From on-demand delivery marketplaces helping their couriers pay for orders to B2B SaaS companies allowing customers to access their earnings, platforms must figure out how to move money.

However, many platforms are still following manual processes that slow down payouts.

Depending on the industry, some businesses mail paper checks, send money via ACH, or integrate with various point of sale systems.

Issuing cards is a better way to give customers immediate access to funds. And, as an added benefit, you also have the opportunity to create a new revenue stream. Every time a cardholder makes a purchase with a card issued through your card program, you can earn money by keeping a portion of interchange (a cost that accompanies every card transaction).

This guide helps you understand the basics of interchange revenue. You’ll learn how interchange is calculated, how platforms can make money from interchange, and how Stripe can help.

Payment fundamentals

Before diving into interchange, it’s helpful to have a high-level understanding of how payments work: how money moves from a customer to your business and how banks facilitate these payments. Learning about these fundamental building blocks will help you better understand the costs involved in this system and the opportunities for your business to increase revenue.

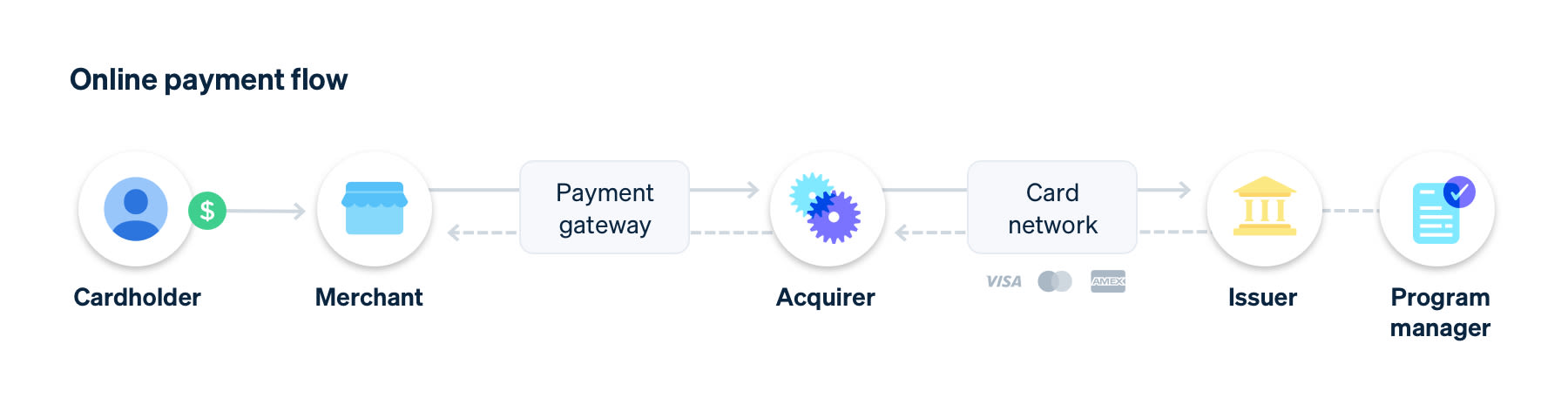

There are several major players involved in each transaction:

- Cardholder: The person who uses a credit or debit card

- Merchant: The business owner that accepts payments by card

- Acquirer: A financial institution that processes card payments on behalf of the merchant and routes them through the card networks (such as Visa or Mastercard) to the issuer. Sometimes acquirers may also partner with a third party to help process payments.

- Card networks: Card networks, like Visa and Mastercard, are the connection among all of these players. They communicate transaction information, move transaction funds, and determine the underlying costs of card transactions.

- Issuer: The bank that provides banking or payment processing services and issues payment cards (such as credit, debit, cards or prepaid cards) as a member of the card networks. Most issuing solutions offer both of these services, but some businesses could have two separate relationships (one with the processor and one with a bank).

- Program Manager: A program manager is a non-bank that partners with the issuing bank to make card programs available to the program manager’s customers. The program manager is primarily responsible for all cardholder-facing materials and communications. The program manager is subject to the oversight of the issuing bank, and fulfills certain compliance obligations on behalf of the bank partner.

