Italian law establishes different time limits for issuing invoices depending on the type of transaction (i.e. the sale of movable or immovable goods or the provision of services). There are also different deadlines depending on the type of invoice: immediate or deferred.

Below, we examine the legal requirements for issuing an invoice, whether it should be issued before or after payment, what a pro forma invoice is, and its purpose.

What’s in this article?

- Legal requirements for issuing an invoice

- Issuing an invoice before or after payment

- Invoice after payment: The pro forma invoice

- When is an invoice issued after payment?

Legal requirements for issuing an invoice

The obligation to issue an invoice is regulated by Article 6 of Presidential Decree 633/1972 and depends on whether the sale involves movable goods, real estate, or the provision of services.

Sale of movable goods: Sales are deemed to occur at the time the goods are delivered or shipped. An invoice can be issued either before or after payment.

Sale of real estate: The transaction is considered to take place on the date the contract is signed. The transferor must issue an invoice when the title to the property is transferred.

Provision of services: The provision of services shall be deemed completed upon receipt of payment. For billing purposes, the service is considered complete when payment is received. Again, an invoice can be issued either before or after payment.

There are two exceptions to these rules:

Earlier issuance of an invoice

According to Article 6, if the invoice is issued before the transaction is completed –such as before the contract is concluded (for immovable property), before the goods are delivered or dispatched (for movable property), or before payment is made (for services) – the transaction is still considered completed.

Therefore, in the case of an advance invoice, the date of issue of the invoice is considered to be the date of the transaction. A pre-invoice is a formal invoice that must comply with all legal requirements.

Advance invoice

In the supply of goods, if the customer makes a down payment before receiving the goods ordered, the supplier must issue an invoice for the amount of the down payment.

In the provision of services, when a down payment is received, the down payment generally constitutes the transaction. In such cases, the invoice for the advance payment must be issued within 12 days from the date of receipt of the payment.

Issuing an invoice before or after payment

The standard practice is to issue the invoice immediately after the sale of goods or the provision of services and receive payment later on the basis of the agreed terms. Practically, this approach is the simplest, as it ensures the invoice is issued on time and avoids potential penalties for late issuance. However, the law does not necessarily require that the invoice be issued before payment; in many cases, it is issued after payment.

