I takt med att den globala marknaden fortsätter att expandera drar fler företag nytta av möjligheterna med gränsöverskridande handel. Under 2022 betalade kunderna företag cirka 2,8 biljoner USD i gränsöverskridande betalningar, medan över 150 biljoner USD i gränsöverskridande B2B-betalningar inträffade samma år. Att skicka och ta emot betalningar över gränserna kan dock vara en komplex och utmanande process, med olika regulatoriska krav, avgifter och risker att navigera.

Trots dessa utmaningar är gränsöverskridande betalningar viktiga för företag som vill expandera till nya marknader, nå nya kunder och diversifiera sina intäktsflöden. Och det finns lösningar på dessa utmaningar. Med rätt betalningsmetoder och strategier kan företag minska kostnaderna, förbättra kassaflödet och påskynda tillväxten.

Nedan går vi igenom de olika typerna av gränsöverskridande betalningar som finns tillgängliga, fördelarna och nackdelarna med gränsöverskridande betalningar för företag och processen för att skicka och ta emot dem. Oavsett om du är ett etablerat storföretag eller ett växande startup-företag är det viktigt att förstå och planera för gränsöverskridande betalningar för att förbli konkurrenskraftig och hålla din finansiella verksamhet så effektiv och ändamålsenlig som möjligt.

Vad innehåller den här artikeln?

- Vad är gränsöverskridande betalningar?

- Gränsöverskridande betalningsmetoder

- Vad används gränsöverskridande betalningar till?

- För- och nackdelar med gränsöverskridande betalningar

- Så skickar man gränsöverskridande betalningar

- Gränsöverskridande betalningar med Stripe

Vad är gränsöverskridande betalningar?

