If you’re a software-as-a-service (SaaS) company, determining if your offerings are taxable in the US is a challenge. Since most sales tax laws were written with tangible products in mind, many states are still determining how to manage sales tax on nontangible products.

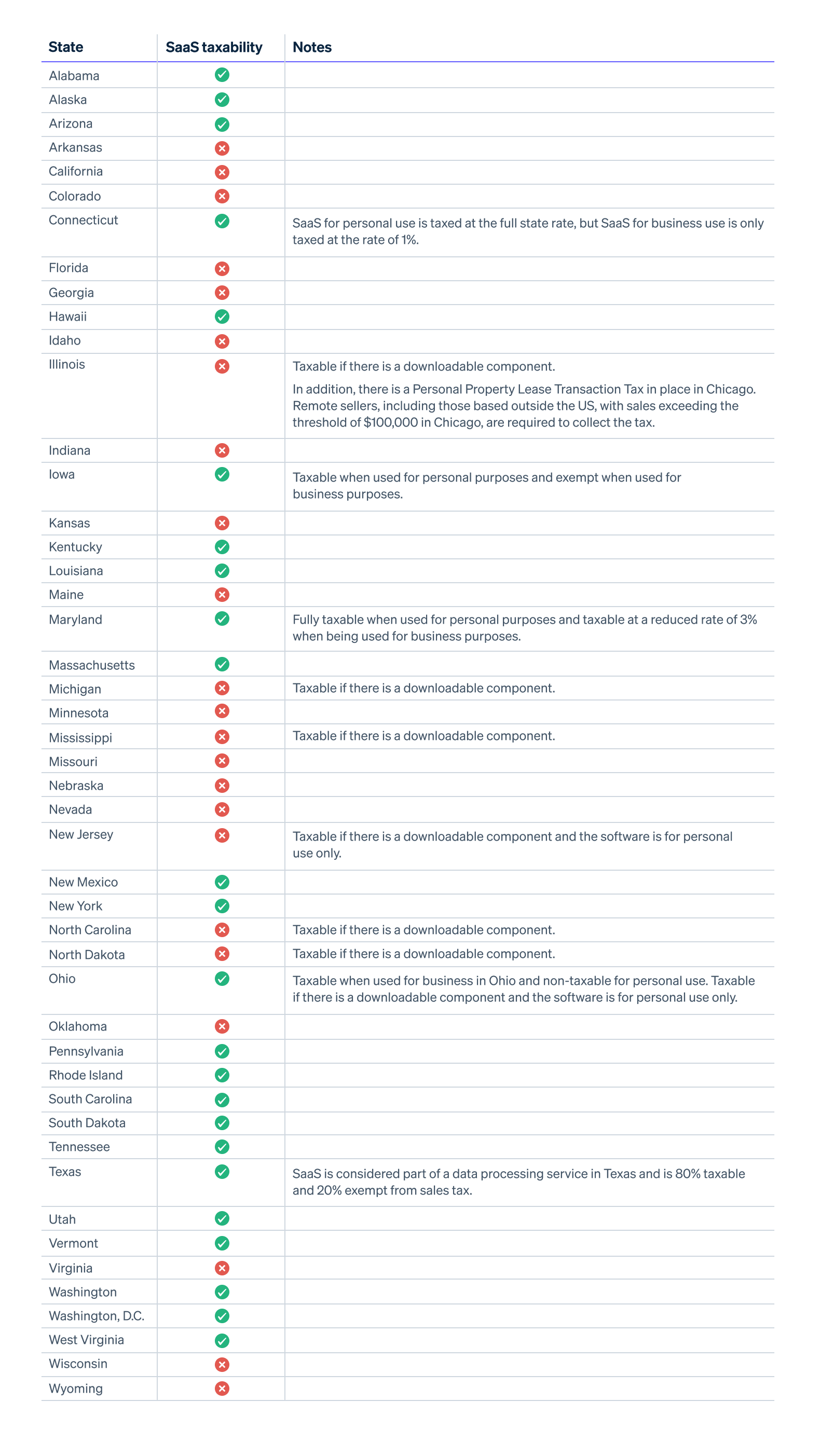

Today, 25 states tax SaaS services, and an additional 7 states tax SaaS if customers are required to download software. Each state has come to this conclusion in different ways. For example, some states consider SaaS a service, not a product. So, if services are generally taxable in the state—such as in Hawaii—then SaaS is likely to also be taxable. In states where services aren’t taxable, SaaS is unlikely to be taxable. Other states, like Washington, consider SaaS to be an example of tangible software and is deemed taxable. In addition, certain states tax SaaS at a different rate depending on whether it’s being used for personal or business purposes. SaaS companies must be aware of how their offering is taxed in all the states where they have customers.

This guide will help you determine where SaaS businesses should be collecting sales tax from customers in the US.

Use this table to look up your customer’s location and whether SaaS is taxable in that state.

How Stripe Tax can help

Stripe helps marketplaces build and scale powerful global payments and financial services businesses with less overhead and more opportunities for growth. Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT and GST on both physical and digital goods and services in all US states and in 100 countries. Stripe Tax is natively built into Stripe, so you can get started faster – no third-party integration or plug-ins are required.

Stripe Tax can help you:

- Understand where to register and collect taxes: See where you might need to collect taxes based on your Stripe transactions. After you register, you can switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe's no-code products, such as Invoicing, with the click of a button.

- Register to pay tax: If your business is in the US, let Stripe manage your tax registrations and benefit from a simplified process that prefills application details – saving you time and simplifying compliance with local regulations. If you're located outside the US, Stripe partners with Taxually to help you register with local tax authorities.

- Automatically collect sales tax: Stripe Tax calculates and collects the amount of tax owed. It supports hundreds of products and services, and it is up-to-date on tax rule and rate changes.

- Simplify filing and remittance: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data – letting our partners manage your filings so you can focus on growing your business.

Learn more about Stripe Tax.