阅读故事

埃森哲:迈向支付和金融自动化的未来

阅读故事

AdaptedMind derives 5%–10% of revenue from recovered payments captured with Stripe

阅读故事

时尚品牌 Adastria 携手 Stripe,共同搭建全新 C2C 平台,并为支付功能的快速开发保驾护航

阅读故事

Adore Me 拥抱技术,打造无缝客户体验

阅读故事

幕后故事:Aesthetic Record 如何通过 Stripe 将支付规模扩展至 10 亿美元

阅读故事

AFGE collects $7 million in monthly dues from 900 union chapters with Stripe Billing

阅读故事

Agua Bendita 通过 Stripe + VTEX 合作伙伴的支付处理解决方案进行国际扩张

阅读故事

Airpaz 借助 Stripe 拓展至东南亚以外

阅读故事

丹麦初创公司 Airwallet 通过 Stripe 扩展到 19 个新领域

阅读故事

领先的英国投资平台 AJ Bell 利用 Stripe 加速交易

观看视频

阿拉斯加航空公司通过 Tap to Pay on iPhone 将非接触式支付带入航空领域

阅读故事

Alberta Motor Association 借助 Hiveway 和 Stripe,拓展会员模式并为未来增长赋能

阅读故事

ALL CONNECT 携手 Stripe 掀起通信基础设施在线销售革命并加快产品上市速度

阅读故事

餐厅管理平台 allO 与 Stripe 合作,推出更快的入驻流程和次日到账服务

阅读故事

捐款额同比增长 18%:AllDons 筹款成功的幕后策略

阅读故事

Alma 通过与 Stripe 建立战略合作伙伴关系优化业绩

阅读故事

Alternative Airlines 成为第一家使用 Stripe Issuing 旅行产品的旅行公司,而此举提高了该公司的接受率

观看视频

Stripe 助力 Amazon 简化跨境支付

阅读故事

AMP supports car washes with error-free subscription billing on Stripe

阅读故事

ANA Group 转向 Stripe,打造新一代里程计划

阅读故事

Ankorstore 利用 Stripe 扩大其在 28 个国家的 B2B 交易市场规模

阅读故事

幕后故事:Anthropic 如何借助 Stripe 构建可扩展收入模式

阅读故事

APCOA 与 Stripe 的专业服务团队合作,实现数字化转型

阅读故事

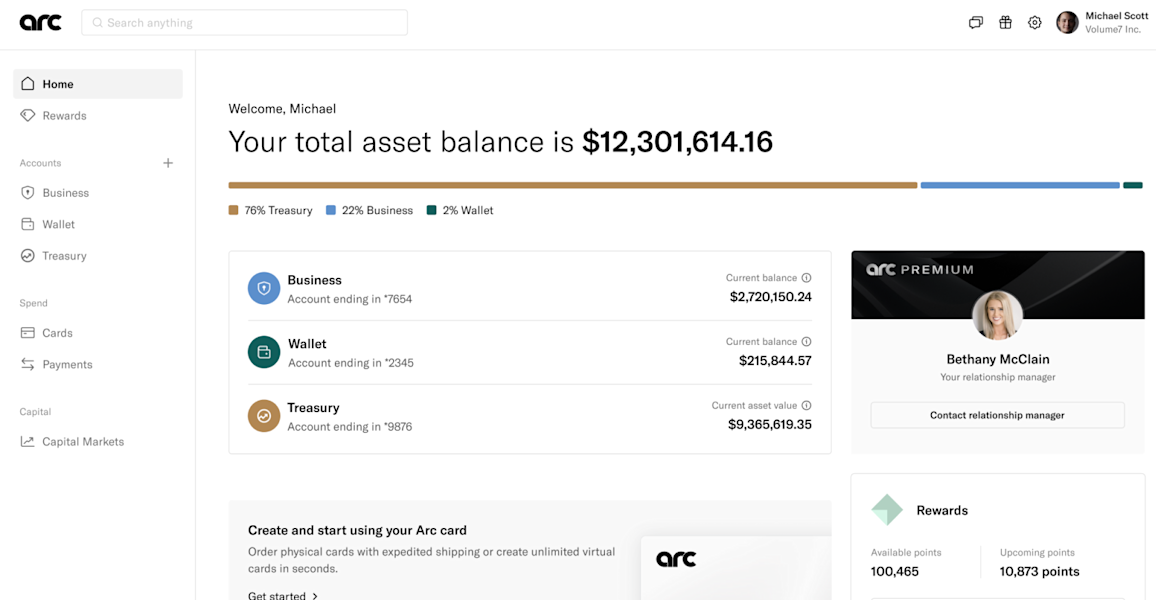

Arc 与 Stripe 和五三银行 (Fifth Third Bank) 一起构建新一代的现金管理系统

阅读故事

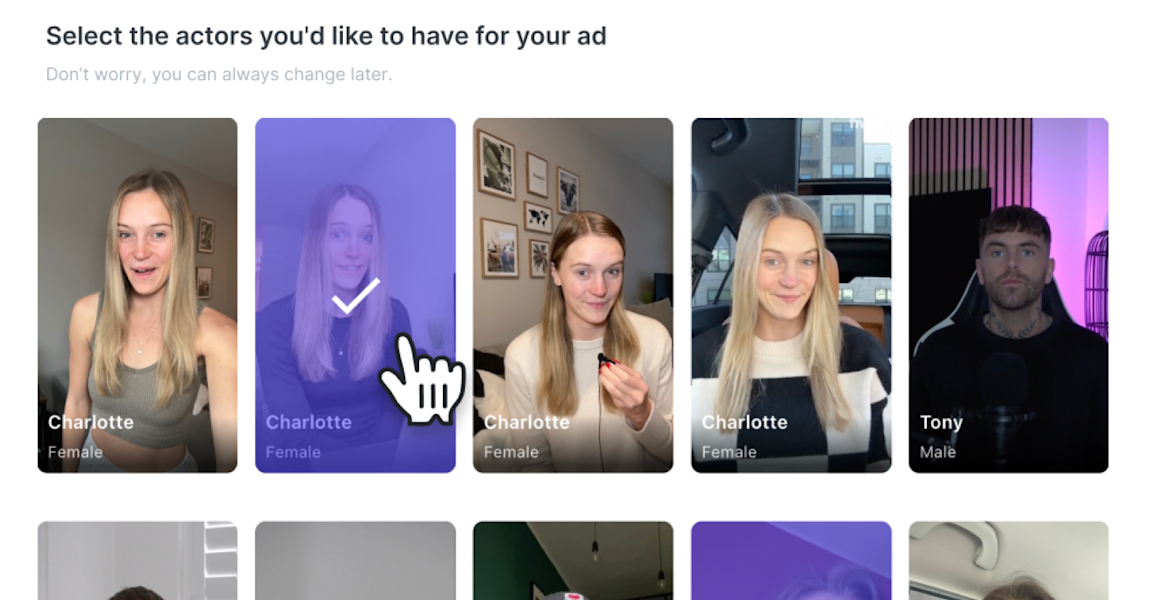

Arcads 依托 Stripe,在不到两年时间里将年度订阅收入提升至 1200 万美元

阅读故事

ARTERNAL 谈艺术界的嵌入式金融工具

阅读故事

Artlogic 通过基于云的集成支付解决方案助力 5000 家艺术类商家

阅读故事

正处于电子商务发展风口的 Astound

阅读故事

Atlassian 选择 Stripe 打造了一个全球统一的计费和支付平台

阅读故事

Atmoph 携手 Stripe,打开 52 个国家/地区的风景之窗

观看视频

借助 Stripe,atVenu 顺利进行演出现场的商品销售

阅读故事

通过使用 Stripe 管理支付,Aureus Academy 的财务管理时间减少了 90%

阅读故事

Aurionpro Payments 借助新的支付平台,将整个亚洲的商业交易速度提高了 97%

阅读故事

Avocadostore 利用 Stripe 灵活的 API 扩大其交易市场规模

阅读故事

AWA 与 Stripe 合作简化流媒体音乐订阅计费

阅读故事

AWS 帮助成长型小型企业利用数据的力量

阅读故事

Barkibu 借助 Stripe 3 年实现营收增长超 3,000%

阅读故事

Stripe Payments 将 BASE FOOD 年同比增长率提高到 90%

阅读故事

Beautiful.ai grows revenue more than 40% with Stripe’s recurring billing tools

阅读故事

Beerwulf 利用 Stripe 在支付领域的全面经验构建全球市场

阅读故事

Beerwulf 致力于采用新的支付方式来保持客户忠诚度

阅读故事

Ben & Frank 利用 Stripe 将在墨西哥的授权率提高了 10%

阅读故事

Beyond Menu transitions 100% of order volume to Stripe Connect in two months

观看视频

BIG4 Parks combines 170-year heritage with Stripe technology nationwide

阅读故事

BigCommerce 首席执行官 Brent Bellm 谈电商的下一阶段

阅读故事

Bikes Online 借助 Stripe 实现了 10 倍的全球扩张

阅读故事

Blackthorn Payments 和 Stripe 为 Salesforce 的客户提供全套支付解决方案

阅读故事

Blaze reduces customer acquisition cost by 25% with Stripe Sigma and Stripe Data Pipeline

