The top industries and business models using AI for fraud prevention

AI has fundamentally changed how businesses manage fraud. What once required teams of analysts manually reviewing transactions can now be handled by machine learning models that analyze hundreds of signals in real time. In fact, our recent survey of more than 4,000 payments leaders worldwide showed that 47% of businesses now use an AI tool or feature to detect and prevent fraud—making it the most popular application of AI in payments.

But adoption isn’t uniform across all sectors. Our survey found that certain industries and business models are embracing AI-powered fraud tools at significantly higher rates, driven by their unique risk profiles and operational challenges. Understanding which types of companies are leading this shift—and why—offers insights into where fraud prevention is heading and which strategies are most effective.

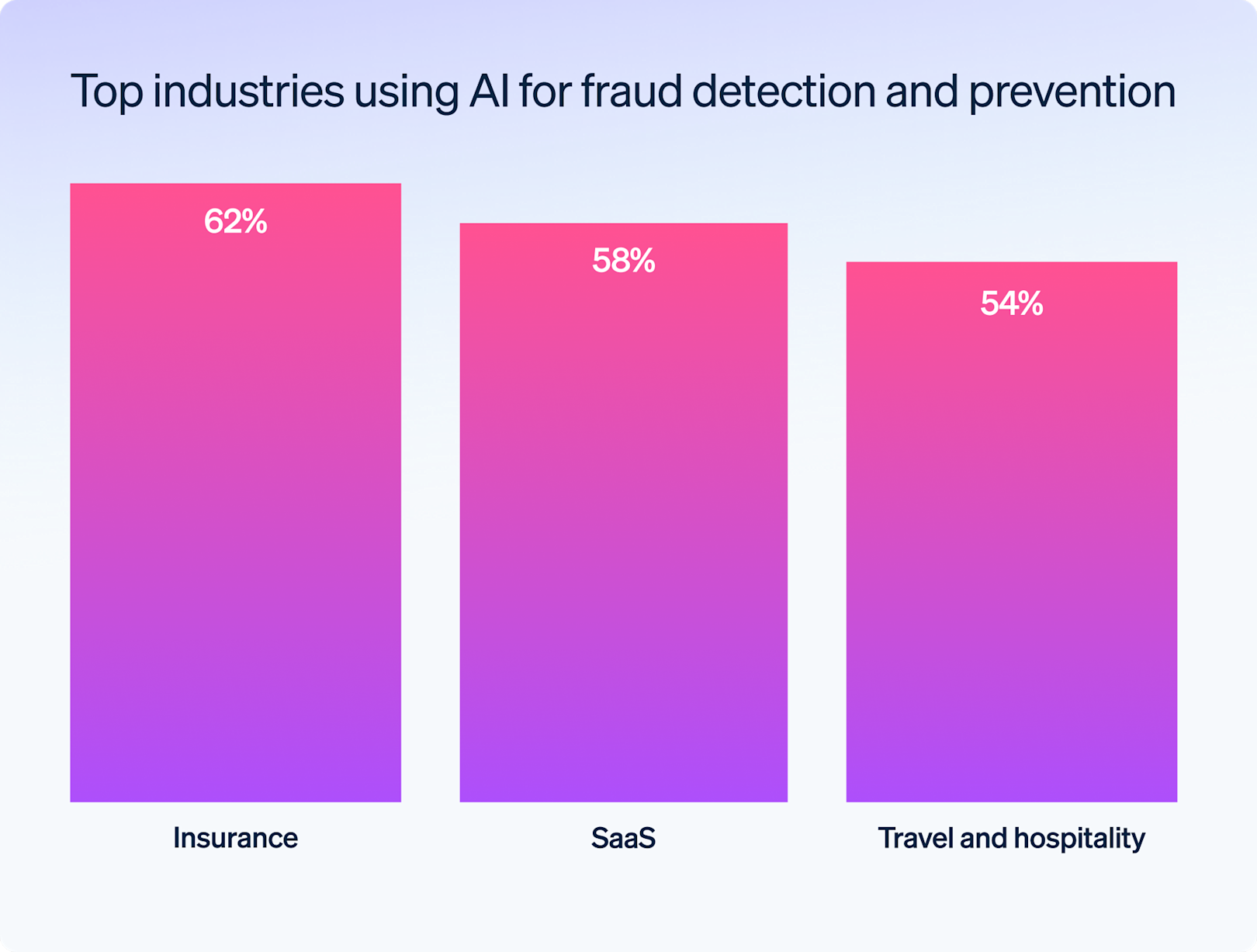

Insurance, SaaS, and travel companies primarily use AI to combat fraud

While businesses across all industries are adopting AI to combat fraud, three industries stand out as early adopters: insurance, SaaS, and travel. These sectors handle high-value transactions and manage complex multistep processes, creating a greater need for AI-powered fraud tools that can scale with their risk.

Here’s how these industries use AI to fight fraud:

- Insurance companies use AI-powered identity verification to confirm recipients are who they claim to be, reducing claims payout fraud.

