Intäkter är en viktig indikator på ett företags tillväxtbana. För investerare, banktjänstemän och interna ledare är intäkter oumbärliga uppgifter som illustrerar ett företags nuvarande ställning och framtidsutsikter. Om du identifierar och redovisar dina intäkter enligt bästa praxis är det mer sannolikt att ditt företag konkurrerar och lyckas på marknaden.

Den här guiden riktar sig till företag som behöver förstå hur de ska efterleva globala redovisningsprinciper och regler när de skalar upp sina företag. Dessa metoder för intäktsredovisning krävs ofta för företag som har för avsikt att skaffa kapital eller har siktet inställt på att få ett lån. De är också viktiga för alla företag som vill fatta strategiska affärsbeslut med korrekta insikter om intäkterna.

Du får lära dig skillnaden mellan kontantredovisning och periodiserad redovisning, regler och riktlinjer för intäktsredovisning och hur du behandlar den baserade på din unika affärsmodell. Vi förklarar också hur Stripes inbyggda verktyg för intäktsredovisning kan hjälpa dig att effektivisera och automatisera dina redovisningsrutiner.

Vanliga termer inom intäktsredovisning

- Redovisningsrutiner:

Småföretag: Enligt USA:s Internal Revenue Service (IRS) är ett småföretag alla företag som har genomsnittliga årliga bruttoinkomster på under 25 miljoner USD för treårsperioden innan innevarande skatteår.

Redovisning enligt kontantprincipen: En redovisningsmetod som redovisar intäkter och utgifter när kontanter utbytes. Den används ofta av småföretag utan lager.

Periodiserad redovisning: En redovisningsmetod som räknar intäkter och utgifter när de intjänas eller faktureras, snarare än när betalning tas emot.

Matchningsprincip: Att redovisa utgifter under samma period som de relaterade intäkterna intjänas. Detta redovisningskoncept ger en mer exakt bild av ett företags resultat och är ett utmärkande drag för periodiserad redovisning (se ovan).

Intäktsredovisningsprincipen: En allmänt accepterad redovisningsprincip som dikterar när och hur företag "identifierar" eller redovisar intäkter i sina bokföringar.

- Efterlevnad av internationella regler:

International Accounting Standards Board (IASB): En styrelse av oberoende experter som fastställer redovisningsstandarder för börsnoterade företag i 144 länder. Den rekommenderar förfaranden som tillämpas på nästan alla större marknader, även om vissa länder som USA, Indien och Kina inte nödvändigtvis följer dem.

International Financial Reporting Standards (IFRS): En uppsättning standarder och principer som har utvecklats av IASB för att skapa enhetlighet mellan marknader, ekonomier, industrier och företag. De är mindre specifika än USA:s motsvarighet (GAAP).

IFRS 15: De delade internationella riktlinjer som IASB har utvecklat för att skapa en enhetlig intäktsredovisningsprocess som behandlar jämförbarheten mellan marknader, branscher och affärsmodeller.

- Efterlevnad av gällande bestämmelser i USA:

Financial Accounting Standards Board (FASB): Den ideella organisation som fastställer och upprätthåller delade redovisningsregler (GAAP) i USA för både vinstdrivande företag och ideella organisationer.

God redovisningssed (GAAAP): En grupp standardredovisningsregler som krävs av Financial Accounting Standards Board (FASB) för företag som inte uppfyller IRS definition av ett litet företag i USA.

ASC 606: USA:s riktlinjer utvecklade av FASB för att skapa en enhetlig intäktsredovisningsprocess som förstärker jämförbarheten mellan marknader, branscher och affärsmodeller.

- Koncept för intäktsredovisning:

Modell för intäktsredovisning i fem steg: Den formella femstegsprocessen för redovisning av intäkter som beskrivs i ASC 606 och IFRS 15.

Prestationsåtagande: En "distinkt" produkt eller tjänst som säljaren har gått med på att leverera som en del av sitt kommersiella avtal.

Transaktionspris: Beloppet för en prestationsskyldighet, inklusive rabatter och konsumenträttigheter, särskilt för returer och återbetalningar.

