所有者权益变动表,也称为权益变动表,是一份财务文件,显示企业在一定时间内权益的变化情况。此报表从权益所有者的角度总结了企业的财务表现,并且与资产负债表和损益表一起构成企业财务报表的重要组成部分。通常,所有者权益变动表是继损益表之后创建的第二个财务报表。

下面,我们将介绍企业所有者关于所有者权益变动表应了解的内容:内容、使用方式以及如何撰写。

本文内容

- 如何分五步准备所有者权益变动表

- 所有者权益变动表如何使用?

- 所有者权益变动表与现金流量表有何关系?

- 所有者权益变动表的关键元素

- 所有者权益变动表的示例

- 所有者权益变动表的优点和局限性

- Stripe Atlas 如何提供帮助

如何分五步准备所有者权益变动表

步骤 1:创建标题与副标题

该文件的标题应为“所有者权益变动表”,以清晰标明其用途。

包括企业名称和报表所涵盖的期间(例如:“截至 2024 年 12 月 31 日止的年度”)。

步骤 2:确定期初所有者权益

该数字为上一账期的期末所有者权益。

步骤 3:对股权进行任何补充

列出所有者在账期内投入的全部投资及追加资本。

列出损益表的净收入。此收入增加了所有者权益。如果企业发生亏损,所有者权益会相应减少。

步骤 4:包括权益中的任何扣减项

列出所有者进行的任何提款或分配。所有者权益会相应减少。

步骤 5:计算期末所有者权益

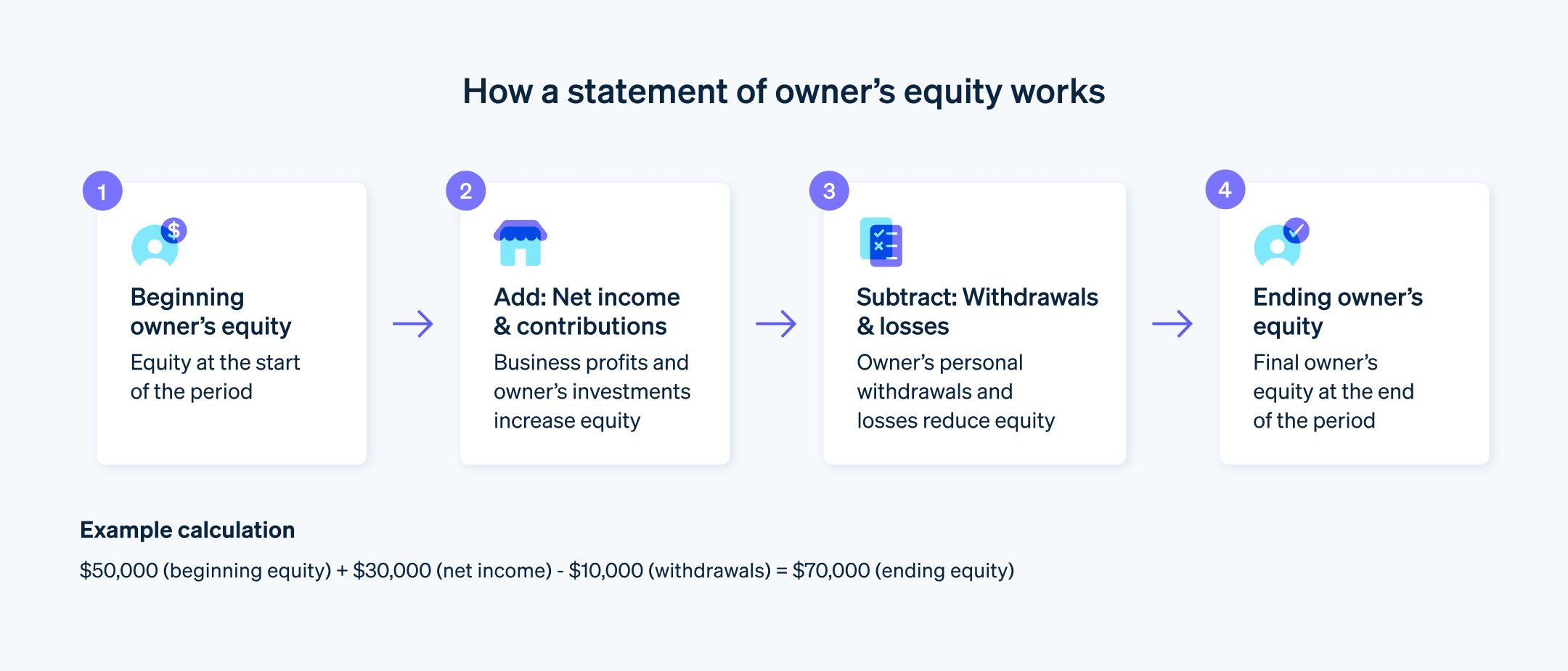

计算期末所有者权益时,将缴款和净收入加到期初权益上,并扣除任何提款或亏损。计算方法的示例如下:

