Forty-one percent of North American customers we surveyed said they have doubled or more than doubled their online shopping in the past year. While this increase in demand presents a huge opportunity for online businesses in North America, it also puts more pressure on companies to successfully capitalize on this potential and offer the best customer experience. However, we found that some of the biggest ecommerce companies in the United States and Canada often overlook one crucial step to making a sale: the checkout flow.

We partnered with Edgar, Dunn & Company to analyze the top 200 ecommerce businesses in the United States and Canada and found that 96% of checkouts had at least five basic errors. Some of the most common issues include poor card information formatting and error handling, not offering popular payment methods, and not allowing customers to save their payment method for future use. On their own, these issues may seem small. But, when combined, they add up to a needlessly difficult checkout experience for customers and lost sales.

This report analyzes the checkouts of the top ecommerce businesses in North America and details the most common checkout errors, categorized into four sections:

- Checkout form design

- Mobile optimization

- Localization

- Buyer trust and security

The report also explores why these checkout issues matter, how to prevent them from happening in your checkout flow, and how Stripe can help.

Checkout form design

Customers expect a fast, intuitive payment experience, with 19% of consumers saying they would abandon a purchase if it took more than one minute to check out. However, it takes 56% of customers, on average, more than three minutes to complete a purchase and 17% blame a long and complicated checkout as the reason for abandoning an order in the past year.

