Invoicing is an essential activity for many businesses. Not only does an invoice ensure that companies get paid, it also acts as an official record of a transaction and, in some cases, needs to be referenced later for reporting or tax purposes.

However, many companies are still using manual, outdated invoicing processes that slow down payments and can lead to lost revenue. Many businesses waste hours chasing down billing details with their users, and most don’t have a centralized workflow to see which invoices are paid and which are outstanding. In addition, up to 40% of companies still mail paper checks, creating more manual work and slower payments for business owners sending out invoices.

An optimized invoicing setup is key to growing your business, managing cash flow, and creating positive customer experiences. The best invoicing systems are 100% digital, allowing you to store all relevant details in one place, automate repetitive processes, and recover more revenue.

In this guide, you’ll learn how online invoicing can save you time and resources and help you get paid faster. We’ll cover how invoicing works, how to find an online invoicing solution for your business, and how Stripe can help.

What is an invoice, and how does invoicing work?

An invoice is a document that itemizes and records a transaction between a business and a customer. It serves as a request for payment, detailing how much the customer owes and the payment terms. An invoice also acts as a tax document—businesses are required to keep copies of each invoice to prove how much revenue they earn and any taxes they collect.

According to a report by research firm MoffettNathanson, 85% of B2B transactions involve invoicing workflows—invoices are frequently used by B2B SaaS companies and professional services companies that have high average order values or require custom contracts with customers. However, professional invoices can be used by any type of business to request payment from customers.

