La tecnologia ha cambiato radicalmente il modo in cui collaborano le aziende, le banche acquirenti e i circuiti delle carte di credito. L'ascesa delle piattaforme software e dei marketplace ha accelerato il cambiamento: sempre più spesso queste aziende mettono in contatto acquirenti e venditori in modi nuovi, aggiungendo funzionalità di pagamento e servizi finanziari e creando nuove esperienze di acquisto.

In questa guida, scopriremo che cos'è un facilitatore di pagamenti (spesso abbreviato con l'equivalente inglese payfac o PF), esamineremo le considerazioni e i costi dei diversi tipi di soluzioni di facilitatori di pagamenti e identificheremo i modi migliori per aggiungere i pagamenti a una piattaforma o a un marketplace.

Se hai domande o vuoi rivedere il tuo modello aziendale specifico con Stripe, contattaci e saremo lieti di aiutarti.

Cos'è un facilitatore di pagamenti?

Oggi molte piattaforme e marketplace aiutano i venditori a ricevere pagamenti, fornendo servizi online per aziende di tutte le dimensioni. Le funzionalità di pagamento sono diventate parte integrante di queste piattaforme per dare risalto al loro prodotto e renderlo attraente, e i venditori che utilizzano la piattaforma non hanno più bisogno di stabilire relazioni dirette con le banche acquirenti o i gateway di pagamento.

Di seguito sono riportati alcuni dei tipi più comuni di piattaforme e marketplace:

- E-commerce: piattaforme come Shopify e Squarespace, che aiutano le aziende o i privati a vendere beni fisici online.

- Fatturazione: piattaforme come Xero e FreshBooks, che aiutano le aziende a emettere fatture per i propri clienti.

- Raccolta fondi: piattaforme come Kindrid, che aiutano le associazioni non profit e le organizzazioni benefiche a raccogliere fondi o donazioni.

- Prenotazioni: piattaforme come Mindbody e FareHarbor, che facilitano la pianificazione degli appuntamenti.

- Viaggi e vendita biglietti: marketplace come Airbnb, che aiutano a mettere in contatto le persone fisiche con alloggi ed esperienze.

- Commercio al dettaglio: marketplace come Tradesy, che aiutano i privati a vendere gli uni agli altri.

- Servizi on-demand: in questa categoria rientra una serie di servizi, tra cui il ride-sharing (come Lyft, Uber), la consegna a domicilio dei pasti (come Deliveroo, DoorDash) e i servizi professionali (come Handy).

- Altro: assistiamo costantemente alla nascita di piattaforme ibride o completamente nuove, che supportano servizi come la salute online, la consegna di farmaci e persino il noleggio di animali domestici.

Benché ogni tipo di piattaforma o marketplace sia diverso, molti hanno reso i pagamenti una parte integrante dell'esperienza del cliente. Sempre più spesso utilizzano le funzionalità di pagamento per differenziare la loro offerta e il loro marchio, rafforzare le relazioni con i clienti e monetizzare le transazioni sulle loro piattaforme.

Di seguito esamineremo due modelli per introdurre i pagamenti all'interno dell'azienda:

- Soluzioni payfac tradizionali, che consentono alle piattaforme di incorporare i pagamenti con carta nel loro software.

- La soluzione payfac di Stripe, che consente alle piattaforme di muoversi più rapidamente per incorporare e monetizzare i pagamenti e personalizzare altri servizi finanziari come l'emissione di carte e i prestiti.

Storia dei facilitatori di pagamenti

Le soluzioni payfac tradizionali si sono diffuse alla fine degli anni '90 per aiutare le piccole e medie imprese a ricevere più facilmente i pagamenti online. Storicamente, i requisiti di attivazione di una banca si rivolgevano alle aziende più grandi in grado di gestire i complessi, costosi e lunghi processi di configurazione tradizionali. In sostanza, queste aziende dovevano diventare esperte di pagamenti e allo stesso tempo costruire la loro attività principale e il loro prodotto.

Il modello payfac è nato per dare alle aziende specializzate nei pagamenti la possibilità di ridurre la complessità dell'avvio dei pagamenti online e di offrire servizi a una gamma più ampia di aziende, consentendo loro di concentrarsi sulle proprie competenze principali.

