Stripe and the UK: A decade in the digital economy

Ten years ago, Stripe went live in the United Kingdom and businesses from every corner of the country signed up and started their journey online. They included Bloom & Wild, the brainchild of Aron Gelbard, who found a way to fit bouquets through letterboxes and built an online business powered by Stripe.

“It was quite an exciting time to set up an internet business. We were part of an early cohort in the UK so there wasn't an established playbook,” recalled Gelbard.

Bloom & Wild was one of many early bets on an unproven concept. At the time Gelbard was starting out, the internet was already 30 years old, but the internet economy was still in its infancy. Four million households in the UK had no internet access and seven million adults had never used the internet at all; half the population still didn’t have a smartphone and the UK had just introduced its first 4G network.

Bloom & Wild launched in 2013 and now serves millions of customers in eight countries.

Ten years later, that’s all changed. Today, more than 90% of UK adults use mobile internet and 60% of them are connected to 5G networks. Online commerce has surged as a consequence—from 10.5% of retail sales in 2013 to 26.6% (and rising) today. Bloom & Wild now serves millions of customers in eight countries.

The digital infrastructure needed to start and run an online business has also improved dramatically. Online business software costs have fallen around 90% over the last decade, according to Stripe estimates. Platforms have sprung up to provide cost-efficient, easy-to-access business software for every conceivable industry, from Treatwell for hair and beauty salons to Herdwatch for farmers.

As a result, turning an idea into an internet business has never been easier. In 2013, a handful of UK businesses and charities used Stripe. Now, well over 300 ventures get started on Stripe every day, and UK businesses collectively process nearly a billion transactions a year through Stripe.

Regional rebalancing

London’s dominance in the internet economy is no surprise; the city is home to more Stripe users than any other in the world. But accessible financial infrastructure has provided the foundation for rapid growth outside the UK’s major tech hubs.

