Canada is a substantial player in global finance, with close ties to the US. As a result, accepting payments from the country is an important strategy for many international businesses.

The country’s payment space is characterised by both established and emerging technologies. While credit cards are popular, Interac e-Transfer – a Canadian bank-to-bank transfer system – continues to grow in popularity. Residents are also adopting digital wallets and contactless payments – though at a slower rate than countries such as the US – but cash payments continue to play a role in Canadians’ everyday lives.

Below, we’ll discuss what businesses planning to enter the Canadian payments system should consider, including:

- Positioning contactless and mobile payments at the forefront

- Complying with Canadian security standards

- Localising payment interfaces and methods

The state of the market

In Canada, where the primary currency is the Canadian dollar (CAD), the coexistence of legacy banking entities and agile fintech players defines the country’s financial sector. Traditional systems, such as the widely recognised Interac e-Transfer, continue to have major market share: Interac reported in April 2022 that it surpassed 1 billion e-Transfer transactions in a 12-month period. At the same time, 78% of Canadians have adopted digital banking channels, reflecting a progressive shift toward online payment systems. Canadians widely use credit and debit cards, and adoption is growing for digital wallets such as Apple Pay and Google Pay.

While Canadians are shifting more toward digital payment methods, cash is still an integral part of the payment system. Cash is a preferred payment option in situations where quick payments are desirable, such as tipping or paying for small street-side purchases, and by older people.

Several government agencies regulate the country’s financial sector, including the Bank of Canada, the country’s central bank, the Financial Consumer Agency of Canada (FCAC), and the Office of the Superintendent of Financial Institutions (OSFI). These agencies manage Canada’s monetary policy, ensuring customers are aware of their rights and well protected, and regulating federal financial institutions.