阅读故事

Blockchain.com 与 Stripe 携手,为加密经济拓展用户基础

阅读故事

Blockchain.com 借助 Stripe 全面升级欺诈检测能力

阅读故事

Bloomerang 的非营利组织利用 Bloomerang Payments 和 Stripe 使捐款额同比增长 20%

阅读故事

Bloomerang 首席执行官 Ross Hendrickson 谈软件为非营利组织带来更多价值

阅读故事

Bloomerang allows nonprofits to accept more flexible donations without hardware using Tap to Pay on iPhone

阅读故事

BloomNation 利用 Stripe 帮助独立花店实现 40% 的年增长率

阅读故事

Bodum 利用 Stripe 的本地支付方式进行全球扩张

阅读故事

Bond Vet generates $4.5 million from 15,000 recovered transactions with Stripe

阅读故事

Bookshop.org 使用 Stripe 帮助 200 多万客户,在电商时代为独立书店提供支持

阅读故事

Booksy 转与 Stripe 合作,加速打款并实现全渠道支付

阅读故事

Online fundraising platform Booster onboards nearly 2,000 schools in three weeks after transition to Stripe Connect

阅读故事

Bounce 借助 Stripe Connect,帮助全球旅行者灵活存储行李

观看视频

Brightwheel 借助 Stripe 的支持从初创公司成长为垂直 SaaS 领域佼佼者

阅读故事

英国文化教育协会 (British Council) 如何利用 Stripe 在线扩展其传统服务

阅读故事

Browserbase powers web browsing for AI agents and apps with Stripe’s usage-based billing

阅读故事

bsport 通过 Stripe 满足精品健身工作室的需求,实现支付量翻倍并迈向全球化

阅读故事

Buck Mason 利用 Stripe Terminal 打造强大的一体化商业零售平台

阅读故事

buyolympia 通过 Stripe Tax 简化了在 11 个州的销售税监管合规工作

阅读故事

ByteSIM 通过 Stripe 将争议率降至 0.02%

阅读故事

Rungis 和 Califrais 使用 Stripe Connect 在 10 天内推出了强大的直接面向消费者的平台

阅读故事

加拿大红十字会借助 Stripe 和 Fundraise Up,使定期捐赠收入增长 24%

阅读故事

幕后故事:Canva 借助 Stripe,让出色设计体验触达全球用户

阅读故事

CarbonPay 推出碳中和卡——仅用了短短 20 周

阅读故事

Carousell 利用 Stripe 创建广泛的防欺诈流程

阅读故事

Castlery 用 Stripe 接受线下和线上付款,并扩展到美国

阅读故事

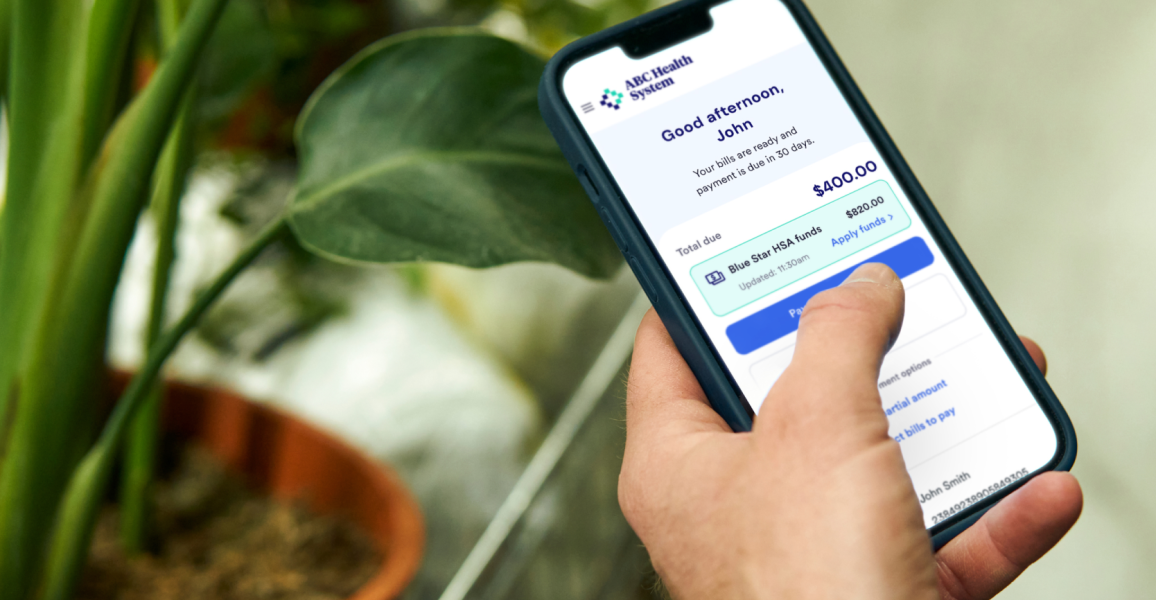

Cedar creates a simple and powerful financial experience for healthcare patients and providers using Stripe

阅读故事

Clip Studio Paint 使用 Stripe 为全球 4000 万客户开发了无差错支付系统

阅读故事

Chargeflow saves 80 hours of work per month by automating usage-based billing with Stripe

阅读故事

Chartmetric 通过 Stripe Tax 在 35 个国家/地区实现全球税务合规

阅读故事

Chatwork 迁移到 Stripe 以增加客户价值并推动业务增长

阅读故事

Child Care Seer 在不到一年的时间里,为儿童保育机构推出了完整的管理平台

阅读故事

周生生利用 Stripe 将其支付转化率提高 20%

阅读故事

ChowNow 通过 Stripe Data Pipeline 揭开新的增长机会和支付洞察

阅读故事

Ciklum 谈无缝支付体验如何提升客户忠诚度

阅读故事

采用 Stripe 后,Classlist 的收入增长 124%

阅读故事

Classy Pay 由 Stripe 赋能,为现代的非营利组织打造一流的筹款体验

阅读故事

Cleo 借助 Radar 风控团队版将撤单率降低 23%

阅读故事

ClickFunnels 通过全面集成 Stripe 节省数百万开发成本并发布新平台

阅读故事

A.J. Axelrod from Clio on why SaaS platforms should focus on outcomes, not take rate

阅读故事

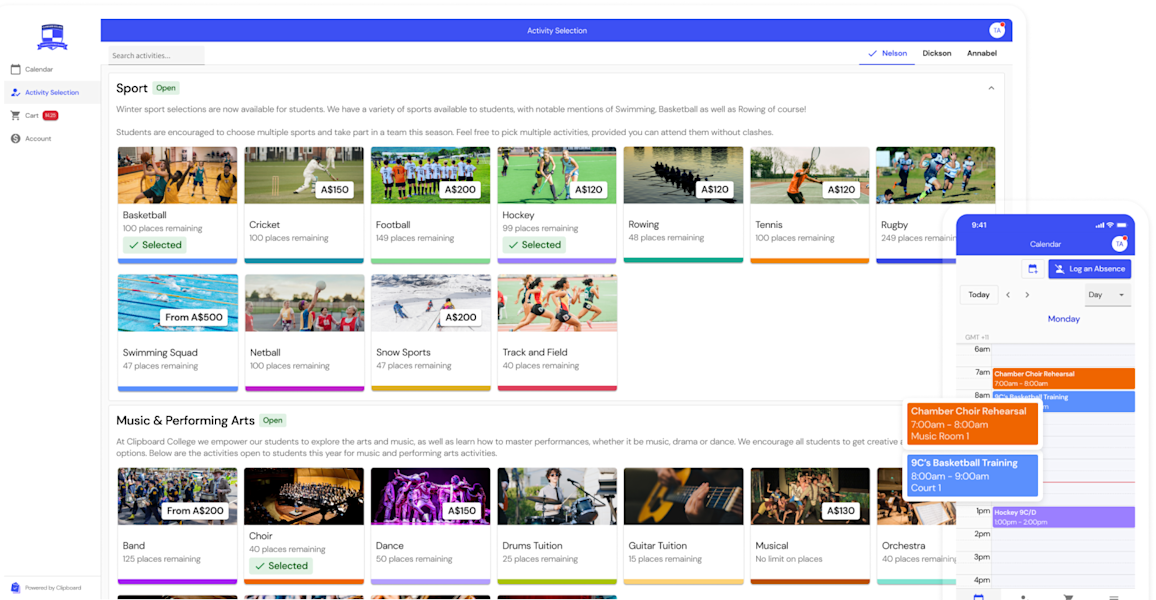

Clipboard enables digital student activity payments with Stripe Connect

阅读故事

通过 Stripe,Cloudbeds 使酒店平台用户的收入增长 15%

阅读故事

CNY Fertility generates $8.43M in revenue with custom payments platform by Echobind and Stripe

