Challenge

Brian Halligan and Dharmesh Shah founded HubSpot in 2006 in Cambridge, Massachusetts, as an inbound marketing platform focused on functions like lead generation, website analytics, and social media monitoring. Building on that foundation, the company enhanced its offerings through a suite of customer relationship management (CRM) tools organised into a Marketing Hub, Sales Hub, Service Hub, Content Hub, and Operations Hub.

As HubSpot integrated more capabilities into its platform, customers began asking the company to help them further consolidate their tech stacks by adding billing and payments functions. In 2021, the company developed Commerce Hub in response, with tools to manage billing, track revenue, and enhance sales and CRM strategies.

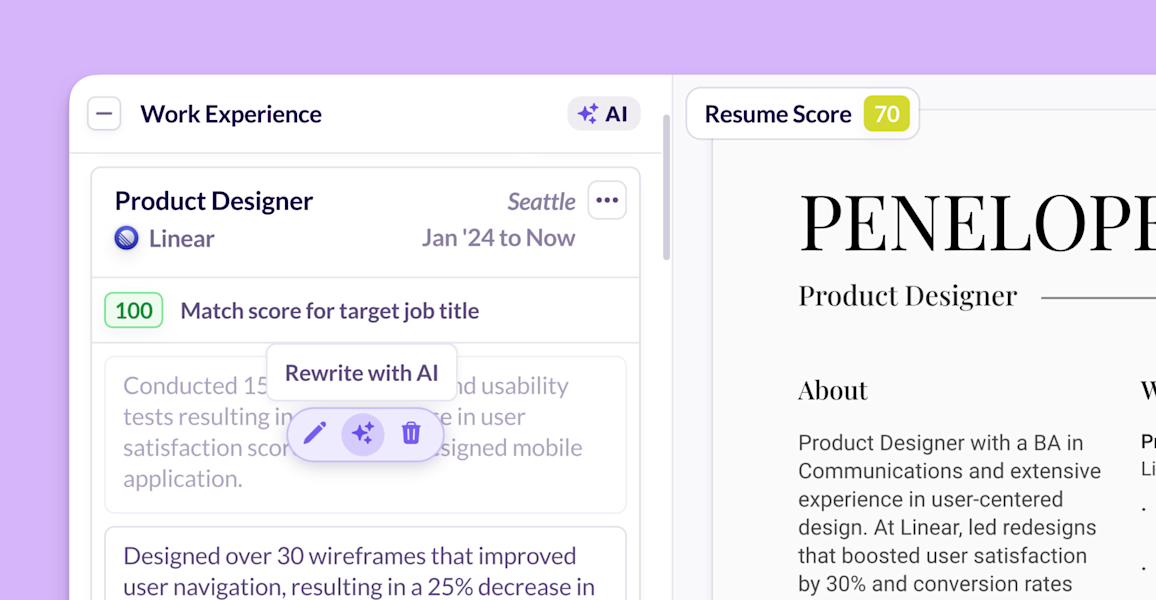

In order to deliver seamless customer value faster and with less risk, HubSpot looked at key players in the payment processing space. The company’s top priorities were finding a partner that prioritised user-friendliness as much as HubSpot does, but that still offered sophisticated technology that features both robust, developer-friendly APIs for customisation, as well as options for pre-built user interface components. Flexible technology was also important to help support the development of a white-labelled payment solution for some customers, while allowing customers who already had a way to accept payments online to integrate that account with Commerce Hub.

Because HubSpot is continually upgrading its services, it also needed a flexible and feature-rich solution that would make it easy for the company to develop additional features, such as support for multiple payment methods and recurring payments. The ideal partner would offer advanced reporting tools to enhance analytics and drive decision-making.

Solution

HubSpot developed Commerce Hub in partnership with Stripe, whose commitment to innovation and the customer experience aligned with its own. “Stripe’s status as a pioneer in the payments sector played a significant role in our partnership decision,” said Libby Maurer, vice president of user experience at HubSpot. Stripe Connect, a solution for money movement among multiple parties – including collecting payments and making payouts – formed the foundation of the integration, allowing HubSpot to control how funds flow based on their unique use case.

Stripe’s APIs and extensive documentation helped HubSpot’s team integrate Connect’s payment capabilities and fund-routing features into Commerce Hub and understand how best to use Stripe features. Using Stripe’s command-line interface (CLI) and Stripe Workbench developer tools, HubSpot could manually test Stripe APIs and inspect objects within the Connect platform.

