All our product updates from Stripe Tour New York

This morning at Stripe Tour New York, we shared more than 40 new products and features from the last 6 months with business leaders and builders. In our keynote, we covered Stripe’s progress in five core product areas, including how we’re expanding our investments in AI and stablecoins to enable you for the next chapter of global commerce.

Here’s a full list of what’s new.

Payments

We shared how Stripe can help you in three key areas: increasing checkout conversion for your customers across devices and markets; growing your revenue, lowering costs, and fighting fraud with the scale of the Stripe network and new AI advances; and preparing you for a new buyer: AI agents.

Here’s what’s new:

Optimized Checkout Suite

- You can now seamlessly redirect customers from your iOS app to a mobile checkout page powered by Stripe Checkout, allowing you to save up to 90% in payment fees.

- We previewed the ability for you to use Managed Payments, our merchant of record solution, for one-time payments and app-to-web payments. With Managed Payments, Stripe manages global tax compliance, fraud and disputes, and the checkout experience—in addition to handling customer support for transactions through Link.

- You can now use Klarna on Link with Checkout and Payment Links, giving your customers the flexibility to pay over time while you get paid in full up front.

- You can now offer businesses on your platform the ability to automatically localize prices in 150 markets with no additional Stripe fees using Adaptive Pricing, available via Stripe Connect.

Payments Intelligence Suite

- You can now use Authorization Boost’s new excessive retry and decline prevention features to help lower card processing costs.

- We previewed new AI-powered controls for Stripe Radar, including dynamic risk thresholds that automatically adjust based on changes in fraud levels and the ability to set your own risk preferences within Radar.

- We previewed the ability for you to write custom fraud prevention rules with Radar for additional payment methods such as Klarna, with support for Affirm, Bacs, and Cash App coming later this year.

- You can now use AI to reduce your dispute rate by proactively refunding transactions based on the likelihood they will result in disputes via Smart Refunds.

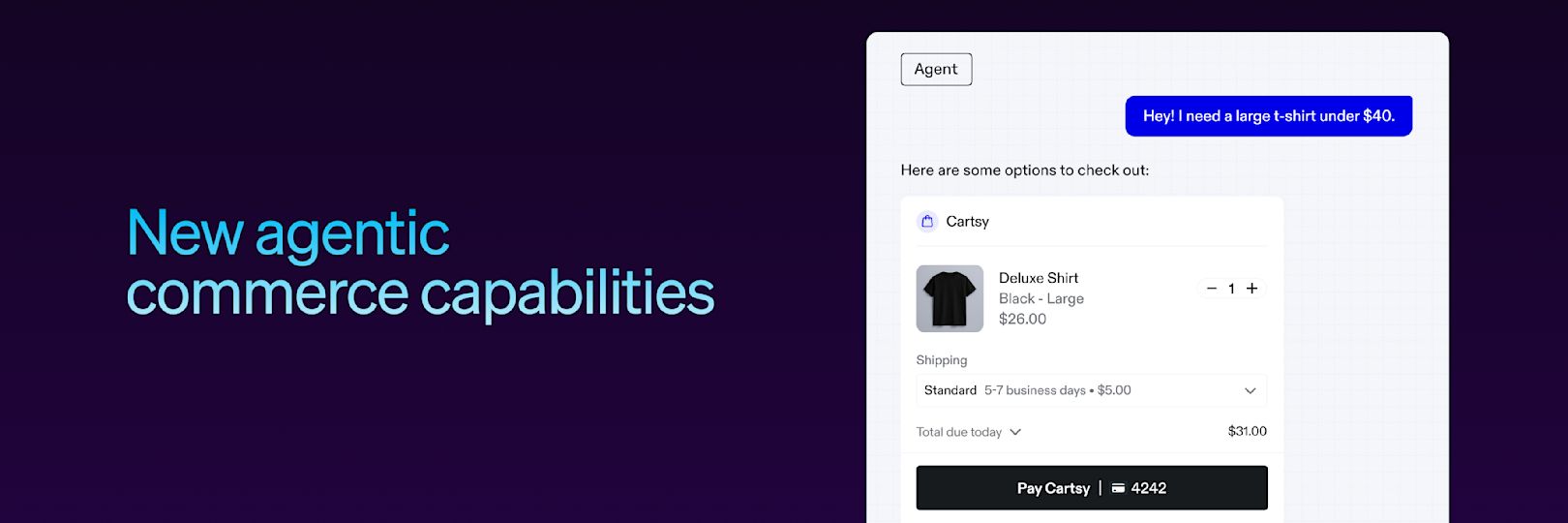

Agentic commerce

- You can now use the Agentic Commerce Protocol (ACP), a new open standard codeveloped by Stripe and OpenAI for businesses to make their checkouts agent-ready by surfacing products, pricing, and checkout flows in a format agents can use.

