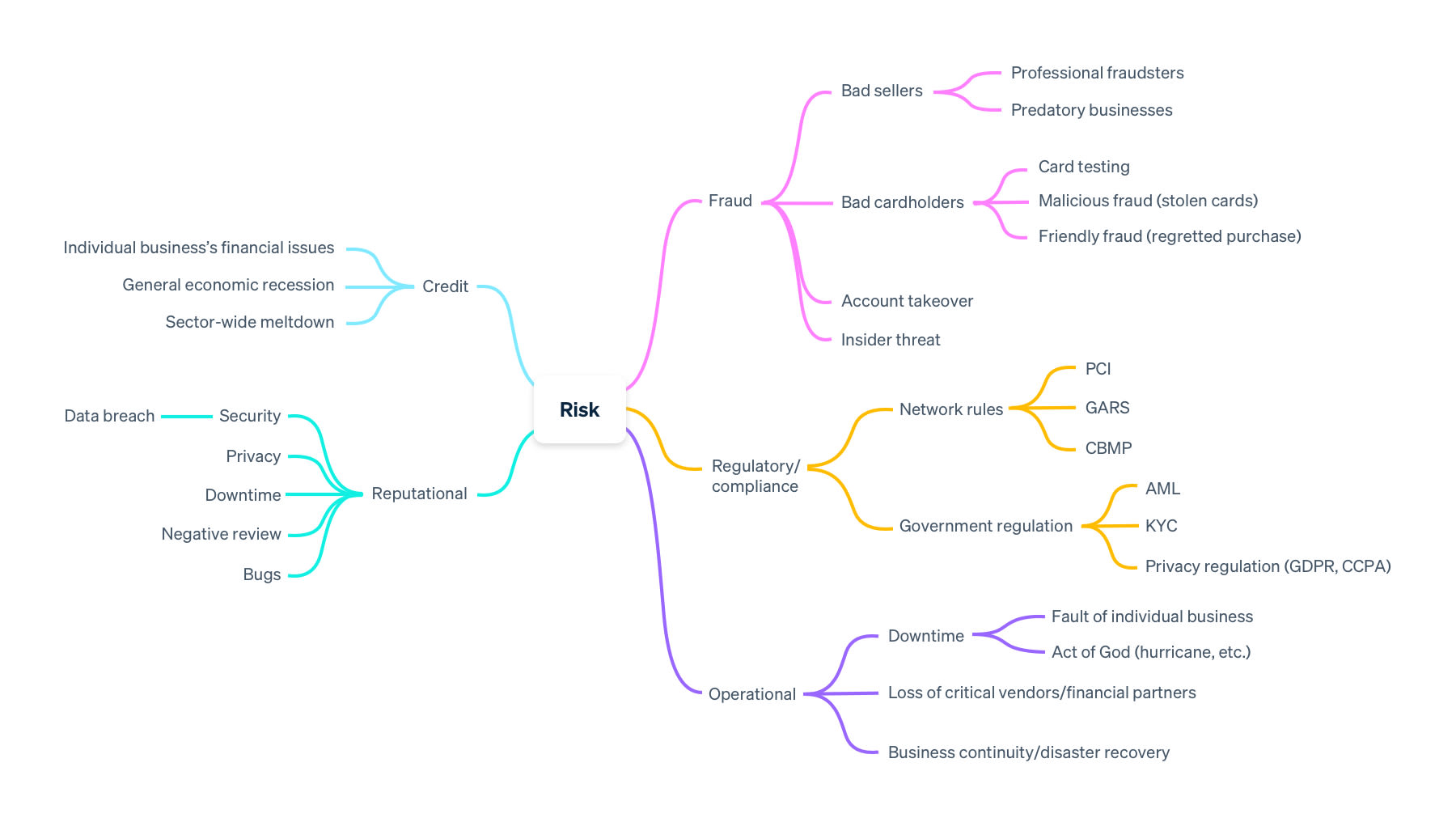

ธุรกิจออนไลน์ทุกแห่งต้องจัดการความเสี่ยง โดยความเสี่ยงมีหลายประเภท ตั้งแต่ความเสี่ยงด้านชื่อเสียง (เช่น การรับรู้แบรนด์ของคุณ) ไปจนถึงความเสี่ยงด้านการปฏิบัติงาน (เช่น ระยะเวลาหยุดทำงาน)

คู่มือนี้มุ่งเน้นไปที่ความเสี่ยงด้านการชำระเงิน 3 ประเภท ได้แก่ ความเสี่ยงด้านเครดิต การฉ้อโกง และการควบคุมบัญชี ถึงแม้ว่าจะไม่มีวิธีขจัดความเสี่ยงด้านการชำระเงินทั้งหมด แต่คู่มือนี้จะอธิบายวิธีการประเมินและจัดการความเสี่ยงของคุณ และช่วยให้คุณตัดสินใจโดยมีข้อมูลประกอบเกี่ยวกับแนวทางที่เหมาะสมได้