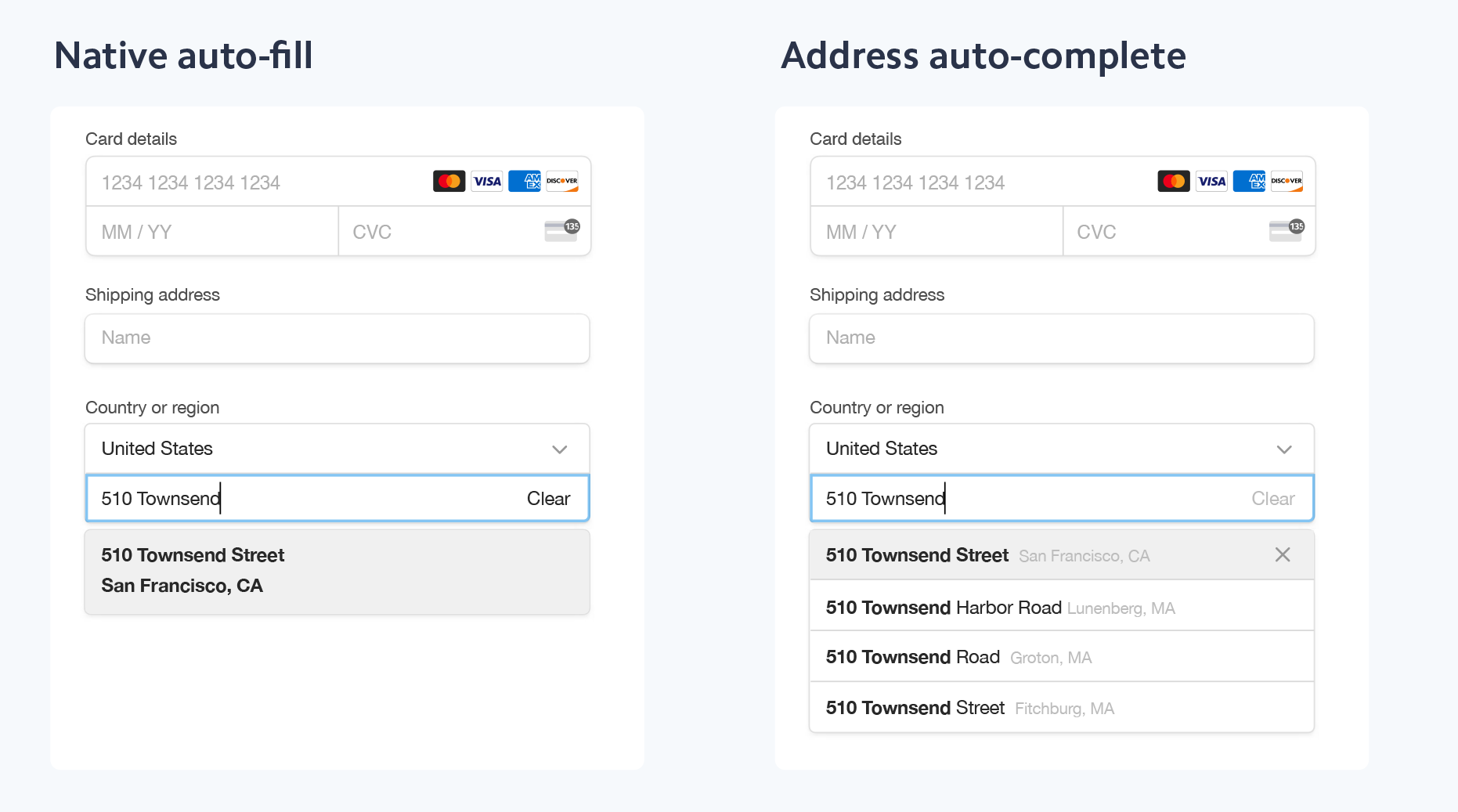

The highest performing checkouts are made up of dozens of small optimizations executed seamlessly. For example, displaying descriptive error messaging when customers enter the wrong payment information, supporting address auto-complete, and allowing customers to save their payment information for future use. In a separate Stripe study, we found that offering address auto-complete can increase conversion by close to 0.8%, and using specific error messaging can increase retry rates following a decline by as much as 3.5% (for example, changing the message from “your card was declined” to “your card was declined; try a different card”). These increases may seem small, but they can quickly add up—especially for ecommerce businesses with high transaction volume.

The top payment form errors

- 46% of top businesses made at least three mistakes when formatting payment information or displaying error messages; these mistakes include not alerting customers when they entered an invalid card number or tried to pay with an expired card

- 51% did not support address auto-complete

- 36% did not format card numbers in blocks of four digits for easier data entry

- 77% did not allow customers to save their payment information for future use

Checklist: How to design an optimized checkout form

-

Error messaging: Highlight payment information errors in real time.

-

Number formatting: Add spacing to card numbers, displaying them in blocks of four to six digits for easier data entry.

-

Default address: Use the same billing and shipping address by default unless customers want to manually add a different shipping address.

-

Address auto-complete and auto-fill: Optimize address collection by supporting both native auto-fill (which uses information saved in a customer’s browser) as well as address auto-complete (which enables typeahead completion).

-

Saved payment information: Allow customers to save their payment information for future use so they can check out with just one click.

Mobile optimization

Fifty percent of customers we surveyed said they do more than half of their shopping from a mobile device, with 62% saying it’s “very” or “extremely” important for a website to be mobile friendly. If your checkout flow isn’t tailored to a smaller screen—for example, if the checkout page doesn’t automatically adjust to the size of the device—customers are more likely to abandon the checkout flow completely. In fact, while more than 50% of ecommerce traffic comes from smartphones, carts are abandoned on mobile at more than twice the rate of desktop.