- We previewed Shared Payment Tokens, our new payment primitive for AI-led commerce that lets AI agents pay with a customer’s saved payment method while securely passing payment details and risk signals to the business. Instant Checkout in ChatGPT, OpenAI’s new commerce experience, is powered by Shared Payment Tokens.

Stripe Terminal

- You can now process in-person payments without Wi-Fi, using Stripe Reader S710 with cellular connectivity.

Stripe Orchestration

- We previewed the ability for you to instantly retry transactions that fail with a different processor.

Revenue

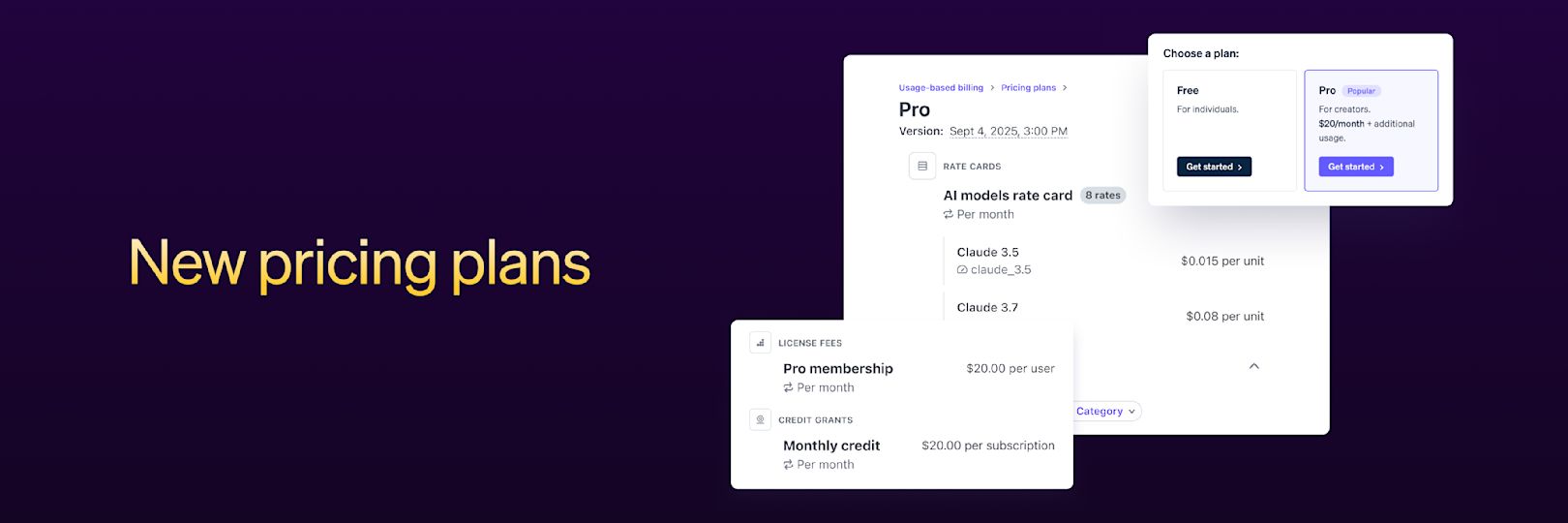

We shared new upgrades to our Revenue suite that make it easier for the fastest growing companies to launch AI-powered offerings, such as charging customers based on LLM token usage and launching hybrid pricing models. Updates in this area include:

Stripe Billing

- We previewed billing for LLM tokens, making it easy to update your prices and protect your margins when AI model costs change. Route calls through Stripe’s proxy API or partner proxies to track usage, apply a markup, and bill customers automatically as they use your AI features.

- We previewed the ability for you to model and manage hybrid pricing models that include rate cards, license fees, and credits with new pricing plans.

- We previewed the ability for you to bill based on multiple attributes of usage data—such as model type used, data request size, and speed of delivery—from a single meter with dimensional pricing.

- We previewed the ability for you to burn down credits in real time, and configure real-time alerts for low credit balances to trigger automatic top-ups.

- We previewed the ability for you to access real-time, aggregated usage data, down to the customer level, to identify trends or power customer dashboards with the Meter Usage Analytics API.

Stripe Invoicing

- You can now accept partial payments on invoices through the Stripe Dashboard and via API.

Stripe Sigma and Stripe Data Pipeline

- You can now export prebuilt Stripe reports, select only the data and reports you need, and get more visibility into data freshness with time stamps via Data Pipeline’s new export customizations.