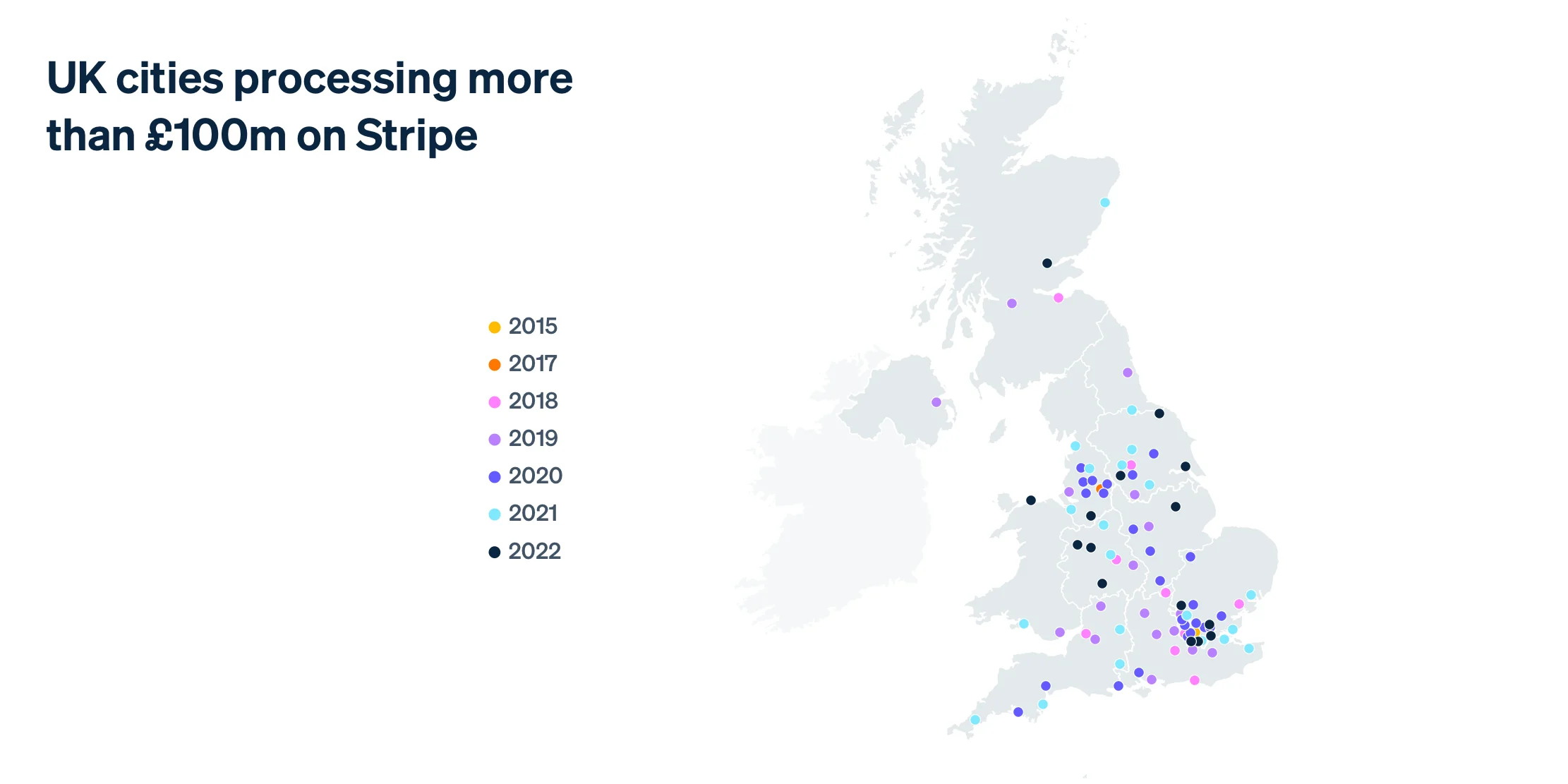

More than half of the UK’s towns and cities grew their payment volume on Stripe faster than London over the last three years, with the fastest acceleration occurring in places as varied as Warrington, Southend-on-Sea, and the Outer Hebrides. From Salisbury to Sutton to Stoke-on-Trent, there are now 90 towns and cities in the UK processing over £100M a year on Stripe, three times more than before the pandemic.

One of them is Wigan, a former mill and coal-mining town that now has thousands of businesses using Stripe to participate in the online economy. They include a cloud storage app and a nebulizer specialist, as well as the local butcher, curry house, and football club. Nearly 750 businesses in Wigan have processed more than £1M on Stripe.

Smaller, rural locations are also growing their economies online. The Outer Hebrides is a picturesque island chain off the northwest coast of Scotland. Its remote location, coupled with a shrinking population, make it a surprising place to find a surging internet economy—yet that is what’s happening.

Hundreds of local businesses in the Outer Hebrides use Stripe to operate online, including the Isle of Harris distillery, Amhuinnsuidhe Castle, the HebCelt music festival, Uist Wool, surf shops, botanicals specialists, bed and breakfasts, bothies, and even treehouses across the archipelago. Altogether, these businesses grew their payment volume on Stripe 6.5x over the last three years, outpacing most of the rest of the UK.

“Ten years ago, it was clear geography would become less important in the online economy—but it was hard to imagine internet businesses in so many of the UK’s homes and high streets. The internet economy is increasingly everywhere, and that’s good news for anyone building a business,” said Max Roberts, head of EMEA at Stripe.

SaaS: The grand enabler

Many of these businesses are now running on UK-built software platforms that feature specialised solutions for every sector of the economy. Whether it’s a church or a nightclub, access to platform solutions has dramatically lowered the barriers to running a business online while spreading economic growth across the country. SaaS platforms are especially powerful for smaller, less technical firms, and 73% of small businesses in the UK now use at least one software platform.

Mixcloud has spent a decade building new ways for creators in the music industry to make money.

While there were only a handful of UK-based SaaS platforms on Stripe in 2013, there are now hundreds, serving hundreds of thousands of businesses. When the pandemic created an urgent need to shift commerce online, the number of businesses using UK software platforms more than tripled.

These platforms have grown their processing volumes on Stripe by more than 1,280x over the last decade. And unlike other types of UK businesses on Stripe, SaaS platforms have become more international: They serve businesses in more than 40 countries around the world and have more than doubled the proportion of their payments that are international, from 10% to 21%.

The next decade

Most of the first Stripe adopters in the UK were digital-native startups. Today, the profile of the typical new Stripe user is very different, as every industry and value chain is being redesigned around the internet. Ten years ago, funding flooded into mobile commerce tools and adtech; now investors are betting on climate tech and generative AI. The conversation has moved from owning a smartphone to accepting payments with your smartphone.

The next decade of innovation will enable business models that aren’t possible today. Progress in open banking will advance fintech, providing a blueprint for regulator-facilitated innovation in other highly supervised sectors. Digital currencies will present new opportunities from micropayments for single news articles to automatic payouts to communities restoring forests. Artificial intelligence will transform how businesses operate online—with industry SaaS platforms well-positioned to expand access to these tools to all kinds of businesses.

“It’s easy to underestimate the extent to which technology companies are now part of the broad fabric of the UK economy. Businesses built in London, Manchester, and Edinburgh are expanding access to opportunity online for millions of entrepreneurs across the country. Whether it’s software platforms lowering the cost of starting an internet business, or generative AI putting productivity on steroids, we’re excited about what UK startups will achieve in the next few years,” said John Collison, president and cofounder of Stripe.