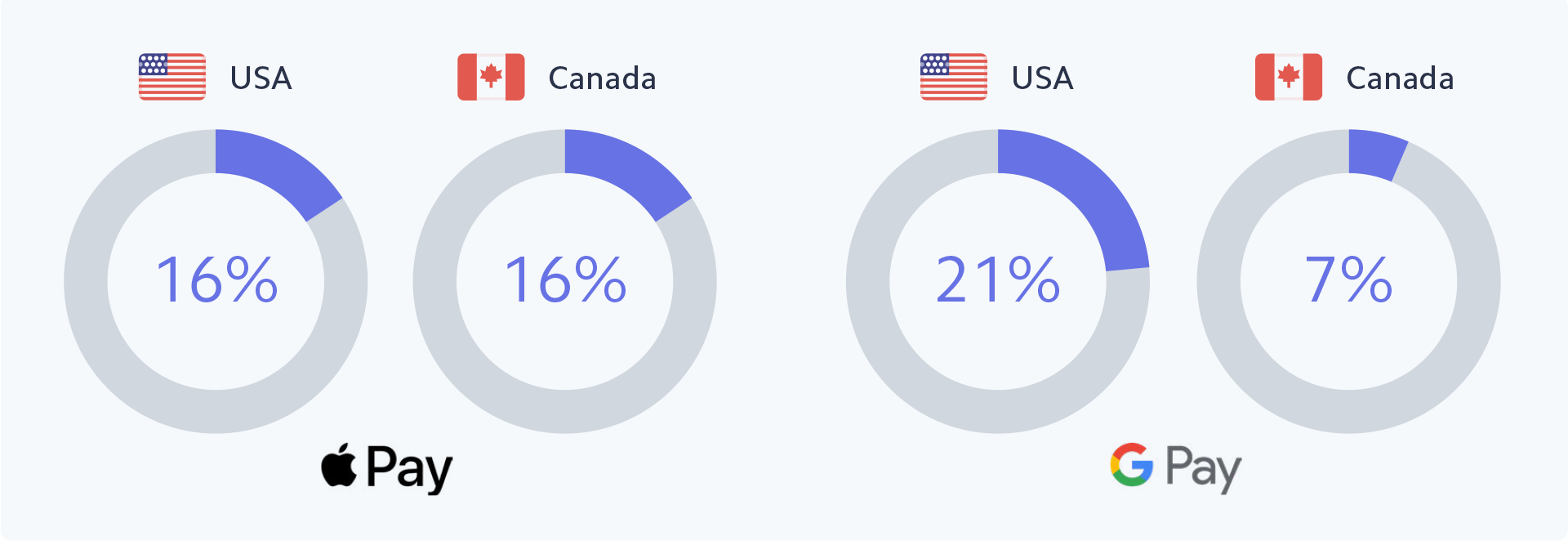

Supporting digital wallets, such as Apple Pay or Google Pay, can help expedite the shopping experience on mobile. A separate Stripe analysis found that close to 37% of American consumers and 34% of Canadian consumers have either Apple Pay or Google Pay enabled on their device, creating the opportunity for businesses to offer a one-click payment experience that, on average, is three times faster than having to manually enter payment details.

The top mobile optimization errors of checkouts

- 76% of checkouts we analyzed did not support Apple Pay

- 88% of checkouts did not support Google Pay

- 13% failed to surface a numeric keypad to enter card information on mobile

Penetration of digital wallets

Checklist: How to optimize for mobile

-

Responsiveness: Ensure your form automatically resizes to the smaller screen.

-

Keypad: Display a numerical keypad when customers are prompted to enter their card information.

-

Wallets: Offer mobile wallet payment methods and ideally only surface them if you know they have been set up by your customer and are usable on their current device.

