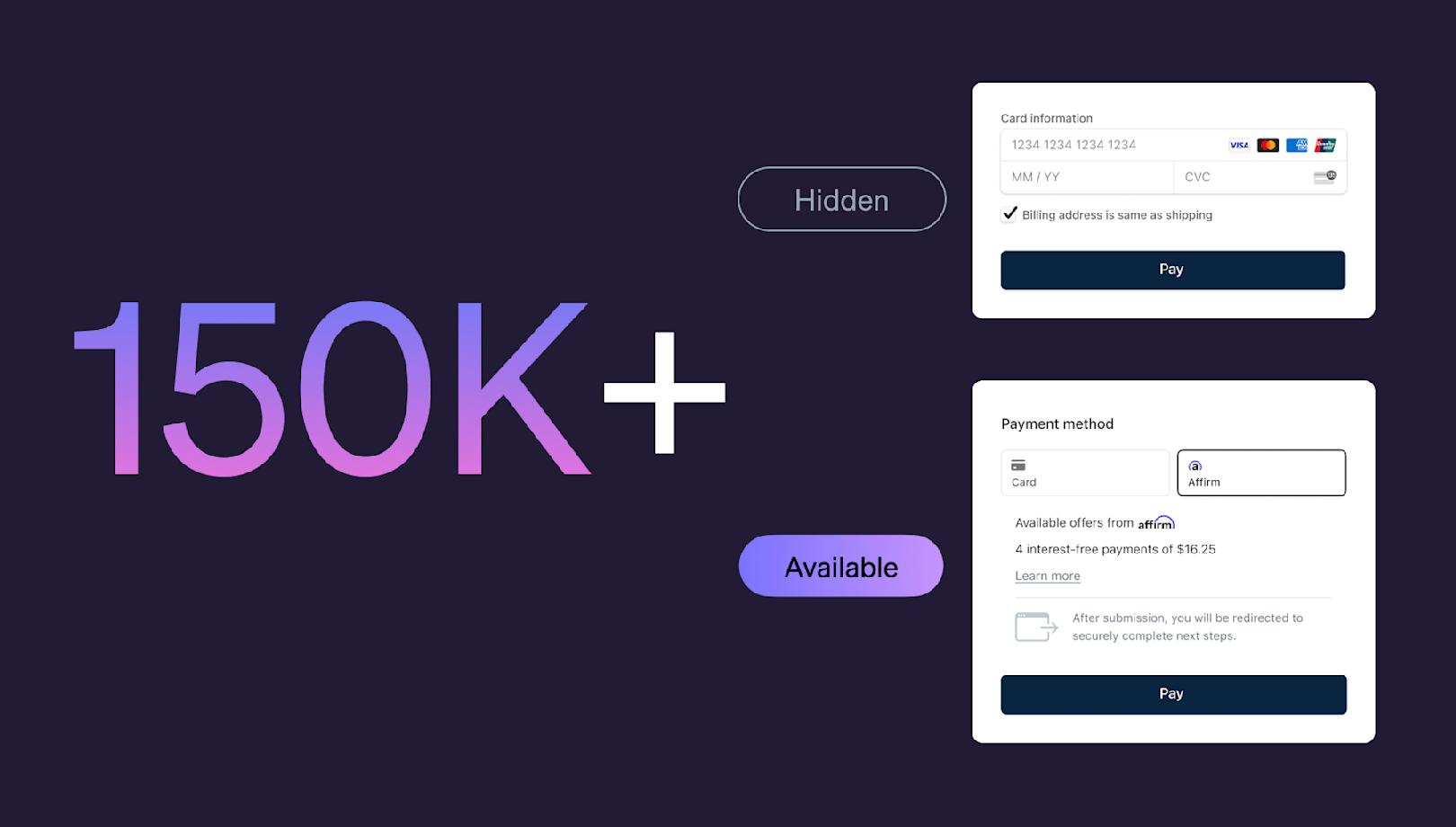

Testing the impact of buy now, pay later across 150,000+ checkout sessions

Last year, one of our users—Yuval Shwager, the head of product at Mixtiles—came to us with a question: “We want to offer buy now, pay later (BNPL) options, but how do we know they won’t add checkout friction or cannibalize our card volume?”

BNPL methods, which allow customers to finance purchases and pay them back in fixed installments, were little-known less than a decade ago. Today they account for more than $300 billion in transactions worldwide. However, they tend to be priced at a premium, so Shwager wanted to know whether the financial benefits would offset the added costs.

Getting all the data required to make strategic payment decisions like this one is hard. It involves understanding checkout click-through rates, payment conversion rates, and the frequency of refunds and disputes. All these factors play a part in determining the overall revenue and conversion impact, and it’s more information than most businesses can collect and analyze on their own.

