Merchant fees are charges that businesses must pay when they accept electronic payment methods, such as credit cards or debit cards. These fees are a combination of several different costs and are typically a percentage of the transaction amount, sometimes with an additional fixed fee. Although merchant fees are only a fraction of the total transaction price, they add up. According to the Nilson Report, US businesses paid a total of US$160.7 billion in fees to process nearly US$10.6 trillion in payments in 2022.

Below, we'll go over the key elements of merchant fees, including the types of fee that most businesses will encounter, ways you can work to reduce the overall financial impact of merchant fees on your bottom line, and the factors to consider when choosing a payment processing provider.

What's in this article?

- Types of merchant fee

- Why merchant fees are so important for businesses to understand

- Ways to minimise merchant fees and costs

- How to choose a payment processing provider

- Stripe's merchant fees

Types of merchant fee

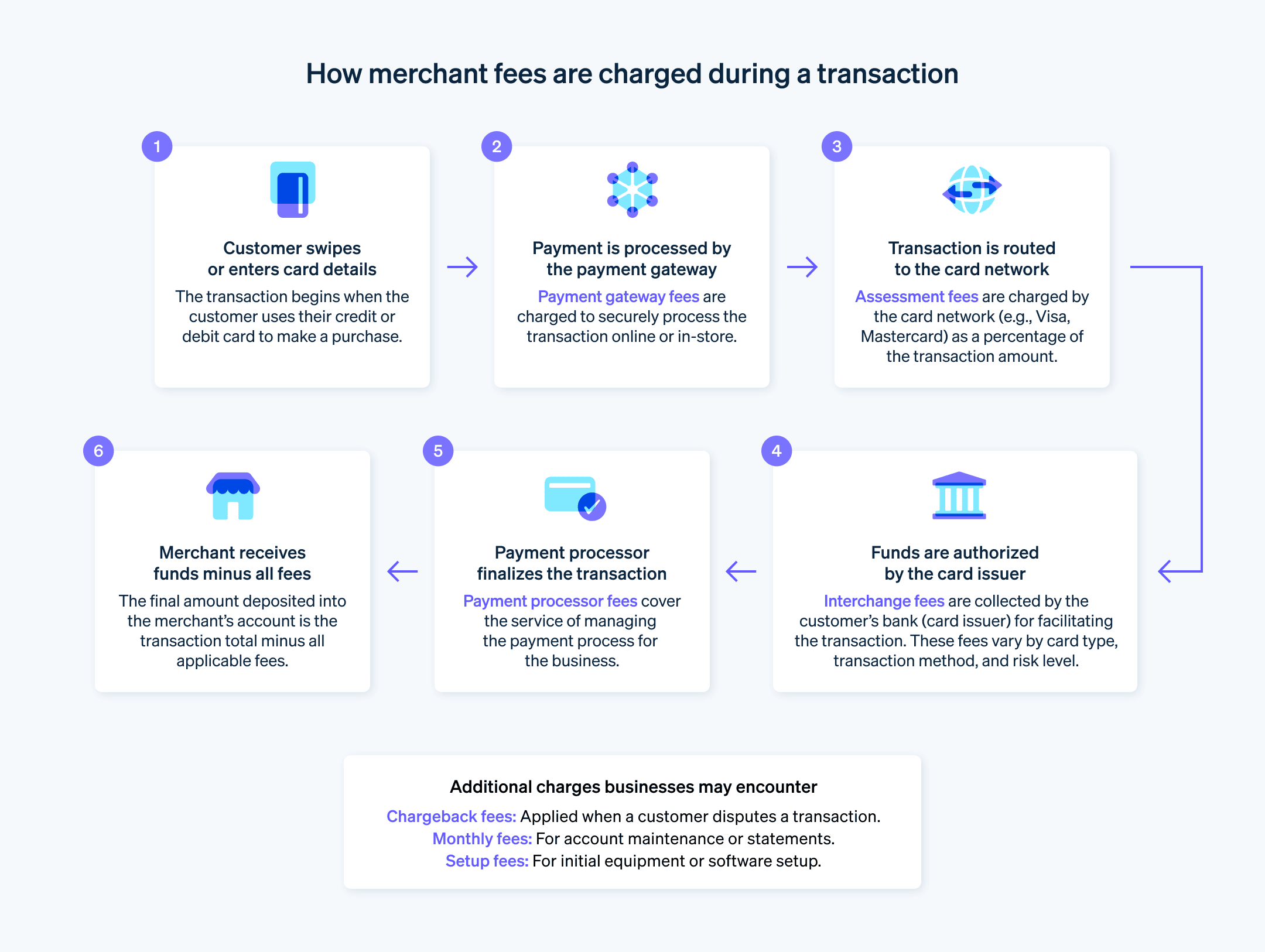

Merchant fees encompass a variety of charges that businesses face when processing electronic payments, such as credit or debit card transactions. The main types of merchant fee include:

Interchange fees: These are fees that the bank issuer of the customer's credit or debit card charges. The amount is a percentage of the transaction value and may include a fixed fee. Interchange rates vary based on factors such as the type of card used, the transaction's risk level and whether the transaction was in person or online.