Localization

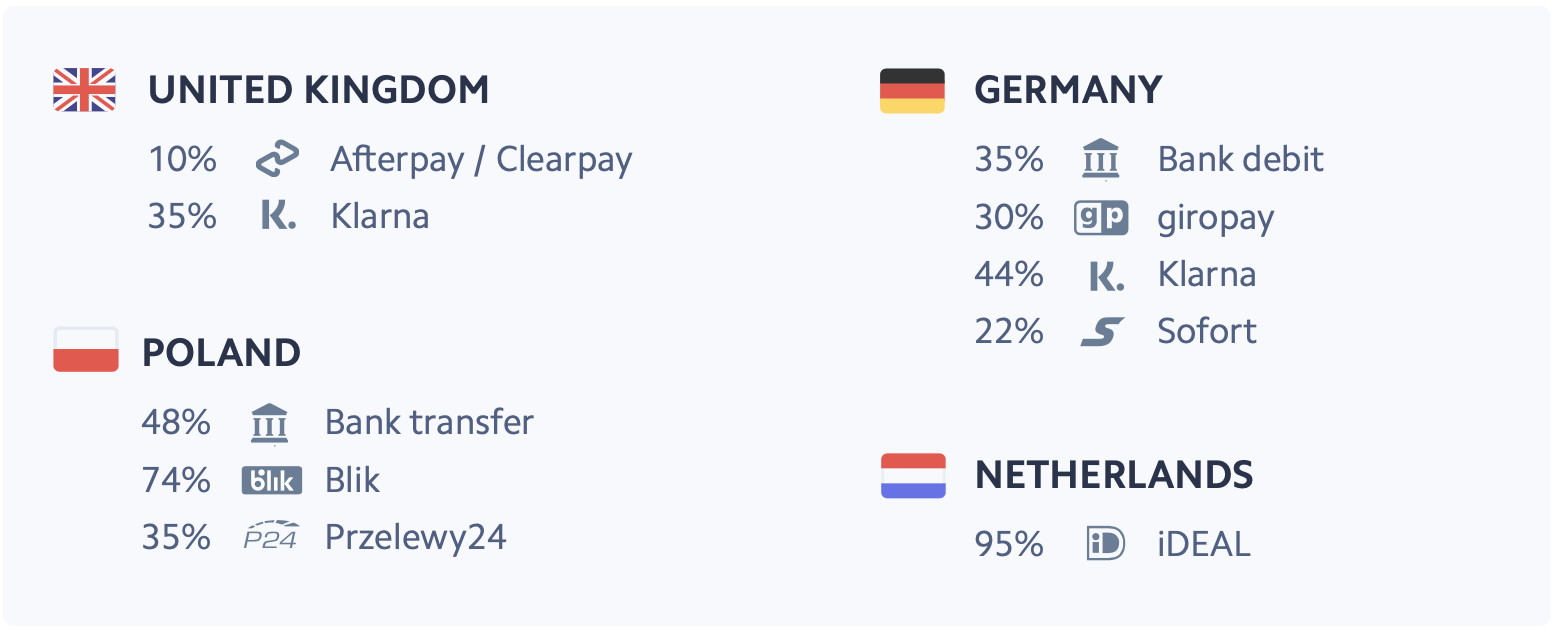

North American businesses need to support a local experience for their international shoppers, like adapting the payment methods they offer to their customer’s location. While cards are the predominant online payment method in the US and Canada, 40% of consumers outside the US prefer to use a different payment method. For example, bank transfers are the most popular payment method in Germany, and almost one-third of Italian customers prefer to pay with a digital wallet.

When we looked at the top North American ecommerce businesses with a presence in multiple markets, the number of payment methods they offered did not increase. Instead, they successfully adapted their payment methods on a per-country basis to optimize for local conversion. For example, the same North American ecommerce business would offer giropay for German customers, iDEAL for Dutch customers, and Przelewy24 for Polish customers.

