本指南涵盖定期开单的基本知识,包括如何管理订阅、开单解决方案的工作原理,以及如何节省时间并收回更多收入。

1.简介

2.经常性收入的基础知识

3.开单解决方案如何运作

4. Stripe 能提供什么帮助

经常性收入能带来增长和参与度,改善现金流,降低客户获取成本,并简化运营。每年都有更多的在线公司采用经常性收入模式——事实上,在过去的一年里,有数万企业加入了 Stripe 来管理他们的在线经常性收入。

要管理经常性付款,公司必须建立或集成开单系统。虽然开单系统是运营重复性收费客户关系的基础架构,但如果操作得当,它也可以成为企业的基本组成部分,对建立客户忠诚度和增加收入至关重要。

建立自己的开单系统不仅复杂度过高,且成本效益低下。例如,您需要确保您能基于定价模式(如统一定价或分层定价)正确地向客户开单,在客户的整个生命周期(如升级和续订)内管理账单和按比例分配,通过免费试用和折扣推动客户获取和续订,并支持客户喜欢使用的任何支付方式。

在本指南中,您将了解定期开单的基础知识。我们将介绍如何管理订阅、开单解决方案的工作原理以及 Stripe 可以提供哪些帮助。您还将了解 Postmates、Noom、Deliveroo 和 eero 等公司如何管理定期开单,以节省时间并收回更多收入。

经常性收入的基本原理是什么?

