If you sell goods or services on an online marketplace, it's important to understand your tax obligations and responsibilities. Marketplaces such as Amazon, eBay, Uber and Etsy are growing in popularity and show no signs of slowing down. In fact, by 2027, the total e-commerce market is expected to total over $7.9 trillion in sales.

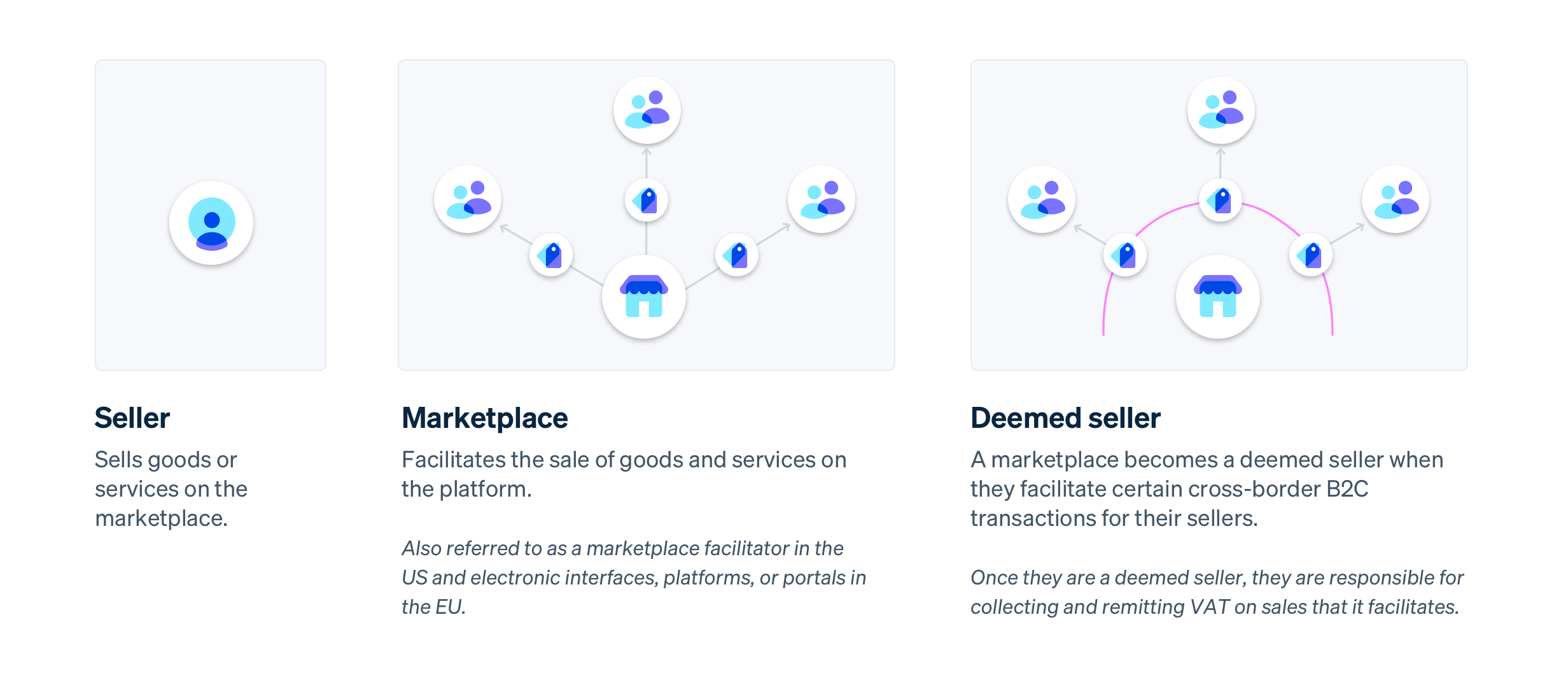

Certain governments have enacted legislation that requires marketplaces to collect and remit tax on behalf of their third-party sellers' transactions. These laws benefit tax authorities because they can collect more tax from fewer entities, which results in simpler compliance. Sellers benefit by having tax for certain transactions handled by the marketplace, but it's not always a straightforward process.

This guide will help you as a seller understand marketplace tax laws in the US and the EU and how to manage tax when a percentage (or all) of your sales take place on a marketplace. We'll also share how Stripe can help you manage ongoing sales tax and VAT compliance.

It's important to mention that we'll cover certain tax obligations, but there may be other tax responsibilities marketplace sellers should consider, such as taxes on marketplace earnings. For more detail on how Stripe helps marketplaces with 1099 forms, see here.

Finally, please bear in mind that the information provided in this guide does not constitute tax or legal advice. This guide has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax or legal advice. You should consult your own tax, legal and other advisors for advice specific to your situation.

Marketplace laws in the US

In the US, the term marketplace facilitator refers to an online platform that lists goods and services for sale and processes payments on behalf of third-party sellers.