- You can now purchase Stripe Sigma and Data Pipeline via subscription, helping you better predict and manage your costs.

Stripe Tax

- We previewed the ability for you to use Tax for additional verticals such as events and ticketing.

- We announced that we will support tax collection in 102 countries for businesses selling physical goods early next year—up from 40 countries in 2024.

- You can now use Tax in Mexico, and we announced that support for Gibraltar, Liechtenstein, and Malaysia is coming soon.

AI development

- We previewed the ability for you to embed Stripe sandboxes directly inside your AI platform, allowing developers to launch and manage payments and financial services from right inside your environment.

Connect and Embedded Finance

More than 15,000 SaaS platforms use Stripe to offer payments and financial services to more than 10 million businesses. Today, we shared how we’re making it easier for you to run your platform, including smarter analytics to fine-tune your payments business, better tools to manage risk at scale, and new monetization features. Here’s the latest:

Connect

- We previewed the ability for you to better control risk and compliance in ways that align with your business by extending due dates for user verification tasks directly from the Dashboard and accessing tailored benefits to streamline operations as you grow with Stripe Verified for platforms.

- You can now receive email notifications from Stripe when your connected accounts have upcoming, due, or past-due risk and compliance actions. You can customize who receives these notifications and how often.

- We previewed the ability for you to offer IC+ payments pricing to your connected accounts with network cost passthrough. It comes with an easy-to-use API for prebuilt reports that you can share directly with your users, helping them understand their underlying platform fees and network costs.

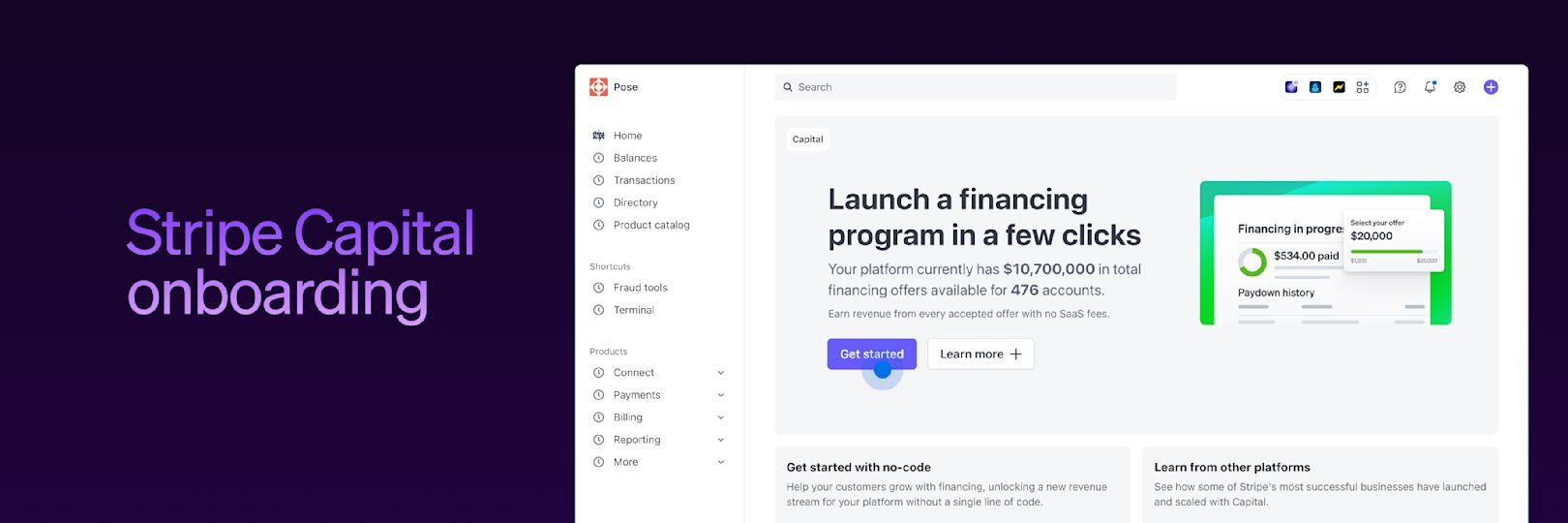

Embedded Finance

- You can now onboard to Stripe Capital and send live capital offers to your users in under five minutes—without any engineering or marketing resources required.

- You can now add new features to your financial account to help your users move and store money, such as cash acceptance, and cross-border payouts.

- You can now embed a promotional tile directly within your platform’s UI that highlights available financing offers to your users with our Capital promo tile component.