观看视频

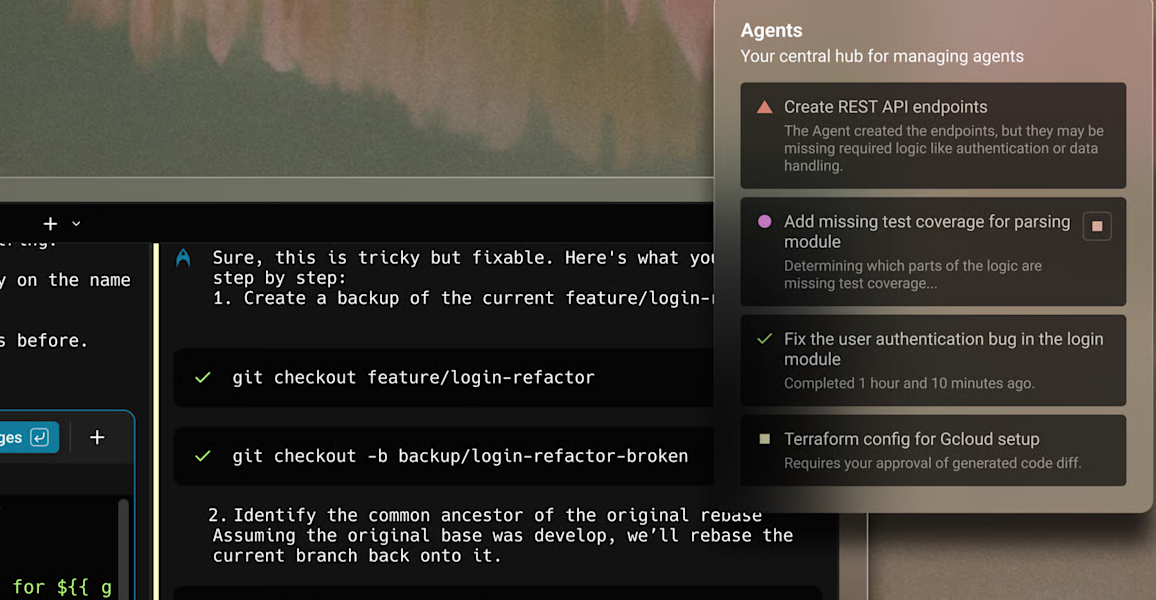

Cognition CEO Scott Wu on the evolution of AI coding agents and the future of software engineering

阅读故事

CoinPanel 减少了欺诈行为的发生率,并在 6 个月内通过 Stripe 将用户规模扩大至 13 万。

阅读故事

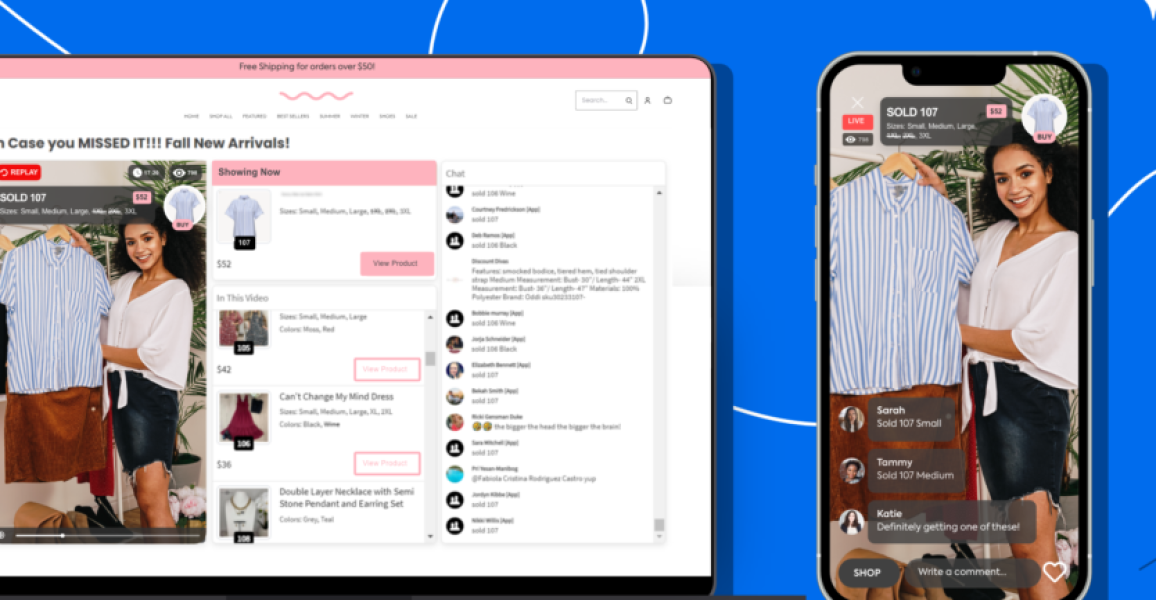

Steven Power 谈实时销售的发展与前景

阅读故事

Constanci on adapting pricing models to a changing marketplace

阅读故事

Crimson Education 在全球范围内扩展,并通过 Stripe 简化客户体验

阅读故事

使用 Stripe,CrowdFarming 农民的收款速度提高 89%

观看视频

墨西哥红十字会携手 Stripe 为线上和移动支付赋能

阅读故事

Crypto.com partners with Stripe to enable convenient crypto payments

阅读故事

CSFloat 通过 Stripe 将加密货币支付处理成本降低 35%

阅读故事

Cursor 借助 Stripe 将经常性收入扩展到数十亿

阅读故事

戴尔·卡内基使用 Stripe 在 24 个国家,支持 16 种货币的信用卡付款

阅读故事

Decagon AI decreases costs for customer support operations by 65% after building Stripe-integrated AI agents

阅读故事

Decathlon 与 Stripe 合作,支持 300 多名新教练和体育课课时费的支付

阅读故事

Deliveroo 利用 Stripe 全球扩张并启动新的收入流

阅读故事

Demodesk accelerates month-end close with Stripe App Marketplace automation

阅读故事

Dermalogica 用 Stripe 将欺诈率降低了 50%

观看视频

借助 Stripe Terminal 与 Dines 合作的商家收入增长了 150%。

阅读故事

Donorbox 用 Stripe 处理了超过 10 亿美元的捐款

阅读故事

DonorsChoose 用 Stripe 将银行卡接受率提高 17%,让更多捐款流入课堂

阅读故事

DoorHub 通过 Stripe 提供的支付功能重构行业电商体验

阅读故事

DoorLoop 通过 Stripe 将手动客户入驻任务减少近 50%

阅读故事

Dorsia pays restaurant partners 60% faster with Stripe Connect

阅读故事

Dreamship 谈消除越南按需印刷企业家的创作障碍

观看视频

Dripos 通过 Stripe Terminal 和 Stripe Reader S700 实现商务一体化

阅读故事

Dubsado expands payment options and develops a surcharging solution with Stripe and Redbridge

阅读故事

Dust 使用 Stripe 的 MCP 服务器,在数分钟内为人工智能代理提供财务数据支持

阅读故事

Dyn Media 携手 AWS 和 Stripe,确保平台在一年内顺利上线

阅读故事

Dyn Media 与 Stripe 专业服务团队合作,确保平台顺利上线并实现增长

阅读故事

EaseMyTrip 通过 Stripe 加速全球扩张

阅读故事

EasyParcel 选择 Stripe,实现无缝集成和更低的丢单率

观看视频

借助 Stripe,EatMe 为食客和餐馆提供更大价值,收入因而增长 10 倍

阅读故事

爱丁堡机场通过 Stripe 将转化率提高 3%

阅读故事

利用 Stripe Billing 和 Payments,eero 以创纪录的时间推出了新的产品

阅读故事

Eight Sleep boosts conversions by 70% and cuts involuntary churn in half by switching to Stripe

阅读故事

伊莱克斯 (Electrolux) 选择 Stripe,仅用 45 天便在新加坡推出 Levande 订阅服务

阅读故事

Elevate Outdoor Collective integrates Stripe and NetSuite with a Nova Module engagement

观看视频

技术幕后:ElevenLabs 如何借助 Stripe 成长为价值 30 亿美元的 AI 音频领导者

阅读故事

车载视频平台 ember 用 Stripe 解锁新的收入流

阅读故事

Embrace Pet Insurance increases revenue and operational efficiency with Stripe Billing

阅读故事

Endava 利用技术将人们聚集在一起

阅读故事

ePages 与 Stripe 专家合作,整合并重新启动支付平台

阅读故事

Etsy partners with Stripe to offer Instant Bank Payments via Link

阅读故事

Eucalyptus 通过 Stripe 将其医疗保健平台扩展到欧洲

阅读故事

Eventgroove 通过 Stripe 帮助客户举办气候友好型的活动并筹集资金

阅读故事

EventsAir launches embedded payments six months faster with Stripe professional services

阅读故事

Eviden 使用 Stripe 为其实时环境评分 SaaS 平台 EcoDesignCloud 推出全球订阅模式

阅读故事

Stripe 帮助 Experienced Capital 提高数字品牌的转化率

阅读故事

EZ-Charge makes charging a breeze for EV drivers with Stripe

阅读故事

Facile.it 携手 Stripe 带来卓越的全渠道支付体验

阅读故事

FareHarbor 旅游运营商通过 Tap to Pay on iPhone 和 Stripe Terminal 实现无现金化,从而简化业务

阅读故事

稳定币和 AI 驱动型汇款推动 Félix 的支付额达到 30 亿美元

阅读故事

Stripe 帮 felyx 扩张到 10 个城市,并节省了 2000 多小时的开发时间

阅读故事

Female Invest 助力女性在 Stripe 的支持下订阅投资工具

阅读故事

Fender 使用 Stripe Billing 迁移工具包在 3 小时内迁移了 70,000 名订阅者

阅读故事

FICO increases authorization rates by moving its myFICO consumer billing and payments to Stripe