- SaaS platforms use AI to detect fraudulent sign-ups, prevent account takeovers, and identify subscription abuse patterns across their expanding user base.

- Travel companies use AI to identify and block risky transactions on high-value bookings, such as international flights and hotel packages, before they’re processed.

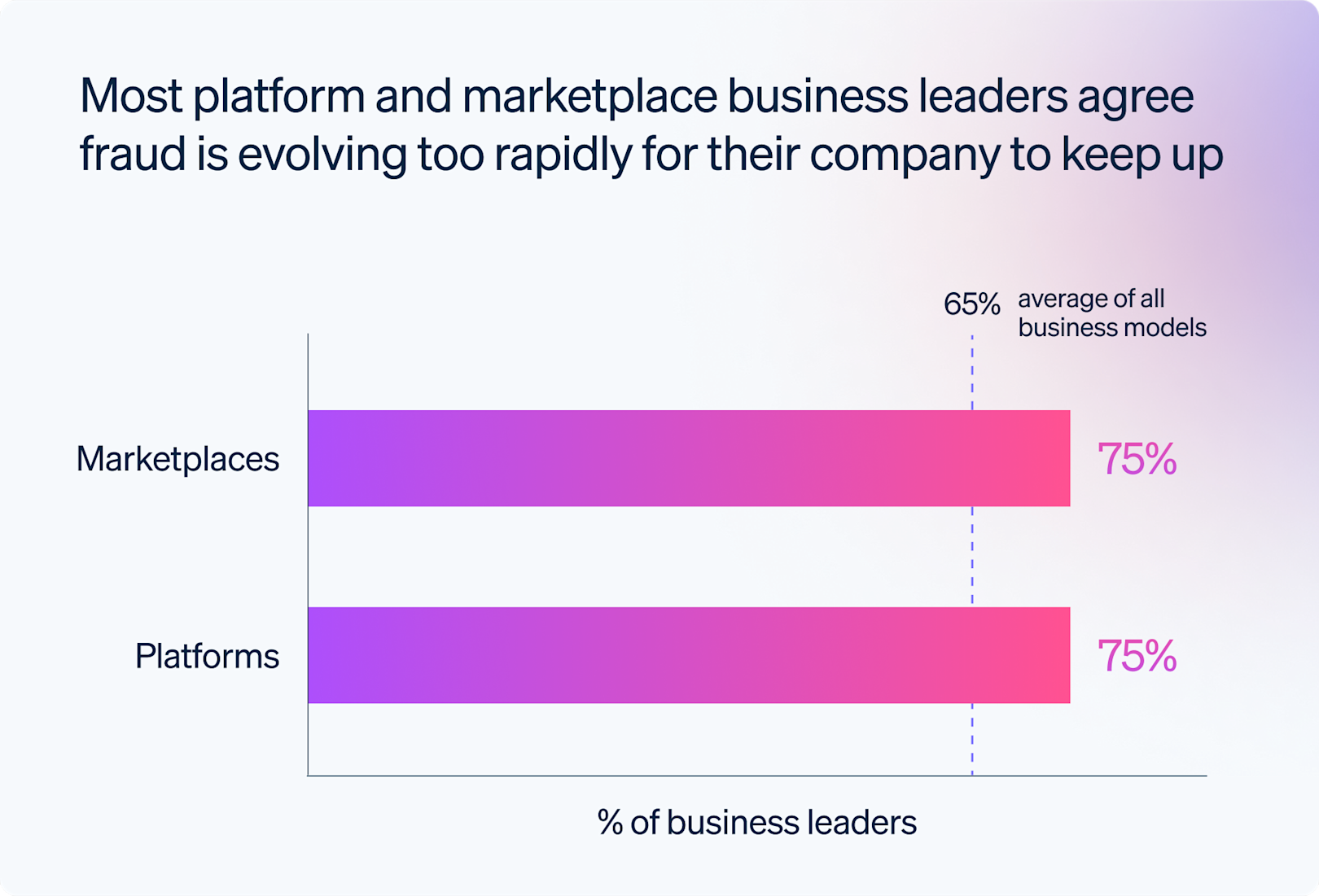

SaaS platforms and marketplaces have the highest AI adoption rate

According to our survey, SaaS platforms and marketplaces are using AI-powered fraud prevention tools at a higher-than-average rate compared to other business models.

Why? Fraud is especially challenging for platforms and marketplaces that enable payments: three in four leaders surveyed say fraud is evolving too fast for their business to keep up. They face both transaction fraud and merchant fraud, and often rely on a patchwork of in-house tools, basic payment processor checks, and third-party services to manage risk. And as they grow, processing higher payment volumes and onboarding more users inherently adds complexity. These unique fraud challenges make AI particularly impactful for their business, as shown in our survey data.

More trends from payments business leaders

To learn more about how businesses are using AI for fraud prevention and detection, download our report on the state of AI and fraud. We explore how AI has made certain types of fraud worse and discuss our predictions for the future of AI and fraud.