The limited partnership brings together investors (i.e. limited partners) and entrepreneurs (i.e. general partners) while limiting the financial risk of the investors. In this article, we discuss how a limited partnership works in France before examining the differences between a partnership limited by shares (société en commandite par actions, or SCA) and the standard limited partnership (société en commandite simple, or SCS).

What’s in this article?

- What is a limited partnership?

- How does a limited partnership work?

- Advantages of limited partnerships

- Disadvantages of limited partnerships

- The different types of limited partnerships

- How to set up a limited partnership in France

What is a limited partnership?

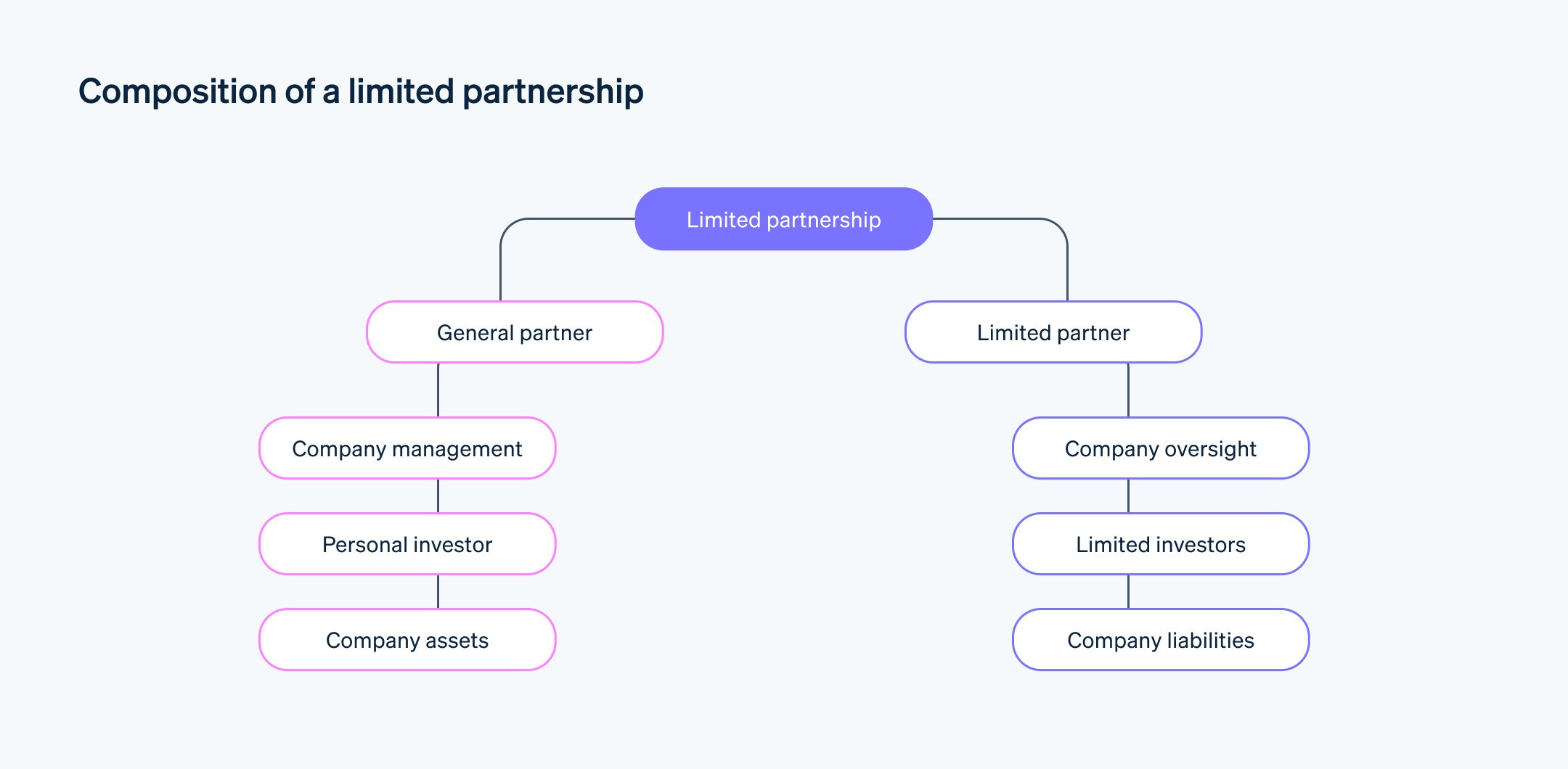

A limited partnership is a legal structure consisting of two types of partners: general partners and limited partners.