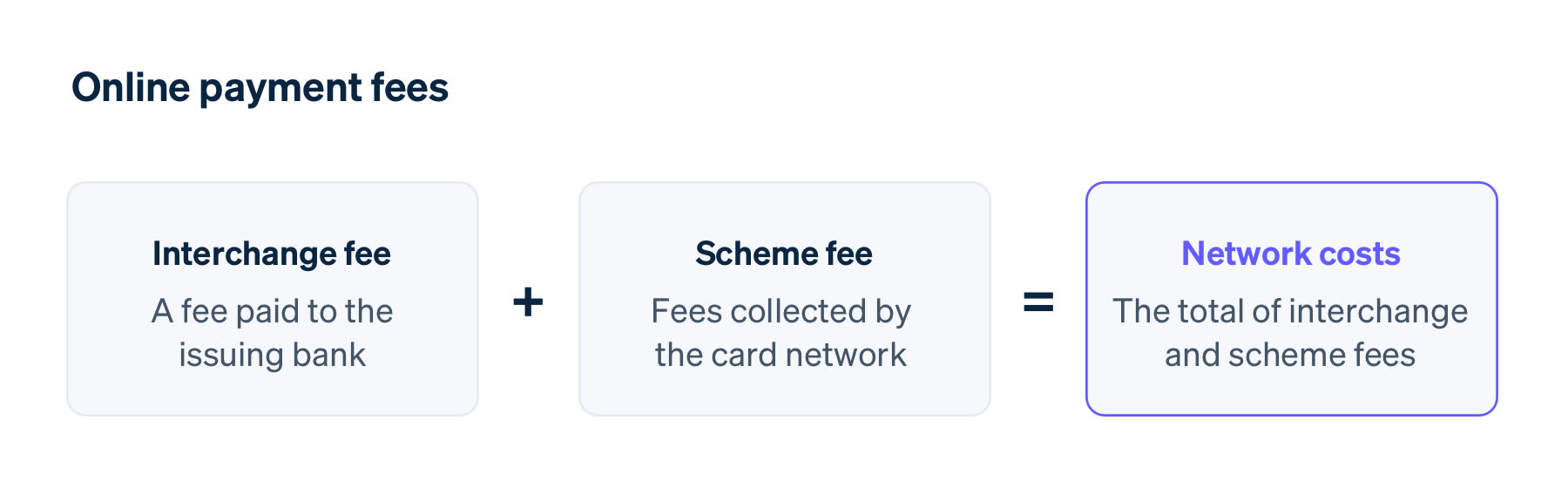

There are a variety of fees that accompany each transaction processed through this ecosystem. Visa and Mastercard set the rates for:

- The fees collected by the card network (the scheme fee)

- The fees paid to the issuer (the interchange)

American Express uses a slightly different model since they are the acquirer, the network, and the issuer, and their network costs are referred to as a discount rate.

For a purchase transaction, interchange is paid to the issuer because the issuer provides the cards, customer service and bears the credit and fraud risk.

Only banks can be principal members of the card networks, capable of issuing cards (in the US). To offer cards to your customers, you can work directly with an issuing bank and use a software solution to process payments used by the cards. This means you would have to manage bank negotiations and partnerships, compliance processes like Know Your Customer obligations and evolving regulatory requirements. Or, you can work with an issuing solution which handles both the issuing and the processing for you. An issuing solution offers built-in banking relationships, reliable compliance and risk management, pre-built workflows and frictionless user onboarding.

With both setups, you would share a portion of the interchange rate – either with the bank or the issuing solution.

Interchange rates are always set by the network based on a set of broad guidelines: the card type (consumer, commercial, or business), funding type (credit, debit, or prepaid), and whether the transaction is domestic or cross-border. Interchange rates are also regulated by federal law.

Consumer interchange rates are capped in Europe due to stringent regulations. As a result, interchange rates are lower and platforms based in Europe don’t have as much flexibility to influence their interchange revenue. Commercial and business interchange rates, while not subject to interchange caps, are generally lower than in the US.

There are many exceptions to these guidelines. For example, the average commercial card has higher interchange rates than the average consumer card, but high-end consumer cards (like Visa Infinite) result in more interchange.

These guidelines also vary based on a number of factors. For example, business card rates can vary based on how much the cardholder spends (the more a customer spends, the higher the interchange rate).

