During the first quarter of 2024, e-commerce turnover in Spain reached a total of €21.793 billion. According to the National Commission for Markets and Competition, this figure represents a year-on-year growth of 13.7% compared to the same period in the previous year. This increase shows that interest in selling online is growing among Spanish companies.

In fact, as reflected in the Digitalisation Observatory 2023 sponsored by GoDaddy – one of the world’s leading web hosting and domain sales companies – 65% of small Spanish companies use online platforms as their main sales channel. If you have considered joining this trend and selling online, this article will show you an analysis of the aspects you should take into account to do so from Spain.

What’s in this article?

- Requirements to start selling online from Spain

- Obligations when selling online from Spain

- Different ways to sell online from Spain

- Frequently asked questions about selling online from Spain

Requirements to start selling online from Spain

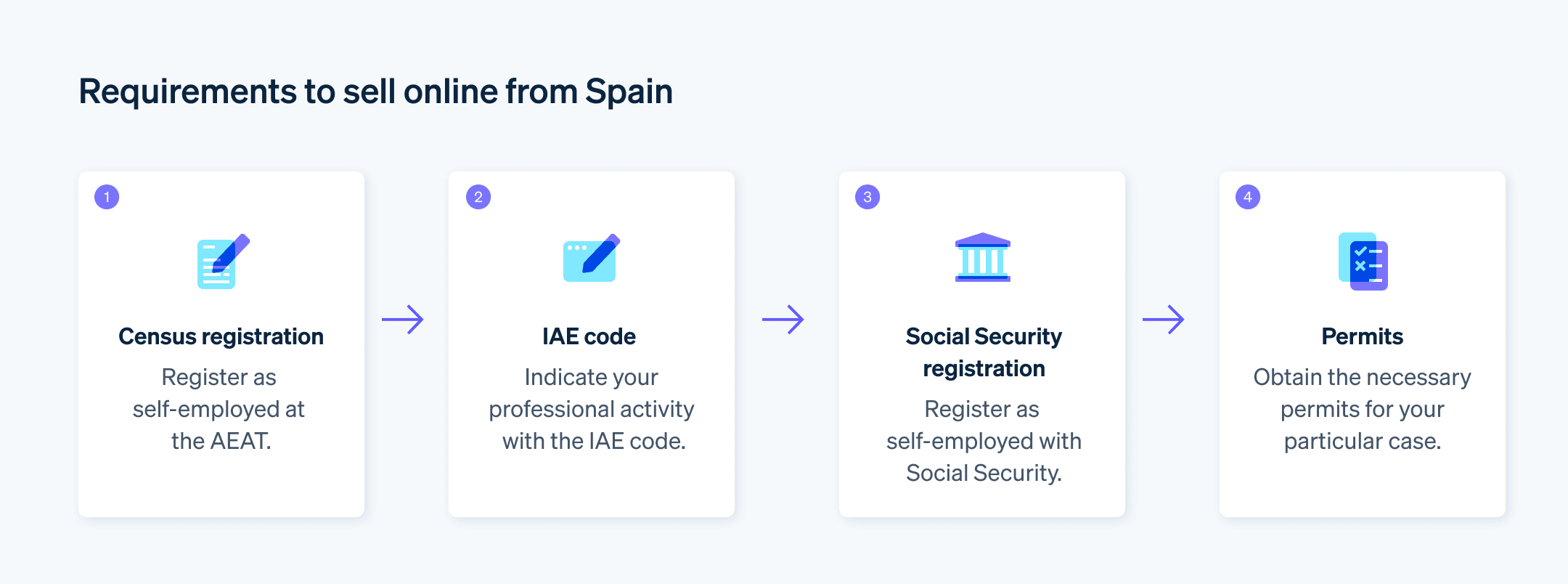

If you want to start selling online from Spain, you must fulfil these requirements:

- Process the census registration as a self-employed professional by filling in Form 036 from the Spanish Tax Agency (AEAT).

- Indicate what type of professional activity you will carry out with the corresponding Tax on Economic Activities (IAE) code.

- Register as a self-employed worker by filling in this Social Security form.

- Obtain the permits required in some cases, such as advance registration to sell food online.

Obligations when selling online from Spain

If you decide to sell online from Spain, you must comply with several obligations. Below is a list of the most important ones:

- Apply Law 34/2002, also known as the “Law on Information Society Services and Electronic Commerce”. Here are some of its obligations:

- Specify whether the price of each product includes value-added tax (VAT), shipping costs, or any other additional amount.

- Clearly display information related to the company or self-employed worker making the sale, such as their Tax Identification Number (NIF) or contact information.

- Apply the regulations of cookies on your website as detailed in the “Guide on the Use of Cookies” from the Spanish Data Protection Agency.

- Specify whether the price of each product includes value-added tax (VAT), shipping costs, or any other additional amount.

- Process customer information based on the General Data Protection Regulation (GDPR).