- You can now allow users to make an instant payout, and see the amounts of funds available to pay out, directly within your product via our Instant Payouts promotion component.

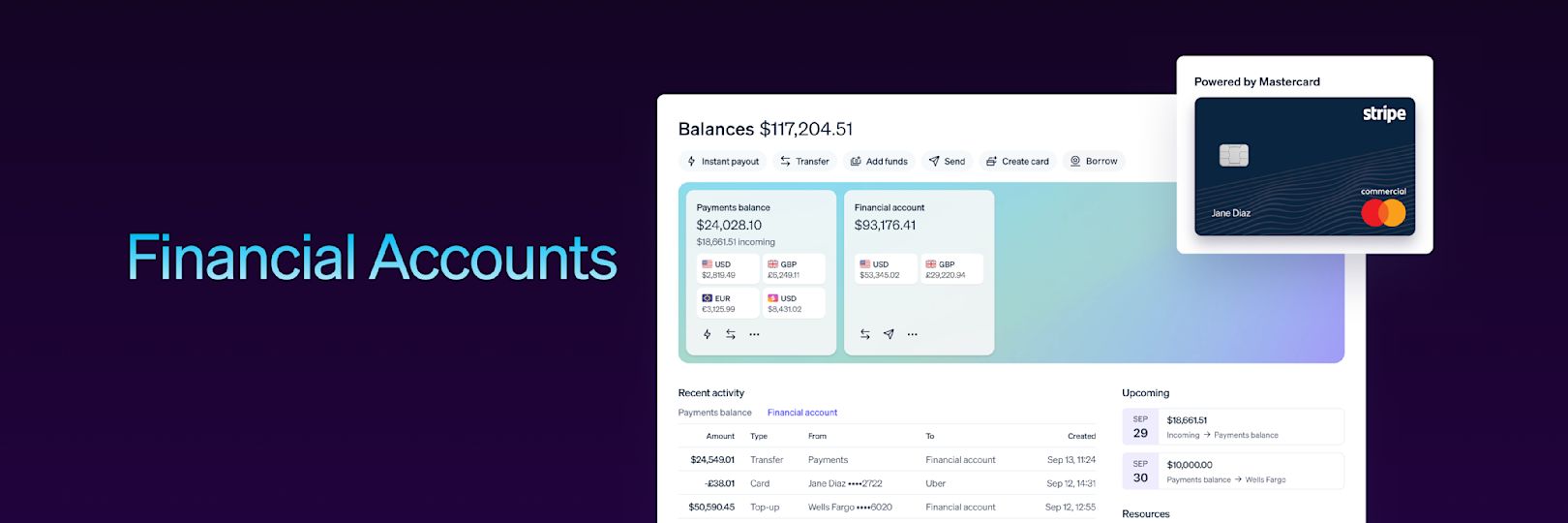

Money Management

Earlier this year at Stripe Sessions, we previewed our biggest-ever upgrade to Stripe with a redesigned balances page in the Dashboard, plus new capabilities to help you manage payments and finances in one place. Today, these money management capabilities are accessible via Financial Accounts for businesses in the US, with support for the UK coming soon. Here’s everything you can do today, directly from the Dashboard:

- You can now easily view the transactions entering your balance—inclusive of different currencies. You can also more easily reconcile payouts and manage your schedule.

- You can now instantly convert currencies, 24/7, right from the Dashboard.

- You can now operate like a local without needing a local presence, and move money cross-border cheaply.

- You can now simplify expense management with virtual and physical cards powered by Mastercard, and send money to anyone, anywhere in minutes using the funds in your financial account—thanks to new integrations between Financial Accounts and cards and Global Payouts.

- You can now integrate your financial account with Xero and QuickBooks Sync by Acodei, allowing you to automatically import transactions to close your books faster.

Stablecoins and Crypto

Today, we announced new, modular infrastructure for all parts of the crypto stack. We highlighted dozens of examples of how stablecoins and crypto can solve fundamental problems with our existing financial systems by offering fast, low-cost, and programmable money movement with global accessibility. For example: Privy, our solution for digital asset management, allows you to offer embedded money storage for your customers in 200 markets; and Bridge, our solution for advanced stablecoin infrastructure needs, offers rails to move funds cheaply and instantaneously across currencies, borders, and entities.

Latest updates include:

- We previewed the ability for you to collect subscription payments using stablecoins.

- You can now hold stablecoin balances in your financial account if you are a US business, allowing you to expand into new markets more easily. Businesses outside the US in more than 100 countries can request access to Financial Accounts with dollar-denominated stablecoin balances.

- We announced that you will soon be able to allow users to buy crypto directly from your app with fiat-to-crypto onramp.