Skillnaden mellan kontant och periodiserad redovisning

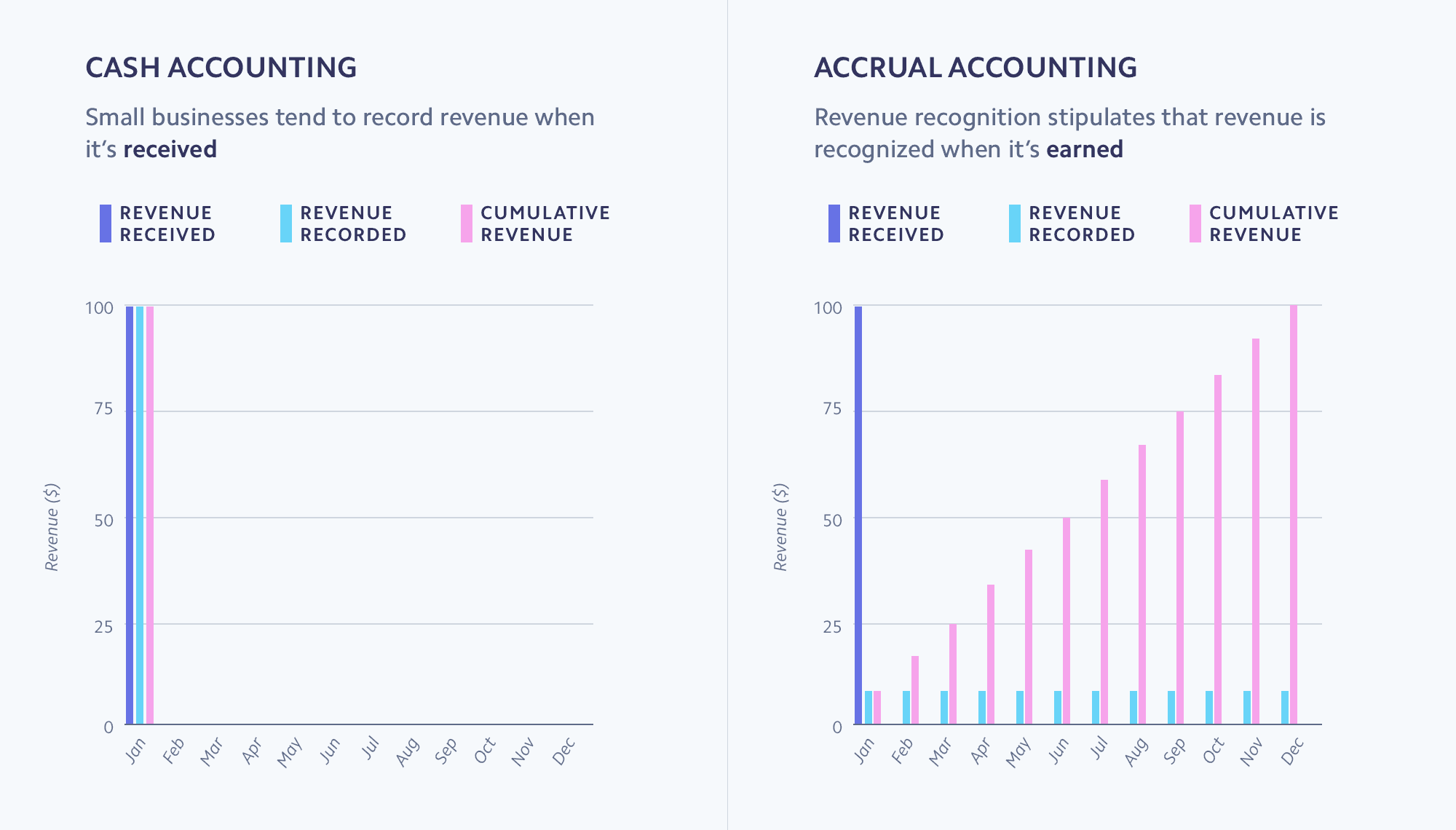

Det finns två primära sätt att hantera ekonomi och uppskatta beskatta: redovisning enligt kontantprincipen och periodiserad redovisning. Beroende på vilken typ av företag du driver och hur stor verksamheten är kan den ena metoden fungera bättre än den andra.