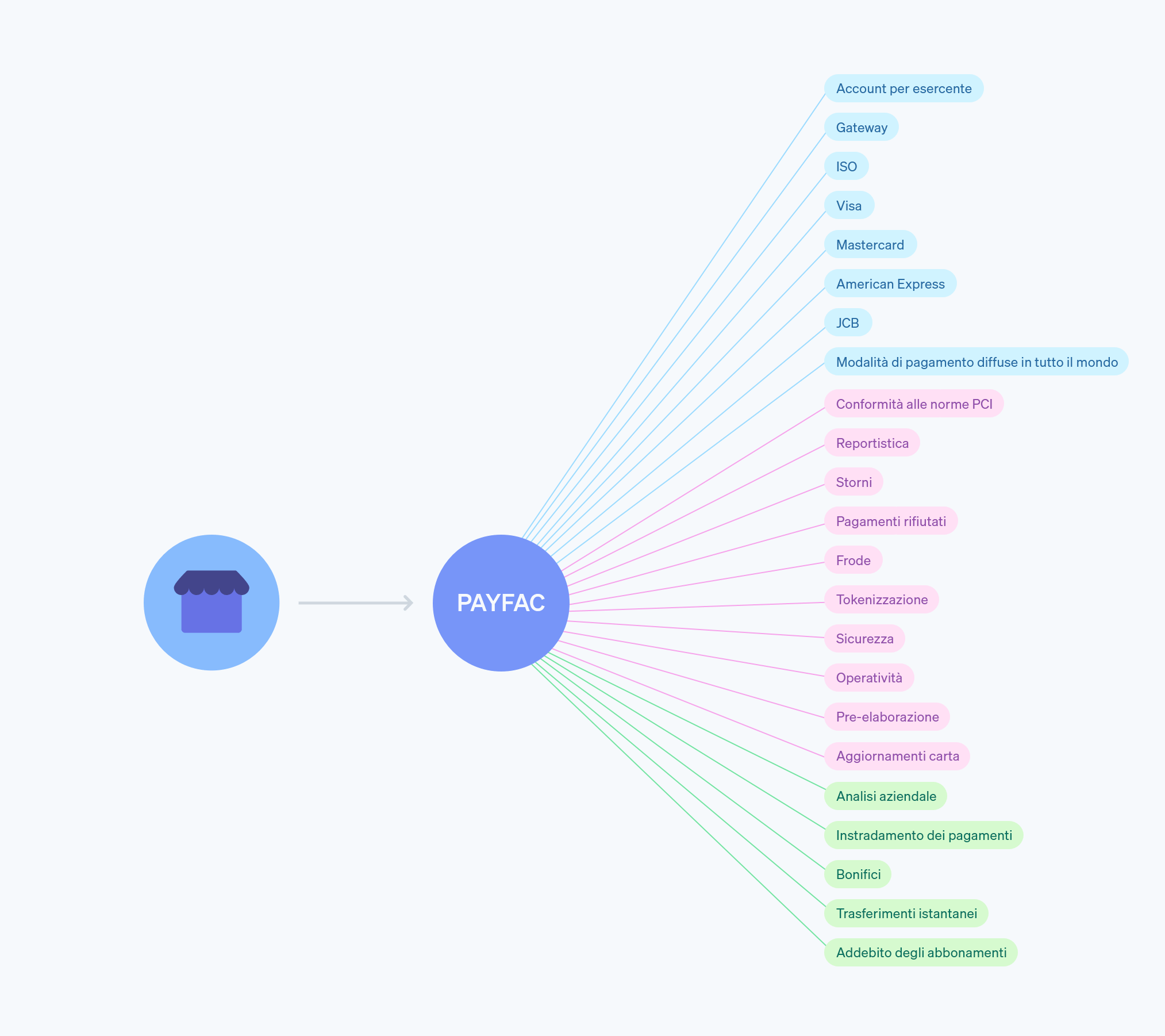

Il facilitatore di pagamenti si fa carico della creazione e della gestione di molteplici relazioni e sistemi, che altrimenti il venditore dovrebbe stabilire e mantenere con ogni singola parte.

Introdurre i pagamenti all'interno dell'azienda

Esistono due tipologie di soluzioni payfac. La prima è una soluzione payfac tradizionale che prevede la collaborazione con una banca acquirente (o un acquirente e un fornitore facilitatore di pagamenti) e la creazione di sistemi per l'elaborazione, l'attivazione, il rischio e altro ancora. Questo in genere dovrà essere fatto paese per paese e consentirà alla tua piattaforma di offrire pagamenti online con carta ai tuoi sub-venditori.

