may need to enter a password or verify the payment on their phone). Banks will begin to decline payments that have not collected this additional authentication when it’s required.

Stripe Billing makes meeting these new requirements easier in a few ways:

- If a recurring charge requires SCA, Stripe Billing can now email subscribers automatically with a link to complete two-factor authentication via 3D Secure 2. These emails can be customised to match your brand. (Soon, you’ll also be able to send them from your own domain.)

- For invoice payments that require SCA, Stripe Billing’s hosted invoice page will now prompt cardholders for two-factor authentication automatically—no changes required by your business.

Under the hood, these new features take advantage of Stripe’s new Payment Intents API, which allows us to automatically apply any SCA exemptions available for a given payment. Our goal is to help you comply with SCA requirements while minimising the number of charges requiring additional authentication.

Send customised and compliant invoices in multiple languages

When scaling internationally, it can be challenging for recurring revenue businesses to comply with local accounting rules and meet global customer expectations. These challenges are much more complicated for B2B businesses that sign custom pricing deals and send invoices for manual payment. To help make international invoicing easier, we’ve made our invoices much more flexible:

- In addition to matching the logo and colour scheme of the invoice to your brand, Stripe Billing now lets you add memos, footers, and custom fields to your invoices.

- Sequential and unique invoice numbers can be customised with a customer prefix.

- Credit notes can be issued to refund an invoice or reduce the amount owed.

- Invoices can now be sent in 13 different languages: French, German, Spanish, Italian, Dutch, Danish, Swedish, Finnish, Norwegian, Hebrew, Arabic, and Japanese, as well as English.

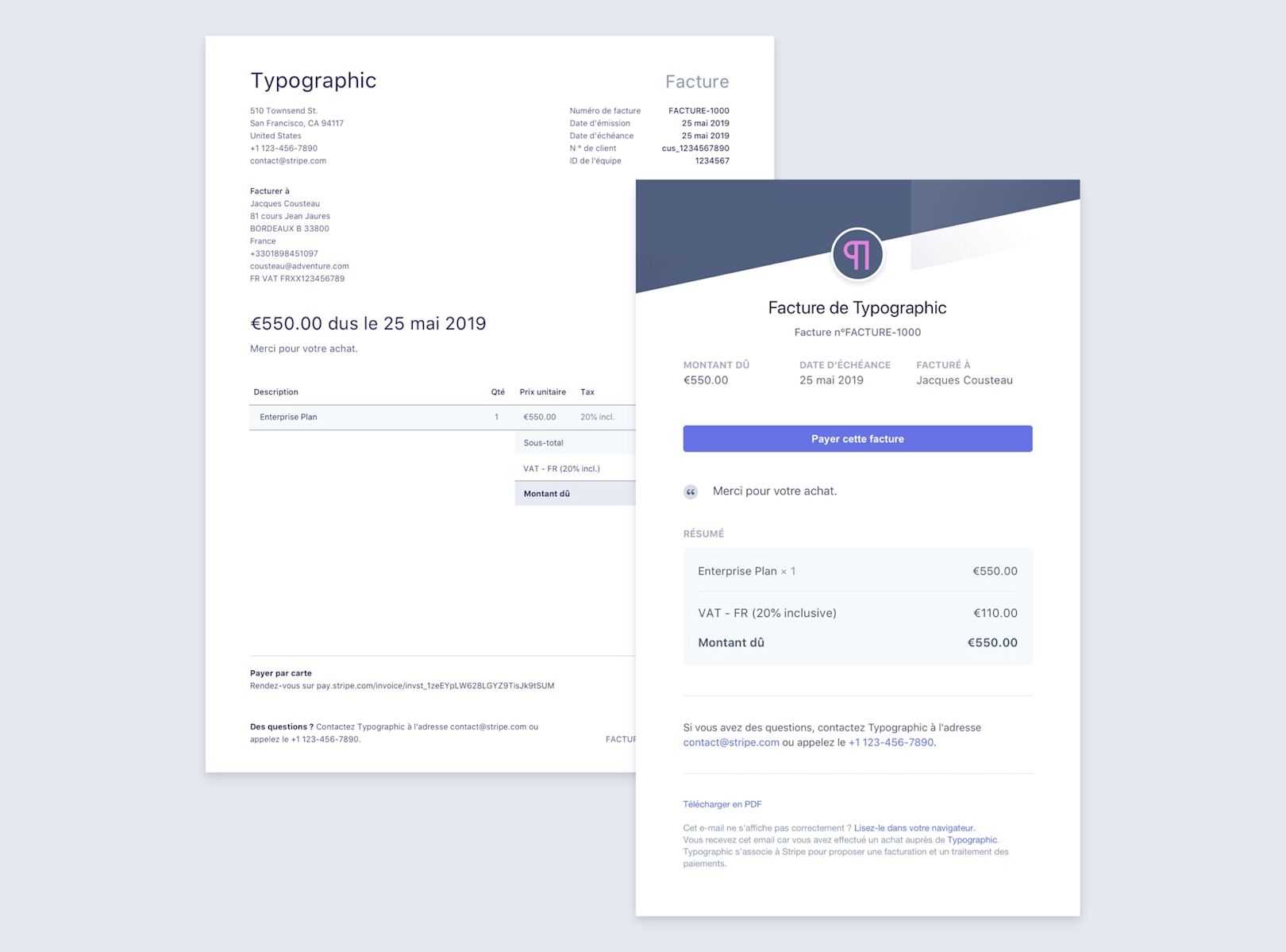

PDF and hosted invoices in French

Collect and report on VAT without leaving the Dashboard

We’ve added a new tax rates feature to help businesses collect the right amount of tax and remit it to the government.

You can now create inclusive or exclusive tax rates for VAT, GST, and US sales tax for different jurisdictions. These tax rates can then be applied to individual invoice line items, invoice subtotals, or all of the invoices for a subscription. Invoices can also now display the customer’s tax ID and Stripe Billing now automatically validates EU VAT numbers to make sure they are correct. As you’d expect, CSV reports detailing which tax rates were applied and how much tax was collected can be downloaded from the Dashboard.

To get started with Stripe Billing, visit the overview—you can use all of these new features either from the Dashboard or via the API. If you’re already using Stripe Billing and want to learn more about updating your integration to be SCA-ready, we’ve put together a short migration guide.

We’ll continue to add more features to Stripe Billing to help you manage the complexity of running a global business.