IBAN-nummers zijn heel handig om veilig geld over te maken in Europa en daarbuiten. Maar wat is een IBAN precies, hoe vind je het en wat betekenen al die letters en cijfers? In dit artikel leggen we alles uit wat je moet weten, inclusief hoe je je IBAN kunt vinden.

Wat staat er in dit artikel?

- Wat is een IBAN?

- Waar is een IBAN voor?

- Hoe wordt een IBAN samengesteld?

- Hoeveel letters en cijfers zitten er in een buitenlands IBAN?

- Waar vind je je IBAN?

- Hoe kun je zien van welke bank het IBAN-nummer komt?

Wat is een IBAN?

IBAN-coördinaten, IBAN-code, IBAN-sleutel, enz. Deze termen hebben allemaal dezelfde betekenis: een gestandaardiseerd internationaal bankrekeningnummer, oftewel een code met letters en cijfers waarmee je overal ter wereld een bankrekening kunt vinden. De afkorting staat voor 'International Bank Account Number'.

Waar dient een IBAN voor?

Het is belangrijk om je IBAN te kennen als je binnenlandse of internationale betalingen wilt versturen of ontvangen. Als je een betaling wilt ontvangen uit Frankrijk of het buitenland, moet je je IBAN-code naar de betaler sturen. Ook heb je het IBAN van de ontvanger nodig als je een betaling wilt versturen.

De codes worden meestal gebruikt binnen de Single Euro Payments Area (SEPA), een unieke eurobetalingszone die bestaat uit de 27 landen van de Europese Unie, plus Zwitserland, Liechtenstein, Noorwegen, Monaco, San Marino, Andorra en Vaticaanstad. Let op: het Verenigd Koninkrijk blijft lid van SEPA, ook na het vertrek uit de Europese Unie in 2020. Alle landen binnen SEPA gebruiken IBAN.

Hoe wordt een IBAN gevormd?