- Clearly provide the conditions of use or sale, and explicitly request customers accept them before finalising their purchases.

- Comply with the tax obligations detailed in the next section.

Tax obligations when selling online from Spain

VAT

VAT for electronic commerce is an indirect tax you must collect from everyone who buys products in your store online, applying the VAT rates that correspond to the items or services you sell. If you don’t, you might incur VAT penalties in Spain.

Please note that in some cases, VAT exemptions can apply. For example, if you sell online from Spain to other countries, you could be eligible for exemptions depending on the location of your clients:

- If your client resides in another EU country: These operations are known as “intra-community deliveries”. If both you and your client have an intra-community VAT number (also known as “NIF-IVA”, “EU VAT number”, or “European VAT number”), you will be exempt from VAT.

- If your client resides in a country outside the EU: These operations will be considered “exports” and will be exempt from VAT. However, exports from Spain carry their own tax obligations (e.g. possible tariffs or the obligation to include them in your tax returns).

Remember that after collecting VAT on your sales, you must declare it and pay it to the Spanish revenue agency (AEAT) by presenting the quarterly VAT declaration (with Form 303) and subsequently validate the data with the annual VAT summary (using Form 390).

Beyond the possible VAT exemption, there are other advantages to selling online from Spain to clients abroad. For example, in 2023, with exports to other countries, Spanish small and medium-sized enterprises (SMEs) that marketed their goods on Amazon invoiced more than €1 billion. Of the total SMEs – almost 17,000 in the third quarter of 2024 – 75% sold their products outside Spain.

Income tax (IRPF)

IRPF is a direct tax you must pay to the AEAT according to the benefits you obtain throughout the fiscal year. This tax is settled annually in the income tax return (known in Spain as “declaración de la renta”); although, you can make payments on account by filling in Form 130. If you apply personal income tax withholdings to hired staff or self-employed collaborators to sell online from Spain, you must complete Form 111.

Corporate income tax (IS)

IS is another direct tax that, in this case, must only be paid to the AEAT if you have formed a company to sell online from Spain. If you have, you must enter the tax annually through Form 200. Following the example of IRPF, it is also possible to make instalment payments of IS by completing Form 202.

Different ways to sell online from Spain

If you meet the requirements and obligations we have listed in the previous sections, you will be able to start selling online from Spain. The most common methods are to sell from your own website or through external platforms.

Sell online from Spain with your own website

If you choose this route, in addition to the products that are part of the catalogue, you will be able to control all the content of your store online (e.g. customising the details of the brand’s image). Although this process is usually more complicated and involves an initial investment of engineering resources, there are platforms for e-commerce that allow you to create a webpage without having to write your own code:

- Shopify: This all-in-one platform allows you to create a store online and sell to customers around the world without having any programming knowledge. Almost 40,000 stores online in Spain use Shopify – more than double than at the beginning of 2021.

- Prestashop: Although the learning curve of Prestashop can be a little more complex than other alternatives, this platform offers some unique customisation options as an open-source platform.

- WooCommerce: WordPress – a popular content management system for creating webpages – has a popular extension called WooCommerce. Its plug-in allows you to create online stores with a high level of customisation, but it requires some slightly more advanced knowledge.

Securely accept online payments with Stripe Payments

Whatever system you use to sell online from Spain, it is important that you have a payment gateway that complies with current regulations and transmits trust and security to your clients, such as Stripe Payments. This tool provides customers with an optimised shopping experience by allowing you to accept payments with your customers’ favourite ecommerce payment methods.

Sell online from Spain through external platforms

If you decide to sell your products from an external platform, the process will be much simpler, but you will give up the customisation options offered by managing your own website. In many cases, you will also have to assume higher commissions on your sales. Here are some of the most common options:

- Marketplaces: These are online sales platforms that allow other companies to register and sell products from their website. The most successful in Spain is Amazon.

- Social networks: You can offer your products or services from your social media profiles using hosted payment pages, such as those from Stripe Payment Links.

- Buying and selling applications: These platforms – such as Wallapop – accommodate individuals or professionals who want to sell goods.

Frequently asked questions about selling online from Spain

Is it necessary to have a website to sell online from Spain?

No. You can use external platforms to sell products (e.g. a marketplace such as Amazon) or include payment links in your communication channels, such as social networks or email lists.

Is it mandatory to have a specific bank account for the online store?

No, but it is recommended. If you have a personal account and a business bank account, it will be easier for you to manage your finances and tax obligations by clearly distinguishing which funds are those of the online business and which ones are not.

Do you have to register as self-employed to sell online from Spain?

Yes. It is often stated that registering as self-employed is only necessary if selling is a regular activity that generates income greater than the Spanish Minimum Interprofessional Wage (SMI). However, the Spanish social security agency can retroactively demand payment of unpaid contributions throughout the period during which the sales took place.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.