La seconda è una soluzione payfac più moderna e tecnologica offerta da un fornitore di servizi commerciali come Stripe. Stripe ti offre un modo per incorporare e personalizzare pagamenti e servizi finanziari nel tuo software. Sei proprietario dell'esperienza di pagamento e responsabile della creazione dell'esperienza del tuo sub-venditore.

Prima di stabilire in che modo introdurre i pagamenti all'interno dell'azienda, rispondi alle domande seguenti:

- Qual è il mio obiettivo per introdurre i pagamenti all'interno dell'azienda? Voglio migliorare l'esperienza del cliente o approfondire le relazioni con i clienti (aggiungendo valore al mio software), introdurre nuove linee di ricavo e aumentare il valore della mia azienda o favorire una più rapida espansione in nuovi segmenti o aree geografiche?

- Qual è la soluzione di pagamento ideale per la mia azienda? Sono compresi i pagamenti online con carta, i pagamenti di persona nei punti vendita, i pagamenti internazionali (come iDEAL, Alipay, BECS Direct Debit e altri) o i pagamenti senza carta come ACH o Apple Pay? Voglio anche aggiungere servizi finanziari per i miei clienti, come i prestiti, i servizi di prevenzione delle frodi e programmi di carte?

- Quali sono le mie tempistiche e qual è la mia disponibilità a investire nei pagamenti rispetto alla mia attività principale? In che misura intendo dedicare le risorse dei miei sviluppatori, del team legale e dei team operativi? Posso creare nuovi team per gestire i sistemi di pagamento e i bonifici, i processi di attivazione dei venditori e i sistemi di conformità?

- Dove opera la mia azienda? Attualmente dove voglio offrire pagamenti e altri servizi finanziari? Dove progetto di espandermi in futuro?

Soluzioni payfac tradizionali

Le piattaforme che utilizzano una soluzione payfac tradizionale aprono un conto bancario per venditori e ricevono un ID venditore (MID) che consente loro di acquisire e aggregare pagamenti per un gruppo di venditori più piccoli, generalmente chiamati sub-venditori. I facilitatori di pagamenti tradizionali hanno sistemi di pagamento incorporati e registrano il loro MID principale presso una banca acquirente. I sub-venditori, invece, non sono tenuti a registrare il loro MID; le transazioni vengono invece aggregate sotto il MID principale del facilitatore di pagamenti. L'obiettivo è ridurre la complessità che i sub-venditori dovrebbero affrontare nell'impostare i pagamenti online per proprio conto, poiché viene eliminata la necessità di stabilire e mantenere rapporti con una banca acquirente, un gateway di pagamento e altri fornitori di servizi.

La piattaforma è responsabile di quanto segue:

- Controllare chi opera sulla piattaforma: impostare i processi di attivazione corretti e creare fiducia in tali processi.

- Soddisfare i requisiti di conformità KYC, AML e OFAC: accertarsi che i sub-venditori siano stati controllati e che soddisfino i requisiti KYC (adeguata verifica della clientela) e quelli dell'OFAC statunitense. Monitorare l'attività dei sub-venditori per escludere le attività di riciclaggio di denaro e finanziamento del terrorismo. Se si opera al di fuori degli Stati Uniti, occorre considerare molte altre normative e requisiti di conformità.

- Controllare l'attività dell'account sulla piattaforma: mettere in atto controlli per tracciare e ridurre le attività finanziarie ad alto rischio su base continuativa.

- Mantenere la conformità alle norme PCI: accertarsi che la piattaforma sia conforme alla Payment Card Industry (PCI) e che tutti i sub-venditori accettino i pagamenti dai clienti in modo conforme. Per ulteriori informazioni, consulta la nostra guida sulla conformità alle norme PCI.

Benché queste quattro categorie siano chiare, è difficile trovare una descrizione coerente delle responsabilità dettagliate di un facilitatore di pagamenti. Ogni banca acquirente ha regole diverse per i facilitatori di pagamenti registrati, che formano una complessa rete di requisiti tra i circuiti delle carte di credito e le banche. In pratica, un facilitatore di pagamenti registrato è un'entità che gestisce i rapporti con i circuiti delle carte di credito, l'attivazione dei sub-venditori e i servizi di pagamento per i venditori. Il facilitatore di pagamenti gestisce direttamente il pagamento dei fondi ai sub-venditori.