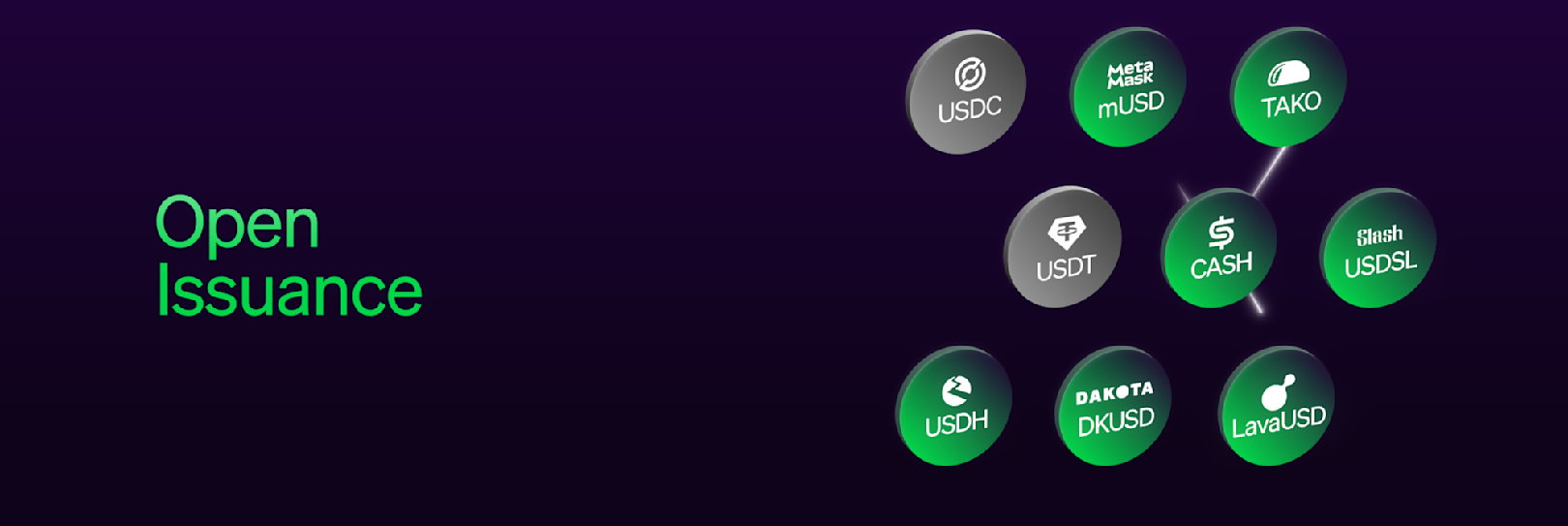

- We announced that you will soon be able to launch your own custom stablecoin with Open Issuance from Bridge. You’ll be able to maximize rewards by choosing the allocation of reserves managed by BlackRock, Fidelity Investments, Superstate, and others. You will also be able to make your stablecoin interoperable with other Open Issuance stablecoins, allowing end customers to swap their stablecoins using an instant, permissionless onchain transaction.

- Via Bridge, you can now use local on and offramps in Mexico, allowing you to easily move funds between dollars, pesos, and stablecoins through a simple set of APIs. We also previewed on and offramp support in Brazil via Bridge.

- Via Bridge, you can now create flexible liquidation addresses that can accept deposits across multiple chains and currencies.

- Via Bridge, you can now launch stablecoin-backed Visa cards to customers in the US, Bolivia, Brazil, Ghana, and more than 10 other countries across Latin America and Africa. Customers can spend stablecoin balances from custodial or noncustodial wallets anywhere Visa is accepted. This infrastructure is also used by Stripe Issuing, extending the 22 fiat countries already supported.

- Via Bridge, you can now instantly create virtual accounts in the Bridge dashboard, allowing customers to onramp funds using a unique bank account number with the new payments module.

- Via Privy, you can now pay for all network fees on behalf of your users directly through embedded wallets, reducing cost and friction, with the native gas sponsorship.

- Via Privy, you can now set up and support accounts across virtually any blockchain, including all Ethereum, Solana, and Bitcoin chains, and now Cosmos, Movement, Near, Spark, Starknet, Stellar, and Ton.

- Via Privy, you can now support yield generation via managed DeFi products using Morpho or Aave.

- Via Privy, you can now set up advanced policies with wallets to manage subscriptions, scheduled payments, automated portfolio rebalancing, and more.

We’d love your feedback on everything we announced at Stripe Tour New York. Share your thoughts, questions, and requests.

You can also read our changelog to learn more about the recent updates we’ve made to Stripe.