Uma declaração do patrimônio líquido dos proprietários, também conhecida como demonstração das mutações do patrimônio líquido, é um documento financeiro que mostra como o patrimônio de uma empresa mudou ao longo de um determinado período. Esta declaração fornece um resumo do desempenho financeiro do negócio sob a perspectiva dos proprietários do capital e, juntamente com o balanço patrimonial e a declaração de rendimentos, constitui uma parte importante das declarações financeiras da empresa. Normalmente, a declaração do patrimônio líquido dos proprietários é a segunda declaração financeira elaborada após a declaração de rendimento.

Abaixo está uma visão geral do que os proprietários de empresas devem saber sobre declarações de patrimônio do proprietário: o que elas contêm, como são usadas e como escrever uma.

O que vamos abordar neste artigo?

- Como elaborar uma declaração do patrimônio líquido dos proprietários em cinco etapas

- Como é utilizada a declaração de patrimônio do proprietário?

- Como uma declaração do patrimônio líquido dos proprietários se relaciona com uma declaração do fluxo de caixa?

- Principais elementos de uma declaração do patrimônio líquido dos proprietários

- Exemplos de uma declaração de patrimônio líquido do proprietário

- Benefícios e limitações das declarações de patrimônio líquido do proprietário

- Como o Stripe Atlas pode ajudar

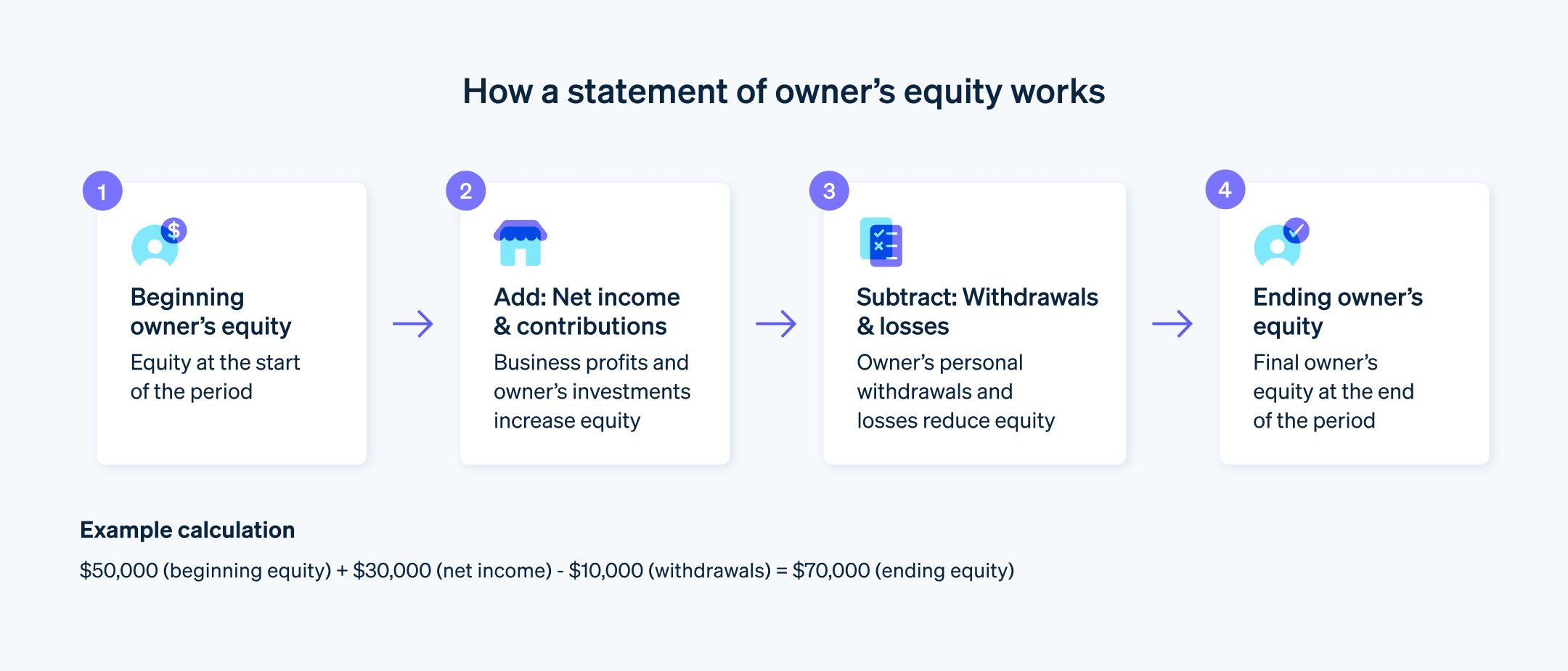

Como elaborar uma declaração do patrimônio líquido dos proprietários em cinco etapas

Etapa 1: Criar um título e cabeçalho

O documento deve ser intitulado “Declaração do Patrimônio Líquido dos Proprietários” para identificar claramente sua finalidade.