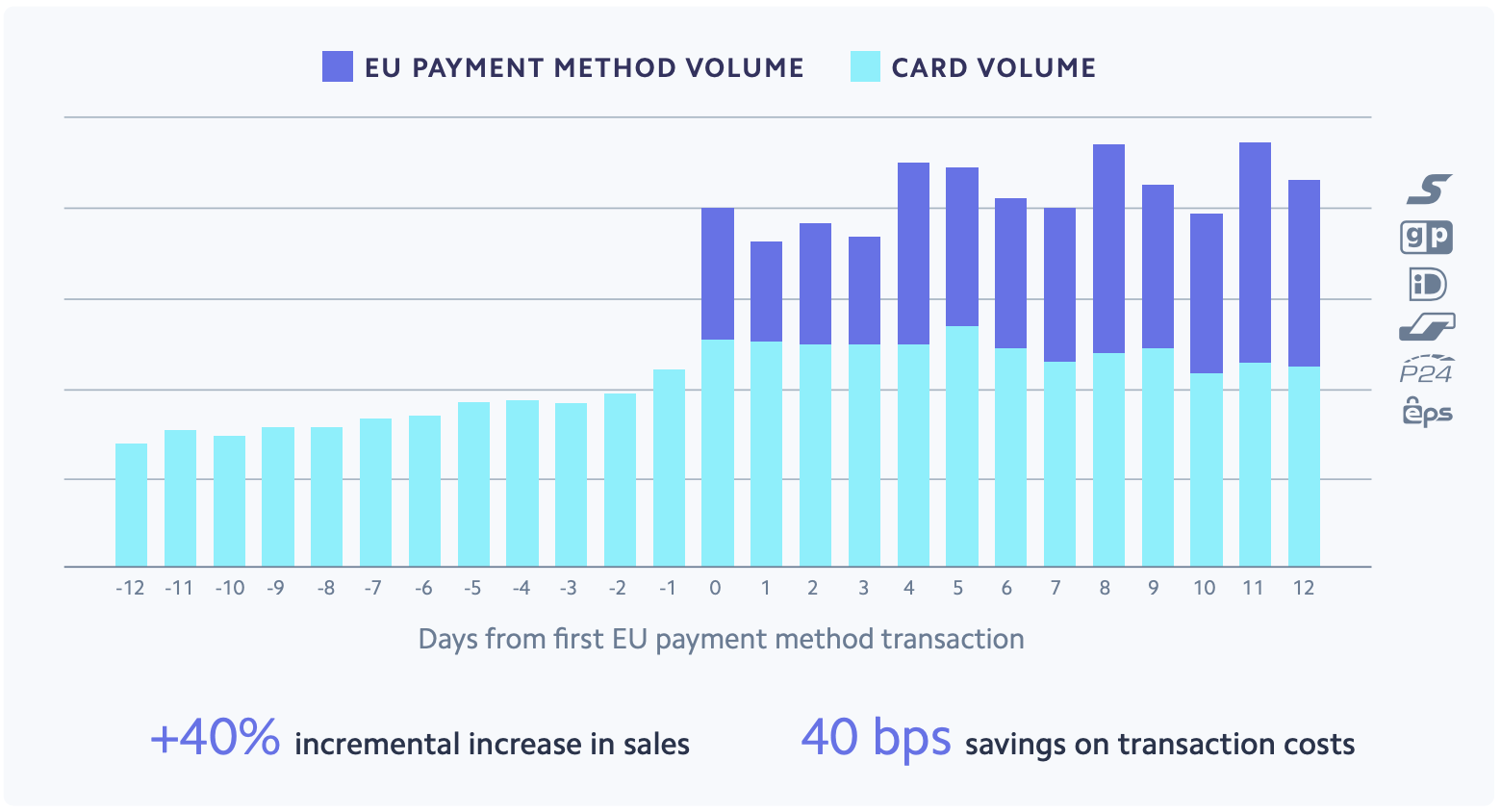

We’ve seen the impact that local payment methods can have on checkout conversion. In a separate Stripe study, we analyzed the impact of accepting popular European payment methods for Austrian, Belgian, German, Dutch, and Polish shoppers. By enabling these methods, businesses saw a 40% incremental increase in sales, and transaction fees were reduced by 0.4 percentage points (while these cost savings may sound small, they can quickly add up).

We estimated the increase in net-new sales that could result from adopting a local payment method. We first predicted a business’s sales volume if they had never adopted that payment method. Then, we analyzed the difference between actual sales volume and our predicted volume.