Assessment fees: These fees, which are charged by the credit card networks (e.g. Visa, Mastercard, American Express, etc.), are usually a fixed percentage of the transaction amount. The business's bank pays assessment fees to the card network.

Payment processor fees: These fees are charged by the payment processor company handling the transaction processing on behalf of the business. They can be structured in a variety of ways, including as a percentage of each transaction, a flat fee per transaction, monthly fees, or a combination of these.

Monthly statement fees: Some payment processors charge a fee for providing a monthly statement of transactions.

Payment gateway fees: Businesses often use a payment gateway for online transactions, and this service may come with its own set of fees. This can be a per-transaction fee, a monthly fee, or both.

Minimum monthly fees: Some processors charge a minimum monthly fee, which is the lowest amount a business must pay in processing fees per month. If transaction fees don't add up to this amount, the business pays the difference.

Setup and equipment fees: These fees cover setting up a merchant account or renting or purchasing necessary hardware (such as POS systems or card readers).

Chargeback fees: When customers dispute a transaction, it can result in a business needing to return funds, which is known as a chargeback. When a chargeback occurs, businesses are often charged a fee. This fee covers administrative costs associated with handling the dispute.

Early termination fees: Some merchant service agreements have a contract term, and terminating the contract early can result in fees.

Incidental fees: These can include fees for additional services (such as paper statements), batch processing fees or fees for non-compliance with security standards.

Why merchant fees are so important for businesses to understand

Merchant fees have a direct impact on a business's profitability. The cost that comes with every swipe of a credit or debit card can eat into a business's bottom line if they are not managed properly.

Here's why understanding merchant fees is so important:

They affect pricing: Merchant fees are a business expense, just like rent or employee salaries. To cover these costs, businesses need to absorb them into their profit margins or pass them on to customers in the form of higher prices. Understanding your merchant fees helps you make informed decisions about pricing strategies and avoid losing money on transactions.

They can vary substantially: Different card types, transaction amounts and industries have different interchange fees. For example, debit cards typically have lower interchange fees than credit cards, and online transactions often have higher fees than in-store purchases. Learning these variations enables you to choose the payment methods and processing options that are most cost effective for your business.

They can be negotiable: While some fees, such as interchange fees, are set by the card networks, others – such as merchant account fees – can be negotiated with your payment processor. Understanding the different types of fee – and how they are calculated – can give you the power to negotiate better rates.

They can help you identify fraud: Some merchant fees, such as chargeback fees, are incurred when a customer disputes a transaction. Learning about the fees associated with chargebacks can prepare you to deal with potential fraud and prevent it from eating into your bottom line.

Ways to minimise merchant fees and costs

While merchant fees are an unavoidable part of processing payments for today's businesses, the right strategy can lower costs and minimise hassle. Here are a few key ways to do this:

Choose the right payment processor: Selecting an appropriate payment processor means evaluating its fee structures against your business's transaction patterns. Processors have different terms for different transaction sizes and volumes, and some may provide specific benefits for your industry.

Negotiate lower rates: Businesses with high transaction volumes or an established history of sales have the potential to negotiate reduced rates with payment processors.

Encourage debit card payments: Debit card transactions typically incur lower fees than credit cards. Encouraging customers to use debit cards, possibly through incentives or discounts, can help reduce overall transaction costs.

Use an address verification service (AVS): AVS helps lower the risk of fraud in online transactions, which can lead to lower transaction fees and reduce chargebacks.

Set a minimum card transaction amount: Implementing a minimum purchase requirement for card payments can help offset transaction fees, making small transactions more cost effective and protecting profit margins.

Batch-process transactions: Processing all card transactions in one batch, typically at the end of the day, can be more cost effective than processing each transaction as it occurs.

Choose standardised hardware and software: Using widely supported and standard payment processing solutions can be more economical for businesses. Using these kinds of solution also offers businesses easier access to support and maintenance.

Avoid chargebacks: Businesses can reduce chargebacks through explicit policies, exceptional customer service and comprehensive fraud prevention measures. Chargebacks come with additional fees and can increase processing costs for a business.

Review your merchant account statements regularly: Reviewing account statements can help you identify and address unexpected fees, billing errors or changes in fee structures.