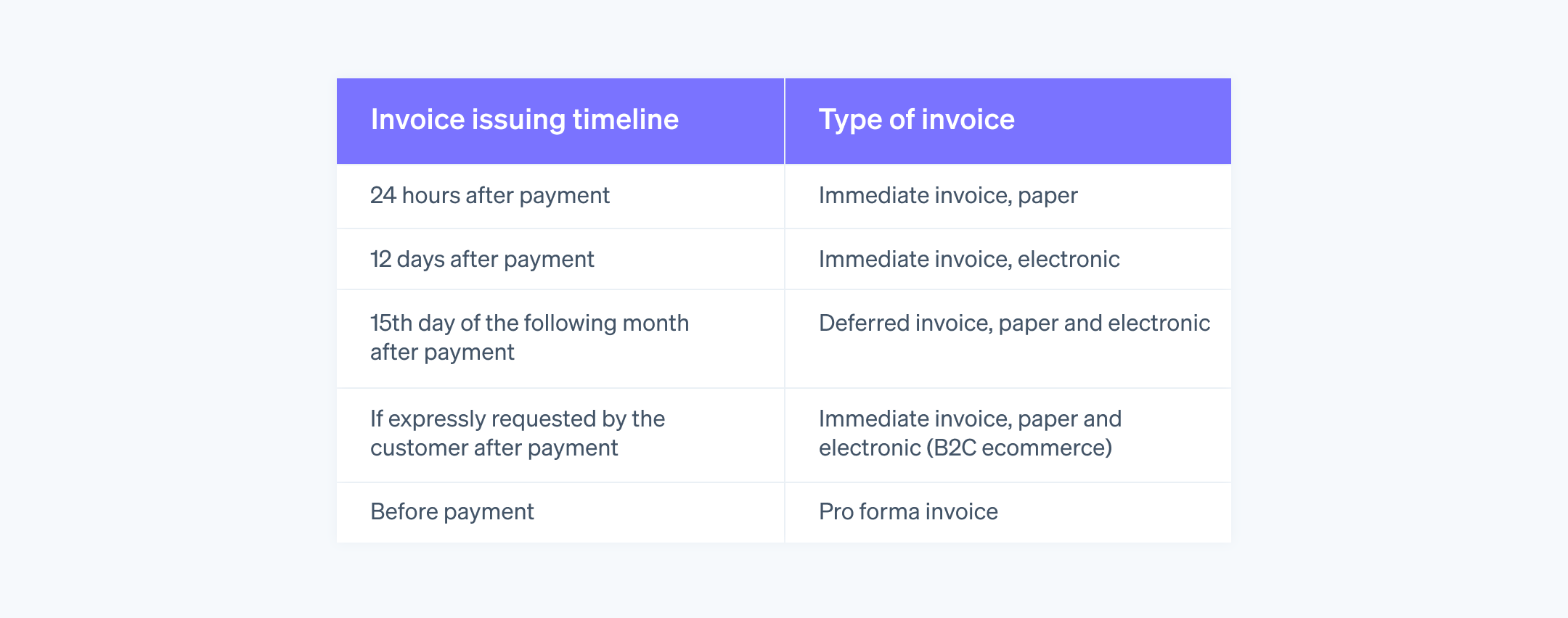

If you issue the invoice after the payment, the amount of time you have to issue it depends primarily on whether the invoice is immediate or deferred:

Within 24 hours: For an immediate paper invoice (for those who are still allowed to issue one)

Within 12 days: For an immediate electronic invoice

By the 15th day of the following month: For deferred billing, whether the invoice is paper or electronic

Invoice after payment: The pro forma invoice

A common example of issuing an invoice after payment is when it follows a pro forma invoice. A pro forma invoice is not a fiscally valid invoice but a draft document. It is provided for review before finalising the agreement between the supplier and the customer and prior to the issuance of the official invoice.

The pro forma invoice can also be created using electronic invoicing software with the appropriate language added to indicate that the invoice is not valid for tax purposes.

What is a pro forma invoice useful for?

A business owner might find a pro forma invoice useful because it can be:

Issued prior to payment: This helps you avoid incurring tax obligations before receiving payment from the customer. In fact, most taxes, including value-added tax (VAT), are calculated based on the date the invoice is issued, regardless of whether payment has been received.

Changed anytime: A pro forma invoice is a non-taxable document that can be modified. Therefore, using a pro forma invoice eliminates the need to issue a credit note in case of errors.

Reviewed for correctness: A customer receiving a pro forma invoice can review the prices, description of services or products, and accuracy of the information displayed.

Features of a pro forma invoice

The main features of a pro forma invoice are:

Date of issuance: The pro forma invoice is issued before payment, while the final invoice can only be created after the customer has settled the amount due. The issuance of the final invoice is mandatory as it is the only document that makes the transaction relevant for tax purposes.

Invoice conversion: Invoicing software enables the easy conversion of a pro forma invoice into a final invoice in just a few steps.

Numbering: The numbering for the pro forma invoice is completely separate from that of the final invoice.

Necessary information: The following statement must be included on the pro forma invoice: “This document does not constitute a valid invoice for the purposes of DpR 633 26/10/1972 as amended. The final invoice will be issued upon payment of the amount due (Article 6, paragraph 3, DpR 633/72).”

As your business grows, managing the invoicing process can become increasingly complex. Some tools can help automate this process, like Stripe Invoicing, a comprehensive and scalable invoicing platform that lets you create and send invoices for both one-off and recurring payments without writing any code. With Invoicing, you can save time and get paid faster, as 87% of Stripe invoices are collected within 24 hours. Thanks to third-party partners, you can also use Invoicing for mandatory e-invoicing.

When is an invoice issued after payment?

It’s up to the business to decide whether to issue the invoice before or after payment. Often, businesses or freelancers – such as lawyers, notaries, or accountants – issue the invoice after payment, initially using a pro forma invoice. The customer pays based on the pro forma invoice, and the supplier then issues the final invoice. This is a common but not mandatory practice; the professional or company can also issue the final invoice before receiving payment.

Even when products and services are purchased online, payment is usually made in advance, before the goods or services are received. In these cases, the invoice – optional in business-to-consumer (B2C) e-commerce, unless specifically requested by the customer – is issued after payment.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.