I USA kräver IRS att företag med mer än 25 miljoner USD i intäkter och börsnoterade företag arbetar enligt periodiserad redovisning. Denna metod följer också International Financial Reporting Standards (IFRS), som beskriver redovisningsstandarder runt om i världen. Investerare vill också se resultaträkningar som efterlever periodiserad redovisning för att säkerställa en korrekt bild av resultatet. Detta tillvägagångssätt säkerställer konsekvens över tid och möjligheten att jämföra olika företag.

Fastän redovisning enligt kontantprincipen är populärt bland egenföretagare och småföretag utan varulager använder de allra flesta företag periodiserad redovisning, särskilt de med återkommande intäkter, stora varulager eller flera olika fullgöranden.

Redovisning enligt kontantprincipen

Småföretag väljer ofta redovisning enligt kontantprincipen eftersom den är intuitiv och enkel. Redovisning enligt kontantprincipen bokför intäkter i samma ögonblick som de når företagets bankkonto och redovisar utgifter i samma ögonblick som de betalas ut. Med andra ord markerar utbyte av betalning transaktionen i ett företags bokföring.

Det innebär att om du är en e-handelsbutik och köpte kläder till ett värde av 10 000 USD från en designer i december 2021, räknar du utgiften på det datumet. Om du säljer kläderna till ett påslag på 20 000 USD till kunder – och deras betalningar nådde ditt bankkonto den 1 januari 2022 – räknar du dessa intäkter för följande år. Du bokför intäkterna den 1 januari, även om kläderna inte har levererats till kunderna ännu. När leverans sker bokför du inga ytterligare intäkter eftersom de redan har bokförts. Även om redovisning enligt kontantprincipen är det enklaste sättet att hantera bokföringen, finns det inte heller några tydliga, konsekventa riktlinjer som företag kan följa. Det innebär också att utgifter och motsvarande intäkter inte alltid stämmer överens inom samma tidsperiod.

Med redovisning enligt kontantprincipen är det också lätt att se en ögonblicksbild av företagets kassaflöde när som helst. Det finns ingen komplicerad matematik, och ibland drar man nytta av ett litet uppskov med skatt eftersom man bokför utgifter när man betalar dem men inte redovisar intäkter förrän de kommer från klienten eller kunden. Sammantaget är redovisning enligt kontantprincipen mest relevant för småföretag utan lager eller återkommande intäkter.

Periodiserad redovisning

Periodiserad redovisning skiljer sig från redovisning enligt kontantprincipen eftersom den räknar intäkter och utgifter när de intjänas eller faktureras, snarare än när pengarna når ett bankkonto. Du registrerar till exempel en försäljning när ditt prestationsåtagande gentemot en kund är slutfört, istället för när kunden betalar.

Låt oss säga att du arbetar med publicering och erbjuder månatliga abonnemang. Kunden betalade en faktura direkt i december 2021 för hela tidskriftsåret. Med periodiserad redovisning skulle du redovisa intäkterna i delbetalningar när var och en av de tolv tidskrifterna levereras.

Periodiserad redovisning hjälper företag att få en tydligare förståelse för sina övergripande resultat. Matchningsprincipen är ett nyckelbegrepp i periodiserad redovisning och föreskriver att det är mer exakt att rapportera relaterade utgifter och intäkter inom samma tidsperiod. Matchningsprincipen är särskilt viktig för lagertunga företag som kräver betydande utgifter för att generera upplupna intäkter och för företag med en modell för intäkter från abonnemang.

När det gäller det senare matchar SaaS-företag som använder redovisning enligt kontantprincipen inte sina intäkter och utgifter. Låt oss säga att du är ett företag som debiterar kunder varje månad. Vanligtvis sker fakturering månaden innan tjänsterna tillhandahålls. Genom att använda periodiserad redovisning säkerställer du att du matchar intäkter som intjänades i december 2021 med tjänsterna som tillhandahölls för den månaden. Dina finansiella rapporter ger en mer korrekt bild av resultatet.

I stor skala upp kan den redovisningsmetod du väljer ha en enorm inverkan på ditt företags framtid. Även om redovisning enligt kontantprincipen ger dig en känsla av kassaflöde, ger den dig inte de insikter du behöver för att fatta övergripande beslut om företaget på samma sätt som periodiserad redovisning.