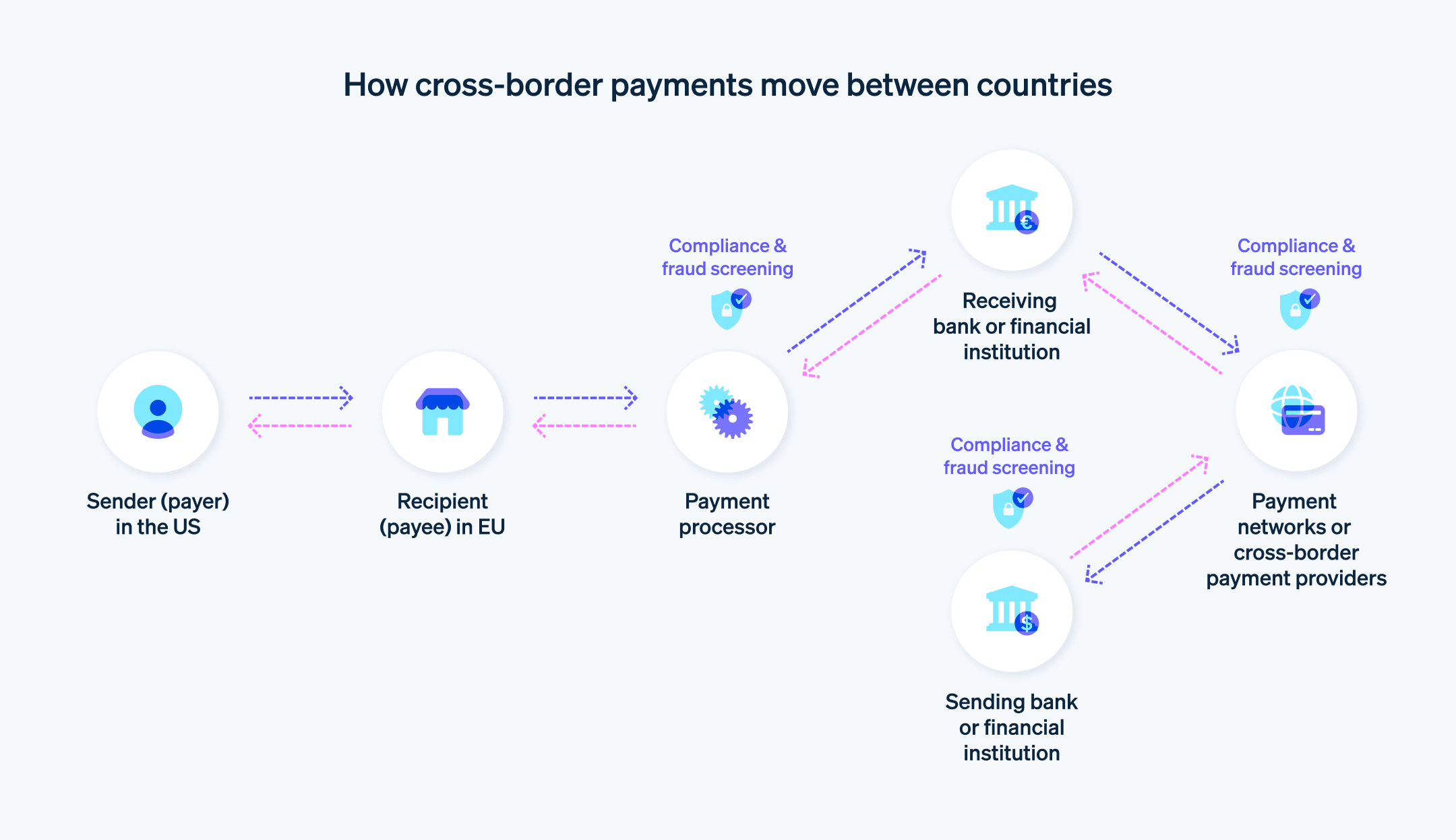

Gränsöverskridande betalningar är finansiella transaktioner som sker mellan parter i olika länder. Dessa betalningar innebär överföring av medel eller tillgångar från ett land till ett annat, vanligtvis via banker eller andra finansinstitut. Dessa transaktioner kan initieras av privatpersoner eller företag, involverar ofta valutaomvandlingar och kan göras med en mängd olika betalningsmetoder.

Gränsöverskridande betalningsmetoder

En betalning anses vara en gränsöverskridande betalning när betalaren och betalningsmottagaren befinner sig i olika länder, oavsett hur betalningen sker. För varje given transaktion beror det perfekta valet av betalningsmetod på olika faktorer, såsom hur mycket pengar som överförs, transaktionens hastighet, de inblandade valutorna och de avgifter som är förknippade med varje metod. Företag och privatpersoner som behöver göra en gränsöverskridande betalning bör överväga de olika metoder för gränsöverskridande betalningar som finns tillgängliga och välja den lämpligaste för deras specifika behov.

Det finns flera vanliga metoder för gränsöverskridande betalningar, inklusive:

Banköverföringar: En banköverföring är en elektronisk överföring av pengar mellan två olika banker eller finansinstitut. I olika delar av världen överförs banköverföringar med hjälp av olika nätverk som betjänar olika geografiska områden. Den här typen av betalning används ofta för stora transaktioner – beloppsgränserna varierar beroende på plats och nätverk – och kan skickas i olika valutor.

Kreditkortstransaktioner: Kreditkort accepteras i stor utsträckning runt om i världen och företag kan acceptera betalningar från kunder i olika valutor. Kreditkortstransaktioner kan vara föremål för valutaväxlingsavgifter och andra avgifter.

Elektroniska överföringar av medel (EFT:er): Elektroniska överföringar av medel kallas vanligtvis elektroniska banköverföringar, e-checkar eller elektroniska betalningar. Dessa överföringar gör det möjligt för privatpersoner och företag att snabbt och säkert skicka och ta emot pengar elektroniskt. Den här typen av betalning är vanligtvis snabbare och bekvämare än andra former av gränsöverskridande betalningar.

Internationella postväxlar: Internationella postväxlar är en pappersbaserad betalningsmetod som kan skickas via post eller överföras elektroniskt med hjälp av en tredjepartsleverantör. De kan köpas på banker och andra finansinstitut och används vanligtvis för mindre transaktionsbelopp.