บทนำเกี่ยวกับความเสี่ยงด้านเครดิตและการฉ้อโกง

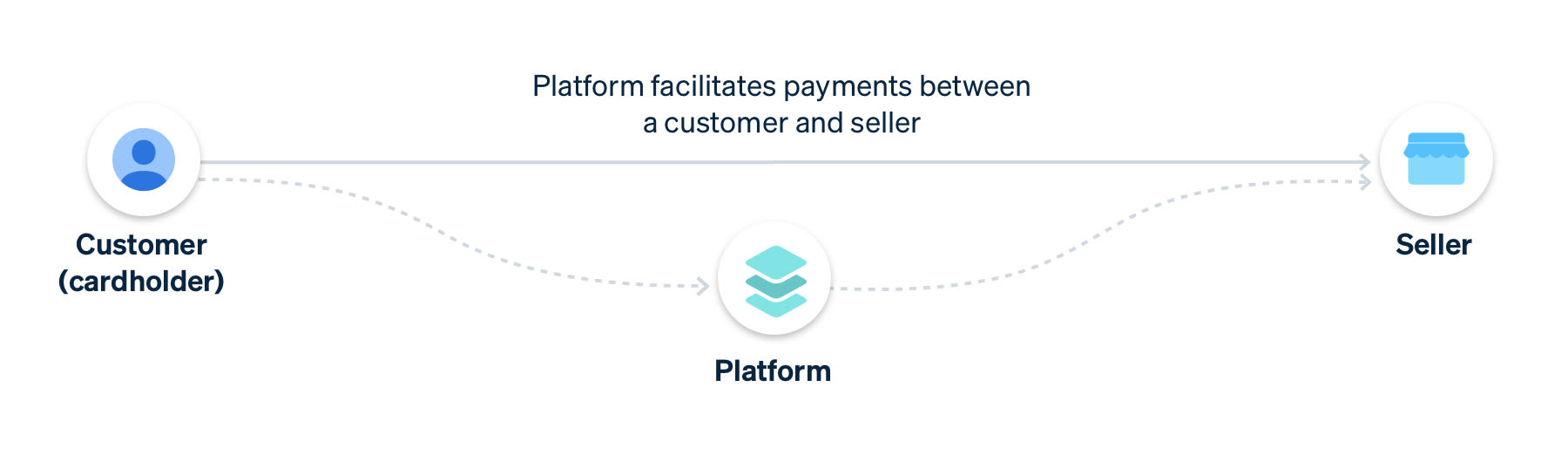

เมื่อแพลตฟอร์มซอฟต์แวร์เพิ่มการอำนวยความสะดวกด้านการชำระเงินลงในข้อเสนอของตน ก็จะเผชิญกับความเสี่ยง 3 ประเภทที่ซับซ้อนและแตกต่างกันเนื่องจากโมเดลธุรกิจแบบ 3 ฝ่าย (ซึ่งประกอบด้วยแพลตฟอร์ม ผู้ขายหรือผู้ให้บริการที่รับชำระเงินผ่านแพลตฟอร์มซอฟต์แวร์ และเจ้าของบัตรที่ชำระเงินให้กับผู้ขายหรือผู้ให้บริการเหล่านั้น)

ความเสี่ยงด้านเครดิต: ความเสี่ยงด้านเครดิตมีแนวโน้มที่จะแสดงให้เห็นว่าผู้ขายมีจุดประสงค์ที่จะดำเนินการตามคำสั่งซื้อสินค้าหรือบริการ แต่ไม่มีทรัพยากรทางการเงินที่จะดำเนินการเช่นนั้น สะสมการคืนเงินและการดึงเงินคืนมากกว่าที่สามารถจ่ายได้ และอาจจะต้องออกจากธุรกิจไป เจ้าของบัตรสามารถส่งคำขอการดึงเงินคืน เนื่องจากสินค้าหรือบริการดังกล่าวไม่ได้รับการดำเนินการตามคำสั่งซื้อ คุณจะเป็นหนี้ลูกค้าเหล่านั้น เนื่องจากโดยทั่วไปแล้วแพลตฟอร์มที่อำนวยความสะดวกด้านการชำระเงินยินยอมที่จะรับผิดต่อกิจกรรมของผู้ขาย

ความเสี่ยงด้านการฉ้อโกง: แพลตฟอร์มต่างๆ ยังต้องจัดการความเสี่ยงที่เกี่ยวข้องกับผู้ขายและบัญชีที่เป็นการฉ้อโกงด้วย ตัวอย่างเช่น คุณอาจมีบุคคลเดียวกันที่ทำหน้าที่เป็นผู้ขายที่ฉ้อโกงและเจ้าของบัตรที่ฉ้อโกง ซึ่งบุคคลนั้นมีสิทธิ์เข้าถึงข้อมูลของบัตรที่ถูกขโมยมา ลงทะเบียนบัญชีบนแพลตฟอร์ม และชำระเงินให้ตนเองด้วยบัตรที่ขโมยมา หรือคุณอาจมีผู้ขายที่ฉ้อโกงและเจ้าของบัตรที่ดี ซึ่งผู้ขายหลอกลวงให้เจ้าของบัตรชำระเงินให้ (เช่น การขายสินค้าที่ตั้งใจที่จะไม่ส่งให้) แพลตฟอร์มยังสามารถรับมือกับการฉ้อโกงประเภทหนึ่งที่เรียกว่าการใช้งานโดยมิชอบของบุคคลที่หนึ่งหรือการฉ้อโกงด้วยความเป็นมิตรได้ ซึ่งเกิดขึ้นเมื่อผู้ถือบัตรที่ชอบด้วยกฎหมายทำการซื้อสินค้า แต่ภายหลังกลับโต้แย้งการชำระเงินนั้น สาเหตุอาจเกิดจากความผิดพลาด เนื่องจากจำไม่ได้ว่ามีการทำธุรกรรมในใบแจ้งยอด หรืออาจตั้งใจ (ตัวอย่างเช่น เกิดความเสียดายภายหลังการซื้อ หรือพยายามฉ้อโกงเพื่อให้ได้สินค้าโดยไม่ชำระเงิน)