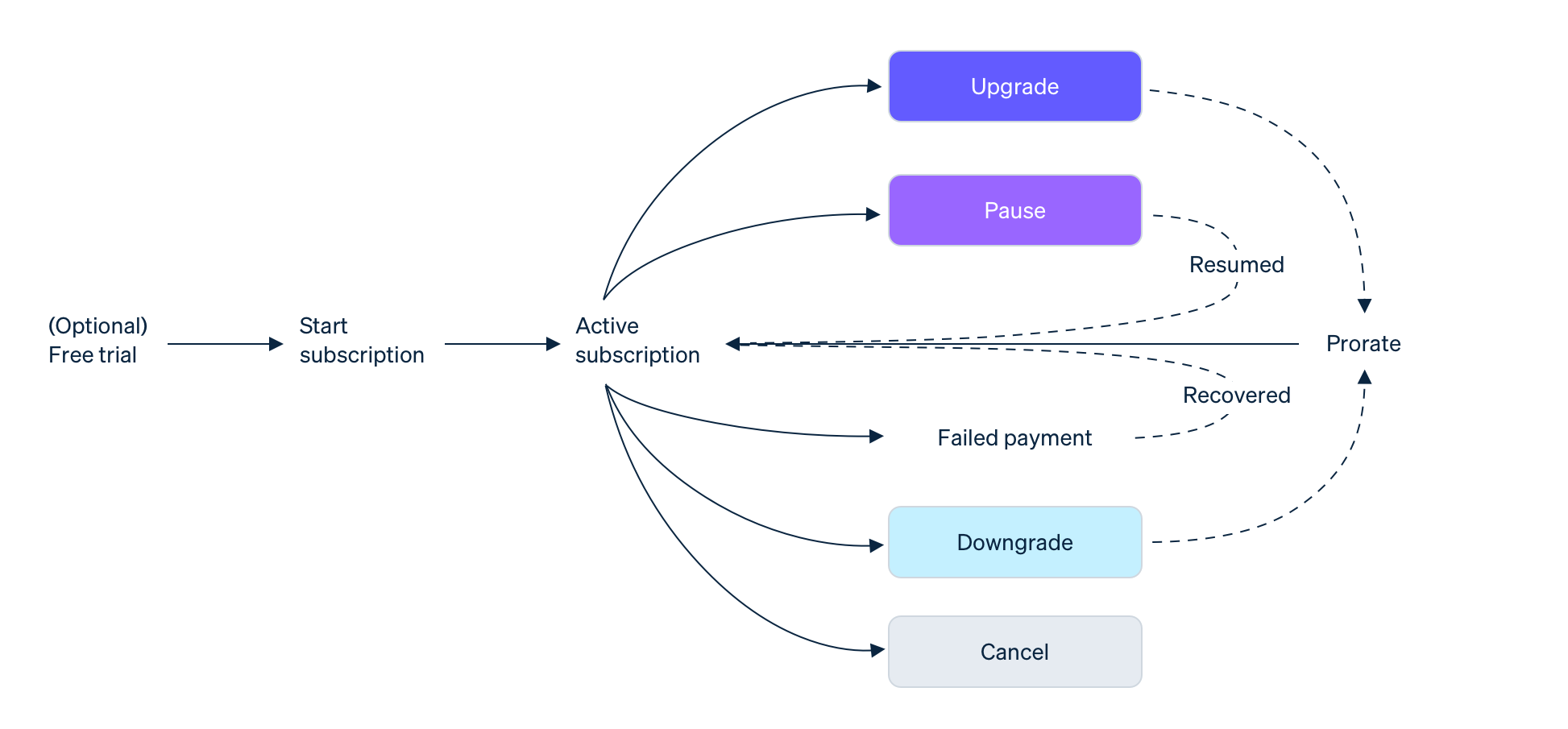

要利用经常性收入的优势,您需要一种方法来创建订阅方案,并在客户关系存续过程中对其进行管理。这意味着要收集信息,以便在正确的时间以正确的价格向客户准确地开具账单。

这还意味着要适应整个订阅生命周期,在客户升级、降级、暂停、续订或取消时调整定价和方案条款。您的开单系统还应考虑到客户随时更改方案的情况。如果有人想在月中换成更便宜的方案,您就必须按比例分配这两个方案的费用,并确保今后将向客户收取正确的费用。

任何开单系统都不仅会处理客户的首次支付,还会安全可靠地存储其支付信息,并在每次账单到期时重复使用这些信息。如能重复使用客户的支付凭证,便可以按照自定义计划发起付款,无需客户进行任何操作。银行卡、钱包和银行借记付款都可以重复使用——客户只需提供一次卡号或银行账户详情。

为了重复使用经常性付款交易的支付详情,事先征得客户的同意至关重要。定期开单系统会让客户无缝同意至少包括以下内容的条款:

允许代表他们发起一系列支付

支付频率

关于如何确定支付金额的详细信息

此外,还有法律法规对企业在用户首次注册时需收集哪些信息以处理重复性收费作出规定。例如,强客户认证 (SCA) 要求企业在欧洲对许多网上购物交易采用双重验证(如 3D 安全验证)进行核实。

优秀的账单系统还具有足够的灵活性,能够满足企业在扩大规模时不断变化的需求。为了生产越来越多的原创内容,经常性业务会根据竞争情况、客户支付意愿的变化以及对产品的投资情况,定期对包装和定价进行调整。为了实现这些变化,企业希望通过开单系统,将用户从旧方案迁移到新方案。

定期开单解决方案如何运作?

定期开单系统有助于自动处理经常性付款关系的每个环节,从定期向客户扣款到在理想时间重试处理逾期付款。

许多企业试图自行构建订阅和开单管理软件,但低估了长期的复杂性和成本。自建解决方案需要持续维护,以支持新产品发布、商业模式、定价实验、全球扩张、监管要求变化,以及企业发展过程中的其他一系列挑战。

预构建的开单解决方案能让您即刻开始使用,同时还具备可扩展的灵活性与功能特性,可为您的规模扩大提供有力支持。

尽管任何开单解决方案都应具备可定制性,但它也应能处理以下六项基本任务。

1.接受订单

您的开单解决方案应与购买流程无缝集成,支持您开具报价单或发票,并能通过线上、线下或移动设备等多种渠道接收订单。若新客户通过网页或移动端结账页面完成订阅,开单系统可通过 API 接口自动创建订阅。而若需手动创建订阅,开单系统则应与管理平台相连,方便您直接输入详细信息。

它还应支持您当前的销售模式以及未来可能出现的任何商业模式。例如,审视您目前的销售策略:是由销售团队负责新用户拓展与续约管理,还是产品或服务通过线上自助模式销售?您的产品是固定的几款标准产品,还是大部分订单都需要定制?您的开单解决方案应既能满足当前这些需求,又能随着业务规模扩大持续适配。

2. 设置灵活的开单逻辑

订阅逻辑包括基于时间和基于价格的规则,通过预定的时间周期向客户准确扣款。如果您只有一个产品和固定定价,例如软件订阅费每月 25 美元,那么在您的开单系统中可以很容易地设置这个逻辑,因为金额是固定的。

然而,网上企业很少是简单或一成不变的。开单系统需要有足够的动态性,以应对企业不可避免的、有时突如其来的变化。理想的开单解决方案应能让您灵活地尝试不同的定价模式,如基于用量的开单,即根据客户每月使用多少千兆字节的存储空间或活跃用户的数量来更改开单。您还可以尝试分层定价,根据客户选择的套餐特性收取不同的价格。

为了应对新的竞争威胁或客户需求,您的开单系统应允许您测试促销折扣或推出免费试用。您可能还想设置订阅计划,向客户收取入门费,然后在设定的几个开单周期后自动更改价格。企业或经济状况也可能会发生意想不到的变化,因此,如果客户需要休息或无法提供服务,能够暂停订阅也很重要。

设置灵活的开单逻辑

随着时间的推移,您甚至可以推出一个新的产品或服务定价等级,以创造额外的收入来源。按需送餐服务 Deliveroo 就是这样做的。在 Stripe 的帮助下,他们推出了Deliveroo Plus,只需支付月订阅费用即可享受免费送餐服务。除了增加经常性收入外,Deliveroo Plus 还提高了采用新服务的用户的留存率。