Företag som använder periodiserad redovisning vill också hålla ögonen på sina bankkonton för att säkerställa att deras företag har tillräckligt med likvida medel för att täcka kostnaderna. Ibland kan företag se lönsamma ut på lång sikt med periodiserad redovisning även om de står inför kortsiktig likviditetsbrist.

|

Redovisning enligt kontantprincipen

|

Periodiserad redovisning

|

|

|---|---|---|

|

Avsedd användare

|

Lämpar sig för mindre, tjänstebaserade företag och enskilda näringsverksamheter |

Lämpar sig för företag med återkommande intäkter, stora varulager eller flera olika fullgöranden Obligatoriskt i USA för företag med över 25 USD miljoner i upplupna intäkter |

|

Så fungerar det

|

Redovisar intäkter och utgifter när betalningen sker |

Redovisar intäkter och utgifter när fullgörandeskyldigheten har slutförts |

|

Skattekonsekvenser

|

Man betalar bara skatt på företagets mottagna intäkter |

Man betalar skatt på alla försäljningar, inklusive intäkter som ännu inte har inkommit |

|

Fördelar för företag

|

Enkla rutiner och detaljerad inblick i det dagliga betalningsflödet |

Mer exakta vinst- och förlusträkningar, tydligare inblick i företagets resultat samt regelefterlevnad |

Allt du behöver veta om principer för intäktsredovisning

Intäktsredovisning är en aspekt av periodiserad redovisning som anger när och hur företag "identifierar" eller redovisar sina intäkter. Principen kräver att företag redovisar intäkter när de intjänas (periodiserad redovisning) snarare än när betalning erhålls (redovisning enligt kontantprincipen). Företag följer denna gemensamma redovisningspraxis eftersom den ger transparens och förutsägbarhet i redovisningspraxisen, vilket gör det möjligt för dem att på ett rättvist sätt bedöma intäkter och rapportera dem till intressenter, aktieägare och styrande organ.

Regleringsorganen har betydande tillsyn över hur företag hanterar sin redovisning för att säkerställa att alla följer samma riktlinjer när de rapporterar sina vinster och förluster. Intäktsredovisning är en allmänt accepterad redovisningsprincip (GAAP) eller standardpraxis som krävs av Financial Accounting Standards Board (FASB) i USA. År 2014 samarbetade FASB med International Accounting Standards Board (IASB), som fastställer redovisningsstandarderna för börsnoterade företag i 144 länder, för att utveckla gemensamma regler. (Genom IFRS kräver IASB förfaranden på alla större kapitalmarknader med undantag för USA, Indien och Kina. Indien har en egen separat standard, som överlappar men inte följer alla aspekter av IFRS.)

Tidigare var globala redovisningsprinciper branschspecifika, vilket skapade osammanhängande och fragmenterade standarder för intäktsredovisning som var svåra att implementera. Det gjorde det svårt att på ett rättvist sätt jämföra företagens resultat och ställning mellan branscher. Tillsammans skapade FASB och IASB gemensamma regler som kallas ASC 606 (i USA) och IFRS 15 (internationellt), som fastställer ett nytt, gemensamt ramverk för redovisning av intäkter mellan branscher och företagsmodeller. Det är relevant för privata, offentliga och ideella organisationer som ingår avtal med kunder om byte av varor och tjänster. Även ideella organisationer som behöver redovisa bidrag, myndighetsavtal eller återkommande donationer drar nytta av att följa periodiserad redovisning.

