Payment agents are companies that act as intermediaries between e-commerce site operators and various payment institutions, handling credit card transactions, mobile carrier billing, and other payment methods.

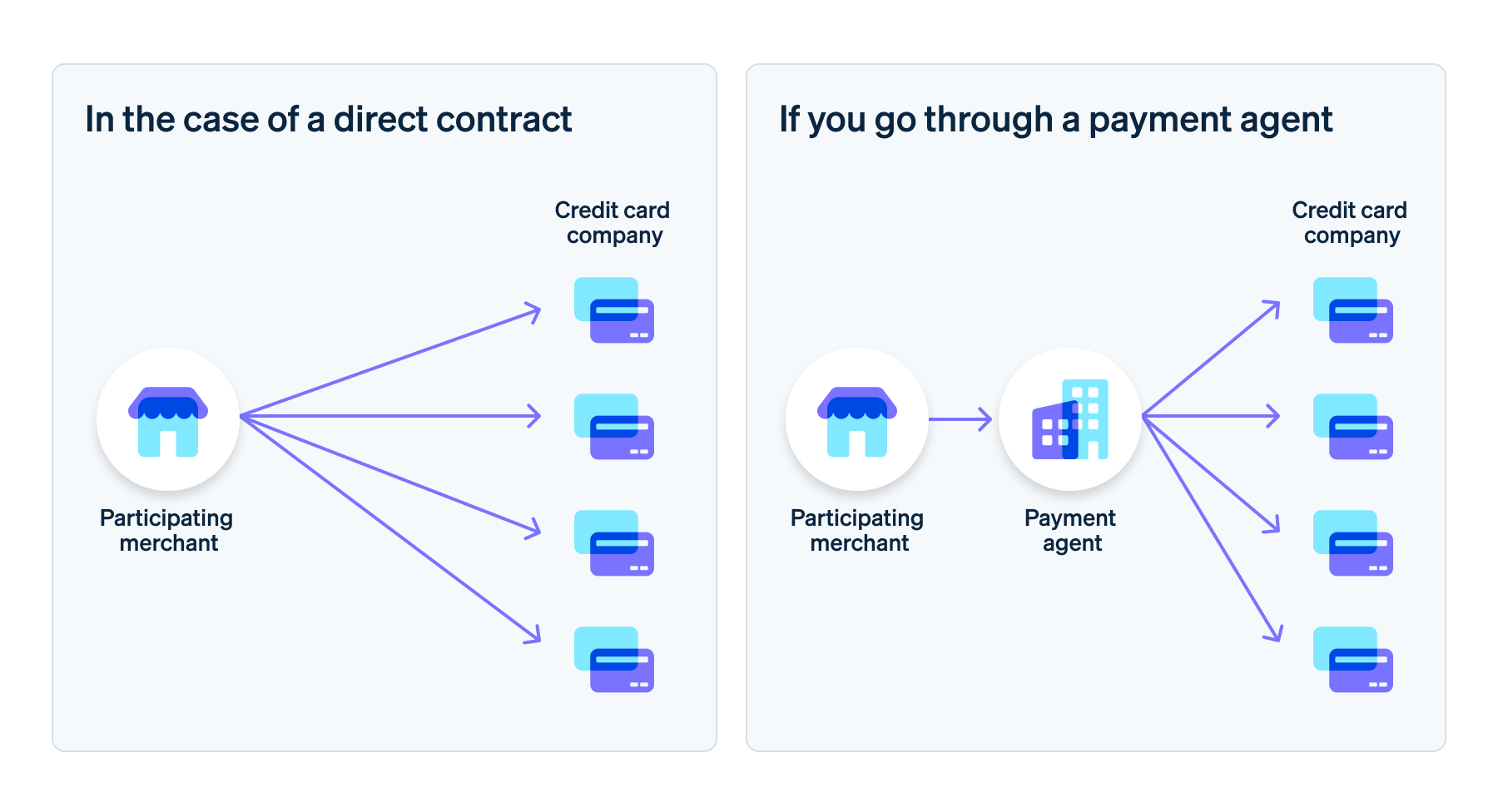

Usually, when a business introduces a payment system, signing a contract with each payment institution is necessary. In contrast, using an agent can handle multiple payment methods with just one contract with the agency.

This article provides an overview of the structure and benefits of these payment agents.

What’s in this article?

- What is a payment agent?

- The benefits of using a payment agent

- Points to consider when choosing a payment agent

What is a payment agent?

Payment agents (also called payment processing companies) act on behalf of payment institutions to provide services. These include contracts, procedures, screening, and the detailed management of transaction information, to facilitate the use of multiple payment methods.

For example, take an e-commerce site operator who is planning to launch an online shop and wants to provide a variety of payment options to make it more convenient for customers to buy products and services. If they sign a contract directly with each institution, they will have to deal with them individually for every option they introduce, costing time and effort.

We will explain the benefits of using a payment agent in more detail later, but, in short, using it allows businesses to avoid signing contracts with numerous institutions. It also reduces payment-related administration because sales and transaction management are centralised in the agent’s system.

Moreover, by making use of a payment agent, companies can avoid the complicated processes involved in signing contracts with payment institutions, which would normally need to be handled individually, as well as the work of integrating their system with each one. This lets a business set up its shop and prepare a robust payment environment in a relatively short period.

What payment agents do

Payment agents act as intermediaries between online shops, stores, credit card companies, and other institutions, providing businesses with transaction systems and methods.

In terms of security, various agents implement different security measures. These contain measures to prevent fraudulent payments and to manage the risks associated with delayed or unpaid fees. For this reason, payment processing companies must comply with information security standards such as PCI DSS for customer- and payment-related information.

