Businesses that offer their services abroad need to keep a careful eye on value-added tax (VAT). Learn what intracommunity services are and where they are taxed. In addition, we’ll also explain the underlying reverse charge procedure and the mandatory recapitulative statements. Plus, you’ll get an overview of which details an invoice needs to contain in the case of an intracommunity service. At the end of this article, you will find a decision tree to help you identify whether your business offers intracommunity services.

What’s in this article?

- What is an intracommunity service?

- Where do intracommunity services need to be taxed?

- What is the reverse charge procedure?

- What mandatory information needs to be in an invoice for an intracommunity service?

- What is a recapitulative statement?

- When do businesses offer intracommunity services?

What is an intracommunity service?

An intracommunity service is when a business provides services in another EU country. Both the provider and the recipient of the service must be companies with a value-added tax identification number (VAT ID number). They must also be registered in member states of the European Union, but in different countries. An intracommunity service is a term used in connection with VAT, and it is different from an intracommunity supply. The latter is applied in the case of the purchase or sale of goods.

Intracommunity services are categorized as other services. They are transacted in accordance with the following legislation:

- Council Directive 2006/112/EC on the common system of value-added tax

- Council Directive 2010/45/EU amending Directive 2006/112/EC on the common system of value-added tax in regards to the rules on invoicing

Where do intracommunity services need to be taxed?

Intracommunity services for companies from other EU countries are subject to German VAT when they are provided by German companies in Germany in exchange for a fee, and no tax exemptions apply. Tax exemptions apply to German companies when, for example, they meet the requirements of the small-scale entrepreneur rule pursuant to Section 19 of the UStG (VAT Act). In addition, tax exemptions also apply, among other cases, to particular financial services or sales in connection with air or sea travel (see Section 4 of the UStG).

However, a service is not taxed in Germany if the place of performance lies outside of Germany in another EU country. In the case of services provided in more than one country, it is important to correctly determine the relevant place of performance. This is generally where the recipient company has its registered office. In such cases, the reverse charge procedure is applied.

What is the reverse charge procedure?

The reverse charge procedure is a special rule for cross-border services within the European Union. For example, if a German company provides a service in another European country—and therefore the place of performance is not Germany but this other EU country—then the service would in principle be subject to VAT in the recipient country. The German company would then have to pay the VAT to the tax office in that other EU country. The reverse charge procedure was mainly developed to spare this bureaucratic headache for businesses. As a result of the procedure, the VAT liability is instead switched around. In other words, this means that rather than the German company that issued the invoice paying the tax, the recipient company pays the tax in its own country.

Different regulations on services and the place of performance

There are several exemptions to the reverse charge procedure relating to the service or the place of performance. These include:

Electronic services: Electronic services are taxed in the recipient’s country. These also include radio, television, and telecommunication services.

Transport leasing: The place of performance is determined in accordance with the length of time the means of transport is leased (for example, vehicles or trailers). In the case of a short-term lease with a maximum of 30 days, the place of performance is the location where the vehicle was handed over. In the case of a long-term lease, the place of performance is the location of the recipient company.

Trade fairs and catering services: Services connected with trade fairs and exhibitions are taxed in the country where the event takes place. This is also the case when companies from other EU countries use such services. The same also applies to the granting of entry rights for trade fairs, exhibitions, and congresses. Catering services are also taxed in the location where the food and drink is provided.

What mandatory information needs to be in an invoice for an intracommunity service?

Invoices that businesses issue for intracommunity services must include the mandatory information specified in Section 14(4) of the UStG:

- Name and address of the invoice issuer

- Tax number of the invoice issuer

- VAT ID number of the invoice issuer

- Name and address of the invoice recipient

- Invoice issue date

- Time and date service was provided

- Serial invoice number

- Name of the service

- Type and scope of the service

- Net amount (note: the tax rate and the gross amount are not required)

There are three things that need to be taken into account when invoicing intracommunity services:

- The invoice must also include the recipient business’s VAT ID number in addition to the VAT ID number of the invoice issuer. In the case of doubt, this must be obtained from the relevant business. If this number is not stated on the invoice, then liability for the VAT lies with the invoice issuer. Subsequent payments may then need to be made to the issuer’s own tax office.

- The VAT ID number must always be checked for accuracy if a business plans to make use of the tax exemption. This can be done either in the portal of the Federal Central Tax Office (BZSt) or by using the European Commission’s VIES.