La maggior parte dei requisiti per i facilitatori di pagamenti sono applicati dai circuiti delle carte di credito e dalle banche acquirenti. Tuttavia, le differenze regionali influenzano la severità con i circuiti delle carte di credito e le banche applicano questi requisiti nelle Americhe, in Europa e in Asia. Ad esempio, Visa e Visa Europe sono due entità differenti, ciascuna con le sue regole.

Secondo le regole del circuito delle carte di credito, un facilitatore di pagamenti registrato deve:

- Eseguire un'adeguata verifica su ciascun sub-venditore.

Firmare un accordo commerciale di accettazione per conto di una banca acquirente. - Monitorare tutte le attività dei sub-venditori per garantire la conformità agli standard dei circuiti.

- Mantenere la conformità alle norme PCI.

- Utilizzare i fondi di regolamento dei pagamenti esclusivamente per pagare i sub-venditori.

Se un sub-venditore supera una determinata soglia di volume di transazioni, è tenuto a stipulare un accordo commerciale diretto con la banca acquirente.

Per iniziare

Le soluzioni payfac tradizionali richiedono la creazione e l'investimento in più sistemi per l'elaborazione dei pagamenti, l'attivazione dei sub-venditori, la conformità, la gestione del rischio, i bonifici e altro ancora. Le piattaforme hanno anche requisiti continui volti a mantenere la loro buona reputazione e requisiti di credito con le banche acquirenti e i circuiti delle carte di credito.

L'Electronic Transactions Association (un'organizzazione consultiva con membri di banche, circuiti delle carte di credito ed elaboratori di pagamento, nota anche come ETA) raccomanda vivamente di rivolgersi a esperti del settore e a consulenti legali per garantire il rispetto delle leggi e delle linee guida in materia di circuiti delle carte di credito, banche acquirenti, governi statali e federali e organizzazioni di regolamentazione globale (come l'OFAC).

Impostare sistemi di pagamento online

- Trovare una banca acquirente: le piattaforme devono rivolgersi alle banche acquirenti con un business plan per stabilire una partnership e ottenere la sponsorizzazione per facilitare i pagamenti dei sub-venditori.

- Integrare i gateway di pagamento: i gateway di pagamento forniscono ai sub-venditori le funzionalità per elaborare i pagamenti online.

- Ottenere la certificazione PCI DSS di livello 1: per garantire la sicurezza dei dati sensibili, la piattaforma deve essere certificata PCI DSS (Payment Card Industry Data Security Standard), che può anche includere la certificazione Europay, Mastercard e Visa (EMV o chip) se la piattaforma supporta transazioni di persona.

- Creare un sistema di gestione dei venditori: questo include dashboard per i venditori, sistemi di pagamento e sistemi di gestione delle contestazioni per gestire gli storni.

Configurare l'attivazione dei venditori e dei sistemi di conformità

Creare politiche e sistemi di valutazione del rischio che garantiscano l'attivazione solo alle aziende legittime che rispettano le regole del circuito di carte e della banca acquirente. Il sistema e i dipendenti della piattaforma dovranno fare quanto segue:

- Verificare le identità dei sub-venditori, compresi KYC, struttura proprietaria e dettagli aziendali.

- Controllare gli elenchi OFAC e MATCH per i sub-venditori prima dell'attivazione; Mastercard gestisce l’elenco Member Alert to Control High-Risk Merchants (MATCH).

- Valutare la salute e il rischio finanziario del sub-venditore, compresi i rischi di frode, credito, finanziari, di conformità, normativi o di reputazione.

Costruire sistemi e politiche interne per eseguire un'adeguata verifica allo scopo di gestire e mitigare il rischio. Il sistema e i dipendenti della piattaforma dovranno fare quanto segue:

- Rispettare le leggi antiriciclaggio codificando le regole e i requisiti dei circuiti delle carte di credito e delle organizzazioni di regolamentazione.

- Identificare le attività sospette (compresi gli indicatori di finanziamento del terrorismo).

- Presentare le segnalazioni di attività sospette (File Suspicious Activity Reports, SAR) al Financial Crimes Enforcement Network (FinCEN) o alla banca acquirente, come richiesto.

