As digital marketplaces grow and businesses become more interconnected, it’s common for both domestic and international shipping to involve more than two parties. Multi-party shipments, known as chain transactions, affect VAT liability.

In this article, we will discuss what a chain transaction entails, what the differences are between active and inactive deliveries in chain transactions, who is liable for VAT in a chain transaction, and more.

What’s in this article?

- What is a chain transaction?

- What’s the difference between an active and an inactive delivery?

- Who pays the VAT in a chain transaction?

- What are the regulations for invoicing in chain transactions?

- How do chain transactions with third countries work?

- How do chain transactions involving private individuals work?

What is a chain transaction?

According to Section 3, Paragraph 6a, Sentence 1 of the German VAT Act (UStG), a chain transaction occurs when more than two businesses enter into a delivery agreement for the same goods, and the first business either transports or ships the goods directly to the customer. In this context, transport refers to any movement of the goods, while shipping refers to using shipping companies or other delivery services to handle the delivery. A key feature of a chain transaction is that one movement of goods corresponds to multiple sales transactions.

Here’s an example: John Smith orders a wooden table from his local furniture store. The store orders the table from a wholesaler and instructs it to send the table directly to John Smith. When the wholesaler ships the table directly to the customer, this is considered a chain transaction.

A common and straightforward type of chain transaction is dropshipping, which is particularly relevant for online retailers and resellers. In dropshipping, when a customer purchases a product from an online store, the manufacturer or wholesaler – not the store itself – ships the goods. The benefit for the online store is that it doesn’t need to store the product in its own warehouse.

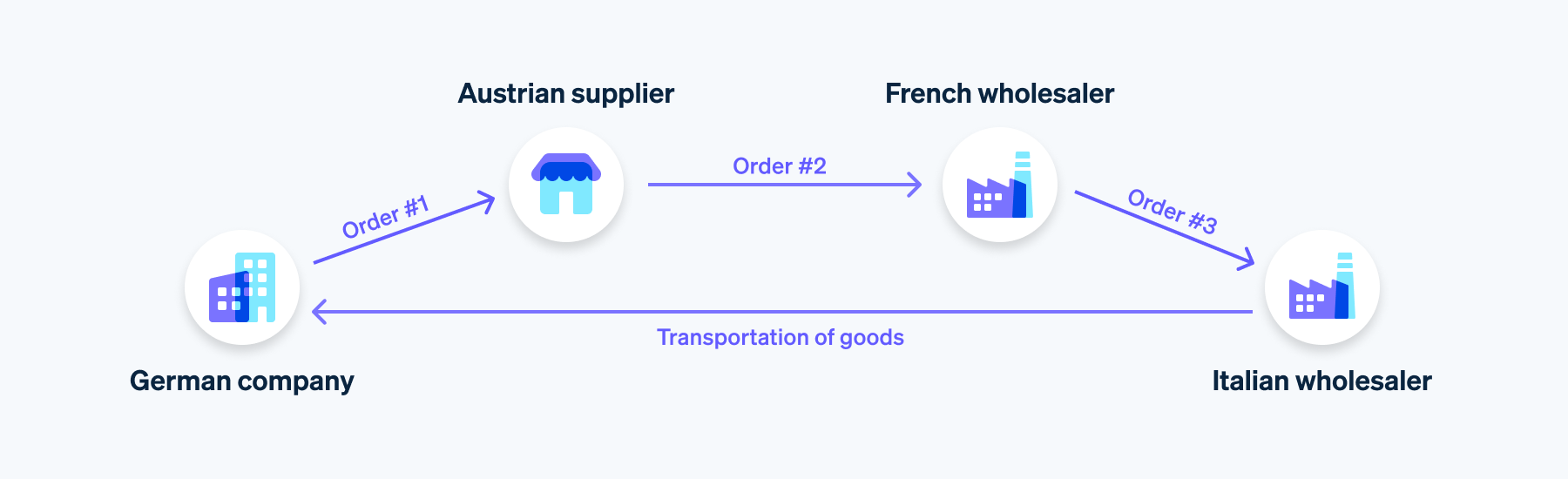

However, a chain transaction can be more complex and involve more than three parties.

For example: a business in Germany orders some equipment from its supplier in Austria. The supplier in Austria orders the equipment from a wholesaler in France. Because the wholesaler in France doesn’t have the equipment in stock, it orders the equipment from a wholesaler in Italy. The wholesaler in Italy then delivers the equipment directly to the business in Germany.

What’s the difference between an active and an inactive delivery?

Chain transactions involve two kinds of deliveries: active and inactive. An active delivery is when a supplier, store, or manufacturer physically transports or ships goods to their final destination. An inactive delivery does not involve the physical movement of goods and occurs only in a legal sense.

In a chain transaction, only one delivery is considered the active delivery, while the other deliveries are the inactive deliveries. The distinction between active and inactive deliveries is key to determining how the tax authority treats these transactions in terms of taxation.

It’s also important to understand that the term "delivery" usually refers to a billable transaction rather than the physical movement of goods. A delivery occurs even if no party physically moves the goods. Further, the term "place of delivery" does not refer to the actual movement of goods but rather indicates the country where the transaction is subject to taxation

Who pays the VAT in a chain transaction?

The VAT treatment of a chain transaction varies based on whether the delivery is active or inactive. VAT also varies based on whether the deliveries are domestic or cross-border.

