If you’ve thought about starting a business under your own name without raising capital, a sole proprietorship (entreprise individuelle, or EI) could be the right choice for you. It’s a legal structure in which a single individual works independently under their own name. Learn how to set up an EI in France and what you need to know about this popular legal structure for entrepreneurs, including its tax regime, the status of the manager, advantages, disadvantages, and more.

What’s in this article?

- What is a sole proprietorship?

- Who can set up a sole proprietorship?

- How do you set up a sole proprietorship?

- What is the status of a sole proprietor?

- What is the tax status of sole proprietorships?

- What are the pros and cons of sole proprietorships?

- What are the differences between EI, EURL, and SASU?

What is a sole proprietorship?

The EI is the simplest legal structure for a business because it does not require the creation of a separate legal entity. The EI is represented by the entrepreneur, who must be a private individual (i.e. the professional activity is carried out in their name).

Except for regulated activities, most commercial, craft, agricultural, and self-employed professions can be carried out under an EI. Sole proprietors enjoy fast, independent decision-making, a simplified startup process, and a clear separation between business and personal assets.

Who can set up a sole proprietorship?

Any adult or emancipated minor who has the capacity to do business can create an EI, a legal status that includes microenterprises.

However, unemancipated minors can only create single-member companies, such as the single-owner limited liability company (EURL) or the single-shareholder simplified joint-stock company (SASU).

It is important to note that the sole proprietor must be a resident of France or another member state of the EU to open an EI.

How do you set up a sole proprietorship?

There are few steps involved in establishing an EI. Unlike the EURL and the SASU, the founder of an EI does not have to draw up articles of association, create share capital, or publish a notice of incorporation in a legal gazette (journal d’annonces légales, or JAL).

The sole proprietor only has to deal with the registration formalities, which are carried out via the business formalities portal. The application for registration must be submitted within 15 days of starting the business.

Documents required for registration

Documents you must include in your registration application include:

Proof of address, such as an electricity, gas, or water bill

Proof of identity

Declaration of non-conviction and a family certificate signed by the entrepreneur

Declaration of exemption from seizure of property not assigned to the business activity

Authorisation to practice a regulated activity (if applicable)

A company project support contract (contrat d’appui au projet d’entreprise, or Cape)

Make sure you allow 7–15 working days for your registration application to be processed. Incomplete applications can delay this time frame.

Registration costs

The cost of setting up an EI depends on the nature of the business:

€24.08 for a commercial activity

€45 for a craft business

€0 for independent or agricultural activities

It’s worth noting that starting a microbusiness is free, no matter what your business is.

You can increase your revenue and speed up your time to market with Stripe Payments, a payment system optimised for startups and multinational companies. Stripe offers over 100 payment methods, so you can accept payments in over 195 countries without writing any code.

What is the status of a sole proprietor?

A sole proprietor is a self-employed worker or a non-salaried worker (TNS). They are not bound by an employment contract and don’t receive a salary.

A TNS is covered by the social security system for the self-employed (sécurité sociale des indépendants, or SSI). SSI is characterised by lower social security contributions compared to those of employees and a unified tax and social security declaration through Cerfa form no. 2042.

Social security contributions for sole proprietors are paid to France’s collection office for social security contributions (Urssaf) and represent approximately 45% of taxable income. You can learn more about TNS status in our article on the subject.

What is the tax status of sole proprietorships?

By default, sole proprietors are subject to income tax (IR). They are taxed as industrial and commercial profits (bénéfices industriels et commerciaux, or BIC) if they are retailers or craftspeople. They are taxed as non-commercial profits (bénéfices non commerciaux, or BNC) if they are self-employed professionals.

Depending on your annual sales excluding taxes (chiffre d’affaires annuel hors taxes, or CAHT) and the nature of your business, you could be subject to the normal tax regime, the simplified tax regime, or the microbusiness regime.

Microbusiness regime option

Sole proprietors subject to IR can opt for the microenterprise scheme if their sales do not exceed:

€77,700 for BIC or BNC services

€188,700 for sales of goods, accommodations, and food (takeaway or consumed on the premises)

The microbusiness regime allows entrepreneurs to benefit from a flat-rate allowance on their turnover, which reduces their taxable income. It also allows them to opt for the pay-as-you-go income tax option – a special tax regime where taxes are paid as receipts are made, based on the exact amount of those receipts.

Corporate income tax option

Alternatively, the sole proprietor can choose not to pay IR and instead pay corporate income tax (IS), just like a EURL.

What are the pros and cons of sole proprietorships?