Payment methods

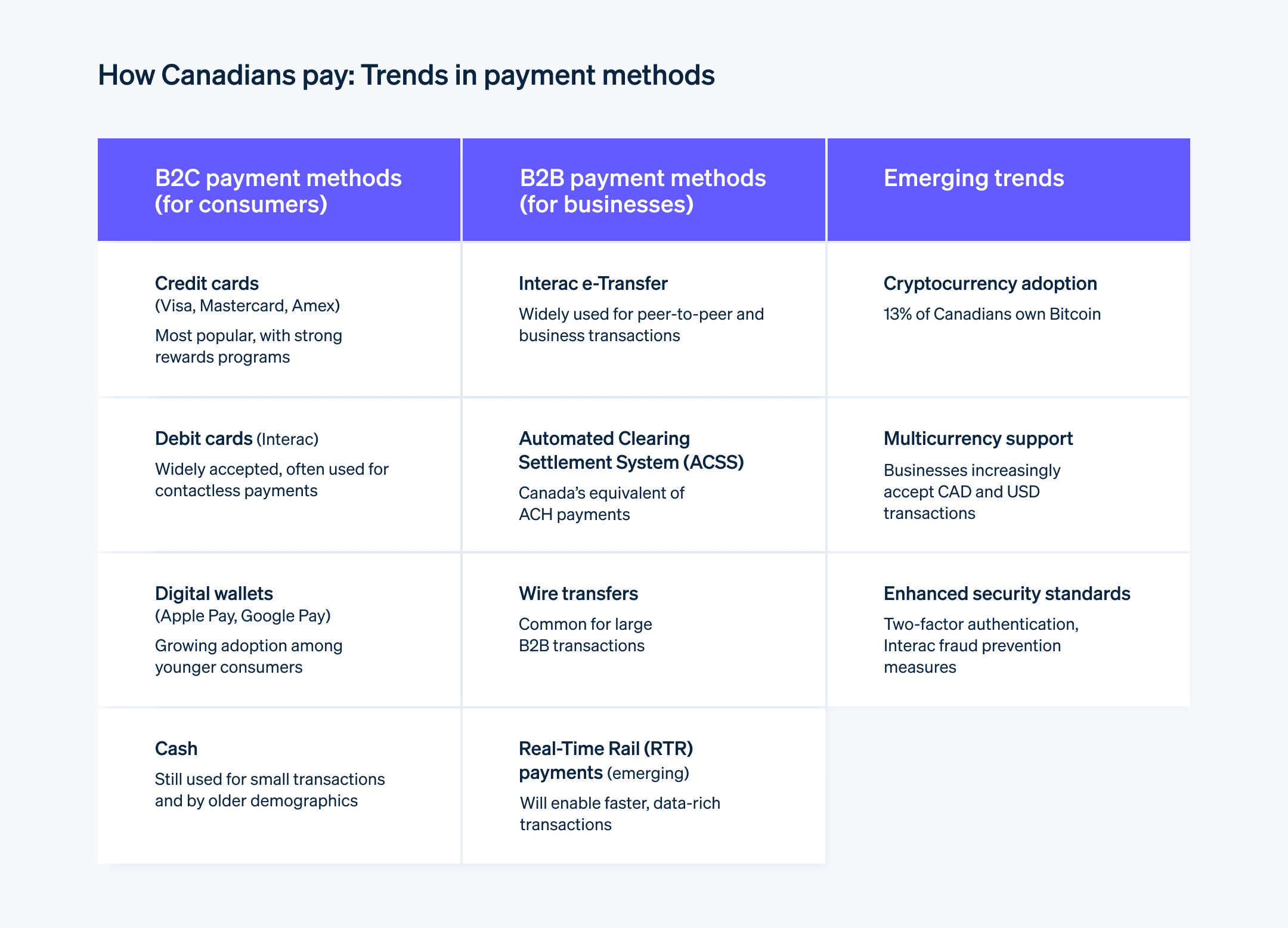

Canadians employ an array of payment methods, with a discernible shift toward digital payment methods in recent years. Here’s a closer look at popular payment methods in Canada:

Current usage

Credit cards are deeply embedded in the Canadian payments system. From security measures to rewards schemes, the Canadian credit card system is convenient and familiar to customers. Visa and Mastercard are the dominant players, with a large number of Canadian customers carrying one or both of these cards, and American Express also has a presence among a more niche group of customers.

Driven by technological advancements and shifting consumer preferences, contactless payments have become a primary payment choice for many Canadians. The country’s digital-friendly atmosphere has also paved the way for the wide adoption of mobile payments, with users linking their banking details or credit cards to mobile wallets such as Apple Pay, Google Pay, or Samsung Pay. According to a 2021 survey, 67% of Canadians who own a smartphone made a mobile payment over a six-month period.

Popular B2C payment methods in Canada

- Credit cards

- Debit cards

- Digital wallets

Popular B2B payment methods in Canada

- Interac e-Transfer

- Automated Clearing Settlement System (ACSS, Canada’s version of ACH payments)

- Wire transfers

Emerging trends

Canadian consumers have gradually begun to adopt cryptocurrency. Coinsquare and Bitbuy, two of Canada’s leading cryptocurrency exchanges, have been instrumental in providing Canadians with platforms to purchase and trade these assets. A 2021 study showed that 13% of Canadians owned Bitcoin, up from 5% in 2020. Beyond Bitcoin, Canadians have adopted other digital assets; Ethereum and Litecoin are particularly popular.

Real-Time Rail (RTR) payments have the potential to evolve B2B payments by enabling instant, data-rich payments that are available 24/7. However, as of June 2023, the modernisation project launch was again delayed, with Payments Canada citing delays “unrelated to the exchange technology components”.

Ease and friction of entry

Although it may be easier to accept payments from Canada than from other countries – particularly if your business is based in the US – there are complexities to consider. These include remitting taxes, managing chargebacks and disputes, and protecting customer data. Here are more details on those aspects:

Taxes

Both customers and businesses pay the federal goods and services tax (GST). Five provinces charge the Harmonised Sales Tax (HST), which is a combination of federal and provincial sales taxes. While customers pay these taxes directly through their transactions, businesses are responsible for collecting and remitting them. Provinces and territories in Canada might also levy their own provincial sales tax (PST) or retail sales tax, which vary by region.

Chargebacks and disputes

Canada handles chargebacks and disputes by balancing the interests of customers and businesses and requiring both parties to support their claims during a dispute.

The Canadian Code of Practice for Consumer Debit Card Services shapes how chargebacks and disputes are addressed by outlining the responsibilities of financial institutions and customers in debit card transactions. Interac has its own guidelines for disputes, which often focus on unauthorised transactions, technical glitches, and double-billing issues. The major credit card companies have implemented the Zero Liability Policy, where cardholders are typically not held liable for unauthorised transactions unless they are negligent.

International payments

Whether your business wants to accept payments from American tourists or global e-commerce businesses, there are several key aspects of accepting international payments in Canada:

Currency conversion

Visitors to the country often convert their home currencies into Canadian dollars (CAD) through various venues, including financial institutions, airports, and specialised currency exchange centres. These institutions set their currency conversion rates using the interbank rate as a baseline, and they often add a markup to the rate when offering currency conversion services to the public. ATMs across the country also allow foreign cardholders to withdraw cash in CAD, but these transactions usually incur a service fee.Multi-currency features for businesses

Canadian businesses, especially those that engage in e-commerce or cater to an international clientele, often implement multi-currency features. These allow customers to view prices and make payments in their preferred currency. The conversion rates are determined at the point of sale, and customers typically pay a fee of 1% to 3% for such conversions.Legal and regulatory compliance

Federal standards guide Canada’s regulations on currency conversion. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) provides the primary oversight for these standards. This institution ensures that all currency exchange providers comply with Canada’s Anti-Money Laundering (AML) regulations. Institutions must be fully transparent about conversion rates and associated fees, allowing customers to make informed decisions.