Inclua o nome da empresa e o período abrangido pela declaração (por exemplo, “Para o ano encerrado em 31 de dezembro de 2024”).

Etapa 2: Determinar o patrimônio líquido do proprietário inicial

Esse valor corresponde ao patrimônio líquido final dos proprietários do período contábil anterior.

Etapa 3: Adicionar o patrimônio líquido

Liste quaisquer investimentos ou capital adicional que os proprietários tenham aportado durante o período contábil.

Liste o rendimento líquido da declaração de resultados. Esse lucro aumenta o patrimônio líquido dos proprietários. Se a empresa tiver incorrido em prejuízo, isso reduz o patrimônio líquido dos proprietários.

Etapa 4: Incluir quaisquer deduções do patrimônio líquido

Liste quaisquer retiradas ou distribuições realizadas pelos proprietários. Isso reduz o patrimônio líquido dos proprietários.

Etapa 5: Calcular o patrimônio líquido do proprietário final

Calcule o patrimônio líquido final dos proprietários somando as contribuições e o rendimento líquido ao patrimônio líquido inicial e subtraindo quaisquer retiradas ou prejuízos. Veja um exemplo de como realizar esse cálculo:

US$50.000 (patrimônio líquido inicial) + US$30.000 (rendimento líquido) − US$10.000 (retiradas) = US$70.000 (patrimônio líquido final)

Formatação

Itens de linha: Represente cada um dos elementos acima como um item de linha separado.

Alinhamento: Alinhe todas as figuras numéricas no lado direito da página.

Subtotais: Forneça subtotais após cada seção.

Resultado final: Identifique claramente e destaque o valor final, o patrimônio líquido final dos proprietários.

Como é usada uma declaração de patrimônio líquido do proprietário?

Uma declaração do patrimônio líquido dos proprietários fornece uma visão financeira geral de todas as atividades do negócio que afetam diretamente o investimento líquido dos proprietários na empresa. Esse documento é utilizado para diversas finalidades importantes, tanto internas quanto externas:

Avaliação de desempenho: Essa declaração permite que proprietários e partes interessadas avaliem o desempenho do negócio ao longo de um período determinado. Ao analisar as mudanças no patrimônio líquido, é possível mensurar o quão bem a empresa está gerando valor para seus proprietários.

Decisões de investimento: Investidores potenciais e atuais utilizam essa declaração para compreender a saúde financeira do negócio e tomar decisões informadas sobre comprar, vender ou manter seus investimentos.

Análise de crédito: Os credores revisam esta declaração para avaliar a estabilidade financeira da empresa e a capacidade de pagar empréstimos. Uma posição patrimonial crescente pode indicar um menor risco para os credores.

Análise financeira: Esta declaração ajuda os analistas financeiros a entender como atividades empresariais, como retenção de receitas ou políticas de distribuição, afetam o patrimônio líquido do proprietário.

Planejamento interno: A administração utiliza essa declaração para tomar decisões estratégicas importantes, como reinvestir no negócio, distribuir recursos aos proprietários ou adotar outras estratégias financeiras para melhorar o crescimento e a estabilidade da empresa.

Finalidades tributárias: Esta declaração pode ser relevante para planejamento e relatórios tributários, especialmente para empresas nas quais os impostos são pagos com base na renda pessoal do proprietário.

Como uma declaração do patrimônio líquido dos proprietários se relaciona com uma declaração do fluxo de caixa?

Uma declaração do patrimônio líquido dos proprietários e uma declaração do fluxo de caixa são declarações financeiras distintas. A declaração do patrimônio líquido dos proprietários se concentra em como o rendimento líquido, os investimentos dos proprietários e as retiradas afetaram o patrimônio líquido dos proprietários ao longo de um período específico. Já a declaração do fluxo de caixa detalha as entradas e saídas de caixa de uma empresa e as classifica em atividades operacionais, de investimento e de financiamento.