观看视频

Figma 完成新计费模式的推出

阅读故事

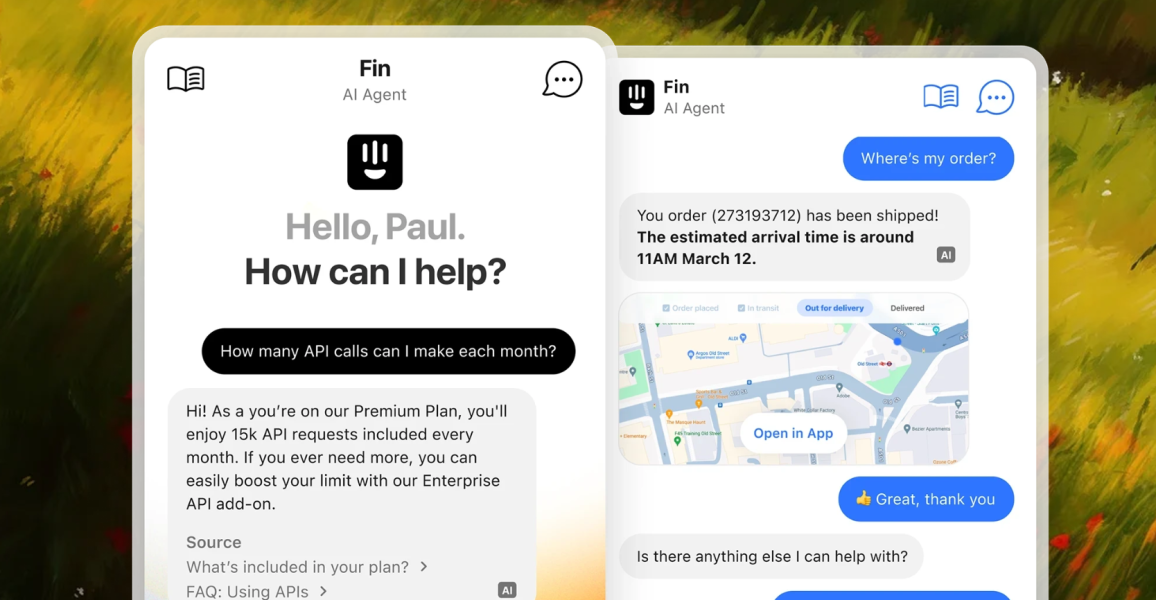

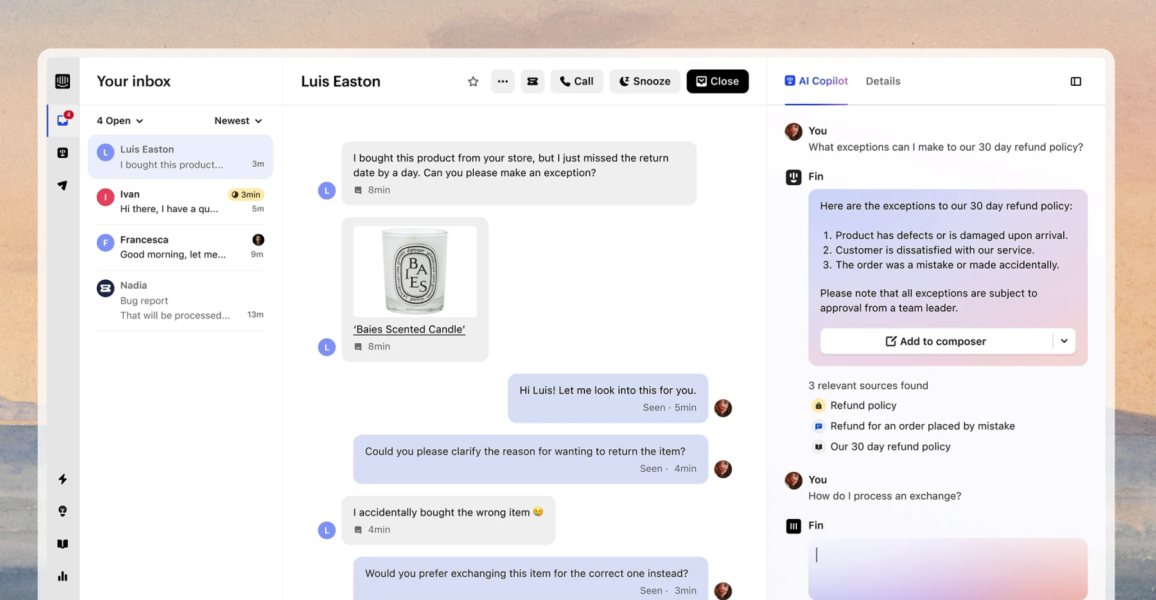

Intercom 携手 Stripe,为 Fin AI 智能体创新推出基于结果的定价模式

阅读故事

Findigs 通过 Stripe Financial Connections 将银行连接转化率提高 14%

观看视频

汽车订阅服务公司 FINN 与 Stripe 合作,年处理额达 1.8 亿美元

阅读故事

在 Stripe 的支持下,Flipdish 在全球扩张过程中实现了 97.42% 的接受率

阅读故事

Flower Chimp 利用 Stripe 增加结账转化率

阅读故事

FOX Sports Mexico 使用 Stripe Billing 后订阅收入增长 20%

阅读故事

FREE NOW 借助 Stripe 专家实施其交易市场

观看视频

FreshBooks 借助 Stripe Connect,推出嵌入式端到端支付解决方案 FreshBooks Payments

阅读故事

来自 FreshBooks 的 Shirley Hsu:平衡结算速度与欺诈风险

阅读故事

Frichti 通过 Stripe 的线下付款扩展到企业餐饮

阅读故事

Frontdoor 通过 Stripe 改进授权率和欺诈率

阅读故事

通过 Stripe 上的支付方式,Fundraise Up 使非营利组织的在线捐款收入翻了一番

阅读故事

G Adventures 通过 Constanci 和 Stripe 推出可扩展的合规支付平台

阅读故事

GAIA Design 改道 Stripe,授权率增长 9%

阅读故事

盖特威克机场依托 Stripe 支持的 Salesforce Payments 提升支付接受率

阅读故事

Getaround 利用 Stripe Connect 加速在欧洲扩张

阅读故事

GitHub Sponsors 通过 Stripe 将国际覆盖范围扩大了 5 倍以上

阅读故事

GiveTap 将慈善募捐者的手机变成带 Stripe Terminal 的读卡器

阅读故事

全球 SaaS 平台通过 Stripe 改变世界健身行业

阅读故事

GlossGenius 利用 Stripe 帮助美容和健康行业老板完成 10 亿美元预订业务

阅读故事

通过提高可扩展性、简化解决方案堆栈并增加捐赠者的灵活性,Vertic 帮助 Good Friday Appeal 创下了筹款记录

阅读故事

Goodtill 与 Stripe 合作,在不到 4 周的时间里使 400 多家新餐厅入驻

阅读故事

政府开源科技部 (Open Government Products) 通过技术力量解决新加坡公共部门面临的最大挑战

阅读故事

Green Flag 采用现代支付系统,通过 Stripe 获得强大的数据洞察力

阅读故事

借助 Stripe,GroundScope 将合规成本降低 50%

阅读故事

GroupGreeting 利用 Stripe Checkout 将转化率提高了 8%

阅读故事

Grubhub 与 Stripe 合作提供 Cash App Pay

阅读故事

借助 Stripe,GuruHotel 使支付交易额增长 128%,并助力酒店接受国际旅客预订

阅读故事

Halara 与 Stripe 合作,通过支付创新推动全球增长

阅读故事

Handyhand 借助 Stripe Connect 实现收入 500% 增长

阅读故事

Global gym management platform Hapana scales to processing $300 million AUD in payments annually with Stripe

