IBAN เป็นกุญแจสำคัญที่ทำให้การโอนเงินในยุโรปและต่างประเทศปลอดภัยและง่ายยิ่งขึ้น แต่ IBAN คืออะไรกันแน่ คุณจะค้นหาได้อย่างไร และตัวอักษรและตัวเลขทั้งหมดในนั้นหมายถึงอะไร บทความนี้จะอธิบายทุกสิ่งที่คุณจำเป็นต้องรู้ รวมถึงวิธีระบุ IBAN ของคุณ

เนื้อหาหลักในบทความ

- IBAN คืออะไร

- IBAN มีไว้เพื่ออะไร

- IBAN มีรูปแบบอย่างไร

- IBAN ต่างประเทศมีตัวอักษรและตัวเลขกี่ตัว

- คุณจะค้นหา IBAN ได้จากที่ไหน

- คุณจะระบุธนาคารต้นทางของ IBAN ได้อย่างไร

IBAN คืออะไร

พิกัด IBAN, รหัส IBAN, ฯลฯ คำเหล่านี้ล้วนหมายถึงสิ่งเดียวกัน ซึ่งก็คือหมายเลขบัญชีธนาคารระหว่างประเทศที่เป็นมาตรฐาน กล่าวคือ รหัสตัวอักษรและตัวเลขที่ช่วยให้คุณระบุบัญชีธนาคารได้ทุกที่ในโลก ตัวย่อย่อมาจาก "International Bank Account Number" หรือหมายเลขบัญชีธนาคารระหว่างประเทศ

IBAN มีไว้เพื่ออะไร

การทราบ IBAN ถือเป็นสิ่งสำคัญหากคุณต้องการส่งหรือรับการเบิกจ่ายในประเทศหรือระหว่างประเทศ หากคุณต้องการรับการเบิกจ่ายจากภายในฝรั่งเศสหรือจากต่างประเทศ คุณต้องส่งคีย์ IBAN ให้กับผู้ออกการเบิกจ่าย ในทำนองเดียวกัน คุณต้องมีรหัส IBAN ของผู้รับหากคุณต้องการการเบิกจ่ายให้กับผู้รับ

โดยทั่วไปรหัสเหล่านี้จะใช้ภายในเขตการชำระเงินยูโรเดียว (SEPA) ซึ่งเป็นเขตการชำระเงินยูโรที่มีลักษณะเฉพาะ ซึ่งประกอบด้วย 27 ประเทศในสหภาพยุโรป รวมถึงสวิตเซอร์แลนด์ ลิกเตนสไตน์ นอร์เวย์ โมนาโก ซานมารีโน อันดอร์รา และวาติกัน โปรดทราบว่าสหราชอาณาจักรยังคงเป็นสมาชิกของ SEPA หลังจากการถอนตัวออกจากสหภาพยุโรปในปี 2020 โดยทุกประเทศที่อยู่ใน SEPA ต่างก็ใช้ IBAN