การเข้าควบคุมบัญชี: การมีผู้ขายที่ดีและเจ้าของบัตรที่ดีนั้นไม่เพียงพอที่จะขจัดความเสี่ยงด้านการชำระเงินได้อย่างสิ้นเชิง แพลตฟอร์มต่างๆ ยังต้องจัดการการเข้าควบคุมบัญชีด้วย ซึ่งบุคคลที่สามที่ประสงค์ร้ายจะเข้าถึงข้อมูลประจำตัวบัญชีของผู้ขายและขโมยเงินของเขา

กลยุทธ์การจัดการความเสี่ยงสำหรับความเสี่ยงด้านเครดิต

ผู้ขายส่วนใหญ่มีความเสี่ยงด้านเครดิตอยู่เป็นประจำ (ในรูปแบบของการดึงเงินคืนและการคืนเงินที่ตนต้องชำระ) แต่มีกระแสเงินสดที่จะชำระเงินตามที่กำหนด ซึ่งทำให้คุณมีความเสี่ยงเมื่อผู้ขายมียอดขายน้อยลงและมีคำขอคืนเงินที่สูงขึ้น ซึ่งอาจส่งผลให้ไม่สามารถคืนเงินให้กับลูกค้าได้

ตัวอย่างเช่น คุณให้บริการแพลตฟอร์มที่ผู้จัดงานกิจกรรมสามารถขายตั๋วและเบิกจ่ายเงินให้กับผู้จัดงานกิจกรรมก่อนที่งานกิจกรรมจะเกิดขึ้น หากการจัดงานกิจกรรมแบบเข้าร่วมด้วยตัวเองถูกยกเลิก ผู้จัดงานกิจกรรมจะต้องคืนเงินให้กับลูกค้า แต่หากผู้จัดงานกิจกรรมไม่มีเงินเพียงพอที่จะดำเนินการคืนเงิน ในฐานะแพลตฟอร์ม คุณอาจต้องรับผิดชอบในการชดเชยความสูญเสียดังกล่าว ด้วยเหตุนี้ คุณจึงต้องรับความเสี่ยงด้านเครดิตจำนวนมากในนามของผู้ขาย ซึ่งอาจทำให้คุณขาดทุนได้

คุณสามารถจัดการความเสี่ยงด้านเครดิตได้หลายวิธี และเราได้จัดกลยุทธ์เหล่านี้ออกเป็น 3 ส่วน ได้แก่ การเริ่มต้นใช้งาน การติดตามตรวจสอบ และการลดความเสี่ยง

การเริ่มต้นใช้งาน

บัญชีใหม่ๆ มีความเสี่ยงเมื่อเข้าสู่แพลตฟอร์มของคุณ เพียงเพราะไม่มีประวัติการติดตามหรือประวัติการประมวลผลกับคุณ ยิ่งคุณรวบรวมข้อมูลเกี่ยวกับบัญชีเหล่านั้นมากเท่าใด คุณก็จะประเมินความเสี่ยงของตนเองได้ดีขึ้นและรักษาสถานะของแพลตฟอร์มของคุณให้ดีขึ้น ตัวอย่างเช่น คุณสามารถระบุบัญชีที่มีแนวโน้มที่จะเผชิญกับปัญหาด้านกระแสเงินสดและมียอดคงเหลือติดลบก่อนที่ปัญหาดังกล่าวจะเกิดขึ้นจริง

ประเมินความเสี่ยง: ประเมินความเสี่ยงของบัญชีต่างๆ ที่อาจเกิดขึ้นระหว่างการเริ่มต้นใช้งาน ก่อนที่จะอนุญาตให้ใช้บัญชีเหล่านั้นบนแพลตฟอร์มของคุณ โปรดตรวจสอบให้แน่ใจว่าคุณมีข้อมูลเพียงพอเกี่ยวกับบริการที่เสนอเพื่อให้คุณทราบว่าบัญชีเหล่านั้นอยู่ในหมวดหมู่ความเสี่ยงสูงหรือไม่ คุณสามารถสอบถามเกี่ยวกับนโยบายการคืนเงินหรือยอดการชำระเงินขั้นต้นที่คาดการณ์ไว้ และค้นคว้าประวัติการดำเนินงานของบัญชีเหล่านั้นบนแพลตฟอร์มที่คล้ายกันกับของคุณ สำหรับผู้ขายรายใหญ่ คุณควรพิจารณาทำการประเมินด้วยตนเองมากขึ้น ซึ่งรวมถึงการตรวจสอบทางการเงินและการตรวจสอบเครดิตของเจ้าของทั่วไปหรือกรรมการของธุรกิจ

จำกัดธุรกรรมชั่วคราว สำหรับบัญชีใหม่ๆ หรือบัญชีที่มีความเสี่ยงสูง คุณอาจกำหนดมาตรการควบคุมชั่วคราวหลายรายการจนกว่าคุณจะเข้าใจกิจกรรมของบัญชีเหล่านั้นบนแพลตฟอร์มของคุณได้ดียิ่งขึ้น ตัวอย่างเช่น พิจารณาจำกัดปริมาณธุรกรรมทั้งหมดในวันเดียวหรือเดือนเดียว หากบัญชีเหล่านั้นเกินขีดจำกัดดังกล่าว คุณอาจระงับการเบิกจ่ายของบัญชีเหล่านั้นไว้ชั่วคราวเพื่อให้คุณสามารถตรวจสอบธุรกรรมได้