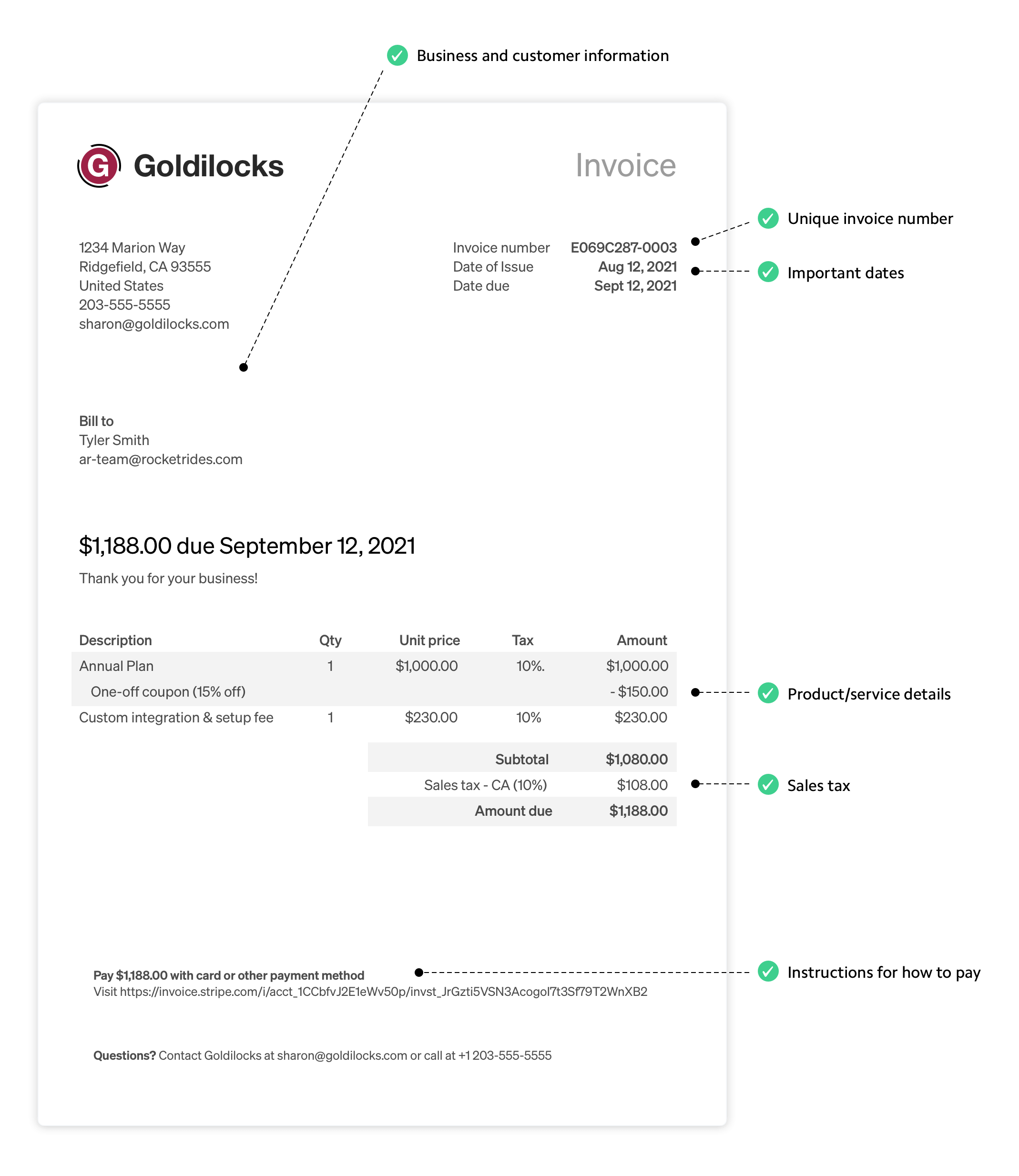

What information needs to be on an invoice?

In most countries, you are required to include certain details when sending an invoice, such as the invoice number, items sold and costs, payment terms, tax details, and contact information.

Depending on which countries you are operating in, you may have to follow different invoice requirements. For example, you may have to follow sequential invoice numbering or set invoice prefixes at either the customer or account level. Consult with a professional for guidance on your specific use case.