5 万美元(期初权益)+ 3 万美元(净收入)- 1 万美元(提款)= 7 万美元(期末权益)

格式要求

行项目:将上述每个元素作为单独的行项目表示。

对齐:将所有数字对齐到页面的右侧。

小计:在每个部分之后提供小计。

最终结果:清晰标注并区分最终数字,即期末所有者权益。

所有者权益变动表如何使用?

所有者权益变动表提供了一个关于所有直接影响所有者在企业中净投资的企业活动的财务概览。该文件有几个重要的用途,无论是内部还是外部使用:

绩效评估:此报表让所有者和利益相关者评估企业在设定期间内的表现。通过检查权益的变化,利益相关者可以衡量企业为股东创造价值的能力。

投资决策:潜在及现有投资者通过此报表了解企业的财务状况,并就买卖或持有投资情况做出明智的决策。

信用分析:借款人和债权人查看这份报表,以评估企业的财务稳定性及偿还贷款的能力。增长的所有者权益可能表明债权人面临的风险较低。

财务分析:此报表有助于金融分析师理解企业活动如收益留存或分配政策如何影响所有者权益。

内部规划:管理层使用这份报表做出关于业务再投资、分配给所有者或其他财务战略的关键决策,以改善企业的增长和稳定性。

税收目的:此报表对税务规划和报告具有参考价值,尤其是对于基于所有者个人收入纳税的企业。

所有者权益变动表与现金流量表有何关系?

所有者权益变动表和现金流量表是不同的财务报表。所有者权益变动表侧重于净收入、所有者投资和取款在特定期间如何影响所有者权益。现金流量表则详细说明企业现金的流入与流出,并将其分类为运营、投资和融资活动。

这些报表共同构成了对企业财务状况的全面呈现。所有者权益变动表反映了企业经营业绩与所有者交易事项对权益总额的影响,以及企业净资产的变动情况;而现金流量表则揭示了这些活动及其他各类活动对企业现金状况的作用。现金流量表还可用于判定企业的流动性与财务稳定性,并体现出企业通过现金创收以履行偿债义务、支撑经营运转的能力强弱。

尽管这些报表的侧重点各不相同,但它们所包含的部分数据存在关联。例如,净收入会影响所有者权益,同时也是现金流量表中经营活动部分的起始数据。所有者权益变动表概述了权益的变动情况,而现金流量表则阐释了这些变动是如何在现金流转中体现出来的。

