Whether you’re accepting payment from customers, issuing payments to vendors, paying bills, buying inventory or running payroll, it’s likely that your business regularly deals with electronic transfers of funds. While you may have come across the acronym "EFT" in the context of payments, you might not know what EFT stands for, what it means, and how a business could use EFTs to send and receive payments.

Here’s everything that you need to know about the different kinds of EFTs and how you can make the most of them for your business.

What's in this article?

- What is an EFT?

- What are EFTs used for?

- EFT vs. ACH transfers

- EFT vs. wire transfers

- Types of EFT payments

- How long do EFT payments take?

- EFT benefits for businesses

What is an EFT?

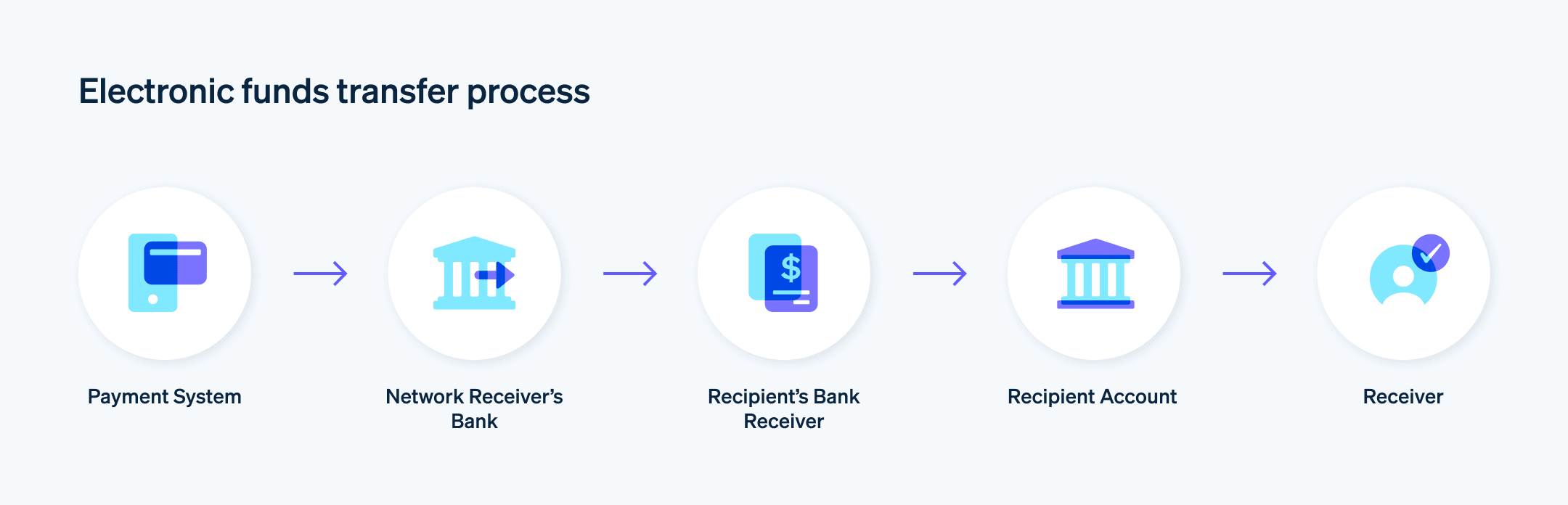

Electronic funds transfers (EFTs) are transactions that move funds electronically between different financial institutions, bank accounts or individuals. EFTs are frequently referred to as electronic bank transfers, eCheques or electronic payments. EFT is an umbrella term, beneath which exist many types of transactions and transfers, but in short, any transfer of funds that takes place electronically is considered an EFT.

What are EFTs used for?

EFTs make it possible to send and receive payments without cash or paper cheques, saving time and money on all kinds of transactions. Electronic payments have many uses, including:

- Consumer purchases

- Utility and other bill payments

- Direct deposit payments

- Funds sent between family and friends

- University tuition payments

- Tax refunds and payments

- Retirement and investment account contributions

- Charity donations

EFT vs. ACH transfers

The difference between EFT and ACH transfers is really a matter of specifics. Automated Clearing House (ACH) transfers are electronic transfers between two financial institutions made using the ACH network, which connects and facilitates transactions between banks and credit unions in the US and Puerto Rico. ACH transactions, which are electronically transferred funds, are a type of EFT, but not all EFTs are ACH transfers.

So when do you refer to a payment as an ACH transfer, and when do you call it an EFT? If you’re talking specifically about a transfer sent using the ACH network, then it would be accurate to refer to it that way. If you’re talking about electronic bank transfers generally, you could say EFT, bank transfer, or electronic payment – all of these are correct.