阅读故事

Hargreaves Lansdown 与 Stripe 合作,将失败的付款减少 5.4 亿英镑。

阅读故事

Heidi achieves 15x year-on-year growth with Stripe

阅读故事

HelloAsso 的接受率达到了 94%,并通过 Stripe 实现了法国非营利部门的转型

阅读故事

Hero Health 通过 Stripe Invoicing 让英国全科医生更快收款

阅读故事

Hertz 通过 Stripe 实现一体化商务

阅读故事

Hex 通过 Stripe 的用量计费模式满足用户日益增长的计算需求

阅读故事

HeyCentric 通过 Stripe 让市民向公共机构付款变得更加容易

阅读故事

通过与 Stripe 专业服务团队合作,HeyGen 成功减少欺诈并将授权率提高 21%

阅读故事

Higgsfield AI exceeds $200M run rate in 9 months since launching on Stripe

阅读故事

HitPaw 通过 Stripe 实现营收增长 1.8 倍

阅读故事

HitPay 通过用 Stripe 打造的一体化支付解决方案为中小企业赋能

阅读故事

Hoalen 借助 Stripe 整合线上与店内支付

阅读故事

HoneyBook 通过 Stripe 处理 84 亿美元的支付流程

观看视频

Housecall Pro 使用全套 Stripe 产品,在一个平台上提供最好的 SaaS 和金融科技服务

阅读故事

Houzer 利用 BigCommerce 和 Stripe 在八周内启动电商网站

阅读故事

HubSpot 借助Stripe 开发灵活的账单开具和支付工具

阅读故事

Huntr doubles subscription revenue four years in a row using Stripe

阅读故事

IBM Consulting 谈全球行业如何适应数字化转型

阅读故事

ICE InsureTech 革新保险科技产业

阅读故事

Ignition 为全球服务类商家打造一流的商务平台

阅读故事

INDOCHINO 通过为精明的消费者通过 Stripe 使用 Klarna 支付的新方式提高了转化率

阅读故事

INFORICH 利用 Stripe 将支付失败率降低 20%,并实现全球拓展

阅读故事

Ingka Centres 建立自动化的共同工作空间

阅读故事

Inland Group 借助 Stripe 支付解决方案,提升跨境效率与规模扩张能力

阅读故事

Inn Style 与 Stripe 合作提高了支付可靠性,并将提现速度提高了 57%

阅读故事

幕后:Instacart 如何利用 Stripe 实现在线杂货配送

阅读故事

Instacart 的首席运营官 Asha Sharma,讲述了推动食品杂货业发展的基本技术

观看视频

Intelsat switches to Stripe to power payments for in-flight Wi-Fi

观看视频

Inter.mx 携手 Stripe 在墨西哥推出“免费增值”保险模式

阅读故事

Intercom 通过 Stripe 支持新的 AI 产品和订阅定价模式

阅读故事

幕后揭秘:Intercom 是如何通过将计费平台迁移至 Stripe 来推出灵活订阅定价并提升客户体验的

阅读故事

Intercom 论 AI 智能体(如 Fin)的基于价值的定价演变

阅读故事

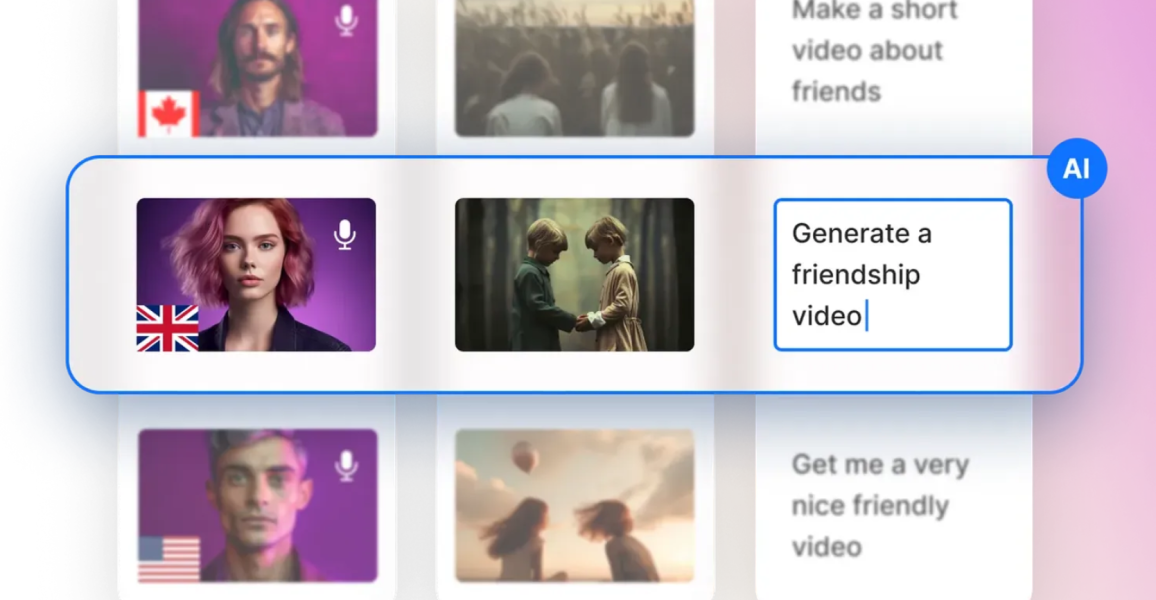

Invideo 借助 Stripe 将失败续订付款恢复率提升至 30%,并实现百万美元收入增长

阅读故事

为了进行全球扩张,IRIAM 使用 Stripe 提供网络支付功能,以更好迎合不同消费者的支付需求

阅读故事

日本石狩市利用 Stripe 提供一种新的按需公共交通服务

观看视频

Italic 通过 Stripe 为其客户带来一键结账的奢华体验

阅读故事

Italic:重新定义奢侈品经济

阅读故事

Jane 为医疗从业者提供无阻解决方案

阅读故事

借助 Chargeblast Stripe 应用,Jenni 的争议活动减少了 96%

阅读故事

Jobber 利用 Stripe Capital 和 Instant Payouts 这两项新的金融服务产品实现平台扩展

阅读故事

Jobber 和 Stripe 帮助 20 多万家庭服务专业人员节省支付费用

阅读故事

Jotform 通过与 Stripe 合作,将表单转化为支付驱动的工作流程,实现了 6 倍增长

阅读故事

在 Stripe 的支持下,Journey 的酒店业绩平台实现年收入同比增长 40%

阅读故事

Kahunas 通过 Stripe Billing 将客户流失率降低了 9%

阅读故事

Kajabi 推出由 Stripe 支持的 Kajabi Payments,并推动 6 万多名创作者取得成功

阅读故事

Kajabi 借助 Stripe Connect 应用程序嵌入式组件快速推出会计集成方案

阅读故事

Karat 利用 Stripe Issuing 在短短三周内便为创作者打造了一款新的金融产品

阅读故事

Karta 消费者交易市场,Special,在 Stripe 专家的帮助下几乎消除了欺诈风险

阅读故事

Cold Fusion 帮助 Kashika 优化支付,实现更快增长

阅读故事

Keap 借助 Stripe,通过一体化的支付和税务合规解决方案帮助小企业主发展壮大

阅读故事

KeyMe 与 Stripe 合作,颠覆了门锁行业

阅读故事

借助 Stripe,Kickstarter 不仅扩大了全球影响力,而且持续提升了众筹体验

阅读故事

KINTO 通过将 Stripe 连接到 NetSuite,使用 PayPack 每天为其团队节省 6 个多小时

阅读故事

Kittl 借助 Stripe 将支付成功率提高了 2.12% 并减少了客户流失

阅读故事

Klarna 和 Stripe 携手在全球提供灵活的支付和无缝处理服务

阅读故事

企业如何借助 Stripe 与 Klarna 实现跨行业增长

阅读故事

来自 Klarna 的 Raji Behal:消费者偏好如何影响支付战略

阅读故事

KRY 与 Stripe 合作,顺畅扩展,增强患者体验

阅读故事

Minna no Market 与 Stripe 合作,为其线上交易市场集成银行卡支付功能

阅读故事

Kwik Fit 推出了一种新的订阅型服务,并在英国市场获得先发优势

观看视频

La Redoute 用 Stripe 取代其旧有系统,提供世界一流的客户体验

阅读故事

通过 Stripe 扩展到 200 多个城市,Landing 简化了支付

阅读故事

Langfuse 利用 Stripe 扩展云计费,同时计量数十亿事件

阅读故事

LaunchDarkly 利用 Stripe Climate,将捐献的每分钱都用于应对气候变化

观看视频

Le Monde 选择 Stripe,提高本地和国际支付能力

阅读故事

LeasePlan 通过使用 Stripe 的自动化服务交付流程,每年节省 3.5 万到 4 万欧元

阅读故事

Leonardo AI 借助 Stripe 计费、支付和反欺诈解决方案实现业务快速增长

阅读故事

LetsGetChecked 的用户在 Stripe Radar 欺诈检测工具上看到了 5 倍的投资回报

阅读故事

LG 电子日本公司携手 Stripe 打击欺诈交易并提升支付成功率

观看视频

作为现代支付服务商的 Lightspeed 利用 Stripe 提高了收入

阅读故事

Lightspeed 与 Stripe 合作,加速在全渠道支付等领域的创新

阅读故事

Lime 利用 Stripe Data Pipeline 提高财务对账的准确性和速度

阅读故事

Linear 与 Stripe 合作处理计费和支付,助力业务增长

阅读故事

LiveX AI powers 200% improvement in customer retention through AI agents integrated with Stripe