EI offers a number of advantages, including:

An easy and quick start

Separation of assets and protection of personal wealth

Autonomous management

Simplified administrative obligations

Ability to choose the microbusiness regime and IS

Lower social security contributions than an assimilated employee manager

However, there are several drawbacks, especially in terms of social security protection for the manager:

Coverage that requires the purchase of additional insurance for optimal protection

Payment of minimum social security contributions, even if the TNS receives no compensation

No option to form a partnership

What are the differences between EI, EURL, and SASU?

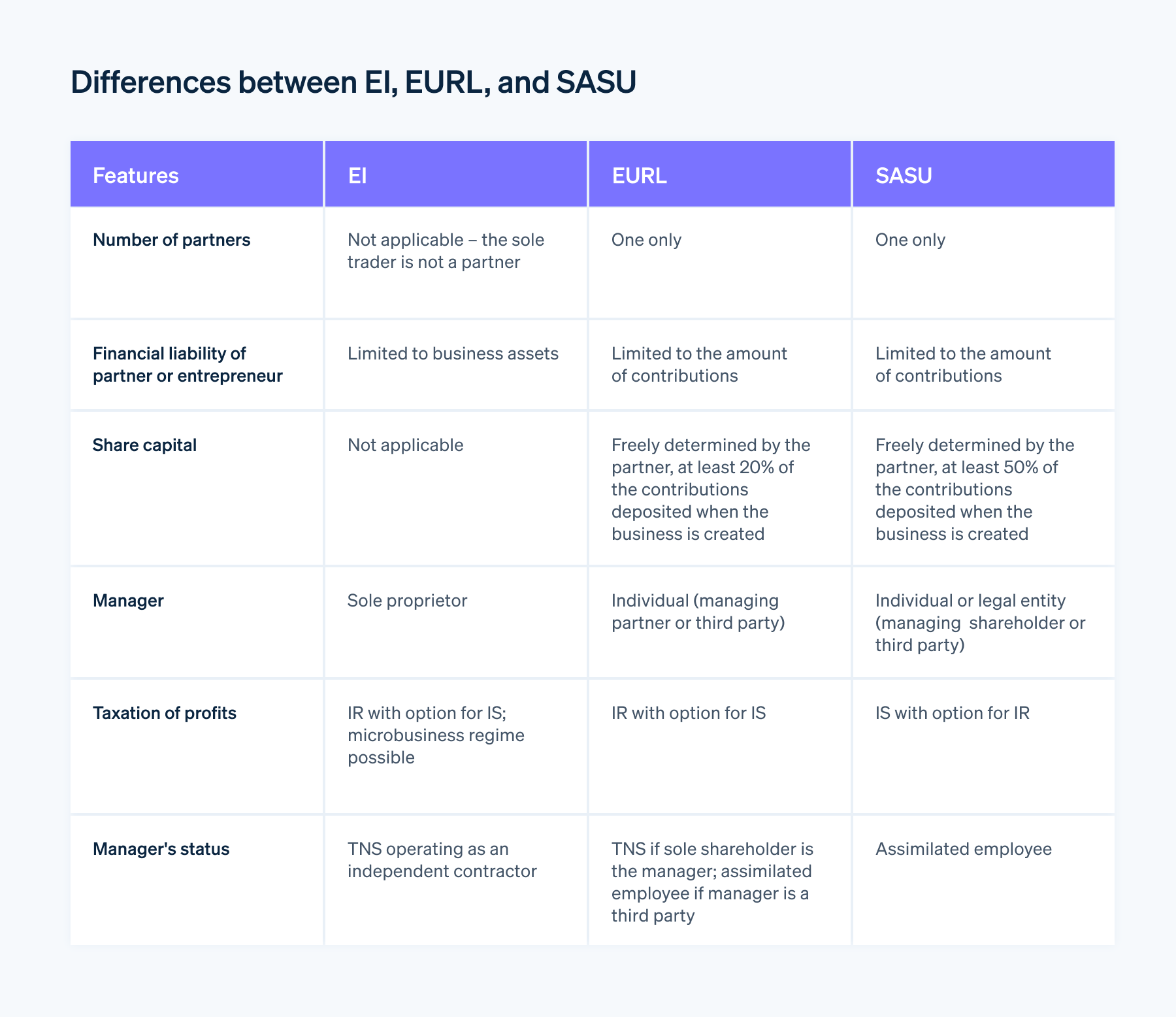

EURL, SASU, and EI are three legal forms that can be suitable for people who want to start a business on their own. Although EI implies a self-employed professional activity, EURL and SASU require the creation of a legal entity. The table below summarises their main differences.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.