In a limited partnership, general partners have unlimited liability for the partnership’s debts, while limited partners are liable only for the amount they have contributed. This hybrid status positions this type of business between partnerships and corporations.

The limited partnership provides significant flexibility and protects the assets of the limited partners while maintaining a streamlined management structure.

How does a limited partnership work?

The operation of a limited partnership is based on the presence of two types of partners. To clarify the roles and management of the business, it’s important to understand the two groups: general partners and limited partners.

What is a general partner?

General partners play a central role in the management of the limited partnership. As active partners, they hold merchant status and oversee the day-to-day operations of the business. They have considerable independence in managing the business but have unlimited liability for its debts.

While general partners are generally appointed as managing partners, the partnership agreement can change this rule. These partners – whether managing or not – are classified as self-employed and are subject to the general social security system for self-employed persons. This status gives them access to certain employee protections but also exposes them to higher social security contributions than employees.

What is a limited partner?

Limited partners, on the other hand, play a more passive role. They provide the capital needed to grow the business and provide oversight of management. They participate through shareholder meetings and, if provided for in the company’s articles of association, a board of directors.

Their role is limited to overseeing the company’s operations. They do not participate in day-to-day management decisions and cannot, under any circumstances, bind the company to third parties.

Their liability is, therefore, limited to the amount of their capital contribution. Limited partners cannot be held personally liable by creditors.

Advantages of limited partnerships

A limited partnership is a type of corporation that offers benefits to each type of shareholder. Partners, whether general or limited, receive profits, and the amount varies according to the rules established by each company.

Typically, this type of organisation offers a number of benefits:

Flexibility: It provides significant flexibility in the management and financing of the company, allowing the structure to be tailored to the unique needs of each project.

Asset protection: Limited partners have limited liability because their financial risk is restricted to their capital contribution.

Investor attraction: This structure can be attractive to investors who want to participate in a project with a limited amount of risk while enjoying the potential for a high return.

Disadvantages of limited partnerships

The unlimited liability of general partners is an obvious risk. Managers are also personally liable to cover the company’s debts with their own assets. If the company runs into financial difficulties, the managers’ personal assets can be seized to repay creditors.

Other disadvantages include:

Risk of partner conflicts: The division of roles between general partners (i.e. managers) and limited partners (i.e. investors) can lead to conflicts of interest regarding the firm’s strategy.

Management complexity: Having two types of partners with different rights and responsibilities can complicate management and requires careful organisation.

Restrictions on limited partners: Limited partners are not involved in the day-to-day management of the business. Their role is limited to providing capital.

The different types of limited partnerships

Limited partnership

An SCS is a type of limited partnership in which the rights of the partners are proportional to their individual contributions. In other words, both general and limited partners receive dividends based on their share of the company’s capital.

Compared to other legal forms, the SCS strikes a balance between management flexibility and investor asset protection. It is often preferred by startup or fast-growing companies seeking capital while maintaining a degree of managerial independence.

Partnership limited by shares

An SCA is a company in which capital is divided into shares that can be freely traded, while some partners can have unlimited liability.

The SCA appeals to entrepreneurs and artisans who wish to combine the flexibility of a small structure with the stability of a commercial company. The SCA is aimed at retailers and a wide range of professionals, including artisans, industrialists, and the self-employed, with the exception of certain fields, such as the legal and medical professions.

Whether you choose an SCS or SCA, Stripe Payments gives you access to over 100 payment methods to help you grow your business. Stripe offers a range of technology tools tailored to different needs to simplify and speed up your limited partnership transactions.

How to set up a limited partnership in France

Similar to other business entities, SCAs and SCSs follow a defined and structured process. The formation of a limited partnership involves a number of legal formalities. Although the process is similar to those of other commercial companies, there are some unique aspects due to the hybrid nature of this structure.

The main steps are as follows:

Draft the articles of association: This document is the outline of the company’s organisation and the roles and responsibilities of each partner.

Determine share capital: The minimum share capital for an SCA is €37,000. This amount must be paid by the partners, with a percentage paid in cash at the time of incorporation. French law does not specify minimum share capital for SCSs. This allows the partners to choose any amount for the share capital, even as little as a symbolic euro.

Publish a legal notice: The publication of a notice of incorporation in a legal gazette is required to inform the public of the formation of the company.

File the registration: Submit the complete file – including the articles of association, proof of legal publication, and other supporting documents – to the commercial court clerk’s office. These formalities can now be completed online through the business formalities portal.

Register: Once the application is approved, the company receives a Business Directory Identification System (SIREN) number and is officially registered with the Trade and Companies Register (registre du commerce et des sociétés, or RCS).

For more details, visit the official French government website for creating an SCA or SCS.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.