Presentare le registrazioni e richiedere eventuali licenze aggiuntive:

- Registrarsi come facilitatore di pagamenti presso ogni circuito di carte in ogni paese.

- Richiedere le licenze di trasferimento di denaro (MTL) in ogni Stato in cui opera il facilitatore di pagamenti, se necessario per supportare determinati flussi di fondi.

- Richiedere le licenze regionali, se necessario. (Brasile, Malesia e UE ad esempio richiedono licenze separate).

Gestire i processi e i sistemi in corso

- Attivare e valutare il rischio di ogni sub-venditore: verificare l'identità, il modello aziendale e le informazioni sul titolare di ciascun sub-venditore. Configurare l'elaborazione dei pagamenti per i sub-venditori.

- Monitorare il rischio e aggiornare i sistemi di gestione del rischio: eseguire un'adeguata verifica, monitorare l'attività dei sub-venditori su base continuativa e ridurre il rischio secondo le necessità (ad esempio, applicare tetti di elaborazione, finanziamenti ritardati o riserve).

- Prevenire e bloccare le frodi: prevenire in modo proattivo le frodi sulla piattaforma e bloccare o esaminare le transazioni sospette. Le pratiche ottimali comprendono l'utilizzo del machine learning adattivo per il rilevamento delle frodi. Presentare prove ai circuiti delle carte di credito se necessario per gli storni destinati ai sub-venditori.

- Versare fondi ai sub-venditori: accertarsi che i sub-venditori ricevano puntualmente i loro guadagni.

- Reportistica e riconciliazione: generare e distribuire il modulo 1099 o altri moduli fiscali richiesti annualmente.

- Mantenere la conformità agli standard PCI DSS: garantire la conformità della piattaforma anche quando i flussi di dati e le esperienze dei clienti si evolvono. Ricorda che alcuni circuiti di carte possono richiedere ai facilitatori di pagamenti di presentare rapporti trimestrali o annuali o di effettuare una valutazione annuale in loco per convalidare la conformità in corso.

- Rinnovare la registrazione come facilitatore di pagamenti e le licenze: effettuare una nuova registrazione annuale come facilitatore dei pagamenti presso i circuiti delle carte di credito e aggiornare o rinnovare le MTL secondo la cadenza richiesta.

Espansione globale

Se la tua piattaforma deve operare a livello internazionale e supportare sub-venditori in altre regioni, potrebbero essere necessarie partnership con banche acquirenti, gateway e altri fornitori di servizi locali. In generale, le piattaforme costruiscono sistemi locali da zero per adattarsi ai requisiti locali o per supportare più regioni.

Anche i governi e le autorità di regolamentazione possono avere requisiti differenti in base alla localizzazione geografica. La legge europea sui pagamenti, nota come seconda direttiva sui servizi di pagamento o PSD2, ha introdotto importanti cambiamenti che hanno avuto un impatto significativo sulle piattaforme nonché sulle attività di marketplace in Europa. Molte di queste aziende non possono più contare sull'esenzione dalle licenze di cui si erano avvalse in precedenza. Le piattaforme che controllano il flusso di fondi devono acquisire una licenza per la moneta elettronica, che può richiedere mesi e milioni di euro.

Adattarsi ai cambiamenti dello scenario

La definizione di facilitatore di pagamenti è ancora in evoluzione, così come il suo ruolo. Ad esempio, nel settembre 2018, l'ETA ha pubblicato un rapporto di 73 pagine con le nuove linee guida. Tutti gli investimenti fatti ora dovranno essere aggiornati nel tempo per soddisfare le normative e i requisiti in evoluzione.

Anche lo scenario tecnologico sta cambiando: considera che a fornitori e venditori diversi può essere richiesto di offrire soluzioni per metodi di pagamento locali (come SEPA, Alipay o iDEAL), valute multiple, pagamenti su dispositivi mobili, transazioni di persona, sistemi di addebito per la fatturazione o pagamenti di abbonamenti e molto altro ancora.

