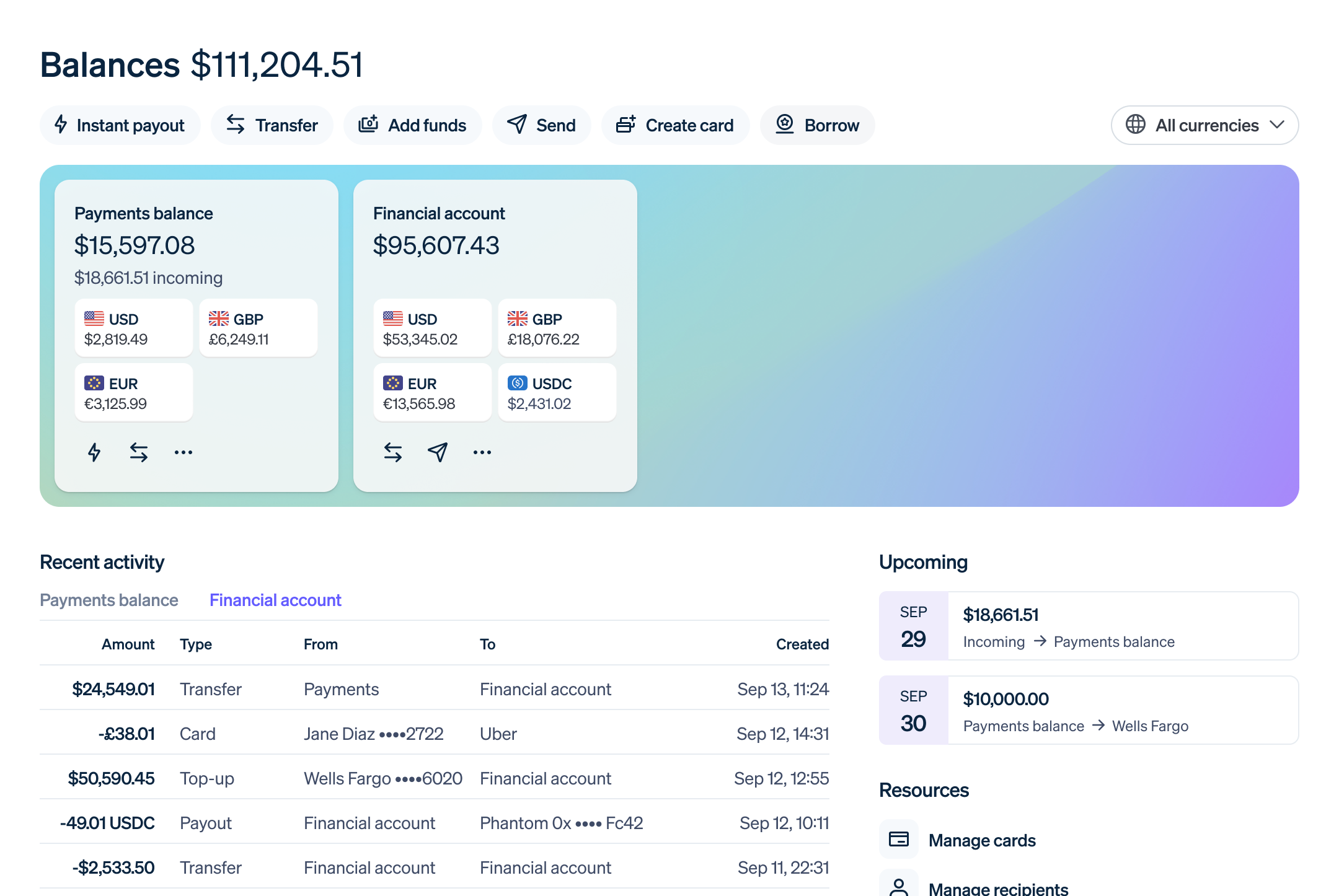

One business account for all your financial needs

Use a global financial account to send money, manage spend, and access stablecoins. Get started in minutes—no monthly fees or minimum balance required.

Financial account

Convert currencies

Send

Simplify money management

Manage payments and finances in a single dashboard, and integrate with finance software to close your books faster.

Access funds instantly

Open an account in minutes and access your settled earnings instantly—regardless of bank holidays or weekend closures.

Manage money like a local

Store multiple currencies, open local accounts, and access dollar-backed stablecoins in 100+ countries.

Keep your funds secure

Mitigate risk with added security through FDIC insurance eligibility that covers funds up to $250K.*

How Financial Accounts work

Turn Stripe into your financial home and do more with your money.

Your financial hub

Powerful payments. Simplified finances.

Store funds, convert currencies, use spend cards, send payouts, and expand your reach with stablecoins—right from the Stripe Dashboard. Get started in minutes by transferring from your Stripe balance or adding funds directly from your bank account.

Manage business finances

Store, send, spend, and borrow—all in one place

Simplify spend management

Create virtual and physical cards right from the Dashboard, with flexible spend controls and real-time reporting. Fund cards directly from your account without waiting for external transfers.

Send money to anyone, anywhere

Pay anyone in their local currency in minutes with no-code payouts, or send money at scale with flexible APIs. Verify recipients in seconds and automatically link bank details.

Expand globally, operate locally

Open local accounts to lock in mid-market rates and convert currencies instantly, or go borderless with stablecoin-backed balances in 100+ countries.

Access fast, flexible financing

Get the funds you need without the complexity. Apply for business loans in a few clicks and get funds in your financial account as soon as the next business day.

Stablecoins

Unlock new markets in 100+ countries

Expand your reach and reduce cross-border costs by sending and spending funds using dollar-backed stablecoins. Get the stability of traditional currencies plus the speed and accessibility of stablecoins without worrying about blockchain complexity, liquidity management, or weeks of integration work.

Seamless accounting integrations

Connect your accounting software to automatically import transactions, improve financial insights, and close your books faster. Sync data in real time directly from the Stripe Dashboard with Xero and QuickBooks Sync by Acodei.

Ready to do more with your money?

Access powerful tools to manage payments and finances. Check out the documentation or log in to your Stripe account to add funds to your financial account.

Financial Accounts for platforms

Give your customers the ability to store funds, send money, and create cards directly on your platform or marketplace.