In France, a société par actions (SPA) is a commercial company designed to generate and distribute profits among its shareholders. It has multiple legal forms. In this article, we’ll explore these legal forms, as well as the SPA’s main characteristics, its purpose, and how to create one.

What’s in this article?

- What is a société par actions?

- What are the different types of société par actions in France?

- What are the key features of a société par actions?

- How do you set up a société par actions?

What is a société par actions?

A société par actions (SPA), known in English as a “joint-stock corporation” or “joint-stock company,” is a type of commercial enterprise in which share capital is divided into shares (a share is a form of ownership that comes with voting, information, and dividend rights). Joint-stock corporations are structured to generate capital gains for their shareholders. They are suitable for most commercial, craft, industrial, and unregulated professions.

What are the different types of société par actions in France?

There are three types of SPAs, or joint-stock corporations, in France: a société par actions simplifiée (SAS), a société anonyme (SA), and a société en commandite par actions (SCA).

It should also be noted that a société européenne (SE), sometimes known by the Latin name “societas europaea,” is another type of joint-stock company in France. A société européenne allows for easier management across several European Union (EU) countries.

Simplified joint-stock company (SAS)

A société par actions simplifiée (SAS), or simplified joint-stock company, is characterized by a high degree of flexibility in its formation, operations, and share transferability. In the company’s articles of association, partners in an SAS have the freedom to define governance and management rules, including those regarding decision-making and management bodies, making it a widely preferred legal structure in France.

Another important characteristic of the SAS is that it cannot be listed on a stock exchange or issue securities to the public.

Public limited company (SA)

A société anonyme (SA), or public limited company, can raise public funds to finance its projects. It is therefore well suited to large companies seeking a stock market listing or international expansion. Shareholders in an SA benefit from the division of power among various management bodies and the unrestricted transferability of shares.

Limited partnership with shares (SCA)

Similar to the SA, a société en commandite par actions (SCA)—known in English as a “limited partnership with shares”—can make a public offering of its shares. However, its hybrid structure sets it apart from the SA. The SCA has two categories of partners: general partners and limited partners. General partners are responsible for the active management of the company, while limited partners contribute to the financing of the company as investors. This structure allows investors to participate in the management of the company while limiting their liability to the amount of their individual contributions to the share capital. In contrast, general partners have unlimited financial liability that is joint and several.

What are the key features of a société par actions?

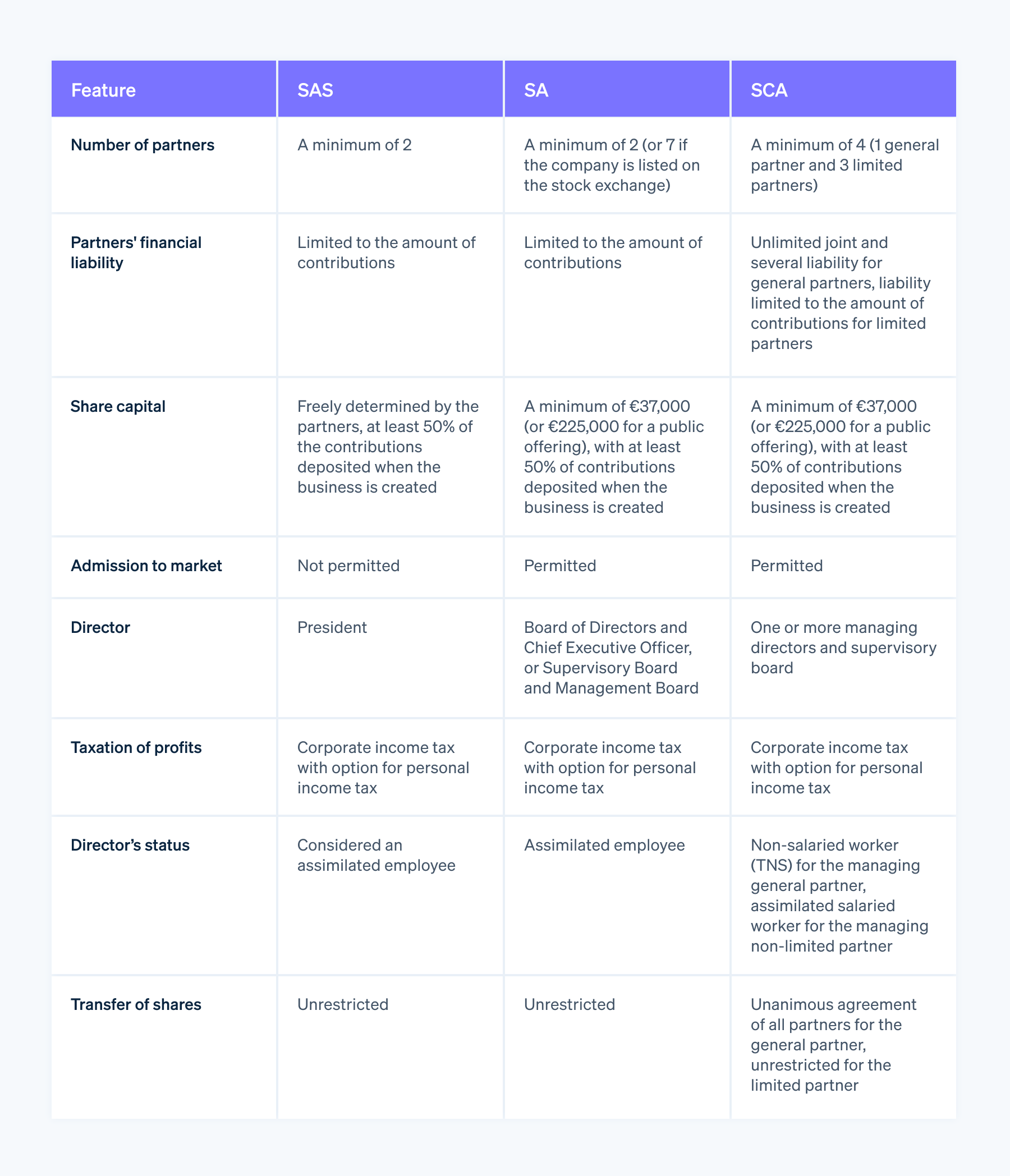

The table below highlights the main features of each type of société par actions, including their tax regimes and the minimum number of partners they require.

You can improve your time to market and increase your revenue with Stripe Payments, a payment system fit for both startups and multinational corporations. Stripe offers access to over 100 payment methods, allowing you to accept payments in more than 195 countries without needing to write a single line of code.

How do you set up a société par actions?

To set up a société par actions, you need to:

- Draft your company’s articles of association, which outline its operating procedures, and choose a company name

- Designate a head office

- Deposit the share capital into the company’s bank account

- Publish a notice of incorporation in a French legal gazette (journal d’annonces légales or JAL)

- Register online via the business formalities portal.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.