Juntas, essas declarações oferecem uma visão abrangente das finanças de uma empresa. Enquanto a declaração do patrimônio líquido dos proprietários mostra como o desempenho do negócio e as transações dos proprietários afetam o patrimônio líquido total e refletem as mudanças no valor patrimonial da empresa, a declaração do fluxo de caixa fornece insights sobre como essas e outras atividades impactam a posição de caixa do negócio. Isso determina a liquidez e a estabilidade financeira da empresa e revela o quão bem o negócio gera caixa para cumprir suas obrigações e financiar suas operações.

Embora essas declarações tenham focos diferentes, alguns dos valores que elas incluem estão conectados. Por exemplo, o rendimento líquido afeta o patrimônio líquido dos proprietários e serve como ponto de partida na declaração do fluxo de caixa, na seção de atividades operacionais. A declaração do patrimônio líquido dos proprietários fornece uma visão geral das mudanças no patrimônio líquido, enquanto a declaração do fluxo de caixa demonstra como essas mudanças se refletem nos movimentos de caixa.

Principais elementos de uma declaração do patrimônio líquido dos proprietários

Os elementos de uma declaração do patrimônio líquido dos proprietários mostram como as atividades do negócio durante um período contábil afetaram o patrimônio líquido dos proprietários. As partes interessadas podem usar essas informações para avaliar o desempenho financeiro e as mudanças nos investimentos dos proprietários.

Patrimônio líquido inicial dos proprietários: Este é o valor do patrimônio líquido no início do período contábil. Representa a participação dos proprietários no negócio após a dedução de todos os passivos dos ativos.

Capital integralizado: Estes são os investimentos adicionais realizados pelos proprietários durante o período contábil.

Rendimento líquido: Este é o resultado da empresa após a dedução de todas as despesas (incluindo impostos e juros) das receitas. Trata-se do lucro gerado pelo negócio durante o período. O lucro líquido da declaração de rendimentos é adicionado ao patrimônio líquido dos proprietários.

Retiradas dos proprietários (saques): Este é o valor em dinheiro ou em bens retirado do negócio pelos proprietários para uso pessoal durante o período contábil. As retiradas reduzem o patrimônio líquido dos proprietários, pois representam ativos retirados da empresa.

Outros ajustes: São ajustes que afetam o patrimônio líquido dos proprietários, mas que não se enquadram claramente nas outras categorias. Podem incluir mudanças em políticas contábeis ou correções de erros.

Patrimônio líquido do proprietário: Este é o interesse dos proprietários no negócio ao final do período contábil. Ele é calculado somando o patrimônio líquido inicial ao capital integralizado e ao rendimento líquido, e subtraindo quaisquer retiradas e ajustes.

Exemplos de uma declaração de patrimônio líquido do proprietário

A seguir estão dois exemplos de uma declaração do patrimônio líquido dos proprietários para as empresas hipotéticas de pequeno porte ABC Consulting e XYZ Design Studio. Esses exemplos ilustram como a declaração é estruturada com base em diferentes atividades financeiras ao longo do ano.

Exemplo 1: ABC Consulting

ABC Consulting

Declaração de patrimônio líquido do proprietário

Para o exercício encerrado em 31 de dezembro de 2025

Patrimônio líquido inicial do proprietário, 1º de janeiro de 2025:US$ 50.000

Adicionar: Rendimento líquido do ano: US$ 30.000

Menos: Retiradas do proprietário: US$ 10.000

Patrimônio líquido final do proprietário, 31 de dezembro de 2025:US$ 70.000

Exemplo 2: XYZ Design Studio

XYZ Design Studio

Declaração de patrimônio líquido do proprietário

Para o exercício encerrado em 31 de dezembro de 2025

Patrimônio inicial do proprietário, 1º de janeiro de 2025:US$ 80.000

Adicionar: Capital aportado durante o ano: US$ 20.000

Adicionar: Rendimento líquido do ano: US$ 40.000

Menos: Retiradas do proprietário: US$ 25.000

Patrimônio líquido final do proprietário, 31 de dezembro de 2025:US$ 115.000

Benefícios e limitações das declarações de patrimônio líquido do proprietário

Benefícios

Visão do proprietário: A declaração oferece aos proprietários do negócio uma visão clara de seu interesse financeiro na empresa, mostrando como as operações e decisões do negócio afetaram seu patrimônio líquido. Essas informações podem influenciar decisões sobre reinvestir lucros ou retirar receitas.

Acompanhamento de desempenho: A declaração pode acompanhar o desempenho financeiro ao longo do tempo, mostrando como receitas retidas e investimentos adicionais contribuem para o crescimento do patrimônio líquido do proprietário.