__ กันวงเงิน:__ เก็บเงินจำนวนหนึ่งไว้เป็นหลักประกันสำหรับผู้ขายที่มีความเสี่ยงโดยใช้ API การกันวงเงินของ Stripe ซึ่งเป็นส่วนหนึ่งของ Radar สำหรับแพลตฟอร์ม คุณสามารถปล่อยการกันวงเงินได้เมื่อเวลาผ่านไปเมื่อผู้ขายสร้างประวัติการติดตามที่ดีกับคุณ

การติดตามตรวจสอบ

ธุรกิจมักจะไม่เรียบง่ายและคงที่ และเมื่อธุรกิจเปลี่ยนแปลงเมื่อเวลาผ่านไป โปรไฟล์ความเสี่ยงของธุรกิจเองก็เช่นกัน ให้ติดตามตรวจสอบกิจกรรมการโต้แย้งการชำระเงิน ยอดคงเหลือติดลบ ยอดประมวลผล และข้อร้องเรียนของลูกค้าอย่างต่อเนื่องเพื่อช่วยระบุพฤติกรรมที่เป็นการฉ้อโกงและดำเนินการในทันที

ตั้งค่าการแจ้งเตือน: สร้างการแจ้งเตือนเพื่อติดตามตรวจสอบผู้ขายที่มีความเสี่ยงสูงกว่าเพื่อให้คุณปรับกลยุทธ์การจัดการความเสี่ยงได้อย่างรวดเร็ว ผู้ขายที่มีความเสี่ยงสูงกว่าจะมียอดขายลดลงอย่างมาก ยอดคงเหลือติดลบ หรืออัตราการโต้แย้งการชำระเงินที่สูงกว่า (โดยปกติแล้ว กิจกรรมการโต้แย้งการชำระเงินที่สูงกว่า 0.75% ถือว่ามากเกินไป)

ทำการตรวจสอบเป็นระยะ: ถึงแม้ว่าการตั้งค่าการแจ้งเตือนจะช่วยให้คุณติดตามผู้ขายได้ในแต่ละวัน แต่คุณจำเป็นต้องทำการตรวจสอบอย่างถี่ถ้วนและเจาะลึกเป็นระยะๆ คุณควรตรวจสอบอัตราการคืนเงินและการโต้แย้งการชำระเงินของผู้ขาย ยอดการประมวลผล และข้อร้องเรียนของลูกค้า

ให้ความรู้กับผู้ขาย: สร้างทรัพยากรเพื่อช่วยให้ผู้ขายของคุณเตรียมพร้อมสำหรับสิ่งที่ไม่คาดคิด ตัวอย่างเช่น แหล่งข้อมูลเกี่ยวกับโควิด-19 จาก Shopify และ Xero หรือข้อมูลเกี่ยวกับเฮอร์ริเคนฮาร์วีย์สำหรับธุรกิจต่างๆ จาก Mindbody

การลดความเสี่ยง

เมื่อคุณเข้าใจโปรไฟล์ความเสี่ยงของผู้ขายรายใหม่ๆ และผู้ขายที่มีอยู่แล้ว คุณสามารถเริ่มจัดการความเสี่ยงของคุณในเชิงรุกได้ ตัวอย่างเช่น สำหรับผู้ขายที่ดูเหมือนว่าจะมีแนวโน้มที่จะก่อให้เกิดความเสี่ยงต่อแพลตฟอร์มของคุณ คุณสามารถเปลี่ยนกำหนดเวลาเบิกจ่ายและกระตุ้นให้ผู้ขายเปลี่ยนวิธีจัดการการคืนเงินและการดึงเงินคืนได้

เลื่อนการเบิกจ่ายออกไป: การเลื่อนการเบิกจ่ายออกไปจนกว่าคุณจะคุ้นเคยกับปริมาณเฉลี่ยของผู้ขายและอัตราการดึงเงินคืน นอกจากนี้ คุณยังสามารถตั้งเวลาเบิกจ่ายกับหมวดหมู่ความเสี่ยงของผู้ขายได้เช่นกัน ตัวอย่างเช่น ยิ่งหมวดหมู่ความเสี่ยงสูงมากเท่าใด ยิ่งกำหนดเวลาเบิกจ่ายนานขึ้นเท่านั้น สำหรับสินค้าและบริการที่ไม่ได้รับทันที ให้ระงับการจ่ายเงินไว้จนกว่าจะได้รับสินค้า วิธีนี้ช่วยลดโอกาสในการถูกปฏิเสธการชำระเงินและการคืนเงินเนื่องจากคุณสามารถยืนยันว่าลูกค้าได้รับเงินที่จ่ายไปก่อนที่จะส่งยอดเงินดังกล่าว

จัดการยอดคงเหลือติดลบ: ตั้งค่าขั้นตอนการกู้คืนเงินทุนจากผู้ขายที่มียอดคงเหลือติดลบจำนวนมาก (ผู้ขายที่มียอดคงเหลือติดลบจะไม่สามารถดำเนินการดึงเงินคืนและคืนเงินได้ ดังนั้น ความเสี่ยงจึงจะตกอยู่ในแพลตฟอร์มของคุณ) คุณอาจตั้งค่าการหักเงินอัตโนมัติเพื่อดึงเงินทุนจากบัญชีธนาคารของตนโดยอัตโนมัติและกู้คืนยอดคงเหลือติดลบได้ ทั้งนี้ ขึ้นอยู่กับตำแหน่งที่ตั้งของผู้ขาย