3. 收款

客户期望获得相关且熟悉的支付体验,而且支付流程越简便,促成销售的可能性就越大。对于基于订阅的商业模式而言,企业通常会在结账时收集信用卡信息,然后在后台每月自动扣款。不过,您还应确保自己的开单解决方案支持多种支付方式,比如 ACH 信用转账、ACH 借记转账、支票、数字钱包和银行转账等。

根据客户偏好自定义支付方式很重要。例如,考虑支持银行转账,以便客户可以轻松安全地进行大额付款。或者,为了向全球扩张,您可以提供以当地货币支付的付款方式,就像 Noom 所做的那样。在德国,该数字健康平台发现,与信用卡相比,客户更青睐直接借记。借助 Stripe,Noom 可以轻松接受这种流行的支付方式,测试不同的本地支付方式,并为全球客户提供更大的支付灵活性。

4. 增加收入

大多数 SaaS 和订阅公司都面临非自愿流失问题,即客户打算支付产品费用,但由于银行卡过期、资金不足或银行卡信息过期而导致支付失败。事实上,非自愿流失占客户流失的 25%。

有了开单解决方案,您就可以建立自动化系统,降低非自愿流失率。您可以在银行卡过期或拒付时自动发送电子邮件。开单系统还可以更新过期银行卡,并按照客户自定义的时间表(例如每七天一次)自动重试处理失败的交易,以提高成功支付的几率。

在线配送交易市场 Postmates 与 Stripe 合作降低非自愿客户流失率,实现了超 6300 万美元的收入增长。借助 Stripe 的银行卡账户更新器 (CAU),Postmates 平台上超过 200 万张过期或更换的客户卡片信息得到了自动更新,由此带来了 6000 万美元的收入。此外,Stripe Billing 的 Smart Retries 功能还成功挽回了 20 多万笔原本失败的支付交易,额外增加了 300 万美元的收入。

您的开单系统在减少自愿流失方面也发挥着重要作用。如果用户想更改支付方式、查看开单历史记录,甚至想结束订阅,专门的门户网站或管理平台应能提供方便。为了提高留存率,同一门户网站可以基于客户的取消原因,动态地为客户提供其他选择。例如,如果客户认为您的价格过高,您可以鼓励他们降级选择更便宜的方案或暂停订阅。

5. 与内部系统集成

您的开单解决方案应作为客户生命周期的正式记录,使您能够基于用户活动做出关键的企业决策。例如,您可以在发生新订阅、支付或取消时自动通知其他内部系统,基于方案变更按比例分配账单,以及配置规则以自动或手动续订客户订阅。

为了覆盖整个客户生命周期,您的开单系统需要与其他现有工作流程集成,特别是与 Xero、QuickBooks 等会计系统和 ERP 解决方案集成。

eero 是一家 WiFi 硬件与软件公司,该公司将 Stripe Billing 与 NetSuite 集成后,月末结账时间节省了 50% 以上。他们采用了 Stripe 与 NetSuite 的预构建集成方案,该方案可自动将 Stripe 数据与 NetSuite 总账同步,实现快速便捷的对账。

6. 监控关键业务指标

开单软件负责管理客户关系,是了解客户和企业的重要来源。为了满足公司的报告和监管合规需求,任何开单系统都应全面呈现订阅数据。它应提供自动报告和管理平台,以创建有关收入的单一真实来源,消除运营摩擦,使每个人都能识别洞见和趋势。

从根本上说,开单系统的报告应允许您监控以下这些关键指标:

SaaS 指标,如每月经常性收入 (MRR)、流失率和终身价值 (LTV)

订阅分析,如净增客户、扩展、试用和队列分析

恢复和流失分析,如恢复的收入

Stripe 能提供哪些帮助

Stripe Billing 是管理订阅的最灵活方式。您可以立即收取一次性或经常性付款,并通过我们的 API 或直接在管理平台中测试和推出更改。

快速上手:几分钟内即可开始接受经常性付款。使用 Stripe Invoicing 在线创建和发送发票。向现有客户收款,或共享支付链接以销售订阅——无代码。使用 Stripe 托管的预建页面,让客户快速、轻松地订阅并管理他们的订阅和开单详情。

支持任何开单模式: Stripe Billing 提供灵活的开单逻辑,从每席位定价到计量开单,一应俱全。此外还内置了对优惠券、免费试用、按比例分配、附加项和超额费用的支持。

收取更多收入: Stripe 利用来自整个 Stripe 网络的数百万个数据信号,在支付最有可能成功时重试处理失败的支付。此外,Stripe 还凭借与卡组织的直接合作关系,使用户支付信息中的新卡号或有效期等详情能得到及时更新。2019 年,Stripe Billing 平均帮助企业追回了 41% 的失败发票款项。

优化运营: 通过自动生成的报告了解您的增长、流失率和保留率。将账单和支付数据与其他工作流程轻松同步。