That’s where we can help. Last year, Stripe processed more than $1 trillion in annual volume, which was about 1% of global GDP. This puts us in a unique position to run powerful experiments—all with the goal of providing insights that help our users grow their business.

With that in mind, we created an experiment to help Mixtiles and other Stripe businesses assess when and how to offer BNPLs. We ran A/B tests on more than 150,000 global payment sessions where a single BNPL (either Affirm, Afterpay, or Klarna) and at least one other payment method were eligible to be displayed to a customer. In half of the checkout sessions, customers saw the BNPL displayed in the available payment method section and in the other half, they did not.

We applied these tests to B2C companies across all industries eligible for BNPLs. Altogether, we found that businesses generated new sales, increased revenue, and boosted conversion rates by offering BNPLs. You can read more about our results below.

BNPLs resulted in net-new sales, largely without cannibalizing card volume

One common concern we hear from businesses is that by offering BNPLs, their current customers might switch from paying with cards to paying with a BNPL. This would add extra costs to a transaction that could have been made with a lower-cost payment method.

Our results indicate this is largely not the case. More than two-thirds of BNPL volume came from net-new sales, suggesting that customers only completed these transactions because a BNPL was offered.

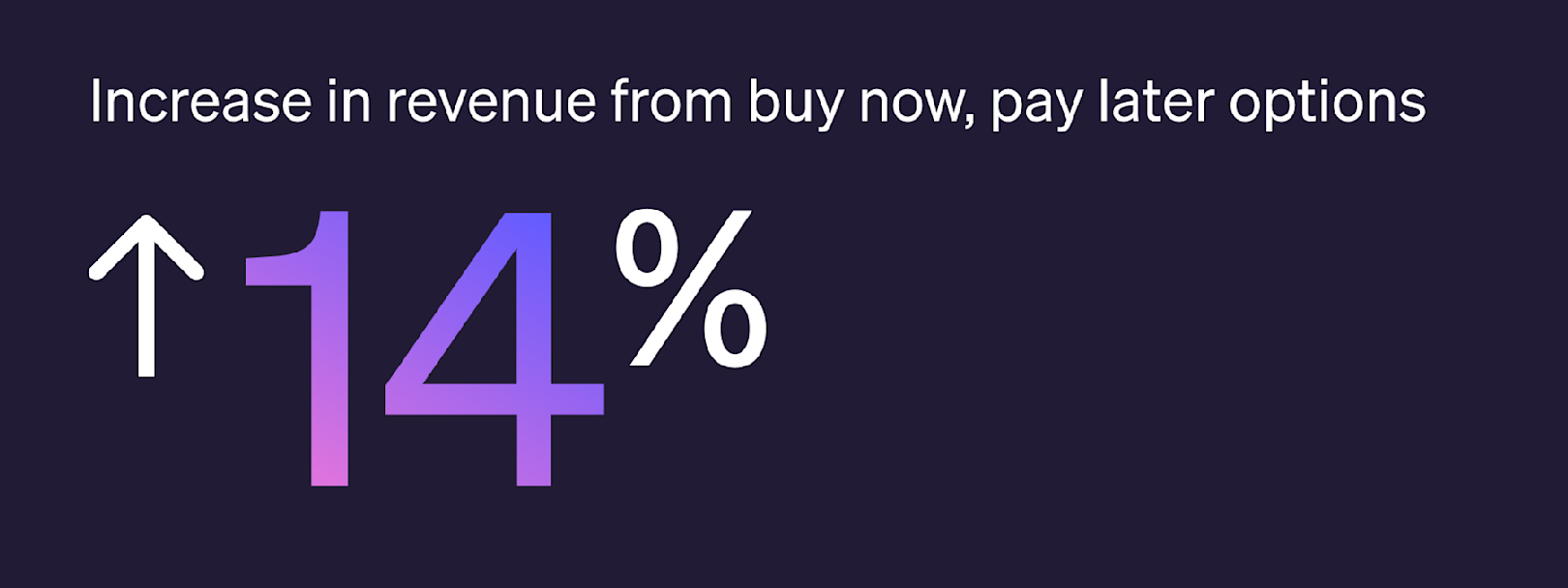

Businesses increased revenue by offering a BNPL

Businesses told us that they were hesitant to change their checkout experience without understanding the financial impact. Our experiment showed that making one update to the checkout page—presenting a BNPL at checkout—was directly connected to an increase in revenue.

For sessions where a BNPL was eligible to be presented as a payment option, businesses saw up to a 14% increase in revenue, which resulted from increased conversion and higher average order values. In other words, customers were more likely to complete a purchase, and more likely to purchase more, when they could use a BNPL.

