Een belastingvrije factuur bevat geen belasting over de toegevoegde waarde (btw). In plaats daarvan wordt de te betalen nettoprijs weergegeven zonder btw toe te voegen. Dit type factuur is meestal bedoeld voor ondernemers die zijn vrijgesteld van btw of die in aanmerking komen voor de basisvrijstellingsregeling voor btw. In dit artikel wordt uitgelegd hoe je een factuur maakt voor een bedrijf dat niet btw-plichtig is.

Wat staat er in dit artikel?

- Definitie van btw

- Bedrijven vrijgesteld van btw

- Wanneer maak je een factuur op zonder btw?

- Hoe maak je een factuur op zonder btw?

- Betekenis van juridische kennisgevingen

Definitie van btw

In Frankrijk is btw een belasting die van toepassing is op alle dienstverlenende bedrijven en op de goederen en diensten die zij aan klanten verkopen. Bedrijven en de belastingdienst berekenen de btw op basis van verschillende tarieven van de staat. Een belastingplichtig bedrijf moet btw innen en aangeven bij de overheid.

Businesses exempt from VAT

Though most businesses in France are subject to VAT, there are exceptions. Some businesses must neither collect VAT for the state nor reclaim VAT on their purchases.

The basic VAT exemption regime exempts certain businesses from VAT. These nontaxable businesses issue invoices differently. To stay within the standards of this regime, businesses must meet various conditions and thresholds. The first step is to identify whether a business is exempt from VAT.

To qualify as a nontaxable business, a service business or self-employed professional must have sales that do not exceed €36,800 in the first year of operation. For commercial or accommodation activities, the threshold is €91,900, according to the public services website.

Wanneer maak je een factuur zonder btw?

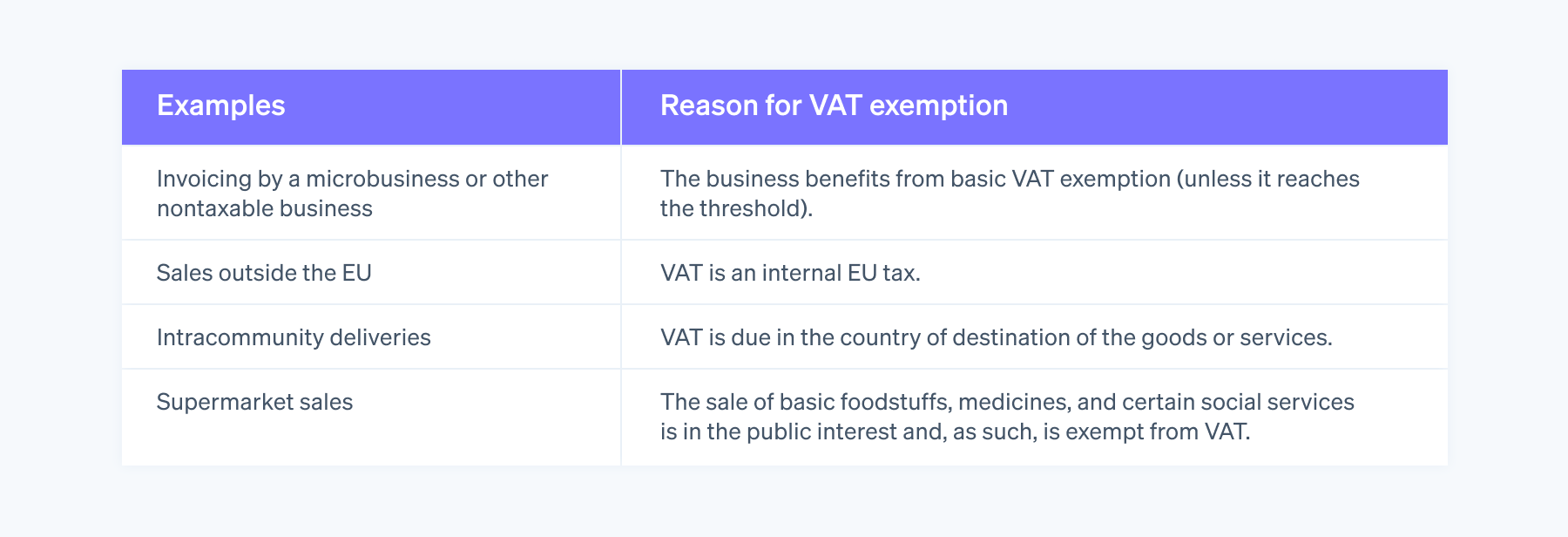

Niet-belastingplichtige bedrijven stellen nooit facturen op met btw. Voor belastingplichtige bedrijven zijn er specifieke situaties waarin ze een factuur zonder btw moeten uitreiken:

- Wanneer een bedrijf verkoopt aan een klant die niet btw-plichtig is, moet het een factuur zonder btw uitreiken. Dit kan bijvoorbeeld gebeuren als de klant een particulier is of een bedrijf dat is gevestigd in een land waar geen btw van toepassing is.

- Sommige bedrijven zijn vrijgesteld van btw voor de verkoop van specifieke goederen en diensten. Voorbeelden hiervan zijn basisvoedingsmiddelen en medicijnen.

- Wanneer een bedrijf goederen verkoopt aan een klant in een ander land van de Europese Unie (EU) zonder de levering af te handelen, wordt dit een intracommunautaire levering genoemd. In dit geval geeft het bedrijf de factuur uit zonder btw en moet het intracommunautaire btw-nummer van de klant worden vermeld.

Een factuur opstellen zonder btw

Dit artikel legt uit wat de essentie is van het maken van een factuur voor een klant. De factuur moet belangrijke informatie bevatten: de naam en het adres van de verkoper en de klant, de verkoopdatum, een beschrijving van de goederen of diensten, de eenheidsprijs en het totale verkoopbedrag.

Als een bedrijf niet btw-plichtig is, mag op de factuur alleen het bedrag exclusief belasting (HT) worden vermeld. Je moet de zinsnede 'na btw' of een gelijkwaardige waarde op de factuur opnemen om aan te geven dat de btw niet van toepassing is.

Dit betekent dat transacties zijn vrijgesteld van btw vanwege bepaalde voorwaarden die verband houden met de status van de verkoper of de aard van de transactie.

Stripe Invoicing verfijnt het maken van btw-vrije facturen in een paar stappen. Daarom kunnen bedrijven facturen uitgeven aan hun klanten in overeenstemming met de huidige belastingregelgeving.

Betekenis van juridische kennisgevingen

Op facturen van niet-belastbare bedrijven zie je vaak de juridische vermelding 'Btw niet van toepassing, art. 293 B van de CGI."

Artikel 293 B van het Algemeen belastingwetboek (CGI) van Frankrijk is de wetgeving die bedrijven die onder de basisregeling voor btw-vrijstelling vallen, vrijstelt van betaling en aangifte van btw. Als bedrijven die niet btw-plichtig zijn, is het niet mogelijk om btw op zakelijke aankopen af te trekken of terug te vorderen.

Deze lijst bevat de vereiste informatie voor een factuur en een sjabloon is beschikbaar op de officiële informatiewebsite van de overheid voor bedrijven.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.