Scadenze e costi

Configurazione dei sistemi di pagamento

|

|

Descrizione

|

Tempo minimo richiesto in mesi

|

Costo minimo approssimativo

|

|---|---|---|---|

| Sponsorizzazione degli acquirenti |

Metti in atto un solido piano aziendale ed eventualmente assumi un consulente che ti assista Assumi un legale per i pagamenti |

3-6 | Variabile in base alla banca acquirente |

| Gateway di pagamento | Negozia, stipula contratti e integra gateway di pagamento | 1-4 | Variabile in base al gateway, ma in genere una combinazione di commissioni fisse e per transazione |

| Conformità alle norme PCI (e certificazione EMV, se necessaria) | Convalida la conformità PCI DSS di livello 1 (include la visita del revisore in loco) | 3-5 | 50.000 USD–500.000 USD |

| Sistema di gestione degli esercenti |

Crea dashboard per gli esercenti Crea sistemi di emissione dei bonifici per gli esercenti Crea sistemi di gestione delle contestazioni per diversi circuiti delle carte di credito |

6-12+ | Oltre 600.000 USD (almeno 4 FTE a 150.000 USD all'anno) |

Attivazione degli esercenti e configurazione dei sistemi di conformità

|

|

Descrizione

|

Tempo minimo richiesto in mesi

|

Costo minimo approssimativo

|

|---|---|---|---|

| Programma di conformità |

Codifica requisiti per i circuiti delle carte Crea sistemi di memorizzazione e salvaguardia dei dati |

2-8 | Oltre 300.000 USD (almeno 2 FTE a 150.000 USD all'anno) |

| Politiche di valutazione del rischio |

Integra con fornitori di servizi di verifica dell'identità Crea sistemi di valutazione dei rischi |

3-12 | Oltre 500.000 USD |

| Fornitore terzo (facoltativo) | Seleziona, stipula contratti e integra sistemi di terze parti | 3-6 | 50.000 USD–500.000 USD |

Registrazioni e ottenimento di licenze

|

|

Descrizione

|

Tempo minimo richiesto in mesi

|

Costo minimo approssimativo

|

|---|---|---|---|

| Costi di licenza e registrazioni a norma di legge |

Commissioni iniziali corrisposte a Visa (5.000 USD) e Mastercard (5.000 USD) MTL richiesti se un facilitatore di pagamenti controlla flussi di fondi (150.000 USD all'anno per circa 3 anni per 50 stati: minimo 450.000 USD) Licenze internazionali (ad es., per moneta elettronica nell'UE), se del caso |

6-18 |

Costi del circuito: 10.000 USD Licenze negli Stati Uniti e nel mondo: oltre 1.000.000 USD+ |

Spese in corso

|

|

Descrizione

|

Costo minimo approssimativo

|

|---|---|---|

| Attivazione e monitoraggio degli esercenti |

Le commissioni una tantum includono 1 USD–2 USD per l'attivazione e l'analisi iniziale dei rischi e 2 USD–3 USD per la verifica dell'identità Sistema di monitoraggio costante |

5 USD al mese per account |

| Monitoraggio e mitigazione dei rischi |

Due diligence e gestione del rischio per garantire il rispetto della conformità da parte di tutti i sub-esercenti Aggiorna i sistemi di protezione dei rischi a cadenza regolare Mantieni saldi o riserve a livello di piattaforma per i sub-esercenti così da ridurre il rischio di credito |

Oltre 250.000 USD all'anno (1 FTE a 150.000 USD all'anno e un analista dei rischi a 100.000 USD all'anno) |

| Prevenzione delle frodi | Gestisci o integra con sistemi di terze parti per prevenire e bloccare le frodi | 0,04 USD–0,10 USD per transazione |

| Gestione degli storni | Gestisci gli storni e l'invio di prove | 15 USD per contestazione |

| Instradamento di fondi e bonifici | Assicurati che gli esercenti ricevano i pagamenti secondo le tempistiche desiderate | 0,25 USD per transazione |

| Reportistica e riconciliazione |

Genera e distribuisci moduli 1099 e altra modulistica fiscale richiesta (il prezzo minimo per generare un modulo 1099 è pari a 5 USD, tuttavia è passibile di una penale di 250 USD in caso di errori nella presentazione della documentazione) Esegui processi di chiusura finanziaria a livello di piattaforma e audit finanziari secondo necessità |

5 USD–255 USD per modulo 100.000 USD per anno (1 finanza FTE) |

| Convalida PCI annuale | Convalida la conformità PCI DSS di livello 1 ogni anno ed effettua la riconvalida ogni volta che vengono apportate modifiche ai flussi di pagamento durante l'anno | Oltre 200.000 USD all'anno |

| Rinnova la registrazione come facilitatore di pagamenti (e altre licenze, se necessarie) |

Effettua nuovamente la registrazione come facilitatore di pagamenti con Visa e Mastercard (5.000 USD ciascuno all'anno) Rinnova le licenze per la trasmissione di denaro ogni 2 anni |

Oltre 10.000 USD all'anno |

La soluzione payfac di Stripe

Le soluzioni payfac tradizionali richiedono tempi e investimenti finanziari significativi e limitano le opportunità di guadagno delle piattaforme per i pagamenti online con carta.

