欧元是全球第二大交易货币(截至 2022 年),对全球经济具有重要影响。它为企业和国家提供了美元以外的重要选择,并在外汇市场中促进竞争与稳定。欧元的强势源自欧元区,这是一个使用欧元的经济强国集合体。

欧元区内的企业受益于单一货币的使用。它简化了贸易,消除了货币兑换的需求。对于国际企业来说,以欧元运营降低了汇率波动带来的风险。强势的欧元增强了欧盟在全球的存在,使欧盟能够倡导其经济利益并帮助制定全球金融法规。

本指南将简要介绍欧元的历史及其目前的使用地。

目录

- 欧元的历史

- 欧元在世界经济中的重要性

- 哪些国家/地区使用欧元?

欧元的历史

欧元是欧元区的官方货币,包括欧盟 27 个成员国中的 20 个国家。创建单一欧洲货币的进程可以追溯到 1970 年的维尔纳报告,该报告曾试图在 1980 年前建立货币联盟,但未能成功。1992 年签署的马斯特里赫特条约正式确定了采用单一货币的标准。1994 年,欧洲货币研究所成立,旨在加强欧盟各中央银行的合作,并为欧洲中央银行 (ECB) 和欧元的推出做准备。

1999 年 1 月 1 日,欧盟推出欧元作为“无形”货币,用于电子支付和会计,而现金交易仍使用各国货币。2002 年 1 月 1 日,欧元纸币和硬币开始流通,取代了 12 个成员国的旧货币,标志着历史上最大规模的现金更替。旧的国家货币随后不再具有法定货币地位。

然而,2008 年的全球金融危机以及随后欧洲债务危机暴露了欧元区经济架构的弱点。欧盟推出了欧洲稳定机制 (ESM),为陷入财务困境的成员国提供金融稳定与援助。

随着新的欧盟成员国满足加入欧元区的马斯特里赫特经济标准,欧元区逐步扩大:斯洛文尼亚于 2007 年加入,马耳他于 2008 年加入,斯洛伐克于 2009 年加入,爱沙尼亚于 2011 年加入,拉脱维亚于 2014 年加入,立陶宛于 2015 年加入克罗地亚是最近的新增成员,2023 年采用了欧元。

欧元在世界经济中的重要性

促进贸易: 欧元简化了欧元区成员国之间以及与世界其他地区的贸易。通过消除货币兑换的风险和成本,欧元创造了更透明的定价并降低了交易费用。

促进经济一体化: 欧元的采用使成员国之间的经济政策和法规更加同步。这种一体化为欧洲内部创造了更稳定、可预测的经济环境,有利于商业规划和投资。

充当全球储备货币: 欧元是全球主要储备货币之一,被多个中央银行和金融机构作为外汇储备的一部分持有。这使欧元对全球汇率和货币政策具有影响力。

影响全球市场: 由欧洲中央银行 (ECB) 管理的欧元区货币政策对全球金融市场有重要影响。欧元区关于利率或量化宽松的决策会影响全球资本流动、投资决策以及超出欧洲范围的经济状况。

促进欧盟合作: 欧元是欧洲团结和身份的象征,其管理需要成员国之间密切合作。这种必要的合作在经济或政治动荡时期促进了地区政治一体化与稳定。

创造有吸引力的投资机会: 欧元区是一个庞大而有吸引力的投资市场。欧元为投资者提供了一个广泛而一体化的市场,避免了因货币波动而可能存在于较小、独立的国家市场中的风险。