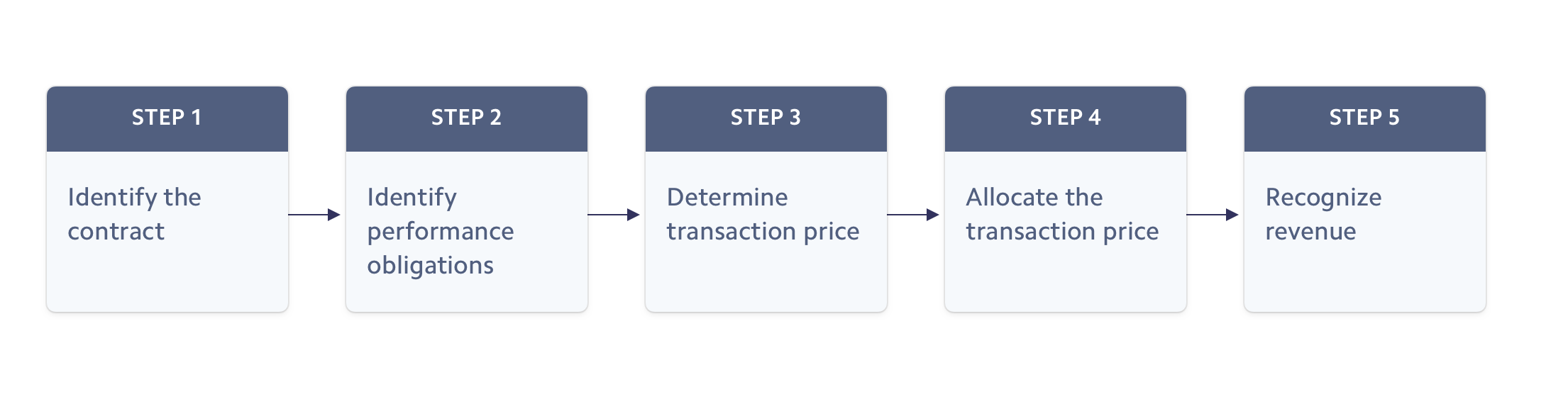

Femstegsmodell för intäktsredovisning

Det gemensamma regelverket angivet i ASC 606 och IFRS 15 kräver att företag följer en 5-stegsmodell för intäktsredovisning.

1. Identifiera kundavtalet

För att redovisa intäkter måste du börja med att identifiera avtalet eller avtalen med kunden. Alla avtal behöver inte vara formella och undertecknade för att slutföra det här steget i processen för intäktsredovisning. Muntliga avtal och angivna villkor för din tjänst eller produkt kan betraktas som ett avtal.

Det finns några viktiga krav för varje avtal. Det måste vara ett kommersiellt avtal mellan två parter där villkoren, rättigheterna och skyldigheterna för betalningen är tydligt angivna. Ett kundavtal kan vara ett formellt skriftligt avtal, vilket ofta är fallet med tjänstebaserade företag, eller ett kvitto på ett köp i POS-systemet i en detaljhandelsbutik. Vid onlineköp är tjänstevillkoren ofta inbäddade i fakturor eller abonnemang och bildar ett avtal.

2. Identifiera prestationsåtagandena i avtalet.

Innan du redovisar intäkter måste du se till att det finns klarhet i dina skyldigheter gentemot kunden. Termen ”fullgörandeskyldighet” avser specifika varor som säljaren har gått med på att leverera.

En ”distinkt” produkt eller tjänst är vanligtvis en egen radpost på ett kvitto eller en faktura. I exemplet med ett bageri kan ett specifikt prestationsåtagande vara en muntlig överenskommelse om att överlämna ett bakverk i byte mot ett fast pris, snarare än hela beställningen. För en försäkringsmäklare kan ett distinkt prestationsåtagande vara en försäkring för ett enda hus.

Det är dock inte alltid så enkelt. En kund måste kunna dra nytta av produkten eller tjänsten separat från de andra produkterna eller tjänsterna i avtalet. Låt oss säga att du säljer vakuum till en kund. Du säljer också en ytterligare garanti för vakuumet, som är en egen radpost på kvittot. Om garantin inte kan köpas utan vakuum utgör den inte en egen ”fullgörandeskyldighet”.

3. Fastställ transaktionspriset

Utöver de pengar som du utbyter med en kund mot en vara eller tjänst finns det också andra faktorer som ingår i transaktionspriset. Det kan inkludera returrätt eller potentiella rabatter. Dessa villkor bör alltid vara transparenta, särskilt om det har skett en förändring från tidigare praxis.

Om du erbjuder rabatt på e-handel för din halvårsförsäljning ingår rabatten i transaktionspriset, liksom rätten att returnera eller häva avtalet. Om ett varuhus till exempel har en rea kan transaktionen omfatta följande: Kunden köper en klänning som vanligtvis kostar 100 USD, men det är 75 % rabatt till en kostnad av 25 USD utan returer eller återbetalningar.

Vanligtvis tänker man på återbetalningar i samband med fysiska varor, men att definiera dessa villkor är lika viktigt i alla tjänste- eller SaaS-företag. Vad händer om man inte är nöjd med tjänsten? Man vill veta vilka rättigheter man har.