Ensure PCI compliance: Maintaining compliance with the Payment Card Industry Data Security Standard (PCI DSS) helps you avoid non-compliance fees and protects against costly data breaches and related fines.

Use off-peak processing times: Some payment processors have lower fees for transactions processed during off-peak hours, which can be a cost-saving opportunity for batch processing.

Take advantage of technology for efficiency: Modern point-of-sale (POS) systems and payment technologies can speed up transaction processing, reduce errors, and provide valuable sales and customer insights.

Consider alternative payment methods: Providing alternative payment options – such as bank transfers or digital wallets – can attract a broader customer base and potentially come with lower processing fees compared to traditional credit card transactions.

How to choose a payment processing provider

Choosing the right payment processing provider is an important step for any business that accepts payments online or in person. It can affect everything from customer experience to your bottom line. Here's how the selection process works:

Understand your needs

Transaction volume: How many transactions do you expect to process monthly? Higher volumes might require dedicated account managers or different pricing models.

Business type: Is your business online-only, brick-and-mortar or hybrid? Each category may require specific features.

Payment methods: Which payment methods do your customers prefer? Credit cards, debit cards, digital wallets or ACH transfers? Prioritise providers that support your needs.

Integration: Does your existing software/POS system have compatible integrations with the provider? Smooth integration saves time and resources.

Industry specificity: Identify whether your industry has specialised needs. Some providers cater to specific industries, such as e-commerce, health care or subscriptions.

Chargeback rates: Certain industries have higher chargeback risks. Factor in the provider's chargeback prevention tools and fees associated with disputes.

Global expansion: If you plan on international expansion, make sure the provider supports the relevant currencies and complies with regional regulations.

Recurring billing: If you offer subscriptions, choose a provider with recurring billing features and reporting capabilities.

Research potential providers

Popular options: Research industry leaders to fully understand your options.

Smaller players: Smaller providers might provide niche features or cater to specific industries.

Reviews and features: Check independent review websites and compare features provided by shortlisted providers.

Specific features: Go beyond basic features and compare specific functionalities, such as mobile payments, invoicing, virtual terminals and data analytics.

User experience: Look for user reviews and test demos to assess the provider's platform usability and interface.

Security certifications: Look for industry-recognised certifications, such as PCI DSS Level 1 compliance for secure data handling.

Integrations and plugins: Check compatibility with your existing software and any necessary plugins for added functionality.

Consider these key factors

Fees and pricing: Compare transaction fees, monthly fees, PCI compliance costs and any potential hidden charges. Look for transparency and flexible pricing models.

Security: Assess the provider's security measures, such as PCI compliance, fraud prevention tools and data encryption protocols.

Customer support: Check the availability, quality and response times of customer support channels.

Scalability: Can the provider adapt to your future growth needs? Consider transaction limits, account management options and international capabilities.

Narrow down your choices and compare quotes

Narrow it down: Select two to three providers that best meet your needs.

Get a quote: Request detailed quotes that break down all fees and potential charges.

Be diligent: Clarify any doubts or questions that you might have about their services.

Negotiate rates: Be prepared to negotiate fees, especially for high-volume or long-term commitments.

Test support: Contact customer support with questions to gauge their knowledge and responsiveness.

Free trials and demos: Use any available trial periods or demos to test the platform's functionality and compatibility with your workflow.

Make your decision

Weigh up your priorities: Prioritise your most important needs – such as security, features or cost – to make the final decision.

Read contracts carefully: Pay close attention to termination clauses, hidden fees and dispute-resolution procedures.

Make a choice: Choose the provider with the best combination of features, security, price and customer support.

Stripe's merchant fees

Stripe uses a pay-as-you-go model with no setup fees or monthly charges. This means that businesses only pay for the transactions they process. Stripe's fees are charged per transaction at different set rates, which are based on factors such as location and payment method (e.g. credit card; debit card; bank transfer; buy now, pay later). Here's a breakdown of Stripe's primary fees.

Other fees

Chargebacks: Stripe typically charges a flat rate per dispute, which varies depending on location.

Currency conversion: Stripe charges a fee for converting currencies, with the rate depending on location.

Radar fraud prevention: Stripe's fraud detection tools are built into the system, and the relevant fees are waived for accounts with standard pricing. However, some enterprise plans may require more advanced security and come with additional fees.

PCI compliance: Businesses are responsible for maintaining PCI compliance, which may involve additional costs.

Here are some factors that can affect your Stripe fees

Your business type: Some industries have higher interchange fees (charged by card networks), which Stripe passes on to you.

Your transaction volume: High-volume businesses may qualify for negotiated rates.

The types of card your customers use: Premium cards may have higher interchange fees.

Find out more about Stripe's pricing structure.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.