Additional factors that influence interchange may include:

- Size of the transaction: Interchange is often a fixed percentage, so the absolute amount of interchange increases as the customer spends more.

- Merchant Category Codes (MCC): Businesses that process card payments are categorized using an MCC. Purchases made from businesses that belong to specific categories may generate more or less interchange.

- Where the merchant is located: The interchange rate changes if you process an international transaction. For example, if you issue a card in the US, but the customer makes a purchase with it in Canada, that transaction would follow a different interchange rate structure.

- Type of BIN: The BIN (Bank Identification Number) is the first six digits of a credit card (in 2022, BINs will expand to the first eight digits). These numbers identify the card network, the name of the issuing bank, the card type, the card class, and more. Depending on the transaction details (like the MCC), the BIN could influence a higher or lower interchange rate.

While you can’t directly influence the BIN, you should consider BIN support, like the ability to mix and match BINs based on the transaction, when you choose your issuing provider.

- Network agreement with the merchant: Both Visa and Mastercard frequently grant lower interchange rates to specific retailers through their partner programs: VPP (Visa Partner Program) and MPP (Mastercard Partner Program). VPP and MPP rates are often much lower than the published interchange rates.

- How the payment is processed: Compared to in-person payments, online card payments have a higher likelihood of fraud. As a result, online card transactions incur a higher interchange rate to make up for this increase in risk.

While the majority of factors depend on the transaction itself (like where the merchant is located or the size of the transaction), you can influence three factors:

- Type of card used: In general, commercial cards, which are used to make eligible business purchases, generate higher interchange than consumer cards.

- Type of funding: In general, credit cards, which require the issuing bank to take on more risk, incur higher interchange than debit cards.

- Size of the issuing bank: For debit and prepaid card payments, large banks have access to a lower interchange rate than smaller banks, which can affect how much interchange revenue you can earn. For example, if you work with a small bank to issue cards to your customers, the portion of interchange you receive will be larger (since the interchange rate is higher on most transactions).

To issue cards, you either work directly with a bank or work with an issuing partner who works with a bank. You have some room to choose which issuer to partner with based on the banks they work with. Some issuing partners are able to mix and match cards and banks to optimize interchange rates on your behalf.

How to calculate your interchange revenue

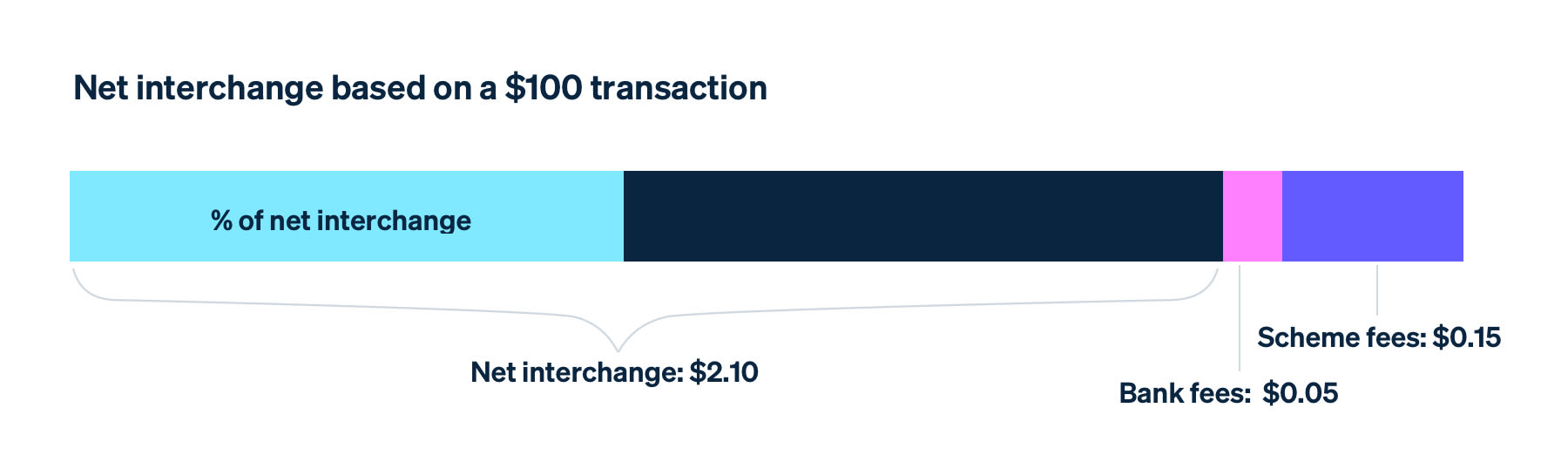

The amount of total interchange that accompanies each transaction is known as the raw interchange. Depending on your partnership with an issuing partner or bank and your revenue sharing agreement, you either keep the gross interchange or net interchange.