Decisões dos investidores: Os potenciais investidores podem usar esta declaração para determinar a saúde financeira e a estabilidade de uma empresa, informando assim como suas decisões de investimento.

Transparência financeira: Esta declaração fornece transparência nos relatórios financeiros, mostrando como os lucros são retidos na empresa ou distribuídos aos proprietários. Isso é importante para o público interno e externo.

Limitações

Escopo: Embora a declaração forneça informações valiosas sobre mudanças no patrimônio líquido, ela não oferece um quadro completo da integridade financeira de uma empresa e deve ser interpretada em conjunto com outras declarações financeiras.

Cronograma: Assim como todas as declarações financeiras, a declaração do patrimônio líquido dos proprietários apresenta dados históricos. Embora essas informações sejam valiosas, elas nem sempre refletem a condição financeira atual ou futura do negócio.

Encargos administrativos: A preparação dessa declaração pode ser demorada, especialmente para empresas que têm vários tipos de contas de patrimônio ou mudanças frequentes no patrimônio.

Como o Stripe Atlas pode ajudar

O Stripe Atlas estabelece a base jurídica da sua empresa, permitindo captar investimentos, abrir conta bancária e começar a receber pagamentos em até dois dias úteis, de qualquer lugar do mundo.

Mais de 75 mil empresas já foram constituídas com o Atlas, incluindo startups apoiadas por investidores de destaque como Y Combinator, a16z e General Catalyst.

Como se inscrever no Atlas

O processo de inscrição para criar uma empresa com o Atlas leva menos de 10 minutos. Você escolhe a estrutura societária, verifica de imediato se o nome desejado está disponível e pode adicionar até quatro cofundadores. Também define a divisão de participação acionária, reserva parte das ações para futuros investidores e funcionários, nomeia administradores e assina eletronicamente todos os documentos. Cada cofundador recebe um e-mail para também assinar digitalmente sua parte.

Aceitar pagamentos e movimentações bancárias antes da chegada do seu EIN

Após a abertura da empresa, o Atlas solicita o seu EIN. Fundadores que possuem número de Seguro Social dos EUA, endereço e número de celular nos EUA são elegíveis para o processamento acelerado junto ao IRS, enquanto os demais passam pelo processamento padrão, que pode levar um pouco mais de tempo. Além disso, o Atlas permite a realização de pagamentos e transações bancárias antes da emissão do EIN, possibilitando que você comece a receber pagamentos e fazer movimentações mesmo antes da chegada do número.

Compra de ações de fundador sem dinheiro em espécie

Os fundadores podem adquirir ações iniciais utilizando propriedade intelectual, como direitos autorais ou patentes, em vez de dinheiro. O comprovante da transação é armazenado no painel do Atlas. Essa função está disponível apenas para propriedade intelectual avaliada em até US$ 100; se o valor for superior, recomenda-se consultar um advogado antes de prosseguir.

Envio automático da eleição tributária 83(b)

Os fundadores podem enviar a eleição fiscal 83(b) para reduzir impostos pessoais. O Atlas faz isso automaticamente — seja você residente nos EUA ou não — por meio de envio certificado via USPS com código de rastreio. O documento assinado e o comprovante ficam disponíveis diretamente no painel da Stripe.

Documentos jurídicos de padrão internacional

O Atlas fornece todos os documentos legais de que você precisa para começar a administrar sua empresa. Os documentos de empresa do tipo C do Atlas foram desenvolvidos em colaboração com a Cooley, uma das principais firmas de advocacia de capital de risco do mundo. Esses documentos são projetados para ajudar você a captar recursos imediatamente e garantir a proteção legal da sua empresa, abordando aspectos como estrutura societária, distribuição de participação societária e conformidade fiscal.

Um ano gratuito de Stripe Payments, além de 50 mil dólares em créditos e descontos de parceiros

O Atlas colabora com parceiros de primeira linha para oferecer aos fundadores descontos e créditos exclusivos. Isso inclui descontos em ferramentas essenciais para engenharia, impostos, finanças, conformidade e operações, oferecidos por líderes do setor como AWS, Carta e Perplexity. Também fornecemos gratuitamente o agente registrado necessário em Delaware durante o primeiro ano. Além disso, como usuário do Atlas, você terá acesso a benefícios adicionais da Stripe, incluindo até um ano de processamento gratuito de pagamentos para um volume de até $ 100 mil.

Saiba mais sobre como a Atlas pode ajudar você a configurar sua nova empresa de forma rápida e fácil, e comece hoje mesmo.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.