In the US, marketplace facilitators are required to collect sales tax on behalf of third-party sellers when they reach economic nexus in the state. However, sellers are liable for tax if the marketplace facilitator does not collect it. This might occur if the marketplace was unable to remit the appropriate amount of tax due to incorrect information provided by the seller, or if the marketplace is not required to collect tax on behalf of the seller. Usually, a seller will receive written certification from the marketplace confirming that the marketplace is collecting sales tax on behalf of the seller.

Most states still require marketplace sellers to report how much sales tax was collected on their behalf by the marketplace facilitator and file sales tax returns, although it may be a zero return. States use sales tax returns as a way to check in on a business, and even though there is no sales tax to remit, a return is often required.

If a seller makes all their sales exclusively on the marketplace, certain states will allow them to cancel their registration to collect tax. Before cancelling a registration, sellers should ensure they can do so without penalty. In addition, sellers should consider if they intend to expand sales outside the marketplace in the future, such as in a physical store, trade show, or on their own online store. If they do, they would need to register again with a state.

How to manage sales tax and marketplace sales

There are two scenarios that may come up when managing sales tax and marketplace sales:

- All a seller’s sales are made on a marketplace.

- A percentage of sales are made on a marketplace.

We’ll walk through how to manage these different scenarios.

Marketplace-only sales

If a seller is only making sales on a marketplace and has confirmed the marketplace is collecting sales tax on its behalf, the seller does not have to calculate, collect, or remit the sales tax from its customers. However, the seller is still required to prepare and file a tax return by the due date that reports how much tax was collected by the marketplace. In this scenario, the seller will likely not owe the state anything, but will fulfil its filing requirements.

Percentage of sales on a marketplace

Let’s say a seller makes 50% of its sales on a marketplace and 50% on its own website. For the marketplace sales, the seller would want to ensure that the marketplace is collecting and remitting tax on its behalf, and maintain records of how much tax is collected on the marketplace. For the 50% of the sales made on its website, the seller is required to collect and remit tax on those sales, assuming it has met economic nexus in the relevant state.

When it comes time to file, the seller must report both how much was collected and remitted by the marketplace, as well as how much the seller directly collected from customers on its website. The seller will only have to pay (remit) the sales tax it has collected, not what the marketplace collected. Most state tax websites in the US will break out marketplace sales from website sales in separate lines, so sellers can easily add in the correct amounts.

Marketplace laws in the EU

The EU has special rules for marketplaces (also referred to as electronic interfaces, platforms, or portals) that facilitate sales of certain goods and services. The following conditions define a marketplace as the facilitator of a sale:

- Setting the terms of the supply either directly or indirectly

- Being involved in authorising the payment

- Being involved in the delivery of the product

Meeting any of these three conditions would mean the marketplace becomes a deemed seller and is responsible for collecting VAT on certain sales that it facilitates. A platform is a deemed seller if it acts in its own name but on behalf of the seller. The deemed seller rule applies only if the marketplace is facilitating a B2C sale for:

- Digital services

- Goods imported from non-EU countries in consignments not exceeding €150

- Goods of any value owned by non-EU sellers and located in the EU at the time of the sale

The European Commission announced significant reforms to the EU VAT system on 8 December 2022. The long-awaited proposals on “VAT in the Digital Age” (ViDA) expand the scope of the deemed supplier rule to platforms in the short-term accommodation rental and passenger transport sectors. Platforms in these sectors will need to collect and remit VAT on transactions that they facilitate if the underlying seller is not required to collect tax. For example, if the underlying seller is a consumer or subject to a small business scheme, the platform is required to collect and remit VAT. The deemed supplier rule will not apply to sales made by VAT-registered businesses that provide the platform operator with their VAT identification numbers.

Additionally, for platforms in the e-commerce sector, the existing deemed seller rule for B2C sales of goods in the EU by non-EU sellers will apply to all supplies of goods within the EU, regardless of the status of the purchaser and the location of the supplier. The proposed rules on the platform economy will take effect in 2025 if unanimously approved by all EU member states.

How Stripe Tax can help

Stripe enables marketplaces to build and scale powerful global payments and financial services businesses with less overhead and more opportunities for growth. Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT and GST on both physical and digital goods and services in all US states and more than 100 countries. Stripe Tax is natively built into Stripe, so you can get started faster – no third-party integration or plug-ins are required.

Stripe Tax can help you:

Understand where to register and collect taxes: See where you need to collect taxes based on your Stripe transactions and, after you register, switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe no-code products, such as Invoicing, with the click of a button.

Register to pay tax: If your business is in the US, let Stripe manage your tax registrations and benefit from a simplified process that prefills application details – saving you time and simplifying compliance with local regulations. If you're located outside the US, Stripe partners with Taxually to help you register with local tax authorities.

Automatically collect sales tax: Stripe Tax calculates and collects the amount of tax owed, no matter what or where you sell. It supports hundreds of products and services, and is up-to-date on tax rule and rate changes.

Simplify filing and remittance: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data – letting our partners manage your filings so you can focus on growing your business.

Learn more about Stripe Tax.