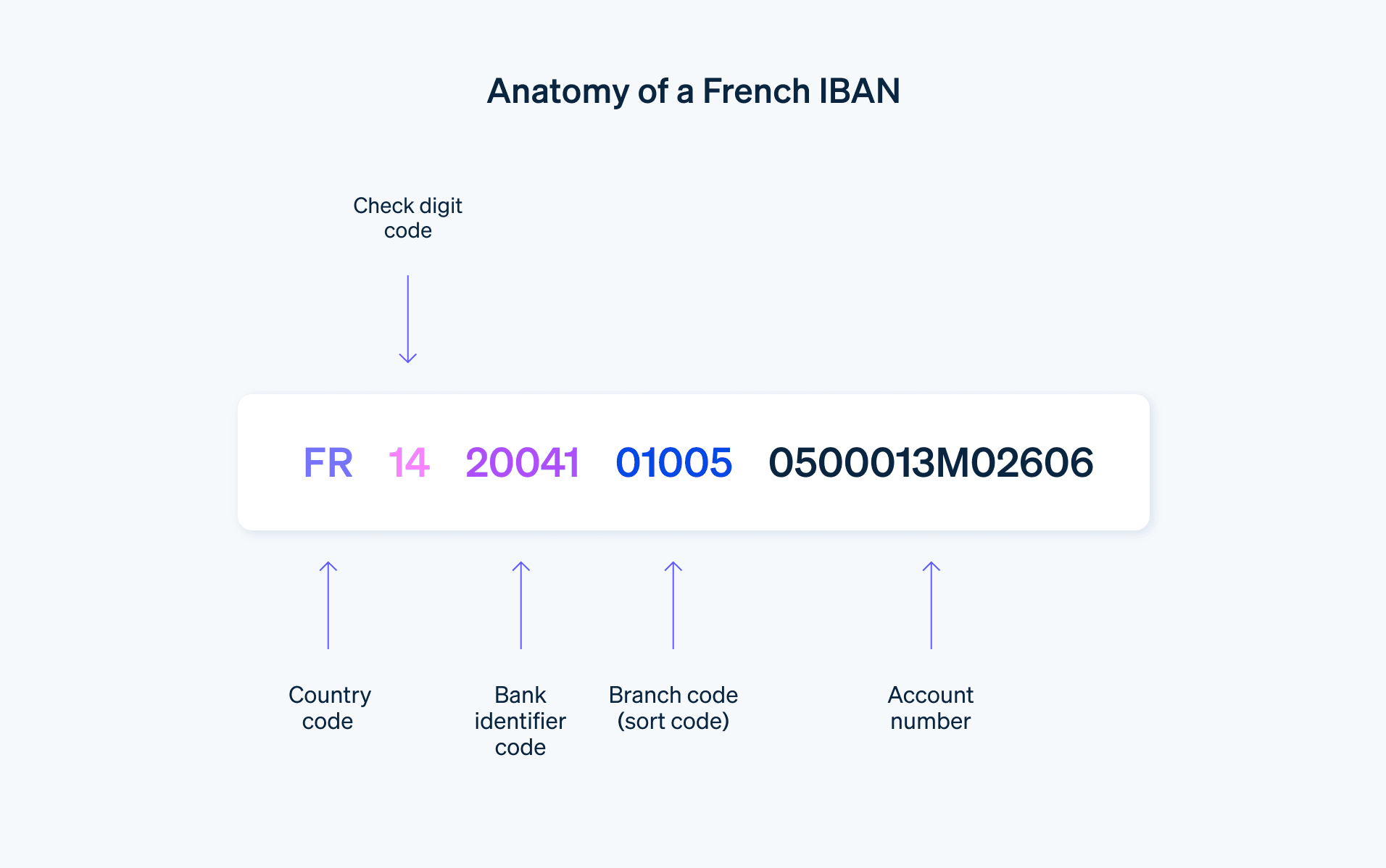

In Frankrijk heeft een IBAN precies 27 tekens. De eerste twee letters zijn de landcode van de bankrekening. In Frankrijk is dat "FR" (in Duitsland is dat "DE" en in het Verenigd Koninkrijk "GB"). Aan de hand van deze twee letters kun je zien welk land het IBAN heeft uitgegeven.

De twee cijfers na de landcode zijn de controlecode die bij de bankrekening hoort. Deze code is belangrijk voor het checken van het IBAN.

De volgende 23 cijfers zijn het basisbankrekeningnummer (BBAN), een nummer dat bestaat uit de bankcode, het routenummer, het bankrekeningnummer en ten slotte de bankgegevens ("relevé d'identité bancaire" of RIB in het Frans).

Bankcodes in Frankrijk bestaan uit vijf cijfers. Het routingnummer is even lang.

Het bankrekeningnummer bestaat meestal uit 11 cijfers. Bij kortere rekeningnummers worden er nullen aan het begin van het nummer toegevoegd om het op 11 cijfers te brengen.

Aan het einde van het IBAN staat de RIB-sleutel, een code van twee cijfers die wordt gebruikt om te checken of de bankrekening echt klopt.

Voorbeeld van een Franse IBAN

FR76 3000 4028 3798 7654 3210 943

In het voorbeeld hierboven is de landcode "FR", de controlecode "76", de bankcode "30004", het routingnummer "02837", het bankrekeningnummer "98765432109" en de RIB-code "43".

Hoeveel letters en cijfers zitten er in een buitenlands IBAN?

Houd er rekening mee dat elk land zijn IBAN-nummers een beetje anders opbouwt. De meeste buitenlandse IBAN-nummers bestaan uit 14 tot 34 tekens. Bijvoorbeeld: DE89 3704 0044 0532 0130 00 voor een Duits IBAN of GB29 NWBK 6016 1331 9268 19 voor een Brits IBAN.

Waar vind je je IBAN?

De makkelijkste manier om je IBAN te vinden, is door je bankafschrift of RIB te checken. Je kunt je RIB online vinden in het klantengedeelte van je bankrekening, in je chequeboekje of door naar een bankloket of geldautomaat van je bank te gaan. Een andere optie is om je IBAN te genereren met behulp van een online IBAN-calculator met de informatie die je invoert (bank, rekeningnummer, enz.).

Zorg ervoor dat je het IBAN zorgvuldig invoert: een onjuist IBAN kan je transactie ongeldig maken als de betreffende bankgegevens niet bestaan, of het kan ervoor zorgen dat je uitbetaling naar de verkeerde ontvanger wordt gestuurd als de bankgegevens wel bestaan, maar niet die van de beoogde ontvanger zijn. Als dit gebeurt, moet je zo snel mogelijk contact opnemen met je bank om de betreffende transactie te annuleren.

Hoe kun je zien van welke bank het IBAN-nummer afkomstig is?

Het is belangrijk om te weten hoe een IBAN eruit ziet en uit welke delen het bestaat, zodat je kunt zien welke bank erbij hoort. Je kunt makkelijk zien welke bank bij een IBAN hoort door te kijken naar de cijfers na de controlecijfers. Deze cijfers vormen samen de bankcode, die aangeeft welke bank bij het IBAN hoort.

Sommige bankcodes bestaan alleen uit cijfers, terwijl andere ook letters bevatten. De lengte en samenstelling van deze codes verschillen per land. Zo bestaat de bankcode in het Duitse IBAN-voorbeeld uit acht cijfers, terwijl de bankcode in het Britse IBAN-voorbeeld uit vier letters bestaat. De bankcode "30004" in het Franse IBAN-voorbeeld "FR76 3000 4028 3798 7654 3210 943" komt overeen met de bank BNP Paribas.

Hier zijn de meest recente bankcodes in Frankrijk:

- BNP Paribas: 30004

- Crédit Agricole: 30006

- Société Générale: 30003

- Banque Populaire (BPCE): 10107

- Caisse d’Epargne (BPCE): 11315

- Crédit Mutuel: 10278

- La Banque Postale: 20041

- HSBC France: 30056

- Crédit du Nord: 30076

- Crédit Coopératif: 42559

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.