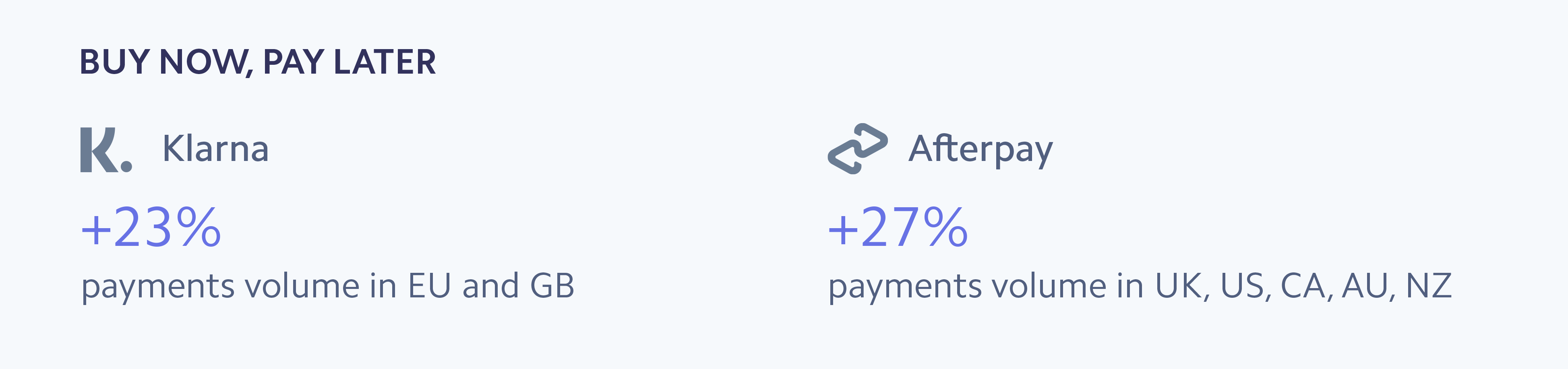

Supporting the right payment methods doesn’t only apply when expanding internationally; it can also be a way to offer your customers extra flexibility and convenience, especially for larger purchases. For example, buy now, pay later services let customers immediately finance purchases and pay them back in fixed installments over time and can result in an increase in sales.

Checklist: How to localize your checkout experience

-

Language and currency: Identify the top countries into which you want to sell and make sure you localize the checkout experience by translating the page and displaying local currency.

-

Dynamic fields: Change the payment fields to capture the right information for each country. For example, if your form recognizes a UK card, you should dynamically add a field for postcode.

-

Local payment methods: Dynamically surface the right payment methods in your checkout depending on where your customers are located or which device they’re using.

-

Installments: Consider offering buy now, pay later services if you have a high average order value and if they’re popular where your customers are based.

Buyer trust and security

North American customers said a “secure” website had one of the biggest impacts on a “positive” shopping experience. However, going through additional security steps after customers confirm an order adds extra friction and negatively impacts their experience.

Many North American customers may not be familiar with additional security layers such as 3D Secure, which have been mandatory for European merchants but also lead to additional friction in the payment flow. To streamline the checkout experience and prevent illegitimate payments, it’s important for North American businesses to invest in robust fraud monitoring that can work in the background to detect and block fraud.

Ecommerce businesses can promote buyer trust and security during the account creation process prior to checkout. For example, allow customers to check out as a guest, reducing the amount of personal information you collect and store. If you do require customers to log in to complete a purchase, give customers the ability to connect to their existing social media accounts. This keeps their personal information stored in the social media profile, rather than on your website, and helps expedite the checkout process.

The top buyer trust and security errors of checkouts

- 18% of checkouts did not allow customers to check out as a guest

- 90% did not allow customers to create an account by connecting to a social media profile

- 22% did not display an order summary that could be easily adjusted

Checklist: How to increase buyer trust

-

Security visuals: Display security visuals, such as a padlock, to reinforce that the page is secure.

-

Cart recaps: Show a summary of all items ordered to instill confidence.

-

Card brand: Automatically display an icon for the card brand (such as Visa or Mastercard) after the card number is entered.

-

Guest checkout: Allow customers to check out as a guest.