กำหนดความกระจุกตัวของความเสี่ยง: พิจารณากำหนดเกณฑ์ความเสี่ยงสูงสุดสำหรับบางภูมิภาค (ตัวอย่างเช่น มีเพียง X% ของความเสี่ยงทั้งหมดของคุณควรมาจากประเทศเดียวเท่านั้น) หรือสำหรับผู้ขายบางราย (เช่น มีเพียง X% ของความเสี่ยงทั้งหมดของคุณควรมาจากผู้ขายรายเดียวเท่านั้น) หากความเสี่ยงของคุณเกินเกณฑ์ดังกล่าว คุณสามารถปรับนโยบายการจัดการความเสี่ยงให้เข้มงวดขึ้นได้

หักยอดเงินในวันที่จัดส่ง: การลดช่องว่างระหว่างวันที่ชำระเงินและวันที่ดำเนินการตามคำสั่งซื้อเพื่อลดความเสี่ยง วิธีนี้สำคัญอย่างยิ่งสำหรับผู้ขายที่มีความเสี่ยงสูงที่ประมวลผลการชำระเงินก่อนจัดส่งสินค้าหรือบริการ (เช่น ผู้จัดกิจกรรมที่ขายตั๋วงานกีฬาหรือคอนเสิร์ต) ในการหักยอดเงินในวันที่จัดส่ง (หรือใกล้วันที่ดังกล่าวให้มากที่สุด) ให้สร้างการเรียกเก็บเงินเพื่อระงับเงินของเจ้าของบัตร แต่การหักยอดเงินนั้นจะเกิดขึ้นเมื่อผู้ขายจัดส่งสินค้าหรือบริการ

กลยุทธ์การจัดการความเสี่ยงสำหรับความเสี่ยงด้านการฉ้อโกง

ในระดับพื้นฐานที่สุด การชำระเงินจะถือว่าเป็นการฉ้อโกงเมื่อเจ้าของบัตรไม่ได้อนุมัติการเรียกเก็บเงิน ซึ่งอาจเป็นผลมาจากบัตรที่ถูกขโมยหรือการโจมตีด้วยการทดสอบบัตร มักจะเกิดขึ้นเมื่อมิจฉาชีพทำการซื้อโดยใช้บัตรที่ขโมยมา ความเสี่ยงของการฉ้อโกงประเภทนี้สามารถป้องกันและจัดการได้โดยใช้ซอฟต์แวร์ป้องกันการฉ้อโกง (เช่น Stripe Radar)

นอกจากเจ้าของบัตรที่ฉ้อโกงแล้ว แพลตฟอร์มต่างๆ ยังต้องจัดการความเสี่ยงที่เกี่ยวข้องกับผู้ขายที่ฉ้อโกงด้วยเช่นกัน โดยคุณสามารถจัดการความเสี่ยงจากการฉ้อโกงได้หลายวิธี และเราได้จัดกลยุทธ์เหล่านี้ออกเป็น 3 ส่วน ได้แก่ การเริ่มต้นใช้งาน การติดตามตรวจสอบ และการลดความเสี่ยง

การเริ่มต้นใช้งาน

กระบวนการเริ่มต้นใช้งานของบัญชีหรือผู้ขายเป็นโอกาสที่คุณจะเก็บข้อมูลให้ได้มากที่สุดเพื่อยืนยันความถูกต้องตามกฎหมายของธุรกิจ อย่างไรก็ตาม เพื่อป้องกันความเสี่ยงของการฉ้อโกง คุณต้องพิจารณาปัจจัยอื่นๆ เช่น การตรวจสอบบัญชีที่มีอยู่และบัญชีที่ถูกปฏิเสธก่อนหน้านี้เพื่อระบุบัญชีซ้ำซ้อน

ประเมินความเสี่ยง: ยืนยันตัวตนของผู้ขายระหว่างกระบวนการเริ่มต้นใช้งานและตรวจสอบว่าธุรกิจดังกล่าวถูกต้องตามกฎหมายหรือไม่ ให้ตรวจสอบโปรไฟล์โซเชียลมีเดียของผู้ขาย เก็บใบอนุญาตประกอบกิจการที่เหมาะสม ตรวจสอบเว็บไซต์ (มองหาสัญญาณเตือน เช่น เว็บไซต์ที่มีเทมเพลต ภาษาที่คัดลอกมาจากเว็บไซต์อื่นๆ ฯลฯ) และตรวจสอบข้อมูลที่เหมาะสมกับแพลตฟอร์ม เช่น ที่อยู่จริง รายการสินค้าคงคลัง หรือประวัติการขาย

ตรวจสอบบัญชีซ้ำซ้อน: มิจฉาชีพอาจเปิดหลายบัญชีบนแพลตฟอร์มของคุณ เพื่อป้องกันไม่ให้เกิดปัญหานี้ โปรดตรวจสอบว่ามีข้อมูลบัญชีซ้ำซ้อนที่เชื่อมโยงกับบัญชีที่ถูกปฏิเสธไปแล้วหรือไม่ (เช่น ข้อมูลบัญชีธนาคาร ข้อมูลภาษี หรือชื่อและวันเกิด) คุณอาจพิจารณาการเชื่อมโยงระหว่างบัญชีต่างๆ เช่น หลายบัญชีจากที่อยู่ IP หรือโดเมนอีเมลเดียวกัน

การกันวงเงิน: การกันวงเงินจำนวนหนึ่งเพื่อเป็นหลักประกันให้กับผู้ขายที่มีความเสี่ยง คุณสามารถปล่อยเงินที่กันไว้ได้เมื่อผู้ขายสร้างประวัติการติดตามการประมวลผลที่ดีกับคุณ