阅读故事

Local Vacation Rentals 通过 Foxbox 和 Stripe 为业主带来 20% 的增收

阅读故事

Lookiero 利用 Stripe 的简易支付服务实现对复杂业务模式的扩展

阅读故事

Lopay 通过 Stripe Issuing 使其用户保留更多利润

阅读故事

Lopay helps its users increase sales with Tap to Pay on iPhone

阅读故事

Visa and Stripe help Lopay’s users increase sales with Tap to Pay

阅读故事

Lottus Education 与 Stripe 合作,在两周内实施了完全合规的支付解决方案

阅读故事

借助 AI 热潮:Lovable 如何借助 Stripe 成长为氛围编程巨头

阅读故事

LTK 联合创始人 Amber Venz Box 谈为创作者和品牌实现经济上的成功

阅读故事

瑞幸咖啡:借助 Stripe 实现无缝客户消费体验,加速全球化布局

阅读故事

Lugg 与 Stripe 合作,简化入驻流程并提供即时提现功能

阅读故事

Luxury Escapes 借助 Stripe 在 30 天内阻止了 20 万美元欺诈

观看视频

Lyft 利用 Stripe 优化了司机和乘客的体验

阅读故事

Lynk & Co 与 Stripe 专家合作,打造无忧支付体验

阅读故事

Lyra Health 通过 Stripe 实现扩张,轻松应对付款交易 200% 的增长

阅读故事

Lyte 将用户现场付款业务扩展到英国,预计到 2022 年底,销售业绩可增长 2.5 倍。

阅读故事

Stripe 帮助 M3 Education 改善运营效率和用户便利性

阅读故事

Magic Eden 通过 Stripe 的加密货币入金服务扩展了对 Web3 经济的访问

阅读故事

MagicSchool launches new freemium model that drives revenue growth using Stripe

阅读故事

Make 利用 Stripe 授权与恢复工具挽回 120 万美元收入

阅读故事

Mamo 选择 Stripe 在阿联酋提供安全、便捷的支付

阅读故事

Mangomint reduces onboarding time by 64% with Stripe

阅读故事

Manus 借助 Stripe 快速实现其爆款 AI 产品的商业化变现

阅读故事

Margin 支付量在 10 个月内增长了 5 倍

阅读故事

me&u 转向 Stripe 来获取速度和可扩展性,助力其进行国际扩张

阅读故事

me&u boosts incremental sales growth for its venues by 60% with Tap to Pay on iPhone

阅读故事

Meetup 利用 Stripe Billing 将试用转化率提高了 3 倍

阅读故事

MemberPress 利用 Link 减少美国和欧盟商家的结账阻力

阅读故事

Mercury streamlines collections with Stripe-powered invoicing solution

阅读故事

幕后:Mindbody 如何与 Stripe 一起搭建集成支付平台

阅读故事

Stripe Billing 助力 Mindvalley 实现 40% 增长和 1.5 亿美元年收入

阅读故事

Minelab 通过实现印尼和马来西亚间跨境支付,开启了新的客户群

阅读故事

MiniMax 借助 Stripe 实现其最新人工智能产品的商业化

阅读故事

Mint Payments uses Stripe to process $3 billion in travel industry transactions

阅读故事

Mixtiles 借助 Stripe 优化,从初创公司发展为国际知名品牌

阅读故事

Monzo 凭借 Tap to Pay on iPhone 拓展面向商家的金融工具

阅读故事

Moon Holidays 通过 Stripe 实现营收增长 6 倍

阅读故事

Moonbeam on using AI to automate the writing process

阅读故事

MoonClerk 提供了一个强大的支付平台,减少了超过 30% 的客户流失

阅读故事

Morisawa Inc. 利用 Stripe 缩短了交付周期并提高了内部开发能力

阅读故事

Motion 借助 Stripe 从初创快速走向高速增长

观看视频

Mountain Warehouse 改用 Stripe,以 99.99% 的正常运行时间提供可靠的线上付款服务

阅读故事

Myers-Holum 致力于为企业支付和金融基础设施提供动力

阅读故事

MyKaarma 通过 Stripe 实现汽车支付现代化后,同比增长达 180%

阅读故事

利用 Stripe Connect,MYOB 几周内在一个新的国家推出 B2B Payments

阅读故事

mySofie 借助 Stripe 简化了医疗保健支付,并能在不到两分钟的时间内完成用户注册

阅读故事

N26 与 Stripe 合作,让他们的 700 万+ 客户实现实时银行账户充值

观看视频

纳斯达克选择 Stripe,看好其强健的安全性和可扩展性

阅读故事

Navan 使用 Stripe Issuing 实现其支付和支出解决方案增长 5 倍

阅读故事

Neuron Mobility 与Stripe 专业服务团队合作,降低市场进入和扩张成本

阅读故事

Sessions 视角:NewStore 和 Stripe 如何简化零售企业管理

阅读故事

Stripe Connect 助力患者体验平台 NexHealth 的支付处理量创下新高

阅读故事

Nextech 借助 Stripe 发布安全的医疗保健支付平台

阅读故事

Nextech 利用 Stripe 快速解决客户异常多变的网络配置问题

阅读故事

Nikkei 选择 Stripe,提升对其快速增长的数字平台的访问

阅读故事

Noleggiare 携手 Stripe,打造一体化的支付与报表体验

观看视频

Noom 利用 Stripe 将全球授权率提高 8% 以上

阅读故事

Nord Security 使用 Stripe Enterprise 服务推动支付优化

阅读故事

Oasis Hotels 使用 Stripe 将欺诈减少了 90%,并实现了支付现代化

阅读故事

Octopus Energy 谈投资可再生能源来解决能源危机

阅读故事

Oddle 使用 Tap to Pay on Android 和 SUNMI,为食客提供简单的支付体验

阅读故事

OfficeRnD 携手 Stripe 为全球联合办公空间简化支付流程

阅读故事

Oh my teeth 通过 Stripe 在一周内集成无现金支付

阅读故事

Ohio Power Tool speeds up transaction times by 50% with Stripe Terminal and Nova Module

阅读故事

Omnyfy 通过不断发展的交易市场模式,推动全球向多供应商模式的转变

阅读故事

Onespot helps schools integrate payment data with Stripe and an embedded app for QuickBooks

阅读故事

Open Infra 借助 Stripe Billing 和 Zapier,将开发票时间从数周缩短至数秒

观看视频

Stripe Sessions:Sam Altman 和 John Collison 炉边谈话

阅读故事

Opus 首席执行官谈通过持续执行助力客户发展

阅读故事

OrderMyGear modernizes its checkout flow and increases average order volume 67% with Stripe

阅读故事

OrderUp 赋能餐馆,打造无缝结账体验

阅读故事

Orix 依靠 Stripe 推出其电子商务文档存储服务 PATPOST

阅读故事

Outseta 选择 Stripe Tax 而非“记录商家”(MoR) 来管理全球税务合规问题

阅读故事

OYO 通过 Stripe 拓展新市场并改善运营商体验

阅读故事

Pai 致力于降低商家的订阅流失率

阅读故事

Papier 转为使用 Stripe,以期提高收入简化客户的购买过程

阅读故事

改用 Stripe 后,Park.Aero 的支付成功率提高了 7.3%

阅读故事

Passenger 通过 Stripe 支持其平台支付,实现了 170% 的增长

阅读故事

PatPat 借助 Stripe 提高银行授权率,打造全球支付新体验

阅读故事

PayFunnels 借助 Stripe Elements 和 Checkout Sessions API 赋能全球个体创业者

阅读故事

移动应用 Payment 与 Stripe 合作,通过无代码解决方案支持超过 15.3 万用户

阅读故事

Payment Plugins 借助 Stripe 为 WooCommerce 商家提供超过 27 种支付方式

阅读故事

幕后故事:百事公司选择 Stripe 助力灵活电商与线下支付

阅读故事

Perfect Tux 凭借 Stripe Capital 提供的资金实现了最佳季度业绩

阅读故事

PGA 携手 Stripe 引领数字化转型

阅读故事

Phil Pallen Collective automates payment processes with Xero and Stripe to serve 360+ global clients

阅读故事

Philo 通过 Stripe Billing 扩展订阅业务

阅读故事

Phorest boosts payments revenue 335% after unifying online and in-person payments with Stripe

阅读故事

Pitch 利用 Stripe 在全球推出新的演示文稿软件

阅读故事

Planity 利用 Stripe 实现支付额增长 200%,并推出了新的收入流

阅读故事

幕后花絮:Planning Center 如何通过 Stripe 实现月捐赠处理额 6 亿美元

阅读故事

借助 Stripe,Playtomic 全球月活用户增至 100 万

阅读故事

Pluralsight achieves global technology learning with Stripe Payments

阅读故事

Podium 通过 Stripe & Affirm 为当地企业实现 300 万美元付款

阅读故事

Podium 通过 Tap to Pay on iPhone 功能为本地商家提供更多灵活性

阅读故事

Polygon.io 在两周内为 Salesforce Platform 实现七年的数据与 Stripe 同步

阅读故事

Stripe 助力 PopChill 创建安全高效、低碳循环的二手精品交易平台

阅读故事

Postmates 利用 Stripe 提高了授权率,使收入增加了 7000 万美元

阅读故事

Postmates 利用 Stripe 的支付咨询服务节省了 300 多万美元的卡组织费用。

阅读故事

POWR enables small businesses to sell globally with Stripe

阅读故事

悉尼基督长老会女子学院 (Presbyterian Ladies' College) 利用现代支付系统将财务对账时间缩短了 80%

阅读故事

PushPress expands to serve 5,000+ gyms by integrating payments with gym management software via Stripe