- The invoice must also include a written reference to the exemption from tax or the reverse charge procedure. On a German invoice, the relevant note is: “Umsatzsteuerschuldnerschaft des Leistungsempfängers”.

Invoice references in the official EU languages

The list below provides the tax exemption reference in the various official languages of the European Union:

- Bulgarian: обратно начисляване

- Croatian: prijenos porezne obveze

- Czech: daň odvede zákazník

- Danish: omvendt betalingspligt

- Dutch: btw verlegd

- English: reverse charge

- Estonian: pöördmaksustamine

- Finnish: käännetty verovelvollisuus

- French: autoliquidation

- Greek: aντίστροφη επιβάρυνση

- Hungarian: fordított adózás

- Italian: inversione contabile

- Latvian: nodokļa apgrieztā maksā–ana

- Lithuanian: atvirk–tinis apmokestinimas

- Maltese: inverżjoni tal-ħlas

- Polish: odwrotne obciążenie

- Portuguese: autoliquidação

- Romanian: taxare inversă

- Slovakian: prenesenie daňovej povinnosti

- Slovenian: povratna bremenitev

- Spanish: inversión del sujeto pasivo

- Swedish: omvänd betalningsskyldighet

Businesses are able to use the services of certified payment service providers to ensure proper invoicing that is compliant with the law. As well as providing automated processes, these companies offer intelligent invoicing programs to reduce error rates to a minimum, including in the case of invoices for intracommunity services.

What is a recapitulative statement?

Under Section 18a of the UStG, one of the most important duties of any business providing intracommunity services is to report the corresponding sales to the tax office on a regular basis. This takes the form of a recapitulative statement, which lists all intracommunity services and is submitted electronically (in Germany, this is done using the ELSTER portal). This statement is submitted quarterly. However, it must be submitted monthly if the intracommunity services exceed 50,000 euros within a three-month period. The reporting deadline is the 25th of the following month.

But why does this report need to be submitted when the domestic company is basically exempted from paying the VAT due to the reverse charge procedure? This rule is aimed at the other party (i.e., the recipient company), which needs to pay the VAT in its own country. The EU tax offices involved in the exchange can use the recapitulative statements to review whether the businesses have paid the correct tax on the transactions.

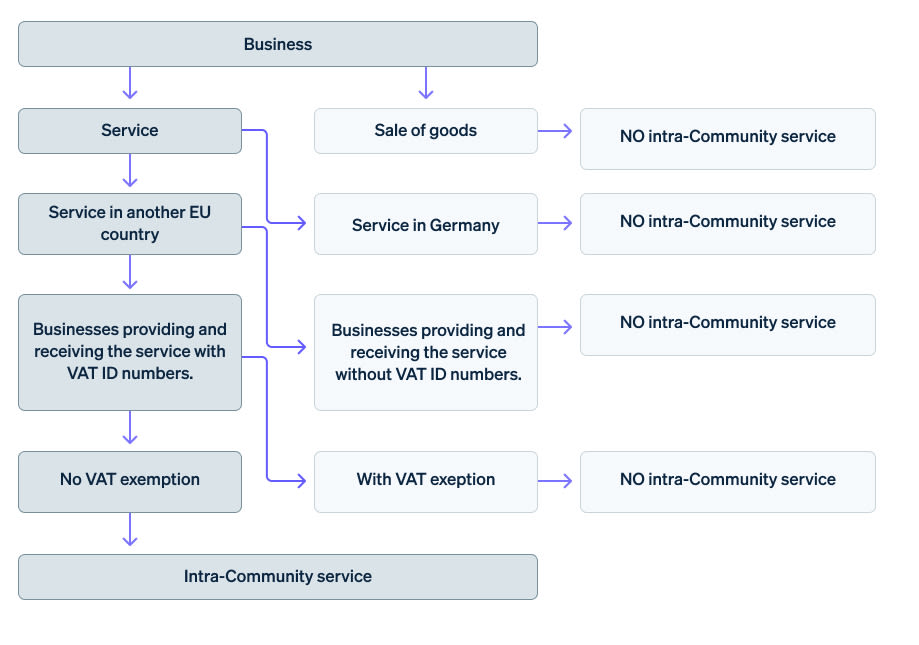

When do businesses offer intracommunity services?

Below is a decision tree that sets out the key criteria for identifying whether your business offers intracommunity services or not.

Learn more about invoicing. You can also contact our sales team to discuss how Stripe can support you with your financial processes.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.