Digitala betalningsplattformar: Digitala betalningsplattformar gör det möjligt för privatpersoner och företag att skicka och ta emot pengar internationellt med hjälp av sina mobila enheter eller datorer. Dessa plattformar erbjuder ofta konkurrenskraftiga växelkurser och låga avgifter. Många kreditkortsnätverk erbjuder också gränsöverskridande betalningar online.

Kryptovalutor: Kryptovalutor som Bitcoin och Ethereum är decentraliserade digitala valutor som kan användas för att göra gränsöverskridande betalningar. En studie visade att 75 % av återförsäljare planerar att acceptera kryptovaluta som betalningsmetod senast 2024. Dessa betalningar kan behandlas snabbt och säkert, men krypto har vissa nackdelar på grund av volatiliteten på kryptovalutamarknaden.

Vad används gränsöverskridande betalningar till?

Gränsöverskridande betalningar är en viktig del av den globala ekonomin och möjliggör penningflödet mellan länder för många olika ändamål. I både yrkesmässiga och privata sammanhang används gränsöverskridande betalningar för en mängd olika ändamål, bland annat för:

Internationell handel

Gränsöverskridande betalningar är viktiga för företag som importerar eller exporterar varor och tjänster mellan olika länder. De gör det möjligt för företag att betala för varor och tjänster från leverantörer och ta emot betalningar från kunder i andra länder.Resor och turism

Gränsöverskridande betalningar gör det möjligt för resenärer att göra inköp och betala för tjänster som flyg, hotell och utflykter när de reser internationellt.Remitteringar

Gränsöverskridande betalningar gör det möjligt för individer att skicka pengar till familjemedlemmar och vänner som bor i andra länder, vilket är viktigt för att stödja familjer och samhällen i utvecklingsländer.Investeringar

Gränsöverskridande betalningar gör det möjligt för investerare att köpa tillgångar som aktier, obligationer och fastigheter i andra länder och erhålla intäkter och vinster från dessa investeringar.Internationella donationer till välgörenhet

Gränsöverskridande betalningar gör det möjligt för individer och organisationer att skänka pengar till välgörenhetsorganisationer och ideella organisationer som är verksamma i andra länder och på så sätt stödja ett stort antal ändamål och initiativ runt om i världen.

För- och nackdelar med gränsöverskridande betalningar

Gränsöverskridande betalningar kan skapa stora möjligheter för företag att expandera till nya marknader och öka sina intäkter – enklare, effektivare och snabbare. Men de medför även olika risker och utmaningar som måste hanteras noggrant för att säkerställa framgång.

Här är några av de viktigaste för- och nackdelarna:

Fördelar

- Tillgång till globala marknader: Med gränsöverskridande betalningar kan företag expandera på internationella marknader och nå nya kunder, leverantörer och partner.

- Ökade intäkter och tillväxtmöjligheter: Genom att sälja varor och tjänster internationellt kan företag öka sina intäkter och utnyttja nya tillväxtmöjligheter.

- Diversifiering: Gränsöverskridande betalningar gör det möjligt för företag att diversifiera sin kundbas, leverantörsbas och investeringsportfölj, vilket minskar deras beroende av inhemska marknader.

- Kostnadsbesparingar: Vissa gränsöverskridande betalningsmetoder kan vara mer kostnadseffektiva än andra, vilket gör det möjligt för företag att spara pengar på transaktionsavgifter, valutakurser och andra kostnader förknippade med internationell handel.

- Flexibilitet: Gränsöverskridande betalningar ger företag flexibilitet när det gäller betalningsmetoder, så att de kan välja den mest bekväma och kostnadseffektiva metoden för deras specifika behov.

Nackdelar

- Regulatoriska krav: Gränsöverskridande betalningar omfattas av olika lagstadgade krav och efterlevnadskrav, vilka kan vara komplicerade och tidskrävande att navigera.