阅读故事

QikServe 联手 Stripe 启动可扩展全球支付平台

阅读故事

Raisely 通过 Stripe 帮助 2000 多家非营利组织和慈善机构筹集 5 亿澳元

观看视频

揭秘:Ramp 如何与 Stripe 携手构建全球公司卡项目

阅读故事

Ray 工作室通过 Stripe 解决支付的本地合规问题

阅读故事

Re-Leased uses Stripe to help digitise $15bn of rent collection

阅读故事

Reach 利用由 Stripe 提供支持的记录商家解决方案简化全球扩张

阅读故事

RefQuest (RQ+) streamlines financial processes with Stripe to enable growth

阅读故事

refurbed 借助 Stripe 和 Klarna 实现一键支付,提升转化率

阅读故事

借助 Stripe 的欺诈情报,reMarkable 将欺诈率降至 0.10%

阅读故事

Rental Car Manager 在不到三周的时间内便为租车公司实施了全渠道付款

阅读故事

ResNexus 借助基于 Stripe 构建的白标支付平台拓展新市场

阅读故事

Retell AI 借助 Stripe 实现按用量定价自动化,推动 AI 语音助手平台规模化发展

阅读故事

Retool 借助 Stripe 收入和财务自动化套件收回 60 多万美元

观看视频

Rezdy 利用 Stripe 为全球超过 17,000 家旅游运营商提供支付功能

阅读故事

River Island 通过 Stripe 的一体化商务解决方案和 Cabiri 将授权率提高 3%

阅读故事

Rohan 在集成 BigCommerce 和 Stripe 后的两个月内额外吸引了 6.5% 的在线购物者

阅读故事

Roomex doubles usage of its expense card solution after switching to Stripe

观看视频

Runway 使用 Stripe 的无代码解决方案,为开发人员节省时间

阅读故事

RushOrderTees boosts conversion rate 3.50% with Stripe’s Optimized Checkout Suite

阅读故事

RVshare 与 Stripe 合作,在预定量提升 3 倍的情况下保证了 100% 的支付可靠性

阅读故事

Salesforce 与 Stripe 合作提供无缝商务体验

阅读故事

Salesforce 高级支付副总裁 Michael Affronti 谈商务云计算服务的加速发展

阅读故事

通过 Stripe,SamCart 将平均订单价值提高了 60%

阅读故事

Samsonite 携手 Stripe 提高客户体验和支付成功率

阅读故事

Scholastic Australia enables fast purchases with Tap to Pay on iPhone

阅读故事

SeatGeek fuels growth of fan-to-fan ticket marketplace with Stripe Connect

阅读故事

Semble 选择用 Stripe 合并 SaaS 医疗保健与支付解决方案

阅读故事

通过与 Stripe 合作,先买后付平台 SeQura 的收入增长了 55%

阅读故事

ServiceM8 通过 Tap to Pay on iPhone 实现工作现场非接触式支付

阅读故事

通过 Stripe 接受稳定币支付,Shadeform 实现收入增长 10%

阅读故事

SHARE NOW 选择 Stripe 作为可靠的合作伙伴,以顺利处理付款

阅读故事

Sharetribe 用 Stripe 为复杂的交易市场需求提供解决方案

阅读故事

Shift 通过 Stripe 加速欧洲扩张并简化支付

阅读故事

通过 Stripe 的支付优化工具将授权率提高了 6.6%

阅读故事

Shopcada 选择用 Stripe 加速增长

观看视频

Shopify 携手 Stripe 打造 Shopify Balance,赋能小型商家资金管理新时代

阅读故事

Shopify 利用 Tap to Pay on iPhone,让商家仅用一部 iPhone 手机即可便利地进行线下收款

阅读故事

Shoplazza:携手 Stripe 全面深耕全球化之路,共创跨境电商新篇章

阅读故事

Shopmonkey 为汽车修理店提供了数百万 Stripe 贷款

阅读故事

Shore 与 Stripe 专业服务团队合作推出 Shore Pay Terminal

观看视频

Shotgun 借助 Stripe Connect 推动支付量增长超过 560%

阅读故事

集英社在 Stripe 的支持下为全球漫画艺术爱好者搭建新平台

阅读故事

Simon Cabaret 借助 Stripe 将授权率提高 24%

阅读故事

SimplePractice 利用 Stripe 为临床医生提供自动提现服务

观看视频

SiteMinder 在 Stripe 的帮助下扩展到为 150 个国家/地区的酒店提供服务

阅读故事

SkipTheDishes 利用 Stripe 提高结账转换率并启动新的即时提现功能。

阅读故事

Slack 使用 Stripe 处理支付并实现 99% 的授权率

阅读故事

SnowCloud 阻止了 320 万美元的欺诈,并通过 Stripe 改变了度假村和游乐场所的运营方式

阅读故事

Snowflake 善加利用基于消费的定价优势

阅读故事

Snowflake 与 Stripe 合作,四个月内启动交易市场

观看视频

sofatutor 部署 Stripe Billing 推出全新订阅学习产品

阅读故事

Sonar propels subscription business and data insights with Stripe

阅读故事

创始人通过简单部署,两天内便设置好了 Stripe

阅读故事

Sonic Automotive 与 Stripe 携手改变在线购车体验

阅读故事

SourceNext 与 Stripe 合作应对信用卡欺诈

阅读故事

Spades 彻底改造了由 Stripe 提供支付支持的餐厅的结账体验

阅读故事

SplitIt 通过 Stripe 加快全球增长步伐

阅读故事

Splunk scales operations with a unified payment solution from Stripe

阅读故事

通过 Stripe,Spond 在 19 个国家实现了 40% 的年度支付增长

阅读故事

Sports Warehouse uses Stripe to centralize global payments across 12 brands

观看视频

Squarespace 允许用户“分互联网的一杯羹”

观看视频

Squire 使用 Tap to Pay,让理发师在短短几分钟内开始接受线下付款

阅读故事

通过使用 Stripe,Stand Up To Cancer 的经常性捐款者增加了 30%

观看视频

Staycity 借助 Stripe 和 Oracle OPERA Cloud 整合客人的支付体验

阅读故事

StoneLoads 为天然石材行业提供现代化的产品采购方案

阅读故事

StyleSeat 与 Stripe 合作帮美容师收入翻倍

阅读故事

借助 Stripe,Substack 的付费订阅量突破 500 万。

阅读故事

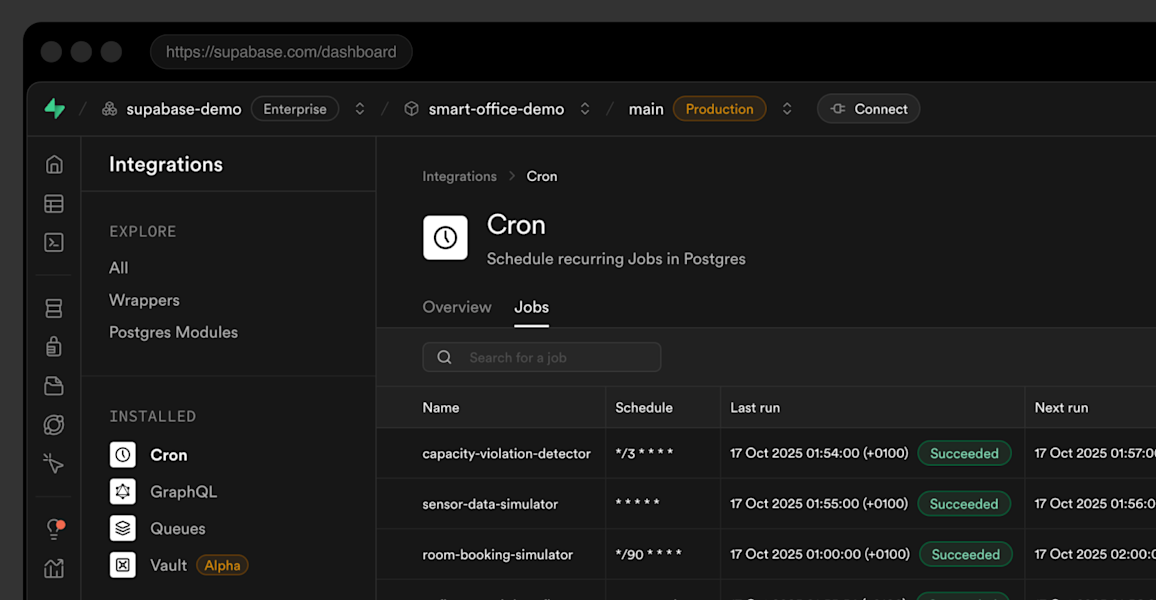

Supabase 借助 Stripe,将其后端即服务 (BaaS) 拓展至 150 个国家/地区

阅读故事

Susquehanna Growth Equity 与 Stripe 合作,为投资组合企业构建支付能力

阅读故事

澳大利亚游泳协会 (Swimming Australia) 用 Stripe 为近 1000 家机构创建了单一支付平台

阅读故事

Taboola 使广告客户通过 Stripe Payments 触达 6 亿日活用户

阅读故事

TADA 借助 Stripe Payments 加速全球增长

阅读故事

Tango 与 Stripe 合作,开启销售导向战略,为企业客户提供服务

阅读故事

Tango 为酒店行业构建商业软件

阅读故事

Taqtile 利用 Zaybra 一小时内完成了 Stripe 支付与 HubSpot 的集成

阅读故事

Targeted Victory 利用 Stripe Connect 在全美为竞选活动捐款

阅读故事

Teachable 通过 Stripe 帮助创作者赚取了数十亿美元

阅读故事

TeamSport 通过 Stripe 实现转化率提升 2.6%–4.7%

阅读故事

Tekion sees 90% of customers adopt its Stripe-powered embedded payments solution

阅读故事

Enhancing auto shop success: Tekmetric integrates Stripe for seamless customer experience