การติดตามตรวจสอบ

ผู้ขายที่ฉ้อโกงอาจใช้เวลาในการสร้างประวัติการติดตามที่ดีบนแพลตฟอร์มของคุณก่อนที่จะกระทำการฉ้อโกง ซึ่งเน้นให้เห็นถึงความสำคัญของการติดตามตรวจสอบอย่างต่อเนื่อง ให้ทำความเข้าใจว่ากิจกรรมของผู้ขายปกติเป็นอย่างไร ตั้งค่าการแจ้งเตือนการตรวจจับความผิดปกติเพื่อแสดงการเปลี่ยนแปลงหรือความผิดปกติที่เพิ่มขึ้นอย่างมาก และพร้อมขอข้อมูลเพิ่มเติม หากคุณพบกิจกรรมที่น่าสงสัย

ระบุพฤติกรรมที่ปกติ: ติดตามตรวจสอบกิจกรรมของผู้ขายเพื่อทำความเข้าใจพฤติกรรมทั่วไป ปริมาณธุรกรรมรายเดือนโดยเฉลี่ยคือเท่าใด อัตราการดึงเงินคืนและอัตราการโต้แย้งการชำระเงินโดยเฉลี่ยคือเท่าใด วิธีนี้จะมอบเกณฑ์เปรียบเทียบที่คุณสามารถค้นหาพฤติกรรมที่น่าสงสัย (เช่น จำนวนและความถี่ของการเรียกเก็บเงิน) และดำเนินการที่เหมาะสมได้

ปรับแต่งการแจ้งเตือนของคุณ: สร้างการแจ้งเตือนที่อิงตามกฎเพื่อติดตามตรวจสอบผู้ขายที่มีความเสี่ยงเพื่อให้คุณปรับกลยุทธ์การจัดการความเสี่ยงได้อย่างรวดเร็ว ให้ดูผู้ขายที่ได้รับการยืนยันว่าฉ้อโกงเพื่อค้นหารูปแบบกิจกรรมต่างๆ เพื่อช่วยคุณปรับแต่งและกำหนดการแจ้งเตือนของคุณได้

ขอข้อมูลเพิ่มเติม: หากคุณสังเกตเห็นพฤติกรรมธุรกรรมที่น่าสงสัย โปรดติดต่อผู้ขายเพื่อขอข้อมูลเพิ่มเติม โดยคุณสามารถขอใบแจ้งหนี้ รูปถ่ายสินค้าคงคลัง หรือหมายเลขติดตามได้

การลดความเสี่ยง

เมื่อคุณเข้าใจโปรไฟล์ความเสี่ยงของผู้ขายรายใหม่ๆ และผู้ขายที่มีอยู่แล้ว คุณสามารถเริ่มจัดการความเสี่ยงของคุณในเชิงรุกได้ ตัวอย่างเช่น สำหรับผู้ขายที่ดูเหมือนว่าจะมีแนวโน้มที่จะก่อให้เกิดความเสี่ยงต่อแพลตฟอร์มของคุณ คุณสามารถเปลี่ยนกำหนดเวลาเบิกจ่ายและกระตุ้นให้ผู้ขายเปลี่ยนวิธีจัดการการคืนเงินและการดึงเงินคืนได้

เลื่อนการเบิกจ่ายออกไป: การเลื่อนการเบิกจ่ายออกไปจนกว่าคุณจะคุ้นเคยกับปริมาณเฉลี่ยของผู้ขายและอัตราการดึงเงินคืน นอกจากนี้ คุณยังสามารถตั้งเวลาเบิกจ่ายกับหมวดหมู่ความเสี่ยงของผู้ขายได้เช่นกัน ตัวอย่างเช่น ยิ่งหมวดหมู่ความเสี่ยงสูงมากเท่าใด ยิ่งกำหนดเวลาเบิกจ่ายนานขึ้นเท่านั้น สำหรับสินค้าและบริการที่ไม่ได้รับทันที ให้ระงับการจ่ายเงินไว้จนกว่าจะได้รับสินค้า วิธีนี้ช่วยลดโอกาสในการถูกปฏิเสธการชำระเงินและการคืนเงินเนื่องจากคุณสามารถยืนยันว่าลูกค้าได้รับเงินที่จ่ายไปก่อนที่จะส่งยอดเงินดังกล่าว

ป้องกันการโจมตีด้วยการทดสอบบัตร: คุณสามารถระบุกิจกรรมการทดสอบบัตรส่วนใหญ่ได้โดยการปฏิเสธที่เพิ่มขึ้นอย่างมีนัยสำคัญ (การปฏิเสธเหล่านี้ได้รับการจัดหมวดหมู่ว่าเป็นข้อผิดพลาด 402 ในบันทึกคำขอที่ไม่สำเร็จ) ในการป้องกันการโจมตีเหล่านี้ ให้ใช้มาตรการรักษาความปลอดภัยเพิ่มเติมระหว่างการชำระเงิน เช่น CAPTCHA

กลยุทธ์การจัดการความเสี่ยงสำหรับการเข้าควบคุม บัญชี

คุณสามารถยืนยันความถูกต้องตามกฎหมายของผู้ขายทุกรายที่ใช้แพลตฟอร์มของคุณได้ด้วยตนเอง และยังคงเสี่ยงต่อการฉ้อโกงในการชำระเงินในรูปแบบของการเข้าควบคุมบัญชี ถึงแม้ว่าบุคคลที่สามที่ประสงค์ร้ายจะยังมีอยู่บนอินเทอร์เน็ตเสมอ แต่คุณสามารถลงทุนในการรักษาความปลอดภัยและการระบุตัวตนที่เข้มงวดเพื่อป้องกันไม่ให้มิจฉาชีพแฮ็คเข้าสู่บัญชีของผู้ขายของคุณได้