4. Fördela transaktionspriset på prestationsåtagandena

Varje företag måste fastställa det specifika försäljningspris som är kopplat till varje enskilt prestationsåtagande. Att fördela transaktionspriset är enkelt när det finns ett fristående försäljningspris för varje produkt eller tjänst. När det finns rörliga överväganden, inklusive rabatter, incitament och rabatter, uppskatta priset baserat på det förväntade värdet.

5. Redovisa intäkter när du har uppfyllt varje prestationsåtagande

Innan fullgörandeskyldigheten har fullgjorts ska inga intäkter redovisas. Om kunden har betalat dig direkt för tjänster som ännu inte har slutförts eller varor som du fortfarande har i din vård ska du betrakta beloppet som ”förutbetalda intäkter”. När du har överfört kontrollen över varorna eller tjänsterna till kunden kan du redovisa beloppet som intäkter.

För abonnemangsföretag kan prestationsåtagandet uppfyllas under en viss tidsperiod. I så fall kan du redovisa intäkterna jämnt under hela tjänsteperioden. På samma sätt finns det företagsmodeller när en tjänst slutförs över tid, men kan mätas på andra sätt: externa milstolpar som nås, procentandel av slutförd produktion, kostnader eller arbetstid.

Vanliga typer av intäktsredovisning

Beroende på din affärsmodell finns det olika metoder och tidpunkter för att uppfylla ett prestationsåtagande och redovisa intäkter.

SaaS och digitala abonnemang

För SaaS-företag som Netflix eller digitala abonnemangsföretag som Slack registrerar sig en kund för en tjänst eller produkt under en viss tidsperiod och får värde från den under hela tjänsteperioden. I dessa enkla abonnemangsmodeller redovisar företag intäkter linjärt under hela tjänsteperioden.

Redovisning av uppgraderingar, nedgraderingar, proportionella betalningar och uppsägningar är en viktig del av ett intäktsredovisningskonceptet för för abonnemangsföretag. Om en kund uppgraderar planer mitt i månaden ska intäkterna för den månaden återspegla de olika abonnemangsplaner som används. Låt oss säga att grundplanen kostar 30 USD per månad och Premium 45 USD per månad. Om kunden använde grundplanen i 20 dagar (motsvarande 20 USD i värde) och sedan uppgraderade till premiumplanen i 10 dagar (motsvarande 15 USD i värde) skulle företaget redovisa 35 USD i intäkter för den månaden.

Abonnemang med orderhantering

I takt med att abonnemangsföretag växer bygger fler och fler upp hybridaffärsmodeller.

Ett företag som erbjuder abonnemang på snacksboxar kan till exempel ta ut en månatlig avgift för abonnemang för att leverera en snackbox varje vecka. Istället för att redovisa intäkterna linjärt under månaden skulle abonnemangsintäkterna redovisas proportionellt beroende på när prestationsåtagandet uppfylls – i det här fallet när snackboxarna skickas eller levereras.

Ett liknande tillvägagångssätt skulle användas av programvaruföretag som debiterar en engångs- eller konsultavgift utöver en månatlig avgift för återkommande abonnemang. Dessa företag måste bedöma om etablerings- eller konsultavgifterna ska betraktas som separata från eller en del av det övergripande prestationsåtagandet.

E-handel med framtida orderhantering

För e-handel tas betalning ofta emot innan varorna levereras, men intäkter redovisas inte förrän kontrollen överförs. Beroende på avtalsarrangemanget med kunderna kan ett företag fastställa att kontrollen överförs vid transport eller leverans, då de kontanter som redan mottagits skulle redovisas. Medan ASC 606 och IFRS 15 rekommenderar att man använder det ögonblick då produkten skickas som utlösande faktor för redovisning av intäkter, rekommenderar den tidigare regeln ASC 605 att intäkter redovisas vid leverans.

Delbetalningar

Många företag tar emot delbetalningar för att locka kunder som kanske inte vill betala hela priset direkt. Enligt ASC 606 tjänas intäkter när tjänsten eller produkten tillhandahålls, även om betalning kanske inte kommer in förrän senare. Företag som erbjuder alternativ för delbetalningar kan redovisa intäkter innan alla kontanter erhålls.