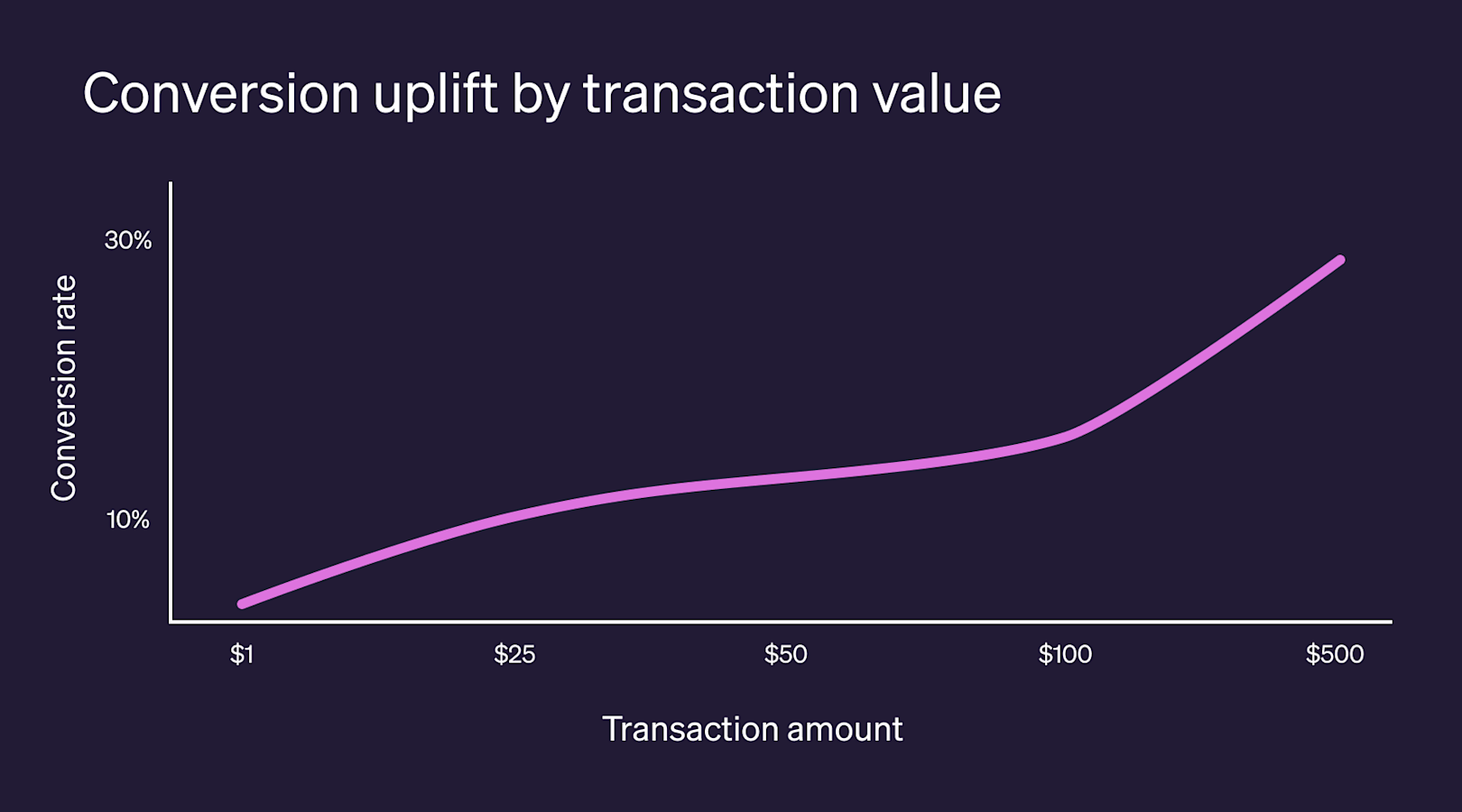

BNPLs improved conversion for both small and large dollar-value transactions

Another commonly held assumption is that BNPLs are only helpful for retailers selling high-value goods, such as luxury items. In our experiment, we found that this is only partly true: while businesses that processed larger transactions (defined as orders between $500 and $1,500) did see the highest conversion increase, businesses across the order value spectrum saw an increase in conversion rate by offering BNPLs.

BNPLs can help you increase revenue and reach new customers

This experiment allowed us to address our users’ concerns head-on, with the ultimate goal of making payments easier for them and better for their customers. For Mixtiles, our findings gave Shwager the assurance he needed to update the company’s checkout flow and add three BNPLs.

“We were thrilled when Stripe shared findings from their own experiments proving the ROI of buy now, pay later options. We were able to confidently add buy now, pay later methods to our checkout page, and after a few weeks, we saw thousands of dollars in increased revenue,” said Shwager.

With Stripe’s Optimized Checkout Suite, you can enable BNPLs and dozens of other payment methods directly from the Dashboard—while Stripe manages the backend logic to surface the most relevant, eligible payment methods to each customer. You can also run your own payment method A/B tests from the Dashboard, control when payment methods are available to your customers, and more. Get started today.