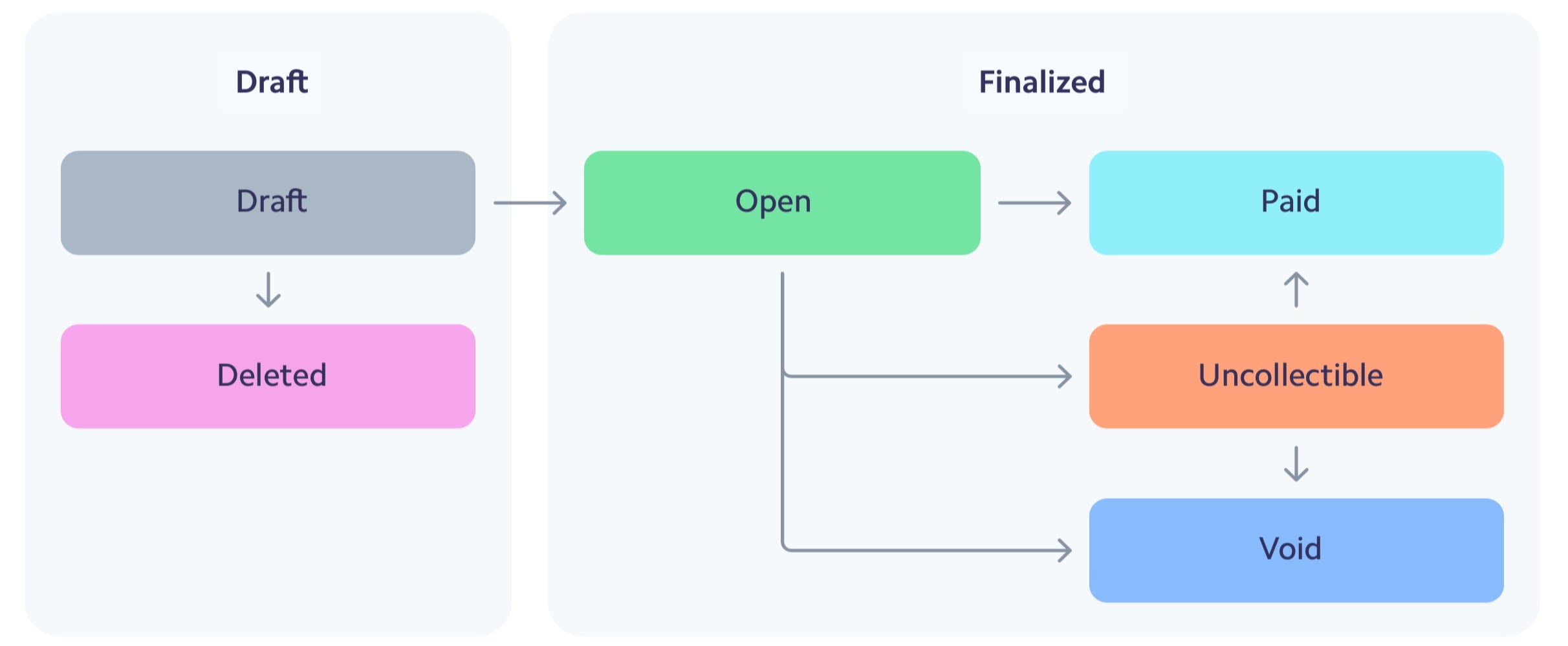

Once the invoice is created, it moves through a number of different states ranging from “open” (when you’re awaiting payment) to paid (when you receive payment). An invoice can also be “uncollectible” if it’s unlikely to be paid, and “void” if you decide to cancel the transaction.

Invoicing workflow

What are the benefits of online invoicing?

Frictionless payment experiences are important for any business, especially if you’re accepting large transactions. Customers expect a fast, convenient payment process—one that lets them review all the details of their invoice and choose how and when to make their payment. Not only does invoicing provide this flexibility to your customers, it also helps you simplify your operations and reduce costs.

A better customer experience: Traditional paper invoices are simple documents that don’t offer customers a way to pay their outstanding balance. Online invoices integrate with online payments, letting customers easily pay you right away or at a later date. Businesses can choose the payment terms (e.g. immediately, within seven days, or within 30 days) and payment methods (e.g. credit card or bank transfer) to offer flexibility and help customers better manage their cash flow.

The ability to manage large or complex transactions: If you offer professional services or wholesale products, even a single payment failure could result in significant revenue loss. The ability to securely and successfully accept large payments—or handle one invoice with multiple line items—can protect your business. This can be solved, in part, by giving your customers more flexibility to initiate payment, like offering a 30-day payment window when funds are more likely to be available.

Streamlined approvals and internal processes: Many finance and legal departments need to approve expenses before they are paid out. Invoices act as a paper trail throughout this process, creating an official record of a purchase that various departments can reference. Invoices also help your accounting team keep track of how much your business is earning and spending, and easily identify and manage outstanding payments.

Lower transaction costs: While credit cards are generally the most popular payment method for smaller, immediate transactions, invoices can often be paid with bank transfers or other debit payment methods that incur lower costs.

What to look for in an online invoicing system

Businesses often underestimate how complex invoicing can be. For example, you may decide to accept different payment methods, such as bank transfers, to lower your costs on large invoices. Collecting these bank payments can be tedious and error-prone without the right tools to help. If you start sending invoices globally, you’ll have to navigate different regulations that govern invoicing in each region where your customers are located.

Finding the right online invoicing software or system can offload these manual, repetitive tasks and simplify your operations, saving you time and resources. All your invoices and payments can be stored digitally in one place, creating a single source of truth for your accounting, finance, and legal teams. These advantages compound over time as your business grows and you manage a larger customer base.

While most online invoicing solutions let you customize invoices, accept credit card payments, and surface basic reports, the best options offer advanced features to help you get paid faster, create a better payment experience for your customers, and integrate into your existing workflows.

Here are four things you should look for in an online invoicing system:

1. Ease of use

Find a solution that lets you easily create new invoices and edit existing ones. You should be able to customize the look and feel of your invoice to match your branding, adding your logo and company colors. You should also be able to update the invoice number, product details, payment terms, customer information, tax rates, and line items, and have the ability to add discounts, coupons, legal footers, and notes. Ideally, you can save all these details so you’re not starting from scratch with each invoice.