I takt med att köp nu, betala senare blir allt populärare inom e-handel är det ännu vanligare att företag registrerar intäkter innan de når sina bankkonton. I enlighet med periodiserad redovisning lägger delbetalningsföretag till intäkterna i sina bokföringar när de skickar eller levererar produkter snarare än när kunderna har betalat.

Kvantitetsbaserad fakturering

Istället för att ta ut en fast avgift fakturerar vissa företag på avräknad basis, vilket binder det pris som kunderna betalar till den mängd som kunderna använder.

När det gäller företag med förbetald kvantitetsbaserad fakturering betalar kunderna innan tjänsten eller varan tillhandahålls. Ett företag kan till exempel låta kunderna köpa krediter för att använda dem för olika motionspass. I så fall redovisar företaget intäkter när kunden använder varje kredit.

Kvantitetsbaserad fakturering efter betalning liknar kvantitetsbaserad fakturering, förutom att företag fakturerar i efterskott. Till exempel kan en molnleverantör för storföretag debitera sina kunder i slutet av varje månad. I takt med att kunden använder gigabyte lagringsutrymme under en viss månad redovisar företaget intäkter proportionellt efter kundens användning. När en faktura skickas i slutet av månaden har molnlagringen redan tillhandahållits och alla intäkter borde ha redovisats.

Digitala varor

För ett fåtal företag levereras varor eller tjänster omedelbart. Till exempel är digitala varor som e-böcker, musik och filmer vanligtvis nedladdningsbara tillgångar och motsvarande intäkter redovisas så snart de laddas ner.

Företag som erbjuder digitala varor skiljer sig från abonnemangstjänster för programvara och streamingtjänster baserat på några viktiga kriterier som definieras av Financial Accounting Standards Board (FASB):

- Kunden kan ta bokföringsprogrammet i besittning under värdperioden utan extra avgifter utöver kostnaden för produkten.

- Kunden kan använda programvaran på sin egen hårdvara eller via en tredje part som inte är relaterad till programvaruföretaget.

Så kan Stripe hjälpa dig

Ju mer du växer, desto svårare är det att hantera intäktsredovisning på ett korrekt och effektivt sätt. Att skala upp manuella processer är felbenäget och ineffektivt, vilket slösar tid, energi och resurser. Stripe Revenue Recognition gör att ditt team slipper periodiserad redovisning och kan göra bokslut snabbt, korrekt och i enlighet med gällande bestämmelser. För en fullständig bild av dina intäkter kan du enkelt få tillgång till och utvärdera transaktioner, orderhantering och faktureringsvillkor från och utanför Stripe med ett enda rapporteringsverktyg.

Vi kan hjälpa dig att:

Bedöma alla dina intäkter

Med Stripe kan du se alla dina intäkter för alla intäkter eller affärsmodeller. Konsolidera alla dina Stripe-intäkter, inklusive abonnemang, fakturor och betalningar, samt intäkter, orderhantering och villkor för tjänster utanför Stripe i ett och samma lättanvända verktyg.

Automatisera rapporter och dashboards

Skippa de omständliga tekniska integrationerna med färdiga redovisningsrapporter. Ditt team kan skapa och ladda ner rapporter som konfigurerar interna och externa revisorer för att behandla intäktsredovisning smidigt.

Anpassa för ditt företag

Konfigurera anpassade regler för att passa dina specifika redovisningsmetoder. Med Revenue Recognition kan du utesluta mellanhandsavgifter, hantera radposter för beskattning och justera redovisningsscheman för olika typer av intäkter.

Revision i realtid

Förenkla interna revisioner och förbered dig för externa revisorer genom att spåra redovisade och förutbetalda intäkter till deras underliggande kunder och motsvarande transaktioner. Granska detaljerade månadsuppdelningar och få detaljerade vyer över hur intäkterna kategoriserades.

För mer information om Stripe Revenue Recognition, besök vår webbplats.

¹ IRS kräver att alla företag som inte uppfyller definitionen av ett litet företag använder periodiserad redovisning. Enligt deras definition är ett litet företag ett företag vars genomsnittliga årliga bruttointäkt för de tre åren_ före _innevarande deklarationsår understiger 25 miljoner USD.