Connect also supported HubSpot’s goal of providing two options for its customers: the white-labelled HubSpot Payments, available to premium accounts in the US, and a “bring-your-own-Stripe” option, in which customers can use their own Stripe accounts to process payments, available to all free and premium HubSpot accounts. For customers signing up for a new Stripe account, HubSpot used Stripe’s APIs to implement its own onboarding flow to allow for a more cohesive onboarding experience within Commerce Hub.

The initial iteration of Commerce Hub supported one-time card transactions by integrating Stripe Payments into HubSpot’s quote and payment link tools for online sales. Over time, HubSpot took advantage of additional Stripe capabilities to add recurring payments, additional payment methods, Commerce Hub Invoices, and other features. Adding these features supports HubSpot users with more complex needs and allows them to move more of their billing processing onto the platform.

In 2023, HubSpot further enhanced its payments experience by adopting Stripe’s Optimized Checkout Suite, which includes Stripe Elements, a set of embeddable UI components. HubSpot implemented the Payment Element to provide its users with access to additional global payment methods. The company also added Link, Stripe’s accelerated checkout solution that allows customers to save their payment information once and then auto-fills those details for subsequent purchases. The Payment Element also supported HubSpot’s plans to expand internationally by making it easy to add regional bank transfer options, such as SEPA Direct Debit transfers in Europe, pre-authorised debits (PADs) in Canada, and BECS Direct Debit in Australia. What’s more, the easy integration between the Payment Element and Stripe Financial Connections allowed HubSpot to instantly verify bank accounts and reduce the risk of ACH fraud.

HubSpot maintains an ongoing partnership with Stripe professional services, which began to guide its initial Connect implementation. The Stripe professional services team has served as the company’s payments advisor, becoming embedded into the HubSpot team as an invaluable resource of expertise in a genuinely collaborative partnership.

HubSpot also partnered with Stripe to accelerate their go-to-market strategy, working with Stripe marketing experts to create a joint value proposition and sales enablement materials for their partnership solution. From this foundation, HubSpot then collaborated with Stripe’s go-to-market team to generate and qualify new leads and co-sell their largest payments opportunities.

“With Stripe’s support, we were able to quickly craft our positioning and messaging so that our customer-facing teams tell a differentiated story that inspires confidence in our solutions,” said Maurer.

Results

More than 16,000 merchants actively use Commerce Hub

Commerce Hub currently serves more than 16,000 merchants. The HubSpot users who have adopted the Commerce Hub to manage billing and payments have reported growth in revenue and greater efficiency in operations. What’s more, the addition of Commerce Hub has made HubSpot an even more powerful full-service solution.

“Front-office teams want to have as much insight into every customer touchpoint as possible, and business owners and executives want unified data and the ability to centralise tools,” said Maurer. “Commerce Hub is helping SMBs achieve all this to help scale their businesses.”

Multiple account options give HubSpot users greater choice

The flexibility of Stripe’s APIs made it easy to offer multiple options for creating a Commerce Hub account. Users that already have an account with Stripe can easily establish a connection in just a few clicks. Those who don’t can enrol in HubSpot Payments or create a new Stripe account for integration. “Offering both options gives our customers flexibility. Whether they have an existing Stripe account or not, we have a solution that caters to their needs,” said Maurer.

The Optimized Checkout Suite helps HubSpot users easily meet customer needs

Integrating the Payment Element has allowed HubSpot to quickly and easily add a range of popular global payment methods beyond credit cards, including bank debits, which allowed HubSpot and its merchants to lower the cost of acceptance. For HubSpot merchants’ US customers, ACH Direct Debit is the most popular payment method after cards and accounts for 29% of payment volume. For European customers, Apple Pay is the top card alternative and accounts for 13% of payment volume. And Stripe’s accelerated checkout solution, Link, has already been adopted by 26% of HubSpot users.

The inclusion of country- and region-specific payment methods has supported HubSpot’s international expansion efforts. “Being able to add more local bank transfer options, including SEPA, PADS, and BECS, has been extremely important in meeting the needs of our international users,” said Maurer.

Working with Stripe gave us the ability to offer multiple payment processing options and enhance the overall experience for our merchants and for their customers.