บังคับใช้มาตรการยืนยันตัวตน: วิธีที่ดีที่สุดในการป้องกันการเข้าควบคุมบัญชีคือการบังคับใช้มาตรการรักษาความปลอดภัยและการยืนยันตัวตนที่เข้มงวด ตัวอย่างเช่น บังคับใช้นโยบายรหัสผ่านที่ไม่ซ้ำกัน และใช้การตรวจสอบสิทธิ์แบบ 2 ปัจจัยเมื่อเข้าสู่ระบบ

ติดตามตรวจสอบกิจกรรมที่น่าสงสัย: การทำความเข้าใจสัญญาณของการเข้าควบคุมบัญชีเป็นสิ่งสำคัญเพื่อให้คุณสามารถระงับการเบิกจ่ายได้ทันที สัญญาณที่พบบ่อยของการเข้าควบคุมบัญชี ได้แก่ ปริมาณการประมวลผลหรือขนาดคำสั่งซื้อเฉลี่ยที่สูงขึ้น หรือการเข้าสู่ระบบจากอุปกรณ์ใหม่ๆ หรือที่อยู่ IP ที่ไม่ได้อยู่ในระบบ

ตัวเลือกการจัดการความเสี่ยงของคุณด้วย Stripe

แพลตฟอร์มที่ใช้ Stripe มี 2 ทางเลือกในการจัดการความเสี่ยง ได้แก่ 1) คุณสามารถให้ Stripe ช่วยจัดการความเสี่ยงในการชำระเงินให้คุณ หรือ 2) คุณสามารถจัดการความเสี่ยงด้วยตัวเองได้ วิธีที่ได้รับความนิยมที่สุดคือการให้ Stripe ช่วยจัดการความเสี่ยงในการชำระเงินให้คุณ ซึ่งรวมถึงการติดตามและลดภาระในการปฏิบัติงานหลักและการลดความเสี่ยงในการฉ้อโกง เมื่อใช้ความเสี่ยงที่มีการจัดการของ Stripe คุณจะได้รับประโยชน์จากโซลูชันการจัดการความเสี่ยงแบบครบวงจรของเรา ซึ่งครอบคลุมทั้งการติดตามและการลดความเสี่ยงด้านเครดิตและการทุจริตอย่างต่อเนื่อง Stripe จะติดตามตรวจสอบและจัดการความเสี่ยงให้คุณโดยตรง ซึ่งรวมถึงการรับภาระยอดคงเหลือติดลบที่ไม่สามารถกู้คืนได้ซึ่งเกิดจากธุรกิจบนแพลตฟอร์มของคุณ ทางเลือกนี้เหมาะอย่างยิ่งสำหรับการลดภาระการจัดการความเสี่ยง เพื่อให้คุณสามารถมุ่งเน้นไปที่สิ่งสำคัญหลักของธุรกิจ โดยไม่ขึ้นอยู่กับระดับความเชี่ยวชาญด้านการบริหารความเสี่ยงของคุณ

Salesforce ซึ่งเป็นบริษัทซอฟต์แวร์รายใหญ่ที่สุดในโลกร่วมเป็นพาร์ทเนอร์กับ Stripe เพื่อเปิดตัว Salesforce Commerce Cloud เพื่อช่วยให้ธุรกิจปรับตัวเข้ากับเศรษฐกิจที่มีการเปลี่ยนไปสู่ระบบดิจิทัลอย่างรวดเร็ว และเนื่องจากการชำระเงินอยู่นอกเหนือขอบเขตความสามารถหลัก Salesforce จึงโอนการจัดการความเสี่ยงไปยัง Stripe เพื่อให้สามารถมุ่งเน้นไปที่การสร้างโซลูชันการพาณิชย์อันทรงพลังสำหรับลูกค้าได้

หากคุณมีความเชี่ยวชาญด้านความเสี่ยงและเข้าใจดีว่าผู้ขายของคุณเป็นใคร คุณสามารถจัดการความเสี่ยงได้ด้วยตัวเอง แพลตฟอร์มที่เลือกจัดการความเสี่ยงด้วยตัวเองมักจะมีทรัพยากรด้านการดำเนินงานและวิศวกรรมสำหรับสร้างและดูแลโซลูชันการฉ้อโกงที่สร้างขึ้นเอง จัดสรรเงินทุนที่เพียงพอสำหรับความสูญเสียที่อาจเกิดขึ้น ผสานการทำงานเครื่องมือของบริษัทอื่น รวมถึงติดตามและรายงานความสูญเสียจากการฉ้อโกง

นอกเหนือจากการจัดตั้งทีมเฉพาะทางเพื่อจัดการความเสี่ยงแล้ว คุณจะต้องเป็นพาร์ทเนอร์กับแผนกภายในอื่นๆ ที่อาจได้รับผลกระทบจากความเสี่ยง ได้แก่

ทีมกฎหมาย: ผู้เชี่ยวชาญด้านกฎหมายภายในหรือผู้เชี่ยวชาญด้าน กฎหมายผลิตภัณฑ์การชำระเงินจะต้องคอยติดตามกฎหมาย ข้อบังคับ และกฎระเบียบของอุตสาหกรรมที่เกี่ยวข้อง และร่วมงานกับหลายๆ แผนกเพื่อตอบสนองต่อการตรวจสอบและสอบถามข้อมูล

ทีมสนับสนุน: ทีมบริการลูกค้าภายในหรือผู้ให้บริการจะต้องเตรียมพร้อมตอบคำถามของผู้ใช้ที่เกี่ยวข้องกับกิจกรรมการจัดการความเสี่ยง รวมถึงการดึงเงินคืน การโต้แย้งการชำระเงิน และการชำระเงินที่ล่าช้า