EFT vs. wire transfers

The relationship between EFTs and wire transfers is essentially the same as between EFTs and ACH transfers. Whereas ACH transactions move funds through the ACH network, which is administered and operated by the National Automated Clearing House Association (Nacha), wire transfers are facilitated by the Federal Reserve, and transmission takes place on the Federal Reserve Wire Network, also known as the Fedwire.

Types of EFT payments

Since any funds transfer that’s completed using an electronic network is considered an EFT, the term encompasses a range of products. For instance, withdrawing cash electronically from your personal current account is a very different function to paying for your best friend’s birthday dinner or sending thousands of pounds to a vendor in another country – but all of these actions involve EFTs.

Here are some popular types of EFTs that move funds around the world through a variety of use cases:

ACH direct deposit

Direct deposit is a type of ACH transfer most commonly used to issue employee pay cheques from employers. In these transfers, the funds are electronically deposited directly into the recipient’s account.ACH direct payments

All ACH transfers – not only direct deposits – are EFTs. This includes transfers like ACH direct payments.ACH direct debits

Whereas direct deposits involve funds being pushed into the recipient’s account through the ACH network, direct debits work in the reverse direction: Funds are pulled from one account, with prior authorisation, and sent through the ACH network to another account.Wire transfer

Wire transfers were the very first EFTs. This method dates back to 1851, when early wire transfers were sent over Western Union’s physical wires. These days, domestic wire transfers in the US are conducted through the Fedwire network, and wire transfers abroad use various networks based on location – all of these are EFTs.ATM transactions

ATM withdrawals, transfers, and deposits are all EFTs, starting with the world’s first ATM machine, which opened in 1967 at a Barclays bank in London.Debit cards

Since first arriving on the scene in 1966, through the Bank of Delaware, debit cards have been the most frequently used type of EFT for consumers.Peer-to-peer payments

Starting with PayPal in 1998, then known under its original name, Confinity, recent decades have seen a proliferation of applications aimed at facilitating direct peer-to-peer payments. These apps, which now include widely used options like Venmo, Cash App, and Zelle, are an easy way for consumers to make direct payments to businesses, for businesses to send payments to other businesses and for family and friends to exchange funds.Any electronic payment sent using bank account information

If you’re unsure whether to classify something as an EFT, there’s a simple way to check: If the payment is sent electronically – meaning that no cash or paper cheques are exchanged – then the transaction is an EFT.

How long do EFT payments take?

Some EFT payments, like contactless digital wallet payments that use near-field communication (NFC) technology, take just a few seconds from start to finish. Others, like ACH transfers, take several days. Here’s a quick rundown of how long different types of EFTs take to deliver funds to their final destination.

|

ACH transfers

|

Wire transfers

|

Digital wallets

|

|

|---|---|---|---|

|

Network

|

National Automated Clearing House Association (Nacha) | Federal Reserve Wire Network, also known as the Fedwire | Credit card networks (in the US American Express, Visa, Mastercard, Discover) |

|

Speed

|

1–4 days | From a few hours up to 2 days | Usually within a few seconds, but card authorisation for a transaction can last up to 30 days and can be settled by the acquirer at any time during that period |

|

Costs

|

Usually free, otherwise a few dollars | Domestic: Up to $35 International: $35–$50 | Subject to varying interest rates and other fees for consumers and processing fees for businesses |

EFT benefits for businesses

Doing business in the modern financial ecosystem means that electronic funds transfers are an inescapable part of your life – and that’s a good thing. EFTs offer heavy-hitting benefits that account for their notable popularity, including:

Ease and flexibility

Because EFTs encompass such a large scope of products for so many different uses, there’s a tremendous amount of flexibility when it comes to moving funds electronically. Whether you need to access cash quickly with an ATM, pay your employees using ACH direct deposit, or send a wire transfer to a vendor overseas, there’s at least one type of EFT that works for most types of consumer and B2B transactions.Security

As technology has progressed over the past century – advancing at dizzying speed over the last few decades – EFTs have become more and more secure, both for consumers and businesses. For example, early debit cards used the magnetic stripe on the back of the card to transmit the real card number to the card reader, making the transaction vulnerable to fraud attempts. But now, most card payments use EMV chips or contactless NFC payments, methods that send encrypted codes and not the card numbers themselves, to card readers. This is just one example of how EFTs have become safer, more secure, and more reliable over time.Affordability

Different types of EFTs have different fees, which can further vary based on network or provider. Overall, fees on EFTs are relatively low, especially when weighed against other factors like speed and convenience.Widespread acceptance

While some newer EFTs, like digital wallets, are still gaining adoption worldwide, the majority – debit cards, wire, and ACH transfers, ATMs, etc. – are now considered foundational staples of the worldwide economy. No matter where you’re located, what kind of industry you work in or what fund-transferring task you’re trying to complete, there is probably an EFT that fits your needs.Speed

Ultimately, most types of EFTs were created to solve the problem of moving money quickly and easily. EFTs are exponentially faster than manual funds transfers for sending and receiving money.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.