- Valutarisk: Gränsöverskridande betalningar är föremål för fluktuationer i växelkurser, vilket kan påverka värdet på transaktioner och ha en effekt på företagens kassaflöde.

- Avgifter och kostnader: Vissa gränsöverskridande betalningsmetoder kan vara dyra, och avgifter och kostnader varierar beroende på land och betalningsmetod.

- Bedrägeri- och säkerhetsrisker: Gränsöverskridande betalningar kan vara sårbara för bedrägerier och säkerhetsrisker, såsom cyberattacker, identitetsstöld och betalningsbedrägerier.

- Operativ komplexitet: Gränsöverskridande betalningar kan vara mer komplexa och tidskrävande att behandla än inhemska betalningar, vilket innebär att företagen måste ha de resurser och den expertis som krävs för att hantera dem effektivt.

Så skickar man gränsöverskridande betalningar

Att skicka gränsöverskridande betalningar kräver noggrann planering och uppmärksamhet på detaljer. Processen kommer att gå smidigare om du har en betalningsleverantör som är bekant med ditt företag, dina finansiella konton och de internationella parter du ofta handlar med. Du bör också välja rätt betalningsmetod för dina behov och noggrant verifiera alla detaljer för att säkerställa att din betalning behandlas snabbt, korrekt och säkert.