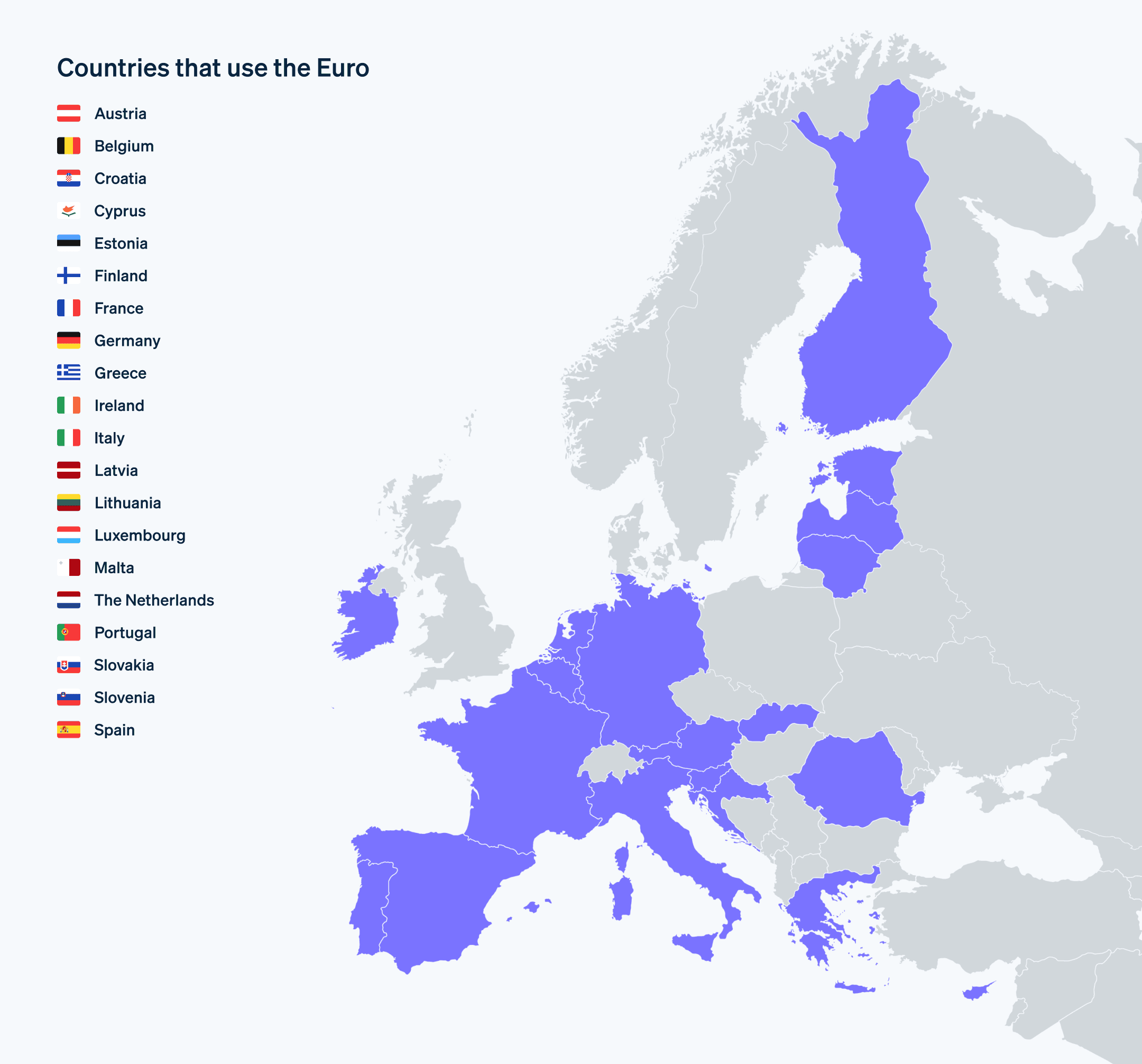

哪些国家/地区使用欧元?

截至 2024 年 5 月,欧元是 20 个欧洲国家/地区的官方货币,每天约 3.41 亿人使用欧元。以下国家/地区共同组成了所谓的欧元区:

奥地利、比利时、克罗地亚、塞浦路斯、爱沙尼亚、芬兰、法国、德国、希腊、爱尔兰、意大利、拉脱维亚、立陶宛、卢森堡、马耳他、荷兰、葡萄牙、斯洛伐克、斯洛文尼亚、西班牙。

尽管一些欧洲的微型国家/地区和城邦不属于欧盟,但由于它们与欧元区国家/地区毗邻,也使用欧元。此外,欧元也被一些已申请加入欧盟但尚未成为成员国的国家/地区所使用。这些地区包括:

安道尔: 安道尔于 2002 年采用欧元,并在 2011 年将其定为官方货币。

科索沃: 科索沃于 2002 年将欧元定为官方货币。

摩纳哥: 摩纳哥于 2002 年将欧元定为官方货币。

黑山: 黑山于 2002 年将欧元定为官方货币。

圣马力诺: 圣马力诺于 2002 年将欧元定为官方货币。

梵蒂冈: 梵蒂冈于 2002 年将欧元定为官方货币。

在这些地方,欧元促进了经济交易,并通过与强劲稳定的货币挂钩,为当地经济提供支持。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。