They help to maintain the efficiency and security of financial transaction processing between e-commerce site operators and the customers who frequent their shops.

How payment agents work

Offering clients multiple payment options helps companies reach a wider range of customers.

However, as the number of payment methods increases, things get complicated due to the need to manage information related to customer payments, handling the numerous transactions required by each institution, and keeping everything up to date and in order.

To reduce the burden on merchants, payment processing companies also act as intermediaries between the various institutions, handling the contract procedures, screening, and managing deposit and sales customer payments produce. This allows the business to introduce many payment options easily.

The benefits of using a payment agent

By offering various payment methods to meet the diverse needs of your site visitors, you can attract more customers to your company’s e-commerce site and increase purchases.

The following advantages accompany using a payment agent when operating a business that accepts multiple forms of payment.

You can save the time it takes to compare and consider payment methods

The payment method that is most suitable for your business could vary depending on the nature of your business. For this reason, in recent years, many payment processing companies have offered advice on comparing and considering payment options as part of their services.

In addition to providing advice on payment options, they also offer a wide range of services that flexibly respond to user needs, such as accounting software and other tools and functions necessary for operating an e-commerce site.

As such, one of the major benefits of using a payment agent is that it provides value-added services related to the operation of the business itself.

A single contract allows you to handle a variety of payment methods

If your payment agent supports them, you can introduce numerous methods, such as bank transfers, convenience store payments, and credit card payments.

There is also no need to communicate individually with credit card or convenience store companies, as contracts are handled in bulk through an agency. Because there is no need to build internal systems or handle security measures for connecting to every payment service, you can handle multiple payment methods without expending significant time or resources.

Centralisation and streamlining of installation work and management operations

As mentioned above, since you sign a single contract with just one payment agent, that single agent can carry out several procedures and security-related tasks involved in introducing new forms of payment quickly and efficiently.

Additionally, because an agent manages transaction data linked to each institution, you can handle all your payment methods in a single location.

Specifically, with cashless payments, the closing cycles, payment dates, and fees differ for each institution. This can make financial management and handling sales and accounting processes quite complicated. However, when using a payment agent, their system will compile and organise the information for you.

It also means you receive the total amount of sales minus any handling fees in a lump sum on a single payment date. This saves you the trouble of reviewing numerous payments and reduces the workload of managing sales.

Points to note when choosing a payment agent

The common point of all payment agents is that they allow businesses to introduce multiple methods through their services. For this reason, you might think that the assistance you receive will be the same no matter which payment processing company you choose. However, the details of the service content and conditions differ depending on the company, so we recommend that you select the agent that is most suitable for your business after considering the following points.

Number and types of payment methods accepted

The number and types of payment methods supported by agents differ from company to company. Therefore, to introduce all the methods you want to use, it is important to choose an agent that offers the options you need.

For instance, there are many types of payment methods, such as provider billing, QR code payments, and bank transfers. However, not all payment processing companies support these options.

On top of that, it is important to find out which credit card brands each payment agency handles in advance.

Stripe supports various payment methods, including convenience store payments, bank transfers, and credit cards. Stripe also provides a variety of functions related to transactions, from implementation to information processing and revenue management. For example, by introducing Stripe Payments, you can create an environment that meets multiple payment needs on a single platform.

Furthermore, with increases in digitalisation come new payment methods. In the future, if your payment agent cannot offer a newly developed option, you will not be able to introduce it to your e-commerce site. To avoid being forced to switch agents, determine whether the company you are evaluating is proactive about incorporating new services and payment methods.

What is the payment agent’s track record?

Making a payment always involves the transfer of money. For this reason, it’s also important to review the track record of the services provided and the system that will be implemented to understand the agent’s reliability.

To illustrate, when considering a payment agent, analyse all aspects of their operations, such as how many companies are using it, what types of businesses are making use of it, whether case studies of them that introduced it can be viewed on the agent’s website, and the ratio of large to small- and medium-sized companies that are using them. Investigating whether companies in your industry use a given payment agent is also a good idea.

A payment agent with a proven track record could have high social trust. You can have peace of mind with a trusted company when relying on your payment processing service. They are also more likely to leverage its experience and know-how if it has done so in the past.

Can you reduce the cost of the service?

When introducing cashless payments via a payment agent, you must pay certain costs and fees to them. These vary depending on the agent. In some cases, there are fixed costs, such as initial and monthly fees, while in other cases, there might be optional fees for using additional functions or services.

What’s more, a fee based on the number of transactions will increase as you increase your sales. For this reason, it is a good idea to compare the rates of several payment processing companies and to choose one with excellent cost performance from a long-term perspective. You should also consider the payment agent’s services and compare their costs with your sales and budget.

Is security being properly handled?

Implementing a payment agent means that you will be sharing your customers’ personal financial information. As such, it is key to understand the security environment and ensure they have adequate safety protocols. This is the most important point when choosing an agent.

When checking the security environment, a key factor is whether the payment agent has obtained certifications from a third-party organisation that demonstrate the robustness of its systems. PCI DSS and Privacy Mark are specific examples of such certifications. You should check whether the company complies with these standards and what the presence of the standard’s logo implies.

In addition, we recommend checking whether the payment agency has protective measures in place, such as SSL/TLS technology, 3D Secure (Three-Domain Secure), security codes, and so on.

Stripe complies with PCI DSS international security standards and takes thorough protective measures for handling personal information and transaction data, including preventing unauthorised access through data encryption (SSL/TLS technology).

For more information on safeguard measures related to payment, please see Payment Security: An in-depth, actionable guide for business.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.