เมื่อจัดการความเสี่ยงด้วยตัวเอง คุณสามารถปรับแต่งวิธีการด้วยชุดเครื่องมือป้องกันและติดตามตรวจสอบอันทรงประสิทธิภาพของ Stripe ได้แก่

การป้องกันการฉ้อโกงบัญชีและธุรกรรม: Stripe Radar สำหรับแพลตฟอร์มให้บริการป้องกันความเสี่ยงทางการเงินที่สร้างขึ้นสำหรับแพลตฟอร์ม โดยใช้ AI ที่ผ่านการฝึกฝนในเครือข่าย Stripe เพื่อป้องกันการฉ้อโกงผ่านการชำระเงินและบัญชีแพลตฟอร์มต่างๆ สามารถใช้เครื่องมือนี้เพื่อตรวจจับและบล็อกบัญชีที่มีความเสี่ยง รวมถึงตั้งค่ากฎระดับธุรกรรมที่กำหนดเอง และเข้าถึงการวิเคราะห์ขั้นสูงได้ เครื่องมือกำหนดกฎของ Radar สามารถปรับแต่งได้เพื่อดำเนินการทั้งในระดับบัญชีและธุรกรรมและช่วยให้แพลตฟอร์มปรับการป้องกันการฉ้อโกงให้ตรงกับความต้องการของธุรกิจ Stripe มีการตรวจสอบบัญชีอย่างต่อเนื่องเพื่อบล็อกบัญชีที่ฉ้อโกงตั้งแต่ขั้นตอนการสมัครใช้งาน และให้มอบป้องกันการถูกควบคุมบัญชีที่อาจเกิดขึ้นได้

การเริ่มต้นใช้งานบัญชี: เริ่มต้นใช้งานบัญชีได้อย่างรวดเร็วและปลอดภัยด้วย UI สำเร็จรูปที่เพิ่มประสิทธิภาพเพื่อการเปลี่ยนเป็นผู้ใช้แบบชำระเงิน ซึ่งจะเก็บรวบรวมข้อมูลส่วนบุคคลที่ละเอียดอ่อนและเอกสารประจำตัวที่จำเป็นสำหรับการยืนยันตัวตนอย่างปลอดภัย Stripe ใช้ประสบการณ์จากการยืนยันบัญชีนับล้านบัญชีและใช้ระบบการเป็นเจ้าของเพื่ออนุมัติธุรกิจต่างๆ ได้อย่างราบรื่นกว่าเดิม ขั้นตอนการเริ่มต้นใช้งานของ Stripe จะอัปเดตตามระเบียบข้อบังคับที่เปลี่ยนแปลงไปและตำแหน่งที่ตั้งนานาชาติ โดยมอบประสบการณ์การเริ่มต้นใช้งานที่ราบรื่นเมื่อคุณเติบโตและเข้าสู่ตลาดใหม่ๆ

การยืนยันตัวตน: แพลตฟอร์มที่มีความเสี่ยงเป็นพิเศษต่อการฉ้อโกงระดับมืออาชีพสามารถป้องกันการสูญเสียจากการฉ้อโกงจากบัญชีปลอมด้วย Stripe Identity ซึ่งจะยืนยันตัวตนของผู้ขายทั่วโลกด้วยโปรแกรมไปพร้อมๆ กับการลดการติดขัดสำหรับลูกค้าที่ชอบด้วยกฎหมาย

ข้อมูลการโต้แย้งการชำระเงินและการคืนเงิน: ติดตามตรวจสอบสถานะ (และความเสี่ยง) ของผู้ขายด้วยแดชบอร์ด Stripe ที่สร้างไว้ล่วงหน้า ซึ่งให้ข้อมูลวิเคราะห์และแผนภูมิแบบเรียลไทม์เกี่ยวกับประสิทธิภาพของแพลตฟอร์ม หรือใช้ Stripe Sigma เพื่อวิเคราะห์ข้อมูล Stripe ได้อย่างรวดเร็ว โดยการเขียนคำขอ SQL โดยตรงในแดชบอร์ด คุณสามารถระบุบัญชีที่โต้แย้งการชำระเงินและคืนเงินมากที่สุด และระบุแนวโน้มต่างๆ ในระยะยาวได้ เมื่อมีสิทธิ์เข้าถึงข้อมูลของคุณแบบมีโครงสร้าง คุณจะสามารถสร้าง Webhook เพื่อสร้างการแจ้งเตือนสำหรับพฤติกรรมที่อาจเป็นการฉ้อโกงและตรวจสอบบัญชีที่มียอดเงินติดลบหรือการอัตราการคืนเงินและการดึงเงินคืนสูง

เปิดใช้การตั้งเวลาการเบิกจ่ายที่ยืดหยุ่น: Stripe Connect มีตัวเลือกการตั้งเวลาการเบิกจ่ายที่แตกต่างกัน ซึ่งขึ้นอยู่กับโปรไฟล์ความเสี่ยงของผู้ขาย คุณสามารถเลือกที่จะเบิกจ่ายเงินทุนโดยอัตโนมัติแบบทันทีหรือเป็นรายวันให้กับผู้ขายที่กำหนดได้ หรือตั้งเวลาการเบิกจ่ายแบบกำหนดเองเพื่อชะลอหรือเลื่อนการชำระเงินไปยังบัญชีที่มีความเสี่ยงสูงได้

หากต้องการข้อมูลเพิ่มเติมเกี่ยวกับบริการจัดการความเสี่ยงของ Stripe โปรดติดต่อฝ่ายขายของเรา