IBAN มีรูปแบบอย่างไร

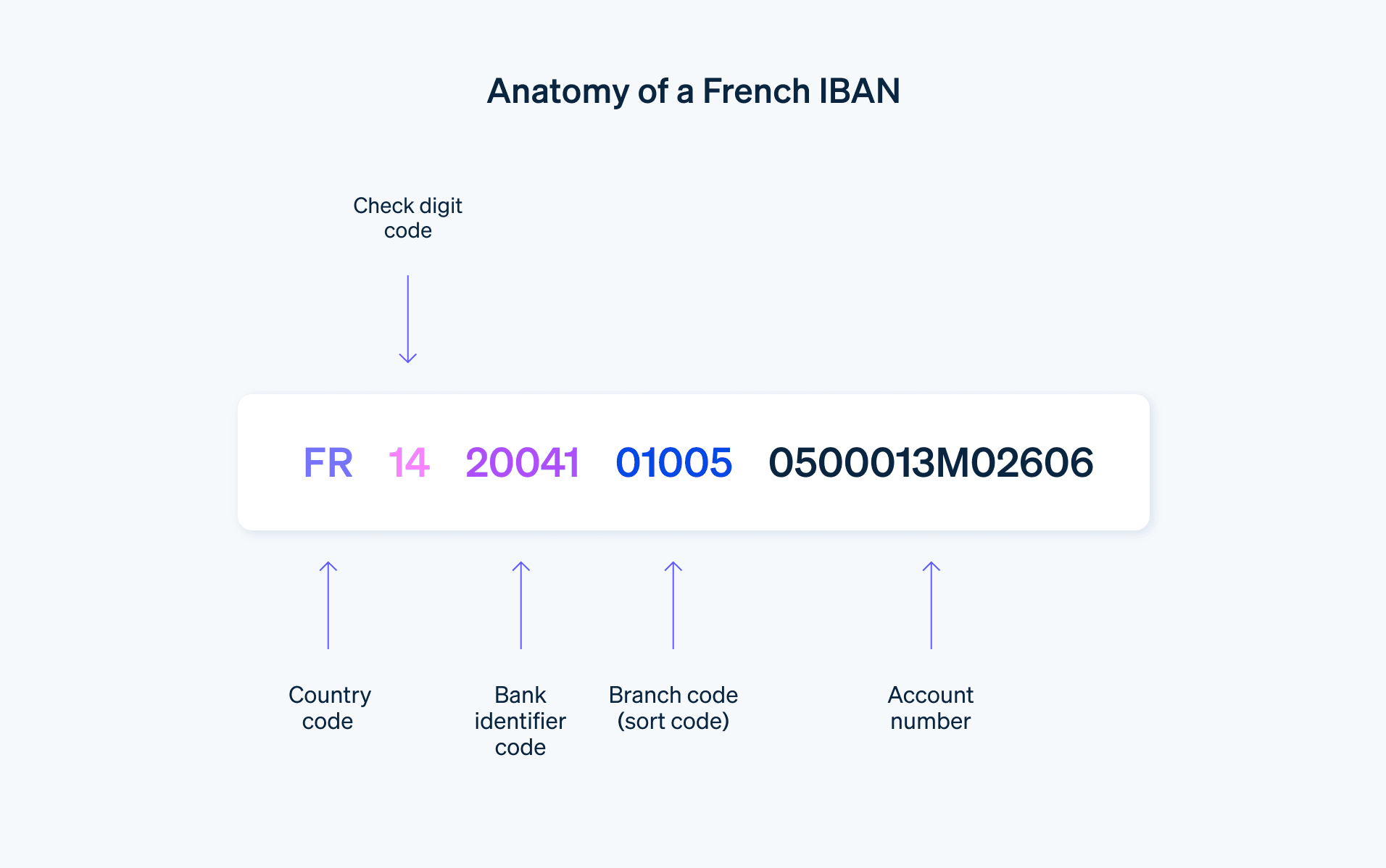

ในฝรั่งเศส รูปแบบ IBAN จะใช้อักขระ 27 ตัวพอดี ตัวอักษร 2 ตัวแรกสอดคล้องกับรหัสประเทศของบัญชีธนาคาร ในฝรั่งเศส ตัวอักษรนี้คือ "FR" (และในเยอรมนีจะใช้ "DE" เป็นรหัสประเทศ ในขณะที่สหราชอาณาจักรใช้ "GB") เมื่อดูตัวอักษรเริ่มต้น 2 ตัวแรกของแต่ละรหัส คุณจะสามารถระบุได้ว่าประเทศใดเป็นผู้ออก IBAN

ตัวเลข 2 ตัวที่ตามหลังรหัสประเทศจะสอดคล้องกับคีย์ตรวจสอบที่เชื่อมโยงกับบัญชีธนาคาร คีย์นี้มีความสำคัญสำหรับการตรวจสอบยืนยัน IBAN

ตัวเลข 23 หลักต่อไปนี้คือหมายเลขบัญชีธนาคารพื้นฐาน (BBAN) ซึ่งเป็นตัวเลขที่ประกอบด้วยรหัสธนาคาร, หมายเลข Routing Number, หมายเลขบัญชีธนาคาร และสุดท้ายคือรายละเอียดธนาคาร ("relevé d'identité bancaire" หรือ RIB ในภาษาฝรั่งเศส)

รหัสธนาคารในฝรั่งเศสประกอบด้วยตัวเลข 5 หลัก โดยมีความยาวเท่ากับ Routing Number

หมายเลขบัญชีธนาคารมักจะมี 11 หลัก แต่หากสั้นกว่านี้ จะมีการเติมเลขศูนย์ที่ด้านหน้าของหมายเลขเพื่อให้ครบ 11 หลัก

ที่ส่วนท้ายของ IBAN คือคีย์ RIB ซึ่งเป็นรหัส 2 หลักที่ใช้เพื่อยืนยันว่าบัญชีธนาคารนั้นถูกต้องจริง