Security and privacy

Canada prioritises the integrity and safety of its financial system, as reflected in the well-structured frameworks governing security, compliance, and regulatory standards. Payments in Canada, from interbank transactions to consumer payments, are thoroughly regulated. Here’s a closer look at these security and privacy measures:

Data protection laws

Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) sets the foundation for data protection. PIPEDA mandates that businesses secure personal data and stipulates that customers must be informed of and consent to any data collection. This act places importance on safeguarding individuals’ personal information, especially in digital transactions.Interac’s security protocols

Interac has multiple layers of security to guard against fraud. These include chip and PIN technology for debit transactions and the Interac e-Transfer system that uses encryption to shield personal details during transfers.Payments Canada’s role

Payments Canada oversees the clearing and settlement of payments to ensure transactions are conducted efficiently and securely. The organisation implements rules and standards financial institutions must adhere to, creating the framework that underpins payment processes in Canada.Anti-Money Laundering and anti-terrorist financing measures

Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) is a key piece of legislation that sets strict standards. Financial institutions, as well as certain other entities, are required to have procedures in place to identify and report suspicious activities. This act is enforced by FINTRAC, which gathers and discloses information on financial activities that are suspicious for money laundering or terrorist financing.

Key success factors

Entering the Canadian payments market involves navigating a complex web of local regulations, implementing strong consumer protections, and customising your payment interfaces. Recognising the following factors will be key to your business’s success:

Payment preferences

Interac e-Transfer and Interac Debit are widely used payment methods in Canada. Facilitating payments through these familiar systems can resonate with Canadian customers, potentially increasing transaction completion rates.Localised payment interface

Canada has two official languages: English and French. Providing payment interfaces in both languages, especially for businesses that cater to both anglophone and francophone Canadians, can create a more relatable, personalised user experience.Multi-currency options

Canada has a significant trading relationship with the US. As a result, many Canadians regularly conduct transactions in both CAD and USD. Incorporating multi-currency payment options, especially with the US dollar, can cater to this segment of customers, making their payment experience more convenient.Strong security protocols

As e-Transfer fraud remains a concern, there’s increased consumer demand for secure payment options. Implementing measures such as two-factor authentication or high-level encryption can assure customers that their transactions are safe and secure.

Key takeaways

Entering the world of Canadian payments brings unique challenges, but a holistic, considered approach that includes mobile and contactless payments, a focus on security and consumer protection, and adapting payment interfaces to local preferences can maximise your potential for success. To summarise, here’s an overview of several important facets to include in your approach.

Make contactless and mobile payments a central strategy

Use technology

Growing adoption of tech innovations has reshaped the payments sector in Canada. Point-of-sale (POS) terminals that accept both card and contactless payments have made electronic transactions more accessible to businesses and customers. Businesses have also adopted QR codes for mobile payments, for their speed and for avoiding errors inherent in handling large amounts of cash.Strongly consider supporting digital wallets

The transition to contactless payments isn’t just limited to cards. Mobile payment solutions, such as Apple Pay and Google Wallet, are also on the rise, driven by the ubiquity of smartphones and the convenience of not having to carry physical wallets.Allow for cash transactions

You can’t avoid cash payments in Canada. Customers may prefer paying in cash for quick, day-to-day transactions, especially older demographics.

Comply with Canadian security and data protection standards

Make multifactor identity verification the standard

To mitigate the risk of card-not-present (CNP) fraud, businesses have implemented two-factor authentication to validate user identities, among other fraud detection tools. For online card purchases, measures such as SecureCode for Mastercard and Verified by Visa require users to input a code sent to their mobile phones or email addresses, adding another layer of authentication.Protect and educate customers

Canada’s Digital Charter, introduced in 2020, requires businesses to be clear about how personal data is used. It stipulates that payment systems need to be transparent in their data handling processes, especially given the sensitivity of financial data.Promote transparent fees and practices

Canada showcases its commitment to transparency and fairness in its financial sector with initiatives such as the Code of Conduct for the Credit and Debit Card Industry in Canada, which promotes fair business practices. It also provides protections for businesses by making sure they are informed about the costs associated with digital payments.

Localise payment interfaces and methods

Offer regionally relevant promotions

Aligning promotions or discounts with regionally specific celebrations, like Canada Day and Victoria Day, can improve customer engagement and potentially influence purchasing decisions.Support multiple languages

Canadians often speak both French and English, with a strong preference for French in areas such as Québec City. Building payment interfaces and providing support in both languages can boost consumer trust and streamline the checkout process.Understand why Interac is popular

With Interac e-Transfer’s real-time capabilities, transactions can be settled instantly. Recognising Canadians’ affinity for instant payment methods and integrating real-time processing can improve the payment experience for businesses and customers.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practice in your jurisdiction for advice on your particular situation.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.