会计对账在确保财务报表可靠、发现错误、防止欺诈并保持监管合规方面发挥着重要作用。优先考虑有效对账实践的企业将自己置于有利地位,可以做出明智的决策、降低风险并保持长期成功所需的财务健康。

根据注册舞弊审查师协会 (ACFE) 进行的一项调查,财务报表欺诈占 2022 年所有报告的欺诈案件的 9%。这凸显了准确的会计对账在组织内发现和防止欺诈活动中的重要性。通过核对银行对账单、发票和收据等财务记录,企业可以识别差异和违规行为,并保护自己免受潜在的欺诈。

我们将介绍组织可用于简化对账流程、最大限度地减少错误并为财务管理奠定坚实基础的最佳实践和策略。

目录

- 什么是会计对账?

- 会计对账的类型

- 为什么会计对账对企业很重要

- 会计对账最佳实践

- 使用 Stripe 进行会计对账

什么是会计对账?

在会计中,对账是指比较两套记录或财务信息的过程,例如银行对账单、总分类账或其他相关记录,以确保其准确性和一致性。

对账的主要目的是查明和解决两套记录之间的任何差异。这有助于保持财务报表的完整性,并识别错误或欺诈活动。

会计对账的类型

会计对账涉及比较和核实财务交易和余额,以识别和解决差异。以下是不同类型的会计对账:

银行对账

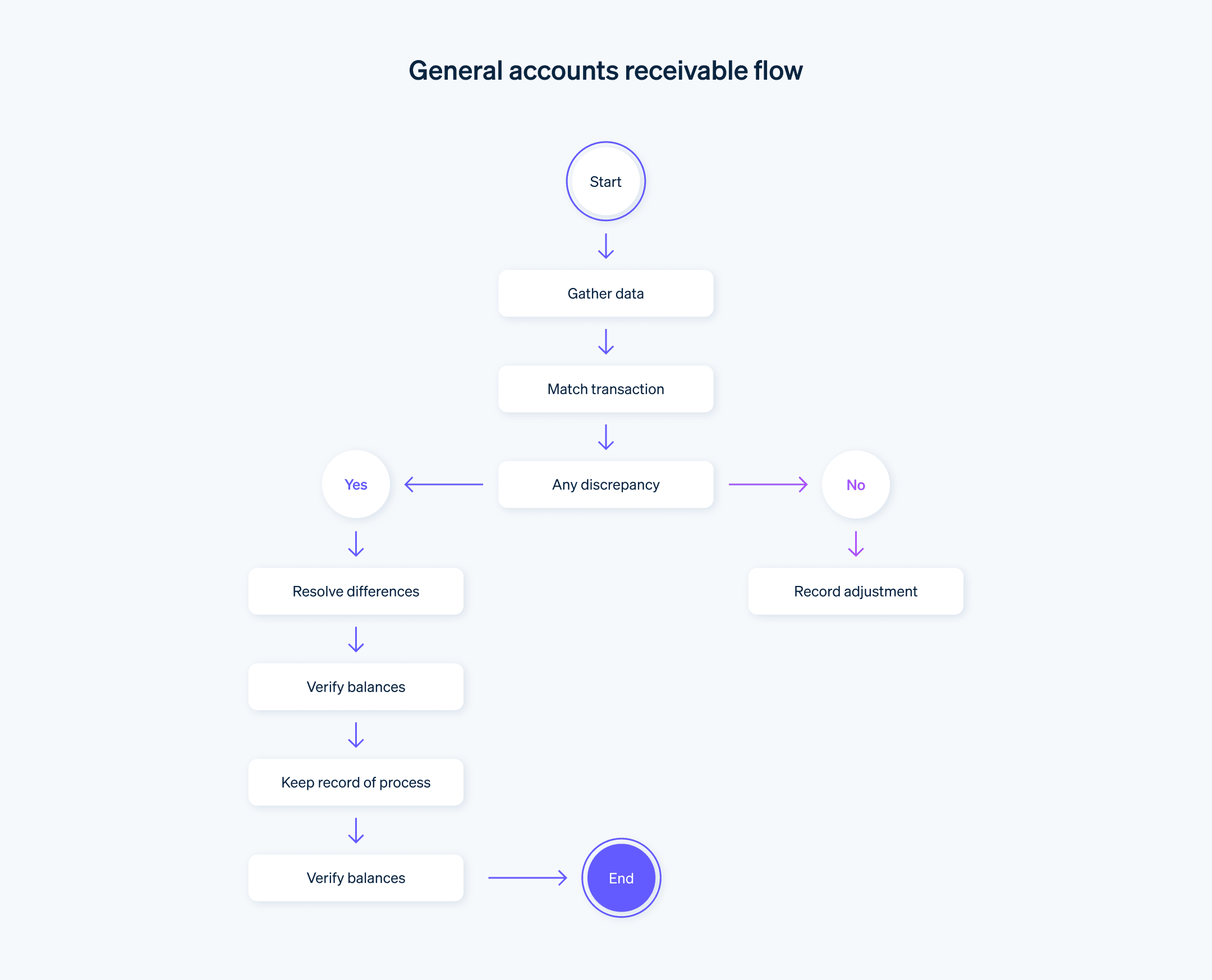

将企业银行对账单中的交易和余额与现金簿或总账中的条目进行比较应收账款对账

通过将应收账款余额与客户发票和付款收据等支持文件进行比较,验证应收账款余额的准确性和完整性应付账款对账

通过将应付账款余额与供应商发票和付款记录进行比较,验证应付账款余额的准确性和完整性公司间对账

协调子公司或部门之间的公司间交易和余额,以保护准确性并消除错误库存核对

将实际库存盘点与记录的库存余额进行比较,以识别差异并解决盗窃或记录错误等问题总账对账

核对各种总分类账,确保记录的交易和余额完整准确固定资产对账

通过将固定资产记录与采购发票、折旧计划和处置记录进行比较来验证固定资产记录税务对账

将税务记录(如销售税或所得税)与相应的财务记录进行比较,以确保纳税义务的报告准确无误信用卡和借记卡对账

将信用卡或借记卡对账单中记录的交易与财务记录进行匹配,以确保准确性和完整性数字钱包对账

验证数字钱包交易与企业的财务记录全球货币对账

通过与汇率和财务记录的比较来确保外币交易的准确性实时自动付款对账

实时自动化付款对账流程,以准确高效地匹配和对账付款

这些不同类型的对账对于维护准确的财务记录、发现错误和欺诈以及确保会计系统的可靠性非常重要。它们使组织能够清晰准确地了解其财务状况,从而使其能够做出明智的业务决策。

为什么会计对账对企业很重要

会计对账对企业至关重要。原因如下:

准确的财务记录

通过比较不同的数据集,对账可确保财务记录准确可靠。当业务处理或记录财务交易时,可能会出现差异、错误和遗漏,对账有助于识别这些差异并纠正它们。这确保了财务报表和报告能够准确、公正地反映企业的财务状况。欺诈检测

对账是检测欺诈活动的关键内控机制。通过比较银行对账单、发票和付款收据等记录,企业可以识别可能表明欺诈交易的差异或违规行为,从而保护企业的资产和财务利益。决策

对账可确保用于决策的数据可靠且完整。通过核对不同的账户和财务记录,企业对其信息的准确性充满信心,这使他们能够根据合理的财务洞察力做出战略决策。合规性和监管要求

对账可帮助企业履行合规和监管义务。例如,通过准确的银行对账,企业可以确保其符合审计标准并创建符合监管准则的财务报表。未能正确核对账目可能会导致违规、处罚或法律后果。风险管理

对账通过及时识别错误、差异或违规行为来帮助管理财务风险。通过核对账目,企业可以检测潜在风险,例如现金流问题、库存差异和不正确的税收计算。及早识别风险使企业能够采取适当的行动并维护其财务稳定。建立利益相关者的信任