ตัวอย่าง IBAN ของฝรั่งเศส

FR76 3000 4028 3798 7654 3210 943

ในตัวอย่างข้างต้น รหัสประเทศคือ "FR", คีย์ตรวจสอบคือ "76", รหัสธนาคาร คือ "30004", Routing Number คือ "02837", หมายเลขบัญชีธนาคารคือ "98765432109" และคีย์ RIB คือ "43"

IBAN ต่างประเทศมีตัวอักษรและตัวเลขกี่ตัว

โปรดทราบว่าแต่ละประเทศมีโครงสร้าง IBAN แตกต่างกันเล็กน้อย IBAN ต่างประเทศส่วนใหญ่ประกอบด้วยอักขระ 14 ถึง 34 ตัว ตัวอย่างเช่น: DE89 3704 0044 0532 0130 00 สำหรับ IBAN ของเยอรมัน หรือ GB29 NWBK 6016 1331 9268 19 สำหรับ IBAN ของอังกฤษ

คุณจะค้นหา IBAN ได้จากที่ไหน

วิธีที่ง่ายที่สุดในการค้นหา IBAN คือการตรวจสอบใบแจ้งยอดบัญชีธนาคารหรือ RIB คุณสามารถค้นหา RIB ทางออนไลน์ได้จากพื้นที่ลูกค้าของบัญชีธนาคาร ในสมุดเช็ค หรือไปที่เคาน์เตอร์ธนาคารหรือตู้เอทีเอ็มของธนาคารนั้น อีกทางเลือกหนึ่งคือการสร้าง IBAN โดยใช้เครื่องคำนวณ IBAN ออนไลน์โดยใช้ข้อมูลที่คุณให้ไว้ (ธนาคาร หมายเลขบัญชี ฯลฯ)

ตรวจสอบให้แน่ใจว่าคุณป้อน IBAN อย่างรอบคอบ IBAN ที่ไม่ถูกต้องอาจทำให้ธุรกรรมเป็นโมฆะหากไม่มีรายละเอียดธนาคารที่ต้องการ หรือหากรายละเอียดธนาคารมีอยู่จริงแต่ไม่ใช่ของผู้รับที่ตั้งใจไว้ อาจทำให้การเบิกจ่ายส่งไปยังผู้รับผิดราย หากเกิดเหตุการณ์นี้ขึ้น คุณควรติดต่อธนาคารของคุณโดยเร็วที่สุดเพื่อยกเลิกธุรกรรมดังกล่าว

คุณจะระบุธนาคารต้นทางของ IBAN ได้อย่างไร

การทราบรูปแบบทั่วไปของ IBAN รวมถึงส่วนประกอบต่างๆ เป็นสิ่งสำคัญ เพื่อระบุธนาคารที่เกี่ยวข้อง คุณสามารถค้นหาธนาคารที่เชื่อมโยงกับ IBAN ได้อย่างง่ายดายโดยดูอักขระที่ตามหลังตัวเลขตรวจสอบ อักขระเหล่านี้รวมกันเป็นรหัสธนาคาร ซึ่งระบุสถาบันการเงินที่สอดคล้องกับ IBAN นั้นๆ

รหัสธนาคารบางรายการประกอบด้วยตัวเลขเท่านั้น ในขณะที่บางรหัสก็มีตัวอักษรด้วย ความยาวและองค์ประกอบของรหัสเหล่านี้แตกต่างกันไปในแต่ละประเทศ ตัวอย่างเช่น รหัสธนาคารในตัวอย่าง IBAN ของเยอรมันประกอบด้วยตัวเลข 8 ตัว ในขณะที่รหัสธนาคารในตัวอย่าง IBAN ของอังกฤษประกอบด้วยตัวอักษร 4 ตัว รหัสธนาคาร "30004" ในตัวอย่าง IBAN ของฝรั่งเศส "FR76 3000 4028 3798 7654 3210 943" ตรงกับธนาคาร BNP Paribas

รหัสธนาคารล่าสุดในฝรั่งเศสมีดังต่อไปนี้

- BNP Paribas: 30004

- Crédit Agricole: 30006

- Société Générale: 30003

- Banque Populaire (BPCE): 10107

- Caisse d’Epargne (BPCE): 11315

- Crédit Mutuel: 10278

- La Banque Postale: 20041

- HSBC France: 30056

- Crédit du Nord: 30076

- Crédit Coopératif: 42559

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