A deep dive into Billing

Learn more about which features subscription businesses prioritise in a billing system from our report: Is your billing system holding you back? Features available at an additional cost are indicated with an asterisk (*).

Selling

Order acceptance

Frictionlessly accept orders online, in person, or on a mobile device using Stripe’s SaaS billing systems.

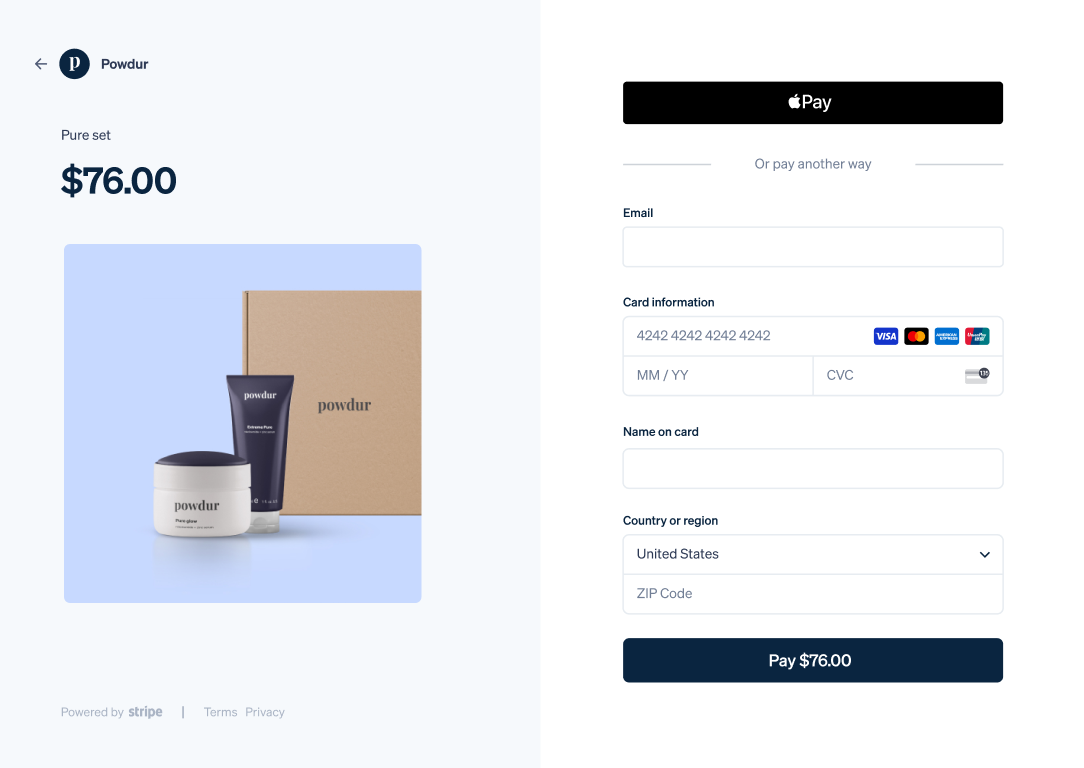

Online checkout

Create a payments page with the help of Stripe’s pre-built user interfaces Checkout and Elements, or use the Stripe payments APIs to integrate with your existing website. You can also encourage customers to upgrade to a longer-term plan with subscription upsells.

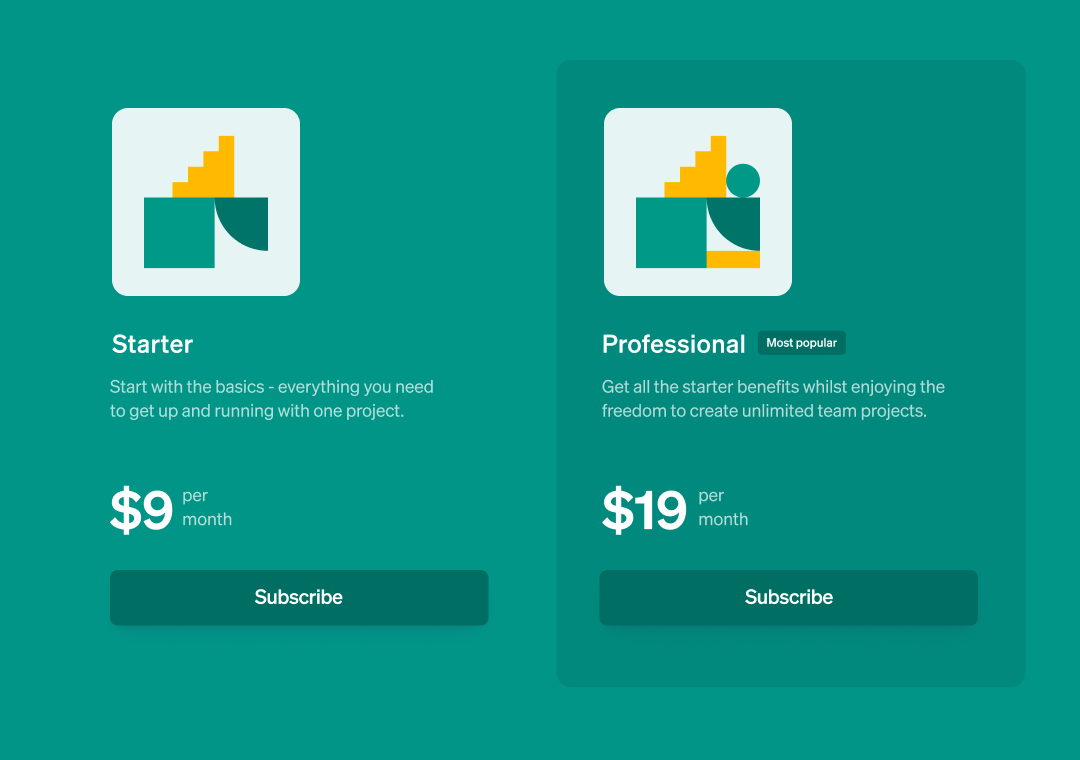

Pricing table

Display pricing information on your website with a customisable, no-code, embeddable pricing table. Upon selecting a subscription or one-off payment, your customers can complete their purchase with Stripe Checkout.

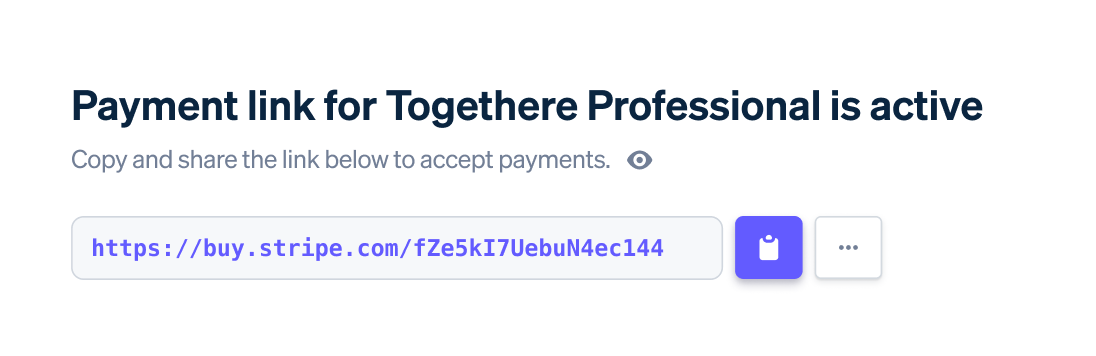

Payment Links

Offer subscriptions in a payments page without writing a single line of code. Share the same payment link with many customers across multiple channels.

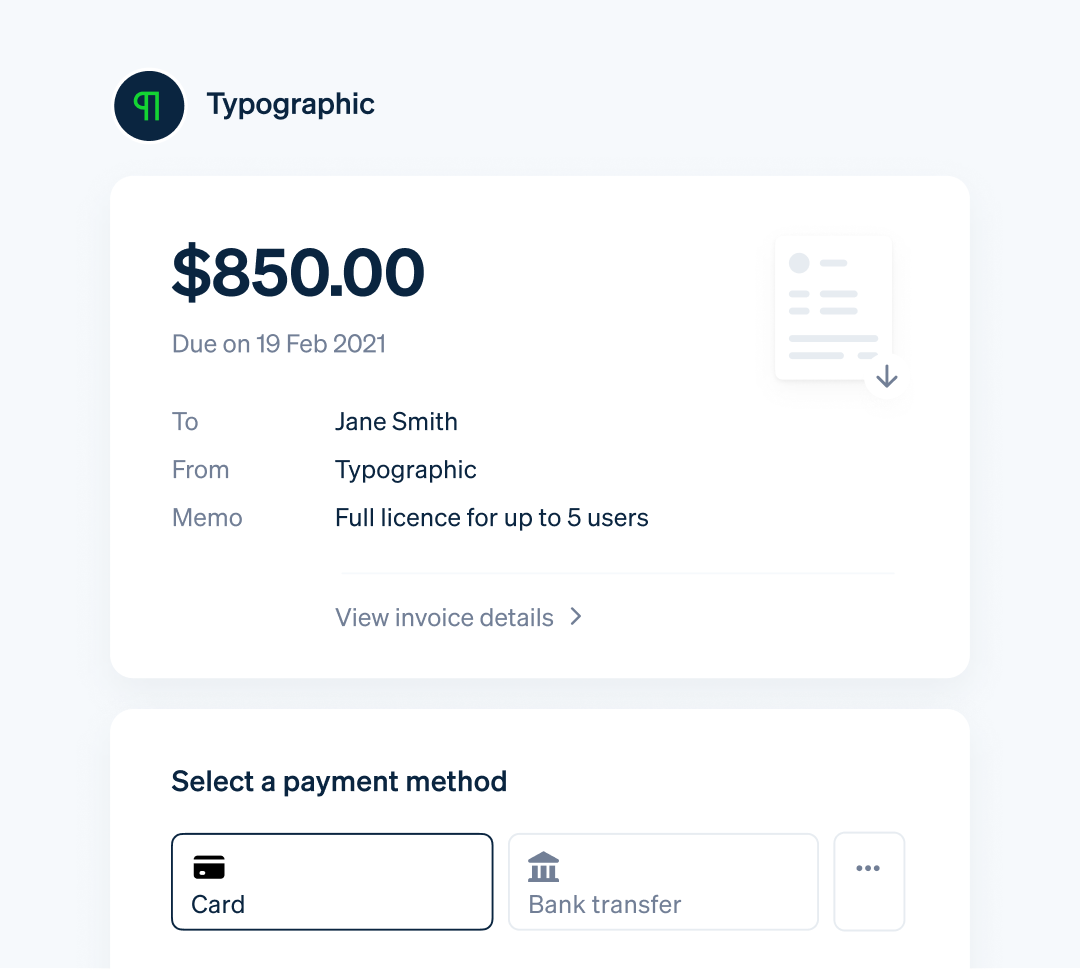

Hosted invoices*

Send customers a unique link to a Stripe-hosted invoice page and create a trackable paper trail for your business. Hosted invoices are optimised for customer viewing and payment across mobile, tablet, and desktop.

Point-of-sale purchase*

Sign up new subscribers with point-of-sale payments and tokenise their payment details to charge on a recurring basis. Create a seamless, frictionless user experience for physical goods and digital services bundles and maximise recurring revenue stream conversion.

Adaptive Acceptance

Adaptive Acceptance uses machine learning to retry network declines in real time, helping to improve authorisation rates for initial subscription charges.

Contracting

Accelerate your sales team’s velocity by making it easy to manage and close a deal in a centralised SaaS billing platform.

Custom quotes

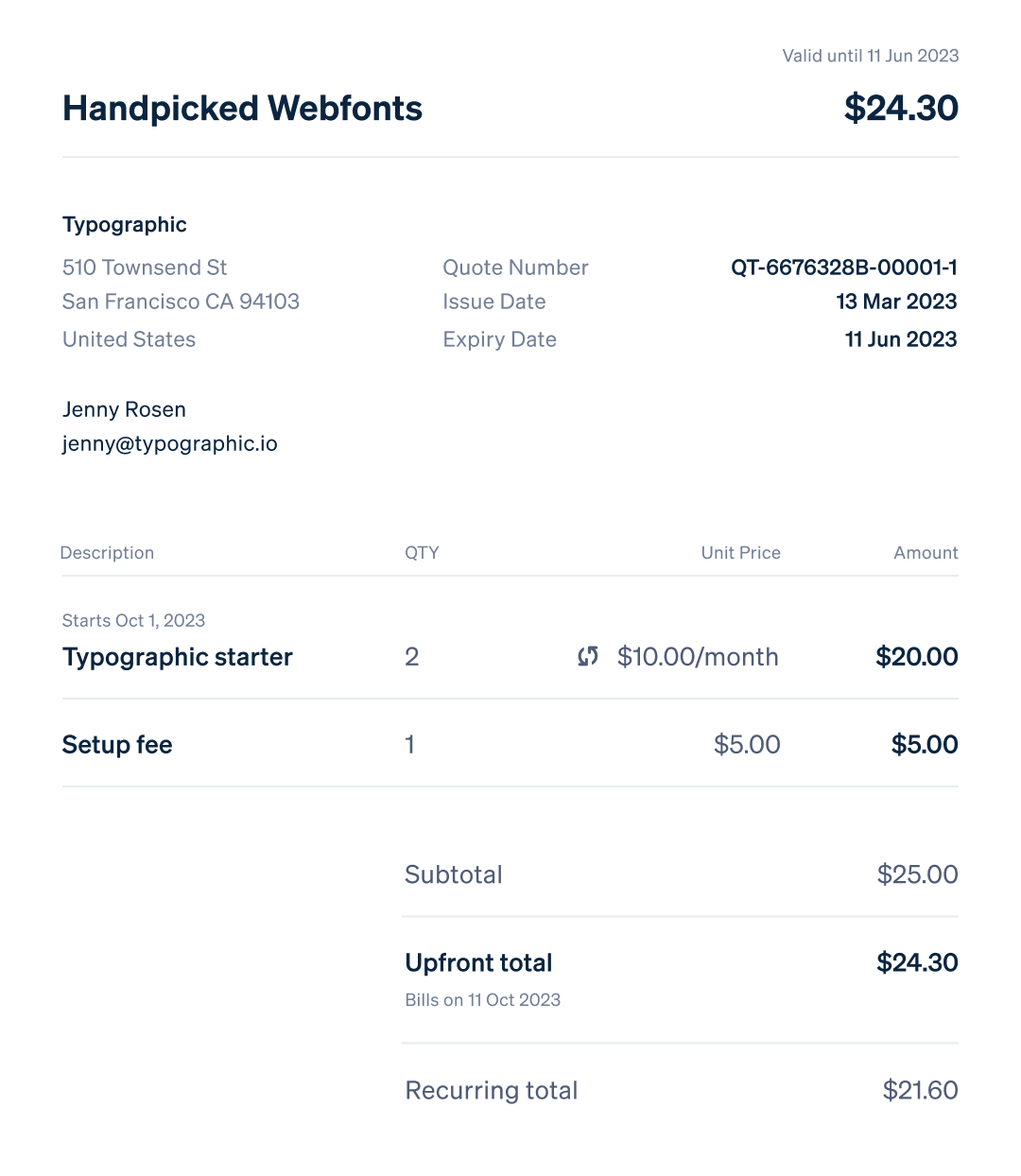

Share a price estimate with a customer and convert an approved quote into a subscription or invoice with a click from the Stripe Dashboard. Customise products, prices, terms, discounts, contract phases, and start dates to translate to a new subscription or invoice.

CRM integrations

Integrate Stripe into your existing CRM system and automate subscriptions and invoice creation from closed sales orders. With Stripe Billing, use flexible sales contract models to help your sales team close complex enterprise deals.

- Hubspot

- Salesforce Preview

CPQ integrations

Create and manage subscriptions on Stripe without leaving Salesforce.

- Salesforce [beta] Preview

Trials

Help customers make an informed purchase decision by letting them try out your product for free or at a lower price.

Free trials

Accelerate your growth and help your prospects experience the full value of your product risk-free before subscribing.

- Flexible trial expiration

- Automated trial ending notifications

- Free trials without collecting a payment method

Billing

Subscription management

Manage customers or subscribers across their lifecycle with Stripe-hosted pages and tools to ensure billing accuracy. See why Stripe Billing was named a Leader in The Forrester Wave™: Recurring Billing Solutions, Q1 2025 and in the 2025 Gartner® Magic Quadrant™ for Recurring Billing Applications.

Invoicing*

Create, customise, send, and revise a Stripe-hosted invoice from the Dashboard without writing a single line of code. Automate invoice collection with advanced features, such as payment reminders and Smart Retries. Streamline your AR workflows and integrate Invoicing into your existing systems, and provide invoice previews for new or existing customers with the Invoicing API.

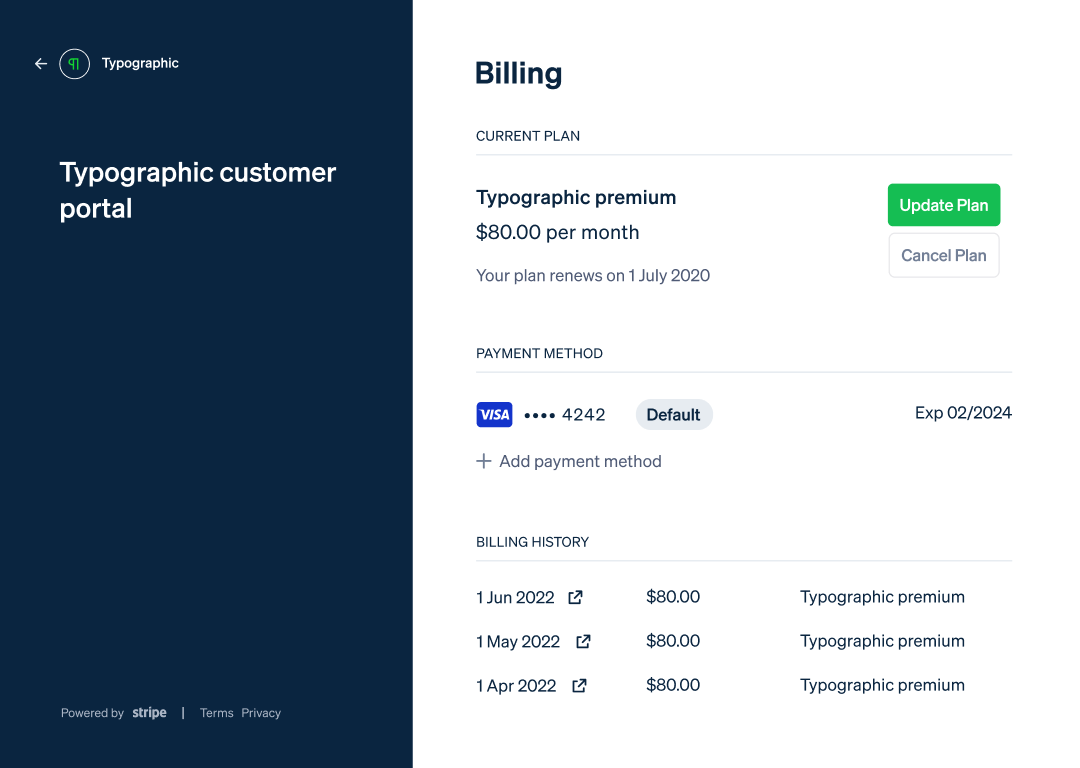

Customer portal

Enable your customers to self-manage their payment details, invoices, and subscriptions with a secure, pre-built customer portal. The customisable experience allows them to easily upgrade, downgrade, pause, resume, or cancel subscriptions; update payment methods; view billing history; and pay outstanding invoices.

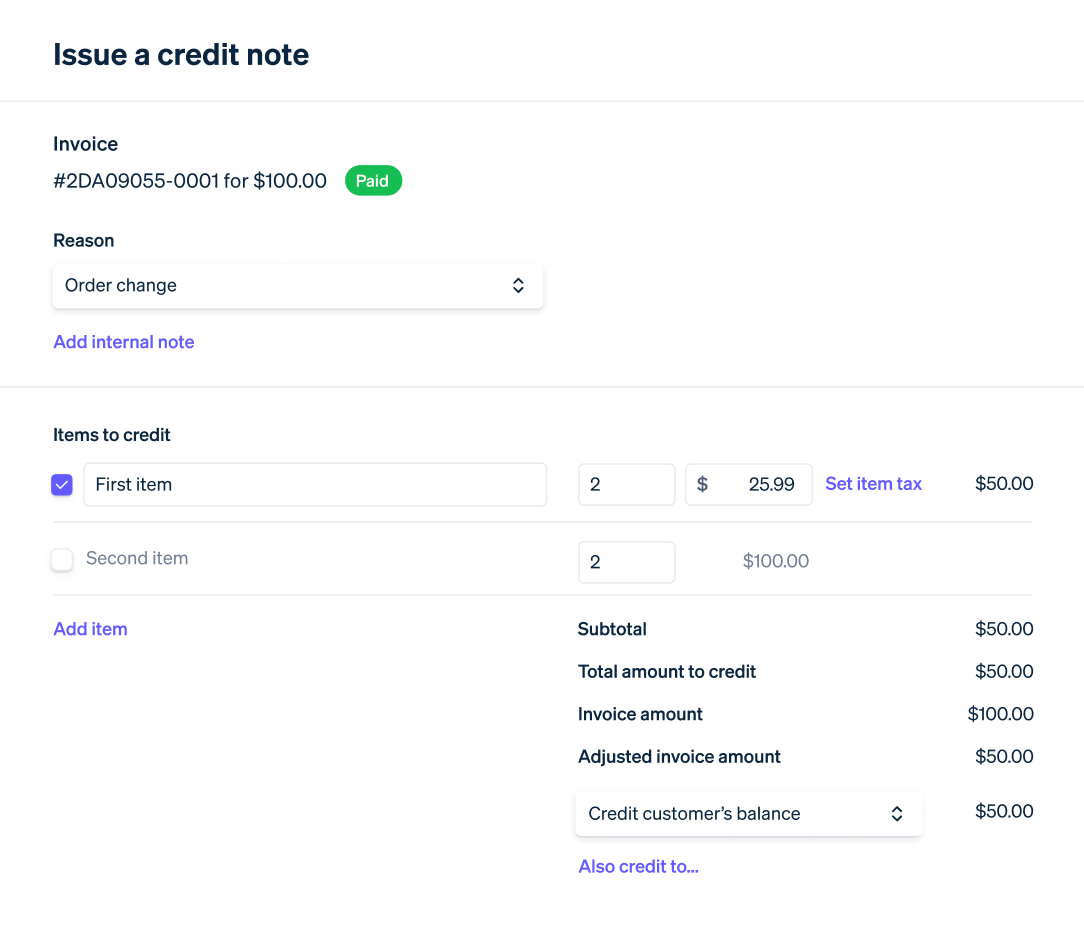

Credit notes

Adjust or refund finalised invoices from the Dashboard or via the Invoicing API. If you accidentally over-bill a customer or are short on inventory, you can issue a credit note to decrease the amount due on an invoice.

Rate cards Preview

Define, manage, and bill for packages of usage-based products and features as a single, unified offering – without code. Easily add new products and manage pricing versions across cohorts.

-

No-code rate card editor

-

Versioning management

-

Seamless integration with Stripe Checkout

Billing for platforms*

Platforms and marketplaces can use Stripe Connect to enable their users to accept recurring payments or send invoices. Billing makes it simple for platforms to bill their connected accounts and package and resell subscription management and invoicing functionality.

Subscription migration

Seamlessly migrate subscriptions from your third-party billing processor or internal billing system to Stripe Billing using our Billing migration toolkit. Upload your existing subscriptions, validate the uploaded subscriptions, and track the overall migration in our self-serve Dashboard.

Subscription schedules

Schedule subscription updates ahead of time, such as upgrading, downgrading, starting a subscription on a future date, and more.

Entitlements

Easily determine which features your customers are entitled to based on their pricing, plus when to grant or revoke access to each feature with our Entitlements API. Change, launch, and experiment with new pricing and packaging – without building a complex in-house feature access logic.

Subscription models

Bill subscribers on a recurring basis and effortlessly handle subscription changes with Stripe’s billing platform for SaaS.

Pricing models

Support a wide range of pricing models as your business grows and evolves. Flexible billing logic makes it easy to experiment with new pricing structures, optimise revenue, and quickly launch new business lines and products.

-

Flat-rate pricing

-

Good-better-best pricing

-

Per-seat pricing

-

Usage-based pricing

-

Tiered pricing

-

Multiple prices

-

Multiple products in a subscription

Usage-based billing

Automate billing for usage-based pricing models, including consumption-based, flat-fee plus overage, and credit burndown. Send, aggregate, and analyse real-time usage events using Stripe’s Meters API.

Discounts

Promotions can be a powerful tool to acquire new subscribers. Stripe gives you the tools to configure which transactions to discount and how to offer a discounted price.

- Set coupon expiry

- Limit coupon redemption

- Use a percentage or a flat discount

- Restrict coupon use

- Apply coupons to one or every invoice or subscription

- Apply multiple coupons on the same subscription or subscription item

- Apply coupons for a certain time

- Generate promotion codes

Stripe Scripts Preview

Design and implement custom billing workflows in Stripe Billing with minimal code, unlocking new business and pricing models.

-

Customisable discounting logic

-

Readily available Stripe-authored scripts

Prorations

Automatically prorate billing when a plan is upgraded, downgraded, cancelled, or paused.

Sales contract schedules

Use our composable API to customise and automate changes to subscriptions over time.

-

Bill in instalments

-

Charge before a subscription starts

-

Backdate a subscription

-

Start a subscription on a future date

-

Schedule an upgrade or downgrade

-

Model and automate complex contracts

-

Apply a discount for a fixed period

Instalments

Split the full price of a good or service over multiple billing periods. Customers pay in set increments until the total amount is paid in full.

Subscription backdating

Set a subscription’s start date sometime in the past. Backdating can be used to charge for unpaid services or to ensure reports are accurate.

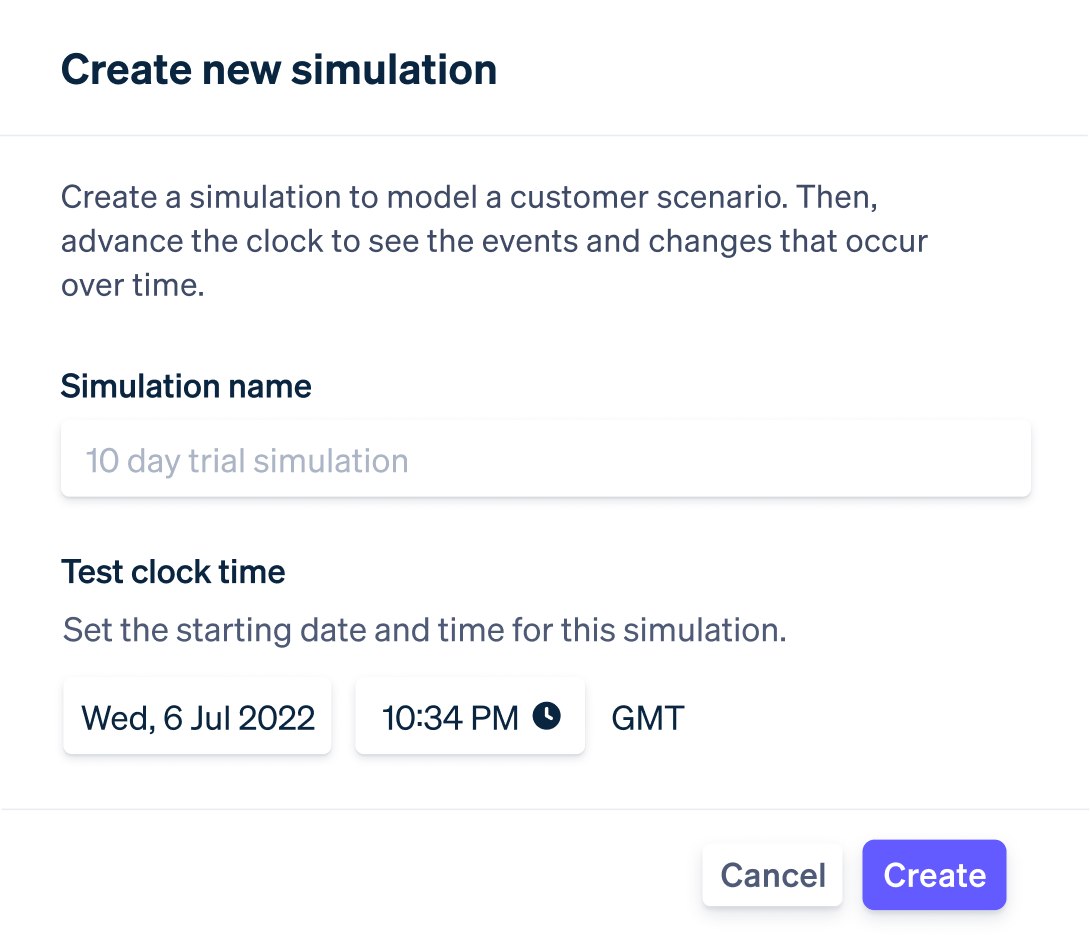

Test clocks

Test clocks let you test your Billing integration and make sure it behaves as designed.

Compliance

Stripe helps you comply with the latest standards and regulations.

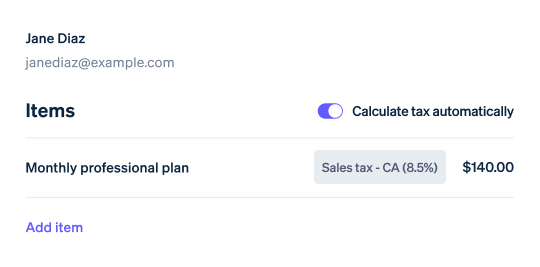

Automatic tax calculation*

Calculate and collect sales tax, VAT, and GST on both physical and digital goods and services in all US states and more than 100 countries. Stripe Tax constantly monitors and updates tax rules and rates to simplify global tax compliance.

Invoice compliance*

In Europe, invoice requirements vary from country to country. Stripe invoice templates make it easy to follow invoicing best practices in the region.

Payment Card Industry Data Security Standards (PCI DSS)

Stripe helps businesses achieve and maintain PCI compliance so that sensitive payment information is handled and protected appropriately.

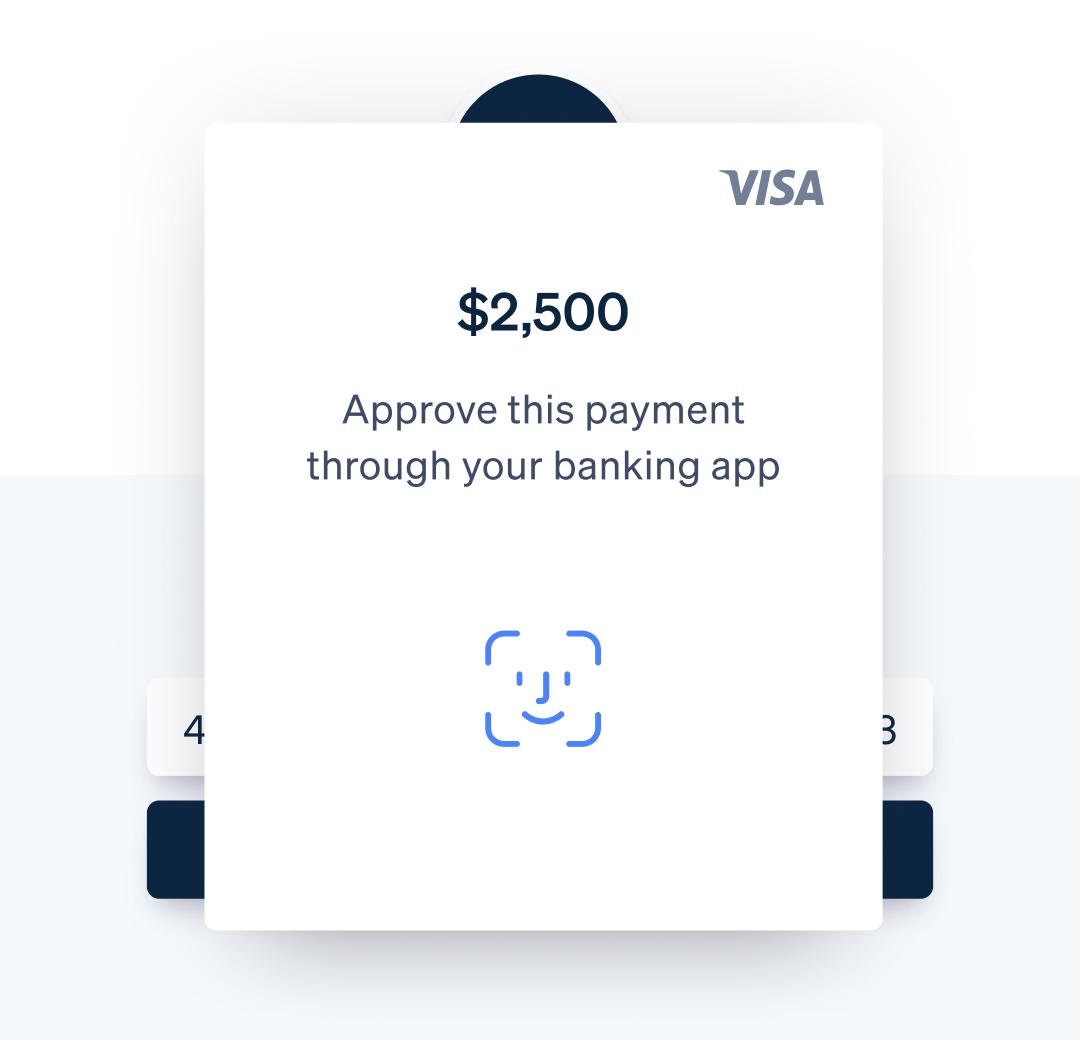

E-mandates for recurring transactions

The Reserve Bank of India (RBI) requires additional authentication for recurring payments from India cardholders. Stripe handles mandate registration and automatically sends pre-debit notifications before charging customers.

Subscription cancellations compliance

Enable your customers to update their billing payment method or cancel their subscription within two clicks to comply with local regulations for self-serve subscription cancellations.

Strong Customer Authentication (SCA)

The PSD2 regulation requires European customers to provide Strong Customer Authentication for subscription and invoice payments. Stripe identifies which charges require SCA and triggers 3D Secure authentication when required.

Revenue optimisation

Payment methods

Charge customers in their local currency and offer their preferred payment options with a single integration.

Cards

Accept all major debit and credit cards.

-

Visa

-

Mastercard

-

American Express

-

Discover

-

Cartes Bancaires

-

Diners Club

-

China UnionPay

-

JCB

Wallets

Enable your customers to check out faster with digital wallets. Wallets eliminate the need for customers to manually enter their card and billing information, offering a quick and convenient way to pay.

-

Apple Pay

-

Google Pay

-

Alipay

Bank redirects

Increase conversion by offering customers a more convenient and secure way to pay from their bank account. Bank redirects are the preferred method of paying online in many countries.

-

Bancontact

-

EPS

-

FPX

-

giropay

-

iDEAL

-

Przelewy24

-

SOFORT

Bank debits and transfers

Minimise involuntary churn by accepting direct debits for subscription or recurring charges. For large transactions, Stripe makes it possible to accept bank transfers with automated reconciliation, lowering the chance of payment failure without adding operational complexity.

- ACH Credit Transfers Preview

- ACH Direct Debit

- Bacs Direct Debit

- BECS Debit

- Cheque Preview

- EUR Bank Transfers

- GBP Bank Transfers

- SEPA Direct Debit

Out-of-band settlement

If a customer paid an invoice or subscription outside Stripe, you can manually mark it as paid in the Dashboard.

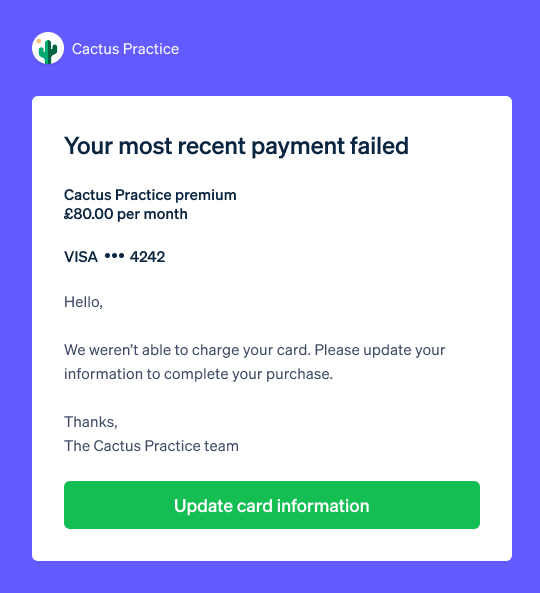

Revenue Recovery

Nearly a quarter of churn is involuntary – it’s caused by missed payments or declined cards. Stripe’s tools help businesses recover failed payments revenue.

Revenue recovery analytics

Understand and analyse your failed payment and recovery rates.

Smart Retries

Our Smart Retries logic with machine learning algorithms is trained on data from across the Stripe network. On average, Smart Retries have helped businesses recover 57% of recurring payments that originally failed. You can also set your own rules for when Stripe retries failed payments.

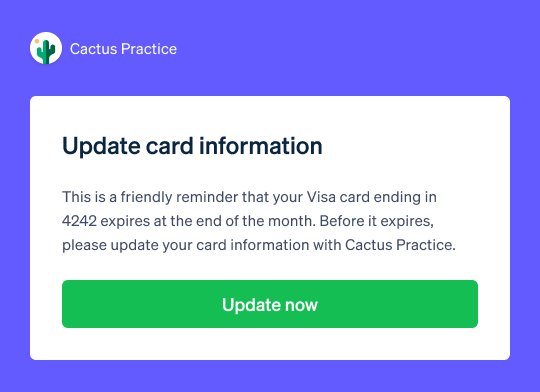

Reminder emails

Maximise your chances of getting paid with pre-built email reminders for cards set to expire, free trials about to expire, upcoming renewals, and failed payments.

Email log

See what emails Stripe has sent on your behalf to your customers.

Hosted recovery page

Include a personalised link in dunning emails which allows users to update their payment information with one click.

Expired card updates

Stripe works directly with card networks to automatically update expired or renewed card information to keep subscription payments recurring seamlessly.

Retention

Use Stripe’s SaaS billing system to retain more revenue and minimise user cancellations.

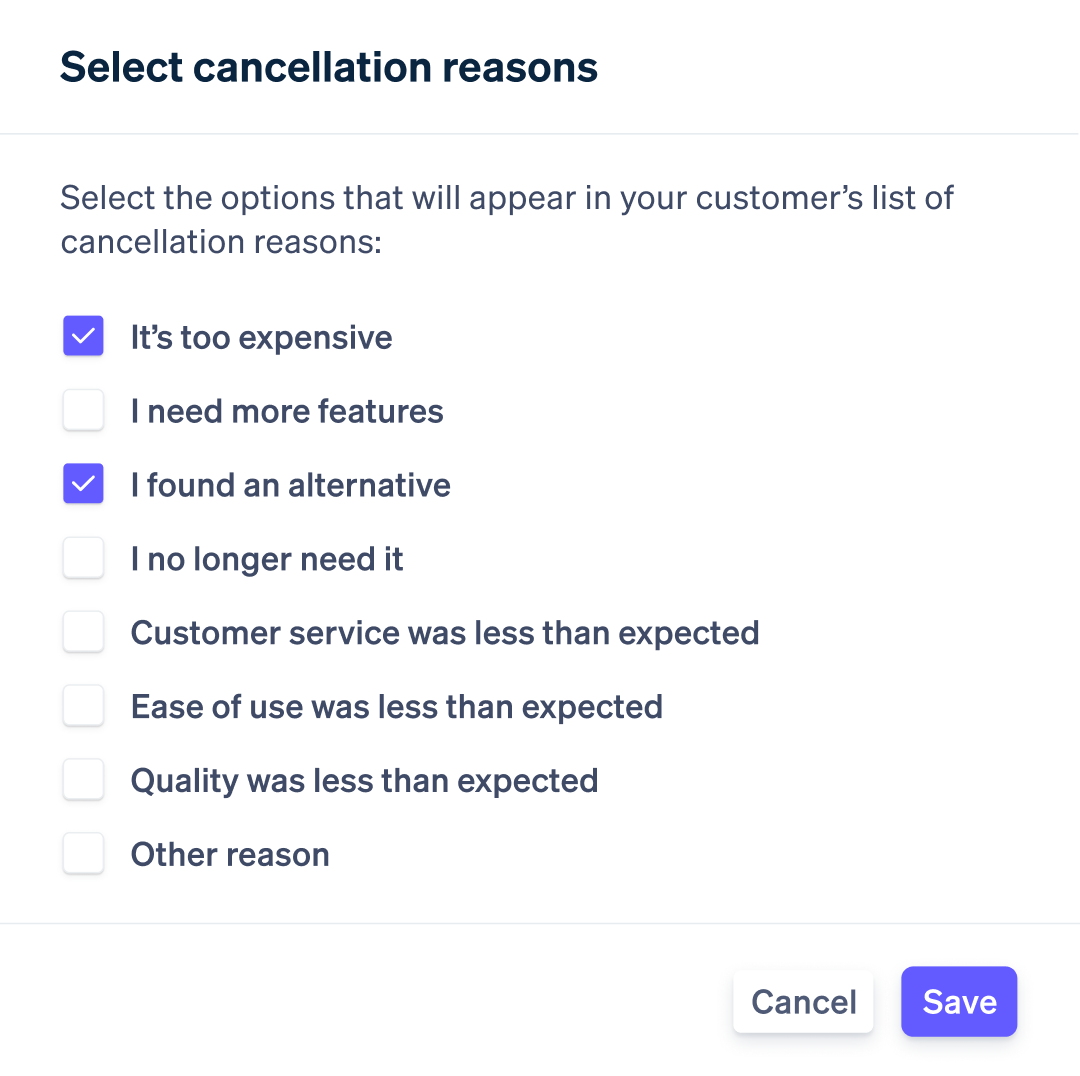

Cancellation surveys

Reduce user-initiated cancellations by understanding why your customers churn. Use the cancellation survey to gather the data and insights necessary to improve net revenue and user retention.

Automations

Configure and automate your dunning processes without a single line of code.

Recovery and retention automations

Create custom dunning strategies based on customer value or subscription length, receive notifications when invoices are overdue, and automatically collect cancellation reasons.

-

Automate dunning, collections, and retention flows.

-

Automate team and subscriber notifications.

Accounting and reporting

Analytics and reporting

Understand your growth, churn, and financial health with automated reporting and configurable analytics.

SaaS and Billing analytics

Monitor real-time metrics such as subscriber count, churn rate, and monthly recurring revenue (MRR) across your subscriptions, invoices, and usage-based transactions. Identify trends, growth opportunities, and valuable customer profiles.

-

Near real-time metrics for revenue, subscribers, churn, trials, collections, and usage

-

Customise how metrics are calculated in line with your business logic

-

Filter, group, and drill-down into metrics to understand performance and customer behaviour patterns at a deeper level

-

Benchmark your metrics against other businesses using Stripe

-

Download MRR and active subscriber roll-forward reports

SaaS and Billing benchmarks

Understand your strengths and growth opportunities with built-in benchmarking. Businesses similar to yours are automatically identified by our machine learning, so you can easily health-check your metrics versus industry peers.

-

MRR growth rate

-

Lifetime value

-

Net MRR churn rate

-

Subscription payment failure rate

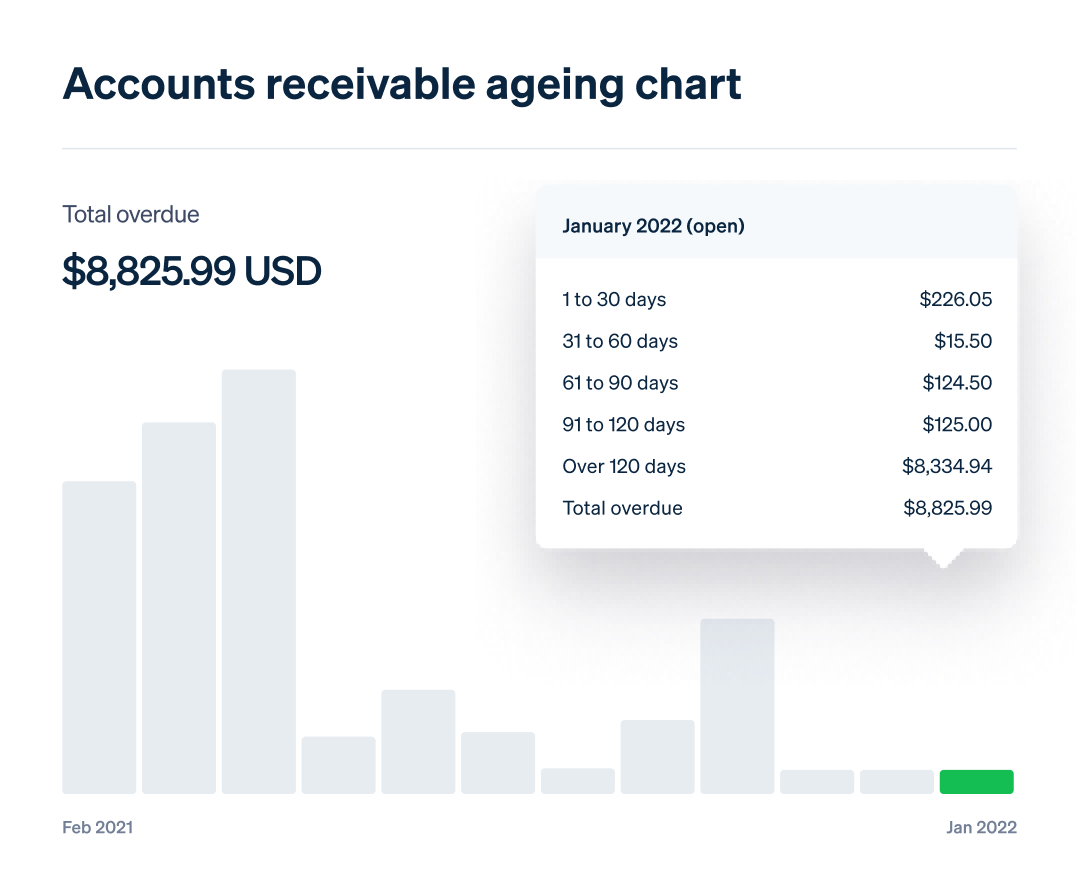

Accounts receivable ageing

Group unpaid invoice balances based on how long they’ve been overdue. Find customers with outstanding invoices and determine your collection strategy.

Custom reporting*

Use Stripe Sigma to explore your Stripe revenue data even further – without leaving the Stripe Dashboard. Get insights, track trends, and build custom reports using SQL or natural language prompts. With structured access to your data, you can identify which payment methods are the most popular, pinpoint your most-sold SKUs, and more.

-

Prebuilt query templates for decline analysis, ARPU, churn, and more

-

Built-in, AI-powered assistant transforms natural language prompts into SQL queries

-

Save and share queries

-

Schedule queries for repeated use

-

Create custom reports and visualisations

Data storage sync*

Streamline data analysis by connecting your Stripe account to your data warehouse or cloud storage in a few clicks with Stripe Data Pipeline – no code required.

-

Built into Stripe – no third-party integration needed

-

Automatically send your Stripe data and reports to your data storage

-

Historical Stripe data included at no additional cost

-

Ongoing data refresh

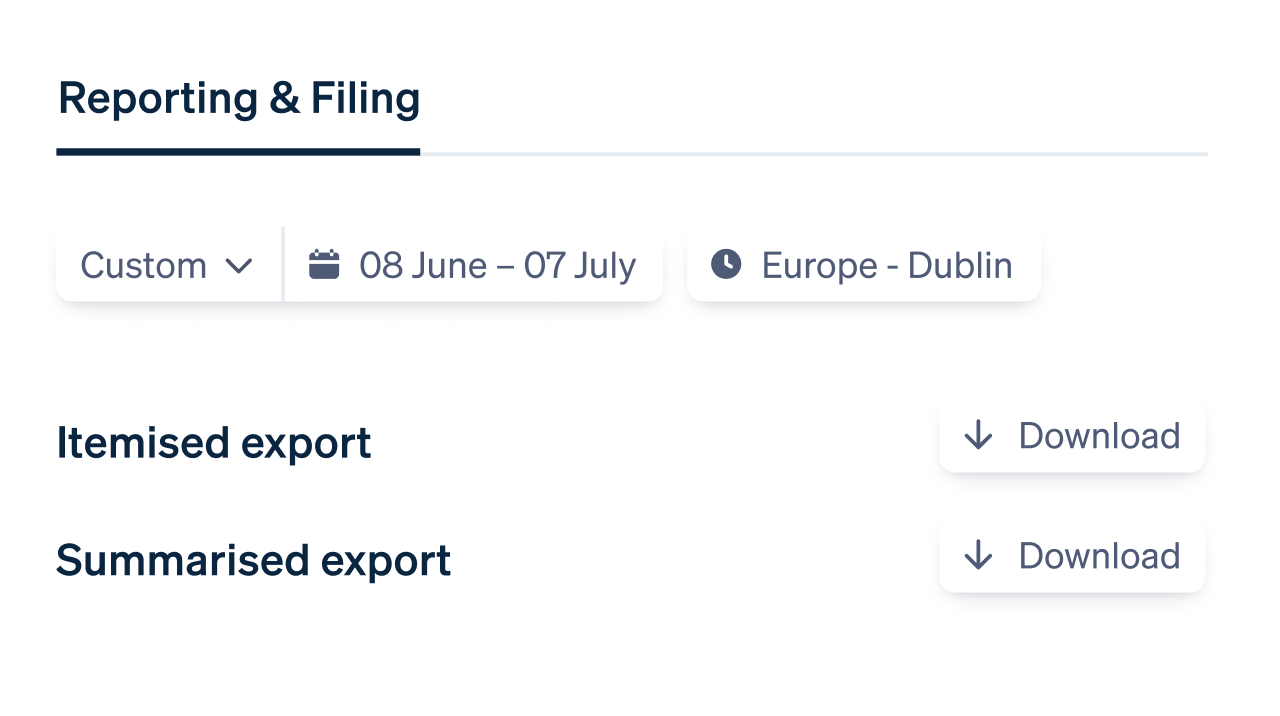

Tax reporting*

Speed up tax filing and remittance with itemised reporting and tax summaries for each market where you’re registered.

Accounting

Automatically recognise revenue and reconcile transactions. Easily sync billing and payments data with your accounting systems.

Revenue Recognition*

Automate complex accrual accounting calculations and reporting to close your books more quickly and accurately. Create custom rules to fit your accounting practices, import non-Stripe revenue data, and audit in real time by tracing any revenue amount back to the underlying customers and transactions.

-

Debits and credits journal entries

-

Balance sheets

-

Income statements

-

Revenue waterfall charts

-

Accounts receivable ageing reports

-

Helps you stay compliant with ASC 606 and IFRS 15

Automated reconciliation*

Automatically reconcile incoming ACH credit or wire transfers with outstanding invoices. Stripe generates virtual bank account numbers to keep your company’s banking details private.

Connector for NetSuite

Send Stripe data to NetSuite, an ERP system for finance, accounting and e-commerce. Avoid hours of custom NetSuite integration effort with our prebuilt connector.

-

Automate cash reconciliation

-

Complete your e-commerce workflow

-

Accept payments on invoices sent from NetSuite

Accounting integrations

Sync your Stripe data with your accounting system.

Ready to get started?

Access a complete billing platform from the Stripe Dashboard.

Learn how to integrate

Design an integration path that’s right for your business.

Test your integration

Simulate subscriptions through time to confirm they work as expected.