National supply chain

In a chain transaction where all the businesses involved are in Germany, there is no cross-border movement of goods. Therefore, VAT rules in Germany apply to the deliveries within the chain.

- Active delivery: Because the businesses transport the goods within Germany, this delivery is subject to VAT in Germany. The sellers responsible for the active delivery apply VAT in Germany, which the customer can deduct as input tax.

- Inactive delivery: These deliveries are also taxable in a domestic supply chain and subject to VAT in Germany.

In a domestic supply chain, all deliveries, whether active or inactive, are taxable in Germany. There are no tax-exempt deliveries since the goods stay within Germany.

Intra-community supply chain

If a chain transaction includes businesses from different EU member countries, it will involve the cross-border movement of goods. This is considered an intra-community chain transaction, and the rules for intra-community deliveries apply. However, regarding VAT liability, it is necessary to differentiate between active and inactive deliveries.

- Active delivery: If the active delivery in an intra-community chain transaction crosses borders, authorities typically classify it as a tax-free intra-community delivery. This requires businesses to transport goods from one EU member country to another within the chain transaction and provide necessary evidence. In these situations, the delivery of goods is tax-free for the supplying or invoicing businesses. However, there is an intra-community acquisition for the business that receives the goods, which requires the business to pay the VAT in its home country. If said business is eligible for an input tax deduction, it can offset its paid VAT against the input tax.

- Inactive delivery: In an intra-community chain transaction involving businesses from different EU countries, the inactive deliveries are taxable in the suppliers’ country of operation. For instance, the tax authority taxes an inactive delivery from a business in Germany to a business in France as a domestic transaction within Germany.

Digital platforms and marketplaces, in particular, need to understand the VAT rules for chain transactions. Stripe Connect can help with this. With Connect, you get automated sales tax calculation and collection, in-person payment options, instant payouts, financing, corporate credit cards, and more. Additionally, your customers can access a wide range of local payment methods worldwide. You can integrate Stripe Connect in just a few weeks, enabling you to create a profitable payments solution that can grow with your business.

What are the regulations for invoicing in chain transactions?

In a chain transaction, businesses must fulfil specific invoicing requirements to ensure proper VAT treatment.

Distinction between active and inactive deliveries

If a delivery is to another EU member country, a business can invoice it as a tax-exempt intra-community delivery – provided there is supporting evidence for the movement of goods, such as shipping documents. The invoice must also include a statement indicating the tax exemption. In Germany, this is a note regarding the tax-free intra-community delivery in accordance with Section 6a of the UStG.

An inactive delivery is only taxable if the receiving business is in the same country as the delivering business. In cross-border chain transactions, the tax authority considers all inactive deliveries taxable in the sender’s country. Invoices must show the applicable sales tax.

Mandatory information to include on the invoice

If a business in Germany is liable for VAT on a delivery in a chain transaction, the invoice must include all mandatory information according to Section 14 of the UstG. This information includes:

- The full name and address of the business providing the product or service

- The full name and address of the recipient of the product or service

- The date of the invoice

- The date of delivery of the product or service

- The tax number issued to the supplying business by the tax authority or the VAT ID number issued by the Federal Central Tax Office (BZSt)

- A consecutive, unique invoice number

- The quantity and type of product delivered, or the scope and type of service provided

- The net amount of the product or service

- The applicable tax rate and corresponding tax amount or, in the case of a tax exemption, a reference to the tax exemption

- The gross amount of the product or service

How do chain transactions with third countries work?

Specific VAT and customs regulations govern chain transactions involving businesses outside the EU.

For example, let’s say the following parties are involved:

- The initial supplier (A): a business in the US

- The intermediary (B): a business in Germany

- The customer (C): a business in France

The initial supplier (party A) sends the goods directly to the customer (party C), even though the sales contracts exist between parties A and B and between parties B and C. The VAT and customs handling for these deliveries depend on which party is responsible for importing the goods.

If the intermediary (party B) imports the goods into the EU, it is usually responsible for paying the import VAT and any applicable customs duties. The parties involved can treat the delivery from party B to party C within the EU as an intra-community delivery and, as a result, it would be tax-exempt.

If the customer (party C) imports the goods, party C is responsible for paying the import VAT and customs duties.

How do chain transactions involving private individuals work?

Special rules apply to chain transactions with third countries (i.e. non-EU countries) involving private individuals, as illustrated in the example below.

Let’s say the transaction involves the following parties:

- The initial supplier (A): a business in the US

- The intermediary (B): a business in Germany

- The customer (C): a private individual in Germany

The active delivery in a chain transaction is when the physical movement of goods occurs. In the above example, the delivery from the initial supplier (party A) to the intermediary (party B) is the active delivery, as the supplier must ship the goods from the US to Germany. The inactive delivery is the one from party B to the customer (party C). It occurs only in a legal sense, as the goods are already in transit from the US to Germany and will not physically move again.

Because a third country shipper will deliver the goods to Germany, import VAT is due upon entry into Germany, and either party B or party C will need to pay it. In this case, party B is acting as the importer and therefore would usually pay the import VAT to clear the goods through EU customs.

Because party C is a private individual in Germany, party B must sell the goods to party C at a price that includes German VAT, and because party C is a private individual, they cannot claim an input tax deduction. The delivery is considered a taxable domestic delivery, meaning party B must also issue an invoice to party C that includes German VAT.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.