对账意味着财务报表的编制具有完整性和透明度,从而在投资者、贷方和股东等利益相关者之间建立信任和信誉。这种信任增强了企业的声誉,并增加了对其财务状况的信心。

会计对账最佳实践

通过遵循这些会计对账最佳实践,企业可以提高财务记录的准确性,加强内部控制,检测和防止欺诈,并保持对监管要求的遵守。这些做法有助于实现可靠的财务报告,这几乎是运营和发展企业的各个方面不可或缺的一部分。

对于企业来说,会计对账的最佳实践包括:

定期对账

定期进行对账,最好每月进行一次,或者根据交易量的需要频繁进行对账。及时和一致的对账意味着企业可以快速识别和解决差异,以免造成问题。文档和记录保存

维护对账流程的详细文档,包括银行对账单、发票、收据和其他相关记录。对账过程的适当记录有助于将来的审计或审查,并有助于识别和解决差异。职责分离

实施职责分离,以确保不同人负责流程的不同方面,例如记录、核对和批准财务交易。这种分离保证了多组人在对账过程中的不同角度审查财务信息,有助于防止错误和欺诈。清晰的对账程序

建立标准化的对账程序,明确界定适当的步骤、个人的角色和责任,以及具体的期限。清晰的程序可以促进一致性,最大限度地减少错误,并确保对账过程以有组织的方式进行。对账自动化

如果可能,请使用会计软件或对账工具自动执行对账流程。自动化减少了人为错误,提高了效率,并为核对账目和记录提供了一个系统的框架。比较和调查

对财务记录进行彻底比较,找出任何差异。通过追踪根本原因、纠正错误并相应地调整财务记录,及时调查和解决这些差异。适当的调查有助于防止再次出现错误,并确保财务信息准确无误。持续沟通

在对账过程中,促进相关部门和个人之间的坦诚沟通。定期沟通有助于解决问题、澄清疑惑和有效共享信息。一个全面和准确的对账过程取决于不同利益相关方之间的合作和协调。对账审查和批准

实施审查和批准流程,以确保对已核对的记录进行独立审查。这一过程应包括审查对账余额的准确性和适当性,并调查任何重大差异。指定机构的批准为对账过程增加了一层额外的保证。持续改进

通过确定需要改进的领域,定期评估和加强对账过程。分析差异模式,识别潜在的弱点,并采取适当的措施来防止将来出现错误。通过不断完善对账流程,企业可以最大限度地提高准确性、效率和整体财务控制。

使用 Stripe 进行会计对账

Stripe 提供了强大的对账解决方案,从而简化了企业的流程。Stripe 的对账解决方案可自动执行企业的对账流程,并全面了解您的资金流动情况。

Stripe 的对账流程包括将您公司的内部记录(如发票)与外部记录(如结算文件、支出文件和银行对账单)进行比较。Stripe 的自动化系统可以处理这种比较,使您能够准确地获取收入,并在交易层面将您的内部会计系统使用 Stripe 处理的费用和退款进行核对。

Stripe 对账解决方案为企业提供了以下几个好处:

它允许您每天跟踪您的现金,使您的财务记录与收到的资金保持一致。通过识别资金流中的任何缺口或数据差异,您可以快速解决泄漏问题并最大限度地减少财务损失。

Stripe 对账提供了对每笔交易整个生命周期的可见性。您可以轻松跟踪和监控资金流动,确保准确记录和核算每笔交易。这种透明度有助于通过识别任何潜在的错误或违规行为来保护您的业务。

Stripe 对账对交易量大的企业特别有利。如果您的企业每月处理数千笔交易,那么 Stripe 对账解决方案的自动化和可扩展性可以简化您的财务运作。

如果您的企业处理复杂的交易场景,例如跨越多个时期的长交易生命周期,或者客户在单笔交易中使用多种支付方式,Stripe 的对账解决方案可以有效地处理这些复杂性。它提供了必要的灵活性和准确性,以协调不同的交易类型并确保准确的财务报告。

Stripe 的对账解决方案自动化并简化了将内部记录与外部记录进行比较的流程,使企业能够准确获取收入、跟踪现金流、识别差异并实施强大的财务控制。无论您的交易量大还是交易场景复杂,Stripe 的对账解决方案都能为您的财务运营提供可扩展且可靠的支持。有关更多信息或开始使用,请访问此处。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。