You want a variety of ways to share branded invoices with customers based on their personal preferences and internal processes. For example, you may want to text an invoice link to some customers and email others a PDF version. The best online invoicing systems allow you to automate this process, triggering customer emails when an invoice is ready and sending reminder emails based on payment due dates.

2. Support for a variety of payment methods and reconciliation tools

Customers expect a relevant, familiar payment experience, and the easier you make the invoicing process, the sooner you’ll get paid. Get paid faster by using an online invoicing system that supports a variety of payment methods, such as cards, ACH credit, ACH debit, checks, and bank transfers. For example, customers complete payment three times faster when using digital wallets such as Apple Pay or Google Pay than when they have to manually enter credit card information.

However, certain payment methods, such as wire transfers or ACH, can make it more difficult to match payments with invoices (also known as reconciliation). For example, when invoices get paid each month, you may only see a dollar amount show up in your bank account without knowing which incoming payment is associated with which invoice. The best online invoicing system will automatically match outgoing invoices with incoming payments so your accounting and finance teams don’t have to manually match each one.

3. Streamlined collections

Your cash flow and overall business health can suffer if you don’t properly manage outstanding invoices. Rather than manually tracking which customers have or haven’t paid their invoices and sending one-off reminder emails, look for an online invoicing system that automatically sends payment reminders when invoices are due or past due. You also want the ability to generate detailed reports and accounts receivable aging reports so you can monitor outstanding invoices and prioritize your collections efforts.

In addition to managing overdue invoices, look for a solution that helps you manage failed payments. For example, customers may intend to pay an invoice, but their payment attempt fails due to expired cards, insufficient funds, or outdated card details. Online invoicing systems can update expired cards and automatically retry failed transactions on a customized schedule—for example, every seven days—to increase the chances of a successful payment.

4. Reports and reconciliation

The best online invoicing solutions automatically generate in-depth reports and dashboards to help you simplify invoicing operations. You want the ability to see at a glance all invoices sent and their status, as well as the ability to filter by outstanding, past due, and paid invoices. Your invoicing solution should be able to automatically void, duplicate, refund, or mark invoices as paid, and give you the ability to manually change each status if you choose. It should also let you mark invoices as paid if the transaction happens outside your invoicing system, like if your customer wants to mail a check or pay with cash.

In addition, you need your invoicing solution to integrate with your existing workflows, like other accounting systems and ERP solutions such as Xero, QuickBooks, and more. Even better, look for a solution that allows you to import invoicing data directly into your own systems.

How Stripe can help with invoice management

Stripe Invoicing is a global invoicing platform built to save you time and get you paid faster. Create and send a Stripe-hosted invoice in minutes from the Dashboard, or use the Invoicing API and advanced features to automate how you collect and reconcile payments.

Invoicing is integrated into the Stripe payments stack, so customers can automatically collect invoice payments with smart retries, email reminders, and automatic card updates, reconcile ACH or wire payments, and invoice globally from day one.

Easy to get started: Create, customize, and send a Stripe-hosted invoice in minutes—all from the Dashboard with no code required. You can also type “invoice.new” into any browser URL bar and jump straight to the invoice editor.

Gets you paid faster: Stripe’s online invoices provide an optimized experience across mobile, tablet, and desktop and support more than 25 languages and 135 currencies. The hosted invoice page dynamically shows payment methods based on your customer’s location, helping you get paid faster. In fact, most Stripe invoices are paid within three days.

Configurable for any use case: Collect one-time or recurring payments via card, ACH, and other payment methods. Add line items, discounts, and tax rates directly to your invoices.

Scales with you: Stripe’s APIs can help automate your invoicing workflows. Use automatic email reminders and aging reports to collect unpaid invoices, and leverage Smart Retries to retry failed payments at optimized times.

For more information on Stripe Invoicing, read our docs. To start sending invoices and accepting payments right away, sign up for an account.

You can also explore our other guides to learn more about collecting online payments: