Every company selling goods and services to European customers needs to collect value-added tax (VAT), even if their business is not established in Europe. As all European countries have different VAT rules and rates, staying compliant can be challenging. The European Commission has made an effort to simplify VAT collection and payment, but this hasn’t entirely spared businesses of VAT complexities. For example, if your business sells to another business in the EU (rather than to a customer directly), you may not be required to collect VAT—depending on where both businesses are based. And for all sales where VAT is collected, the government requires you to collect additional data to confirm the address of your customer.

This guide is for businesses that sell to customers in the EU and covers the basics of VAT and VAT One Stop Shop (VAT OSS). You’ll learn when and how to register to collect VAT, how to calculate and collect VAT, and how to file your VAT returns. You’ll also learn how Stripe Tax can help you comply.

What is EU value-added tax (VAT)?

Value-added tax (VAT) is a consumption tax that applies to all digital and physical goods or services sold in the EU. It’s charged whenever value is added to the product throughout the supply chain, from production to the point of sale.

Here’s an example of how VAT works in real life:

A jeweler sells a necklace to a high-end ecommerce retailer for €1,000 at a VAT rate of 23%. The retailer pays €230 in VAT to the jeweler, in addition to the cost of the necklace itself. The retailer then adds a markup to the necklace and posts it online for €1,500. At the online checkout, the customer pays an additional 23% in VAT, which equals €345 collected by the retailer. When the final transaction is complete, the retailer ends up making back the VAT they previously paid to the jeweler. While filing taxes to the government, they only pay €115 (which is €345 minus the jeweler’s VAT of €230).

This image shows at what point VAT is added to the necklace.

The importance of complying with VAT laws in Europe

Any business selling physical or digital goods in the EU, including non-EU sellers, must collect VAT according to local regulations and laws. Registering late or not registering at all can result in significant fines and penalties, in addition to accruing compounding interest. For example, in Austria, a business can receive penalties up to €5,000 when they intentionally fail to register for VAT, even if the business does not owe any VAT.

Does the United States use VAT?

The United States does not use value-added tax. Instead, state and local governments are responsible for collecting sales tax. Many businesses must take extra steps to ensure compliance with sales tax rules and regulations. For more information on tax when selling to US customers, see our guide to US sales tax and economic nexus.

How to comply with EU VAT

VAT rules in Europe depend on where you are, what you sell, where your customer is based, and whether your customer is a business or an individual. Although the regulations differ across national lines, the following steps for VAT compliance are consistent if you’re selling in the EU.

1. Register for VAT and VAT OSS

Registering for local VAT

In the EU, the threshold to register and collect VAT depends on the country in which your business is based.

For example, in Spain there is no registration threshold. Businesses in Ireland, on the other hand, have two different VAT thresholds: €85,000 for local businesses selling goods and €42,500 for local businesses selling services. These domestic registration thresholds apply only to domestic, or in-country, business. Businesses based outside of Europe or selling cross-border within Europe have to register before their first sale.

There is an exception for EU businesses that are established in one EU country and sell physical goods and digital products to private individuals in other EU countries. In these business-to-consumer (B2C) sales, businesses need to collect VAT at the rate of their country of residence rather than the customer’s country of residence. Once the B2C sales exceed €10,000, they need to collect at the rate of the customer’s country of residence. There is no similar exception for non-EU businesses selling to private individuals in the EU.

When you register for VAT, you will receive a VAT identification number. This number has between 4 and 15 digits, starting with the two-letter country code (e.g., BE for Belgium or CY for Cyprus), followed by 2–13 other characters. Businesses should include their VAT ID number on their sales invoices and collect the customer’s VAT ID number when selling to another VAT-registered business.

Registering for VAT OSS for European businesses (Union scheme)

European businesses who sell to private individuals (e.g., B2C sales) in multiple EU countries can register for the VAT One Stop Shop (VAT OSS) Union scheme. The program was created to simplify the process of collecting and paying VAT across countries within the EU.

If you sign up for VAT OSS, you don’t have to register with each EU country where you sell goods or services remotely. If you are based in an EU country, you can register with your home country’s VAT OSS portal. You will remit all the VAT that you collected to your local tax authority, who will then distribute this VAT revenue to other EU countries on your behalf. In other words, if you sell across the EU, rather than registering and filing in 27 countries, you can register with one country’s VAT OSS and file one VAT OSS return.

Registering for VAT OSS for non-European businesses (non-Union scheme)

All non-EU-based businesses (including UK businesses after Brexit) selling digital products to private individuals in the EU may register for the VAT OSS non-Union scheme. These businesses can choose any European country to register for VAT OSS. Typically, non-EU businesses register in those countries where the majority of their customers are based or opt to register with the country that has the most user-friendly registration portal. When a non-EU business registers for VAT OSS, it is allocated a unique VAT ID number in the format starting with EU.

Registering for Import One-Stop Shop (IOSS)

Both EU and non-EU businesses may register for IOSS if they sell goods to EU consumers and the goods are imported in consignments not exceeding EUR 150. The IOSS scheme allows sellers to charge the VAT of the customer country at the time of sale. This means that no VAT will be levied at the border when the goods arrive in the EU. Non-EU businesses can choose any European country to register for IOSS, whereas EU businesses must register in the country where they are established. The IOSS registration is voluntary. Non-EU sellers are often required to appoint an intermediary to use IOSS.

2. Calculate VAT

To calculate VAT on a transaction, you need to determine three things: the customer’s status (business or individual), which country’s VAT to collect, and the correct VAT rate.

Identifying whether your customers are businesses (B2B) or private individuals (B2C)

Before you calculate VAT, you need to determine if your customer is a business or a private individual. This is an important step, as it will determine whether you have to charge any VAT at all.

If your customer provided a valid VAT ID number, you can consider it a business. You can verify the validity of the number with the VAT Information Exchange System (VIES) portal. You are required to verify the VAT ID number to help prevent tax fraud.

If you’re a European business selling to a business in a different EU country, you often don’t have to charge VAT. For these business-to-business (B2B) sales, either the reverse charge method applies (in which case the buyer pays the VAT directly to their government rather than through you) or you may benefit from the application of a zero VAT rate (in which case you don’t have to pay any VAT).

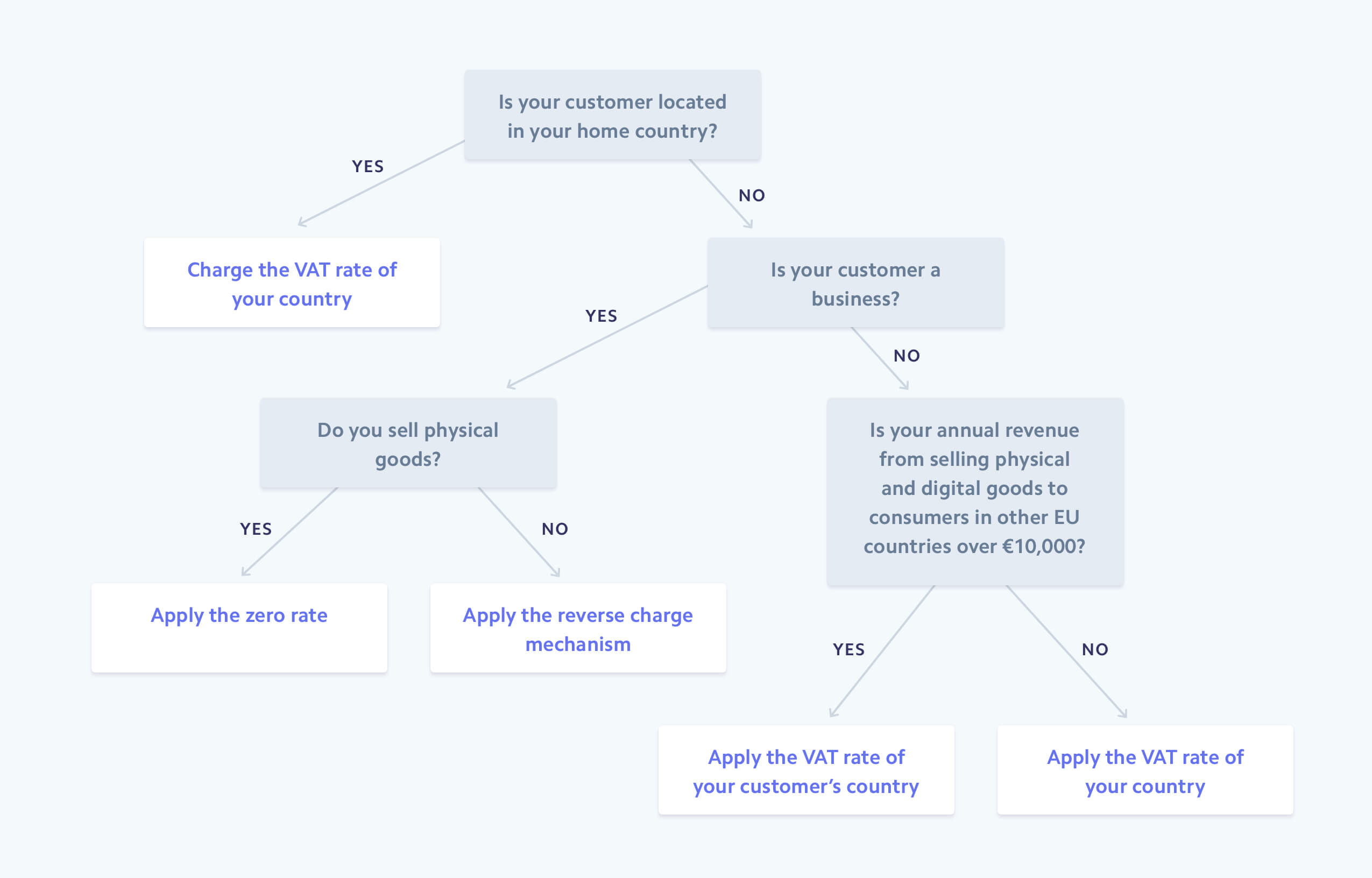

This graphic explains how an EU business can determine the correct VAT rate for physical goods and digital services sold in the EU.

Determining which country collects VAT

In cross-border situations, it is important to determine which country should collect VAT on a transaction. The rules that determine which country should collect tax are very complex and depend on many factors, such as the type of service, the customer’s profile, the country where the goods are shipped from and the country where the goods are shipped to, among other factors.

Determining VAT rates

VAT rates vary per EU country. The EU’s standard minimum VAT rate is 15% for its 27 member countries. The actual VAT rates of the EU countries range between 17% and 27%. Switzerland is not part of the EU and has a standard VAT rate of 8.1%, which is far lower than neighboring countries.

VAT rates differ across European countries.

Although each country sets a standard VAT rate, the majority of them also have reduced rates and exemptions based on the kind of product or service being sold. Given the variety of VAT rates, it’s important to be able to categorize the products you’re selling according to local law.

VAT rates for digital products

According to the EU law, digital products fit the following criteria:

- They’re not a physical product.

- The merchant delivers the product online.

- The provision of the product involves minimal human interaction.

- The product cannot exist without technology.

E-books, games, music, software, SaaS, website hosting, and many more products and services fall under this category. Digital products are generally subject to the standard VAT rates, but some exceptions may apply. For example, for e-books, the VAT rate is reduced to 10% in Austria and 4% in Spain.

VAT rates for physical goods

VAT rates for physical goods can be checked on the European Commission’s website. Some transactions are eligible for reduced, special, or zero rates. In Ireland, for example, children’s diapers and undecorated wax candles, among other products, are sold tax-free. And in Croatia, some food products benefit from a VAT reduction.

3. Gather evidence of buyer location

Given that the tax rates vary significantly based on the buyer’s location, the government wants a record that confirms where the customer was when they purchased digital goods. You generally need to keep two pieces of evidence that confirm your customer’s address for every sale of digital products.

This extra layer of documentation limits the possibility that businesses or individuals could commit tax fraud by either charging or paying the wrong tax rate. You’ll need to collect and store two of the following to confirm a customer’s residence and that the correct tax rate was charged and paid:

- Bank location

- IP address

- Billing address

- Country that issued their card

There is an exception: If you’re making less than €100,000 per year on the sale of digital products, you only need one of the above pieces of customer information. Make sure to keep these records on file for 10 years, in accordance with EU law.

When selling to business customers, you also have to issue a VAT invoice even if you don’t charge VAT. Selling businesses need to retain these records—which include their business information, the selling price and applied VAT rate, the buyer’s name and address, and the VAT ID number, among other information—for the time period specified by their local legislation.

4. File VAT returns

Submitting a VAT return is the key to ensuring compliance. Even if you have no VAT to pay or reclaim, you need to file your returns on time. You will need to report two types of VAT: the amount you charged to your customers (output VAT) and the amount of VAT you paid to your suppliers (input VAT). You will also need to deduct the VAT you paid from the VAT you charged. For instance, if you were the retailer selling the necklace you purchased from the jeweler, you can reclaim the 23% VAT (€230) that you paid to the jeweler. When you file your return, you only pay the difference between the VAT that the end customer paid (€345) and what you originally paid (€230), which is €115.

The return forms and filing frequency vary per country. How often you need to file may also depend on your annual sales revenue. For example, in Germany, the standard filing period is quarterly, but sellers whose tax payable exceeded €7,500 in the previous year must file monthly, and sellers with a tax payable under €1,000 must file yearly.

If you opted for OSS registration, you must submit a quarterly OSS return in your country of registration. This return must be submitted in addition to any domestic VAT returns that you may have to file. In your OSS return, you will indicate your OSS-eligible sales to customers in all EU countries and the respective VAT amounts. Once you pay all VAT in the country where you registered for VAT OSS, your local tax authority will redistribute the VAT revenue to the other countries on your behalf.

If you don’t file the correct amount of VAT, you may face interest and penalties in every country where you were supposed to collect and remit tax. In Portugal, for example, you can face fines of up to €3,750 for failing to file your VAT correctly. In Germany, filing VAT late results in fines of up to 10% of the VAT amount, with a €25,000 limit.

How Stripe Tax can help

Stripe helps marketplaces build and scale powerful global payments and financial services businesses with less overhead and more opportunities for growth. Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT, and GST on both physical and digital goods and services in all US states and in 100 countries. Stripe Tax is natively built into Stripe, so you can get started faster—no third-party integration or plug-ins are required.

Stripe Tax can help you:

- Understand where to register and collect taxes: See where you might need to collect taxes based on your Stripe transactions. After you register, you can switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe’s no-code products, such as Invoicing, with the click of a button.

- Register to pay tax: If your business is in the US, let Stripe manage your tax registrations, and benefit from a simplified process that prefills application details—saving you time and simplifying compliance with local regulations. If you’re located outside the US, Stripe partners with Taxually to help you register with local tax authorities.

- Automatically collect sales tax: Stripe Tax calculates and collects the amount of tax owed. It supports hundreds of products and services, and it is up-to-date on tax rule and rate changes.

- Simplify filing and remittance: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data—letting our partners manage your filings so you can focus on growing your business.

Learn more about Stripe Tax.