La soluzione payfac di Stripe è basata sulla tecnologia e progettata per aiutare le piattaforme a incorporare completamente i pagamenti e i servizi finanziari aggiuntivi nel loro software. Aiuta le piattaforme a entrare rapidamente nel mercato, a mantenere bassi i costi di installazione e a far crescere il loro potenziale di monetizzazione.

Piattaforme come Lightspeed e Shopify utilizzano Stripe per incorporare e personalizzare i pagamenti e offrire ai clienti un valore aggiunto come i pagamenti con soluzione POS, i programmi di emissione di carte, le soluzioni antifrode, gli abbonamenti e i finanziamenti. L'utilizzo di Stripe consente alle piattaforme di fornire esperienze di pagamento personalizzate ai propri clienti e di monetizzare una serie di prodotti e servizi finanziari correlati.

La soluzione API-first di Stripe consente alle piattaforme di progettare la migliore esperienza per i propri clienti. Le piattaforme hanno la possibilità di:

- Personalizzare completamente l'esperienza d'uso o sfruttare componenti dell'interfaccia utente predefiniti

- Impostare la tempistica dei bonifici

- Impostare tariffe e commissioni

- Gestire complessi trasferimenti di denaro

- Integrare e unificare la reportistica finanziaria

- Espandere l'attività a livello globale senza dover creare conti bancari locali ed entità aziendali in ogni mercato

- Offrire ai clienti nuovi servizi come i pagamenti con soluzione POS, la fatturazione, l'emissione di carte di pagamento, gli abbonamenti e i prestiti

Un confronto

Ripensa alle domande che ti sei posto su come introdurre i pagamenti all'interno dell'azienda.

- Quali sono i tuoi obiettivi nell'introdurre i pagamenti nell'azienda: valore aggiunto per il software, nuove linee di ricavo o un'espansione più rapida?

- Qual è la tua soluzione ideale: solo pagamenti online o anche servizi finanziari e metodi di pagamento aggiuntivi?

- Quali sono le tue tempistiche e qual è la tua disponibilità a investire nei pagamenti rispetto alla tua attività principale?

- Dove opera la tua azienda oggi e in futuro?

Tenendo conto delle tue risposte, considera in che modo la soluzione payfac di Stripe è paragonabile alla soluzione payfac tradizionale:

- Stripe consente alle piattaforme di iniziare a monetizzare i pagamenti più velocemente e sul volume globale, non solo il volume statunitense. Le soluzioni payfac tradizionali richiedono mesi per essere avviate e in genere funzionano solo negli Stati Uniti, per cui è necessario investire in più soluzioni quando ci si espande in nuovi mercati.

- La soluzione payfac di Stripe ha costi di configurazione e spese correnti inferiori rispetto alle soluzioni payfac tradizionali.

- Stripe consente alle piattaforme di arricchire il proprio prodotto e di ottenere ricavi da altri servizi finanziari come prestiti, programmi di emissione di carte, pagamenti con soluzione POS e bonifici più veloci. L'integrazione dei servizi finanziari può far aumentare il fatturato per cliente di 2-5 volte rispetto al modello tradizionale. Le soluzioni payfac tradizionali sono limitate ai soli pagamenti online con carta.

L'aggiunta di pagamenti e servizi finanziari a una piattaforma o a un marketplace presenta numerosi vantaggi. La soluzione payfac di Stripe può contribuire a differenziare la tua piattaforma nei mercati competitivi, a migliorare l'esperienza dei sub-venditori e a rappresentare un importante fattore di guadagno per le piattaforme.

Per ulteriori informazioni sulla nostra soluzione, visita il nostro sito web. Se desideri parlare con il nostro team del tuo caso d'uso specifico e discutere degli approcci da adottare, contattaci.