Gross interchange

Gross interchange is the amount of money you receive based on your monthly transaction volume, regardless of the amount of interchange actually generated. For example, if you processed $100K in transactions and you had a gross revenue share of 1%, you would receive $1,000 regardless of what the interchange was on those purchases.

Gross interchange is operationally simpler to manage and offers more predictability than net interchange because you don’t have to worry about deductions and interchange rates on individual transactions.

Net interchange

Net interchange is a percentage of the total interchange after deducting bank fees and the scheme fees. The percentage varies depending on your revenue sharing agreement.

This can make it harder to forecast your revenue over time, as you are subject to variance in the underlying cost structure and in transaction amounts. However, net interchange does give you more visibility into the amount of interchange from your card program because you can see how much interchange individual transactions generate.

What to do with interchange revenue

Whether you receive net interchange or gross interchange, you get additional revenue. Some platforms choose to keep the interchange as part of their business model, creating a revenue stream to help them scale.

Others give some or all of the interchange revenue back to the cardholder. One way to do this is by offering a cashback reward, like giving customers $.25 or 1% every time they use their card and paying them out on a monthly or yearly basis. (Note: Rewards are mandatory for all non-commercial cards beyond the lowest and most basic rates.)

You can also think of more creative ways to use your interchange revenue, which could help you differentiate your card programme and foster more loyalty among your customers. For example, rather than giving cashback, you could add funds or credits to a wallet to use on your platform. Or, you could donate some or all of the interchange to social good causes on behalf of your customers; one Stripe business issues cards to their customers and donates a portion of the interchange revenue to Stripe Climate to remove carbon from the environment.

How Stripe can help

Platforms of all sizes use Stripe Issuing to issue cards and create new revenue streams. They also use Stripe's products to not only create and offer business cards, but to also support payments solutions, bank account replacements and business financing.

Stripe offers a variety of products that let you easily integrate these financial services directly into your platform:

Stripe Connect

Stripe Connect helps you onboard and manage your users and enable them to accept payments for their business.

- Onboard users: Onboard your users, complete KYC and verify their identity to support your compliance requirements.

- Accept payments: Accept and facilitate payments on behalf of your software platform's users or participants in your marketplace.

- Manage and monetise payments: Manage users on your platform and monetise via revenue share or markup on payments and additional services.

Stripe Capital

Stripe Capital gives you a way to offer customers fast and flexible financing if they need to supplement their payments volume. It's an end-to-end lending API that helps customers on your platform grow while earning a revenue share on all loans extended, with zero financial liability on credit losses.

Stripe Financial Accounts

Stripe Financial Accounts then allows your users to store the money they earn through payments or that they receive through financing. Our embedded financial solutions API allows you to embed financial accounts directly in your platform so users can pay bills and manage their cashflow.

- Faster funds: When funds are sent to Stripe, we're able to move money faster than the traditional banking system. When the funds are in one system, it's simply a ledgering event.

- Store funds for your customers: Enable your customers to keep funds on your platform and become the main destination for them to store, manage and move money.

Stripe Issuing

Next, Stripe Issuing can allow your users to spend their funds via cards. Stripe provides the infrastructure for you to build and manage card programmes for your platform.

- Issue cards instantly: Create virtual cards instantly or issue physical cards in as little as two business days.

- Control programmatically: Control expenses and help prevent fraud by setting spending limits, blocking types of businesses, or creating advanced combinations of rules.

- Monetise: Users who hit a certain volume threshold get a percentage of the interchange earned from all card purchases. Stripe uses gross interchange, which helps streamline operations and offers cashflow predictability.

For more information on Stripe Issuing, read our docs. To create your own virtual and physical cards right away, sign up for an account.