阅读故事

TENTIAL 通过将 Stripe 集成至其电商平台,实现 98% 支付成功率并加强反欺诈措施

阅读故事

tete marche 利用 Stripe Billing 扩展 Instagram 分析订阅服务

阅读故事

TF1 推出了法国首个流媒体平台,并提供关于使用 Stripe 技术的付费选择

阅读故事

The Giving Movement 将转化率提高了 25%,并通过 Stripe 在全球范围进行扩张

阅读故事

theCut 使用 Stripe 构建其端到端支付体验

观看视频

Thinkific 与 Stripe 合作,提高创作者收入并简化后台操作

阅读故事

Thinkific 谈为创作类教育者打造平台来构建其业务

观看视频

ThinkReservations uses Stripe to enable faster, more secure onboarding for hotel operators

阅读故事

Thoughtworks(思特沃克)致力于通过技术和文化优势创造非凡的影响力

阅读故事

ThriveCart helps 75,000 creators boost revenue worldwide with ThriveCart Pro+ powered by Stripe

阅读故事

Ticket Tailor 如何利用 Stripe 驾轻就熟进行全球扩张

阅读故事

TicketSocket 借助 Link 将转化率提升了 10%

阅读故事

Tiller 用 Stripe Checkout 将其试用注册人数提高了 90%

阅读故事

TixTrack provides access to more experiences globally by reducing reporting time, with Stripe

阅读故事

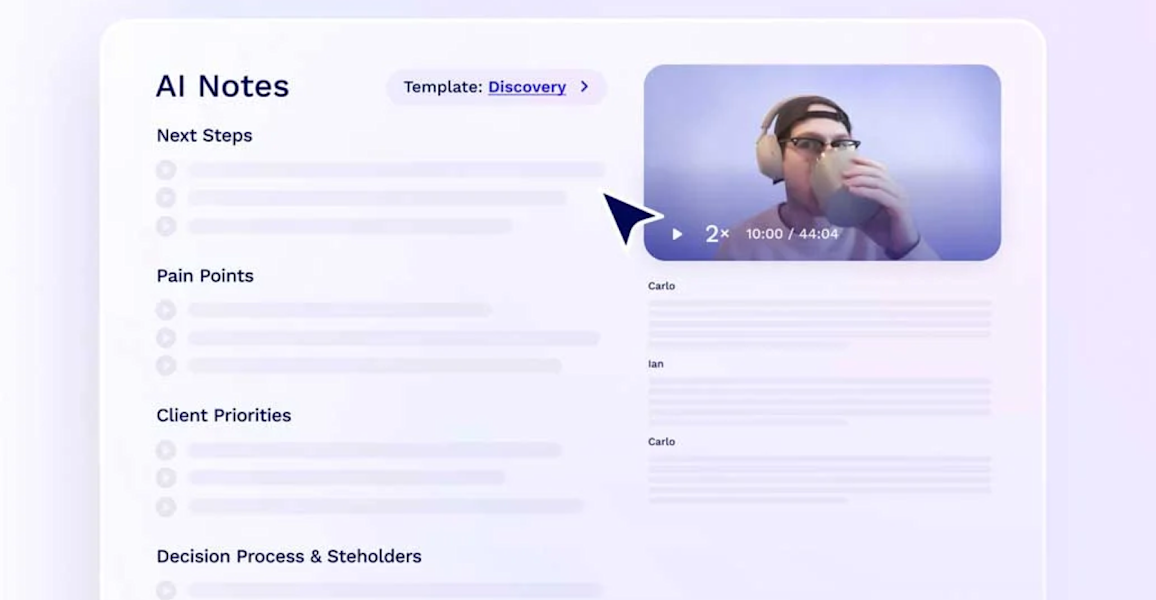

tl;dv 借助 Stripe 实现收入增长 600%

阅读故事

Togetherwork 与 Stripe 专家携手,合力为客户打造无缝体验

阅读故事

借助 Stripe,Togetherwork 每月节省 40 个小时的工作时间,从而可以专注于财务分析和战略,而非数据管理工作

观看视频

Tokyo Otaku Mode 用 Stripe 实现其日本流行文化电商平台的支付功能

阅读故事

东急借助 Stripe 提高了运营效率,并将转化率提升了 20%

阅读故事

托伦斯大学通过 Stripe 为超过 1.9 万学生提供现代化的支付体验

观看视频

丰田选择 Stripe 创建可持续发展驱动的设备买卖平台

阅读故事

Trade Tested boosts sales 1.5% and reduces fraud by 50% with Stripe

阅读故事

Travello 通过 Stripe 将订单金额提升 4%,欺诈减少 16%

阅读故事

TravelPerk 首席运营官 Huw Slater 谈如何在危机中变得更强大

阅读故事

Traxero 用 Stripe 四周启动其集成的全渠道支付解决方案

阅读故事

Tuple on how pair programming can make people feel less lonely

阅读故事

Turo reduces costs and boosts revenue by consolidating pay-ins and payouts on Stripe

阅读故事

TV 2 使用 Stripe 构建灵活的订阅计费平台

阅读故事

Twilio 利用 Stripe 将其授权率提高了 10%

阅读故事

Twilio 谈建立全球客户参与平台

阅读故事

Typeform 利用 Stripe 驱动其全球订阅

阅读故事

Ubsidi helps restaurants improve cash management with embedded finance tools from Stripe

阅读故事

Unanet uses Stripe Connect to streamline payments for B2B customers

阅读故事

Undetectable AI sees 48% increase in gross profit since adopting Stripe

阅读故事

Ungerboeck 助力疫情后现场活动的回归

阅读故事

Universe 用 Stripe Terminal 提供线下和线上客户体验

阅读故事

Unobravo 借助 Stripe Connect 迅速开拓了两个新市场

阅读故事

迪拜 UNTOLD 音乐节借助 Stripe,数日内启动全球票务销售

阅读故事

Uplisting 使用 Stripe 应用程序带来 70 万美元的推荐销售

阅读故事

Urbankissed 借助 Stripe 确保自身线上交易市场增长了 150%

观看视频

URBN 将 50 亿美元的在线和店内收入整合至 Stripe

阅读故事

VEED recovers $1.8 million in payments in 1 year with Stripe’s Smart Retries

阅读故事

Vibefam 通过 Stripe 将嵌入式支付业务提升至收入的 10%

阅读故事

Videopro frees up cash flow and optimizes checkout with Stripe

阅读故事

Visualsoft 通过 Stripe 搭建的支付平台将转化率提升 35%

阅读故事

Vonage 探讨借助对话转化销售的力量

阅读故事

Voodoo 与 Stripe 在美国达成合作,推出简化版应用内购买服务

阅读故事

Vyro 借助 Stripe 推动其人工智能驱动的 SaaS 平台的全球扩张

阅读故事

借助 Stripe,Warp 将基于用量的 AI 计费收入提高到总收入的 20%

阅读故事

Wayflyer 部署 Stripe Issuing,为成长中的电商初创公司释放超过 7 亿美元资金

阅读故事

Weave 用 Stripe 为中小企业推出新的支付平台

阅读故事

Whimsical 利用 Stripe Climate,让其捐出的每分钱都发挥最大效益

阅读故事

Whoppah 利用 Stripe 实现三位数同比增长

阅读故事

Wiley 通过 Stripe 简化支付运营

阅读故事

Withlocals 谈通过共享的文化体验将游客和当地人联系起来

阅读故事

Wix 致力于帮助企业过上最好的数字生活

阅读故事

Wix 携手 Stripe,拓宽 Wix Payments 在 EMEA 的覆盖范围

阅读故事

Wonderbly 选择 Stripe Checkout 实现效率和转化率最大化

阅读故事

WooCommerce 与 Stripe 合作,3 个月内推向了 17 个新的国家

观看视频

WooCommerce 支付总经理谈赋予商家“无限灵活性”,助力其蓬勃发展

阅读故事

Woo 用 Tap to Pay on iPhone 降低线下收款的门槛

阅读故事

WordPress.com 用 Stripe 处理数百万个网站的经常性付款

阅读故事

Wordtune 使用 Chargeflow Stripe 应用程序将退款恢复率提高 5.4 倍

阅读故事

World History Encyclopedia(世界历史百科全书)通过 Checkout 将转化率提高了 5%

阅读故事

Xero 借助 Stripe 帮助客户加快现金流周期

观看视频

Xero 和 Stripe 通过 Tap to Pay on iPhone 让小型企业更容易收款

阅读故事

YAMAP 借助 Stripe,实现跨业务线支付流程一体化

阅读故事

Yohana 通过 Stripe 提供下一代家庭礼宾服务

阅读故事

Yoycol 提高了防欺诈能力,将误报率和争议率降低到了 0.2% 以下

阅读故事

借助 Stripe,Zapier的授权率提高了 4%,收入提高了 300 多万美元。

阅读故事

借助 Stripe,Zeffy 将捐款规模扩大了 30 倍,为非营利组织处理超过 10 亿美元的捐款

阅读故事

Zendesk 借助 Stripe 进入新市场,每年节省 150 万美元成本

阅读故事

Zoom 利用 Stripe 开通全球支付方式并减少客户流失

阅读故事

ZoomInfo 利用 Stripe 实现了现金欠款回收自动化及高速增长