-

Account creation: Let customers create an account by connecting to their social media profile.

Checkout best practices for global subscription businesses

An increasing number of companies are turning toward subscription models as they offer the ability to create a reliable revenue stream. In addition, consumers have grown accustomed to signing up for digital subscriptions, with our survey showing that, on average, North American consumers pay for 2.5 active subscriptions.

Like ecommerce companies that process one-time payments, subscription businesses should prioritize the same checkout optimizations we’ve covered: checkout form design, mobile optimization, localization, and buyer trust and security. However, there are additional optimization opportunities that are unique to subscription businesses.

The top three checkout best practices for subscription businesses

- 44% offered a free trial

- 53% let customers enter a coupon code directly on the checkout page

- 16% offered reusable payment wallets such as Apple Pay or Google Pay

How Stripe can help

Our analysis shows that basic checkout issues are widespread, even among the top companies in North America that likely have dedicated teams focused on conversion rates.

When optimizing your checkout flow, you could try to prevent issues on your own and divert development resources to focus solely on your checkout experience. Or, you could leverage an optimized, hosted payment page like Stripe Checkout.

Stripe Checkout was designed with conversion best practices in mind, allowing businesses of all sizes to design seamless checkout flows that are optimized for mobile and cater to an international audience. It combines all of Stripe’s front-end, design, and analytics expertise to offer a seamless payments experience, allowing you to integrate in minutes to securely accept payments.

- Designed to reduce friction: Help your customers quickly and easily complete the checkout process by letting them auto-fill card and address information, adjust item quantities or enter promotional codes directly from the checkout page, and pay in just one click. Stripe Checkout also helps customers spot errors in real time with card validation, card brand identification, and descriptive error messages.

- Optimized for mobile: The checkout form is designed to be fully responsive and work across any device. It displays a numeric keypad to make it easier for customers to enter their card information and comes with Apple Pay and Google Pay built in, without any additional registration or domain validation required. And, Stripe Checkout will only surface mobile wallets when Stripe knows that they’ve been correctly set up by your customer.

- Seamless support for payment methods: With Stripe Checkout, you can add payment methods by changing a single line of code, creating localized payment experiences for your entire customer base. Stripe allows you to quickly add and scale payment method support without filling out multiple forms or following one-off onboarding processes.

- Built for global: Stripe Checkout supports more than 25 languages and 135 currencies, so your customers around the world can see the checkout form that’s right for them. You can decide which local payment methods to surface, or rely on Stripe to dynamically display the right payment methods based on IP, browser locale, cookies, and other signals.

- Increased buyer trust and security: The checkout form comes with built-in fraud prevention and compliance, using machine learning to help you distinguish fraudsters from customers. You can apply extra authentication to high-risk payments, support the simplest method of PCI validation with a pre-filled SAQ A, and trigger CAPTCHA during card testing attacks.

If you would like to build your own custom checkout form, you can use Stripe Elements, a set of rich, pre-built UI components. Like Stripe Checkout, Stripe Elements also offer mobile optimization, real-time validation, auto-fill, localization, and front-end formatting. Learn more about Stripe Elements.

Methodology

Stripe partnered with Edgar, Dunn & Company to select the top 100 ecommerce websites (for a total of 200) in the United States and Canada based on online sales volume from Statista. Adult entertainment platforms or online gambling websites were not included in the analysis. After determining the relevant websites, each one was tested for pre-defined errors by placing a product in the shopping cart to simulate an online purchase and, in some cases, using a VPN to complete the checkout process to mimic customers based in different countries. Checkouts were tested for a total of 26 criteria related to checkout form design, mobile optimization, localization, and buyer trust and security.

We also analyzed the top 200 global subscription companies based on online website traffic from Crunchbase, focusing on B2C subscription websites offering digital content.

Lastly, we surveyed 200 consumers in North America to uncover insights around current shopping behaviors and trends, payment preferences, and factors that affect the checkout experience.