所有者权益变动表的关键元素

所有者权益变动表的要素展示了账期内的企业活动如何影响所有者权益。利益相关者可以利用这些信息评估财务表现和所有者投资的变化。

期初所有者权益:这是账期期初时的权益金额。它代表了在所有负债从资产中扣除后的所有者在企业中的权益。

投入资本:这些是所有者在账期内进行的额外投资。

净收入:这是企业在扣除所有费用(包括税费和利息)后的收入。它是企业在该期间内产生的利润。损益表中的净收入会被加入到所有者权益中。

所有者提款(取款):这是所有者在账期内从企业中提取的用于个人用途的资金或价值。提款会减少所有者权益,因为它代表了从企业中提取的资产。

其他调整:这些调整影响所有者权益,但不完全归入其他类别。它们可能包括会计政策变更或错误更正。

期末所有者权益:这是账期期末所有者在企业中的权益。它通过以下方式计算:从期初权益中加上投入资本和净收入,再减去任何提款和调整金额。

所有者权益变动表的示例

以下是两个假设的小型企业 ABC 咨询公司和 XYZ 设计工作室的所有者权益变动表示例。这些示例展示了根据全年不同的财务活动,所有者权益变动表的结构。

示例 1:ABC 咨询公司

ABC 咨询公司

所有者权益变动表

截至 2025 年 12 月 31 日止的年度

2025 年 1 月 1 日的期初所有者权益:5 万美元

加:当年度净收入:3 万美元

减:所有者的提款:1 万美元

2025 年 12 月 31 日的期末所有者权益:7 万美元

示例 2:XYZ 设计工作室

XYZ 设计工作室

所有者权益变动表

截至 2025 年 12 月 31 日止的年度

2025 年 1 月 1 日的期初所有者权益:8 万美元

加:年度内投入资本:2 万美元

加:当年度净收入:4 万美元

减:所有者的提款:2.5 万美元

2025 年 12 月 31 日的期末所有者权益:11.5 万美元

所有者权益变动表的优点和局限性

优点

所有者洞察:此报表为企业所有者提供了清晰的视角,展示了他们在企业中的财务权益,显示了企业运营和决策如何影响他们的权益。这些信息可能会影响企业所有者是否将利润再投资或提取收益的决策。

业绩跟踪:此报表可跟踪不同时期的财务表现,反应留存收益与追加投资如何推动所有者权益增长。

投资者决策:潜在投资者可通过此报表判断企业的财务状况和稳定性,并指导其投资决策。

财务透明度:此报表通过展示利润是如何在企业中保留或分配给所有者的,提供了财务报告的透明度。这一点对于内部和外部的利益相关者都至关重要。

局限性

范围:尽管此报表提供了所有者权益变动的重要信息,但它并未提供企业财务健康状况的完整视图,必须与其他财务报表一起解读。

及时:像所有财务报表一样,所有者权益变动表呈现的是历史数据。尽管这些信息有价值,但它可能并不总是反映企业的当前或未来财务状况。

行政负担:准备此报表可能是耗时的,尤其是对于那些拥有多种所有者权益账户或权益频繁变动的企业。

Stripe Atlas 如何提供帮助

Stripe Atlas 可为贵公司搭建法律架构,助力在两个工作日内从全球任何地点完成融资、开设银行账户及接收付款。

已有超 7.5 万家公司通过 Atlas 完成注册,其中包括获 Y Combinator、a16z 与 General Catalyst 等顶级投资机构支持的初创公司。

申请使用 Atlas 注册公司

通过 Atlas 申请注册公司仅需不到 10 分钟。您可自主选择公司架构,即时核验公司名称是否可用,并可添加最多四位联合创始人。您还需确定股权分配方案,预留一定比例的股权供未来投资者与员工认购,指定公司管理人员,并通过电子签名完成所有文件签署。所有联合创始人也将收到邮件邀请,通过电子签名签署其对应文件。

在获取雇主识别号 (EIN) 前开通收款和银行服务

完成公司注册后,Atlas 会为您申请雇主识别号码 (EIN)。持有美国社会保障号、美国地址及手机号码的创始人可享受美国国税局 (IRS) 的加急处理服务,其他创始人则需通过标准流程申请,耗时可能稍长。此外,Atlas 支持在 EIN 下发前进行收款与银行开户操作,让您在 EIN 获批前即可开始收款并完成交易。

无现金创始人股权认购

创始人可使用知识产权(如版权或专利)而非现金认购初始股份,相关认购凭证将存储在 Atlas 管理平台中。使用该功能需满足知识产权估值不超过 100 美元的条件;若您持有的知识产权价值高于此限额,请在操作前咨询专业律师。

自动提交 83(b) 税务申报

创始人可通过提交 83(b) 税务申报降低个人所得税负。无论您是美国籍或非美国籍创始人,Atlas 均可代为完成申报流程——采用 USPS 认证邮件寄送并附带物流追踪服务。您可直接在 Stripe 管理平台获取已签收的 83(b) 申报表及官方寄送凭证。

全球顶尖水准的公司法律文件

Atlas 为您提供创办公司所需的全部法律文件。Atlas 的 C 类公司文件由全球顶尖风投律所美国科律律师事务所 Cooley 联合设计,旨在助您立即启动融资,并确保公司获得全方位法律保护,涵盖股权架构、权益分配及税务合规等核心领域。

Stripe Payments 服务首年免费,更享价值 5 万美元的合作伙伴专属优惠与折扣

Atlas 与顶级合作伙伴深度联动,为创始人提供独家优惠与资源支持,涵盖 AWS、Carta、Perplexity 等行业领军企业的工程开发、税务合规、财务管理及运营必备工具折扣,更免费赠送首年特拉华州法定注册代理服务。作为 Atlas 用户,您还将解锁 Stripe 专属权益——最高 10 万美元交易额的全年免费支付处理服务。

了解关于 Atlas 如何助您快速轻松地创立新企业的更多信息,或立即开始使用。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。