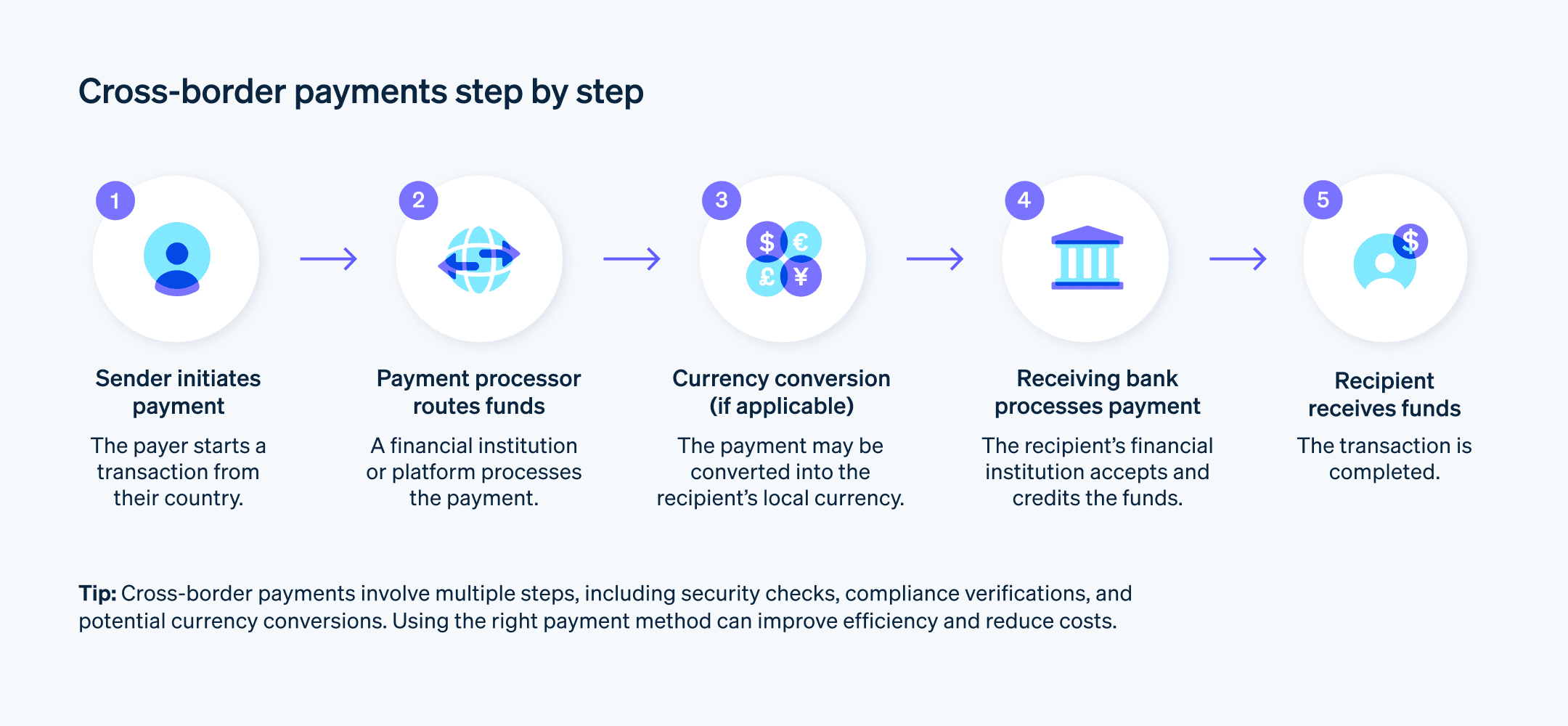

Processen för att skicka gränsöverskridande betalningar kan variera beroende på hur pengarna rör sig och vilken överföringsmetod du väljer, men här är de grundläggande stegen:

1. Välj en betalningsmetod

Det finns flera sätt att skicka gränsöverskridande betalningar, inklusive banköverföringar, kreditkortstransaktioner, elektroniska överföringar av medel, internationella postväxlar, digitala betalningsplattformar och kryptovalutor. Varje metod har sina egna fördelar och nackdelar, så välj den som bäst passar dina behov.

2. Kontrollera växelkursen

Om du skickar en gränsöverskridande betalning i en annan valuta måste du kontrollera växelkursen för att säkerställa att du förstår både vad överföringen kommer att kosta dig och vad beloppet som tas emot i andra änden kommer att vara. Växelkurser kan variera beroende på land och betalningsmetod.

3. Ange mottagarens uppgifter

För att skicka en gränsöverskridande betalning måste du ange mottagarens uppgifter, inklusive namn, adress, bankkontonummer och clearingnummer. Du kan också behöva tillhandahålla ytterligare information, till exempel syftet med betalningen och eventuella relevanta referensnummer. Olika finansinstitut och överföringsnätverk kan kräva olika information för att behandla överföringen.

4. Verifiera betalningen

Innan du skickar en gränsöverskridande betalning bör du dubbelkolla alla uppgifter för att säkerställa att de är korrekta. Detta hjälper till att undvika förseningar eller fel i betalningsprocessen, vilket är särskilt viktigt för oåterkalleliga betalningsmetoder som postväxlar.

5. Skicka betalningen

När du har verifierat betalningen kan du skicka den med din valda betalningsmetod. Hur lång tid det tar för betalningen att komma fram kan variera beroende på vilken metod som används och vilka länder som är inblandade.

6. Bevaka betalningen

Det är en bra idé att bevaka din gränsöverskridande betalning för att säkerställa att den kommer fram till mottagaren. Detta kan göras med hjälp av spårningsnumret eller referensnumret som du fått av din betalleverantör.

Gränsöverskridande betalningar med Stripe

Stripes plattform är utformad för att förenkla processen för att ta emot betalningar från kunder i olika länder. Genom att använda Stripe kan företag hantera olika valutor, betalningsmetoder och efterlevnadskrav – allt från en och samma integration. Stripes tjänst kan också bidra till att minska kostnaderna och göra gränsöverskridande betalningar snabbare och effektivare.

Stripe behandlar betalningar från 197 länder och Stripe Radar använder maskininlärning för att identifiera och blockera bedrägliga transaktioner från hela världen innan de kan genomföras. Avancerade verktyg för identifiering av bedrägeri – som Radar – gör det möjligt att sälja till kunder överallt utan att behöva oroa sig för nya bedrägeririsker i samband med internationella transaktioner.

Med hjälp av rätt betalleverantör gör gränsöverskridande betalningar det möjligt för företag att växa på global nivå utan att göra sina betalningsprocesser alltför komplicerade. Se en fullständig lista över de valutor som stöds av Stripe.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.