A tax-free invoice does not include value-added tax (VAT) charges. Instead, it displays the net price payable without adding VAT. This type of invoice is typically for business professionals exempt from VAT or eligible for the basic VAT exemption regime. This article explains how to create an invoice for a business not subject to VAT.

What’s in this article?

- Definition of VAT

- Businesses exempt from VAT

- When to prepare an invoice without VAT

- How to prepare an invoice without VAT

- Meaning of legal notices

Definition of VAT

In France, VAT is a tax that applies to all service businesses and to the goods and services they sell to customers. Businesses and the tax office calculate VAT based on varying rates from the state. A taxable business must collect and report VAT to the government.

Businesses exempt from VAT

Though most businesses in France are subject to VAT, there are exceptions. Some businesses must neither collect VAT for the state nor reclaim VAT on their purchases.

The basic VAT exemption regime exempts certain businesses from VAT. These nontaxable businesses issue invoices differently. To stay within the standards of this regime, businesses must meet various conditions and thresholds. The first step is to identify whether a business is exempt from VAT.

To qualify as a nontaxable business, a service business or self-employed professional must have sales that do not exceed €36,800 in the first year of operation. For commercial or accommodation activities, the threshold is €91,900, according to the public services website.

When to prepare an invoice without VAT

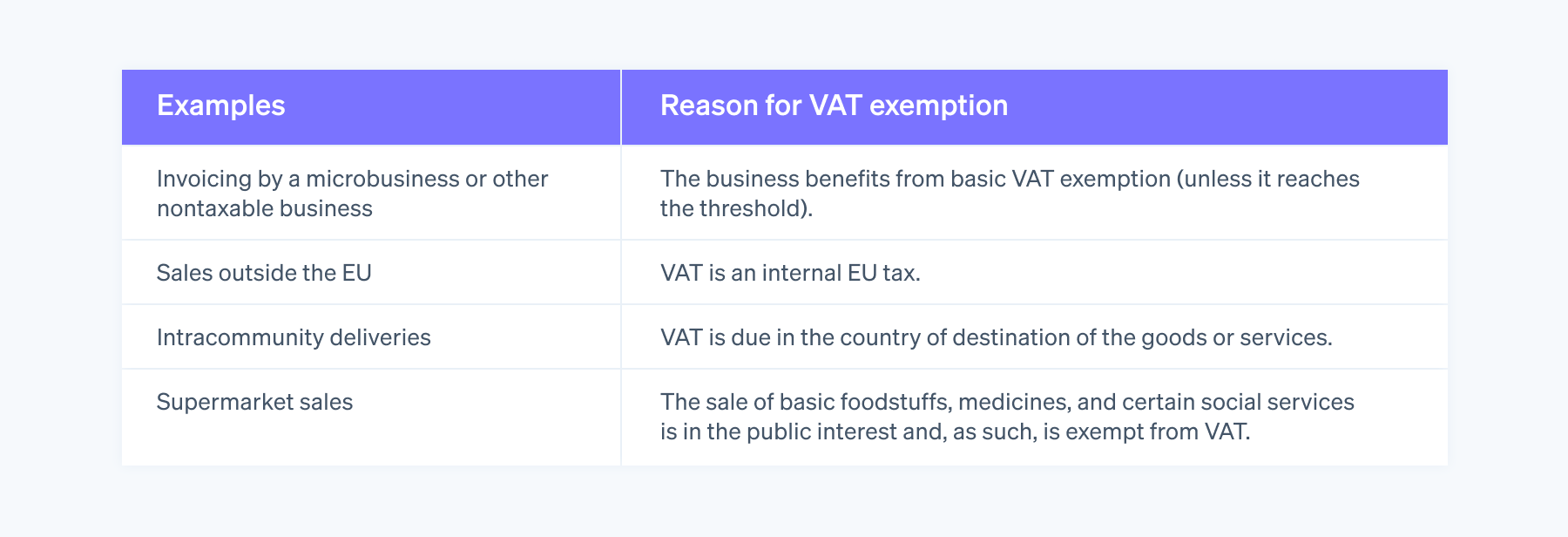

Nontaxable businesses never draw up invoices with VAT. For taxable businesses, there are specific situations in which they must issue an invoice without VAT:

- When a business sells to a customer who is not subject to VAT, it must issue an invoice without VAT. For instance, this can occur if the customer is a private individual or a business based in a country where VAT does not apply.

- Some businesses are exempt from VAT for the sale of specific goods and services. Examples include basic foodstuffs and medicines.

- When a business sells goods to a customer in another European Union (EU) country without handling the delivery, this is known as an intracommunity supply. In this case, the business issues the invoice without VAT and must include the customer’s intracommunity VAT number.

How to prepare an invoice without VAT

This article explains the essentials for creating an invoice for a customer. The invoice must include key information: the names and addresses of the seller and the customer, the sale date, a description of the goods or services, the unit price, and the total sale amount.

If a business is not subject to VAT, its invoices should display only the tax-exclusive amount (HT). You must include the phrase “net of VAT” or an equivalent on the invoice to indicate VAT is not applicable.

This signifies transactions are exempt from VAT because of particular conditions related to the seller’s status or the nature of the transaction.

Stripe Invoicing fine-tunes the creation of VAT-free invoices in a few steps. Therefore, businesses can issue invoices to their clients in accordance with current tax regulations.

Meaning of legal notices

On invoices from nontaxable businesses, you’ll commonly see the legal notice “VAT not applicable, art. 293 B of the CGI.”

Article 293 B of the French General Tax Code (CGI) is the legislation that exempts businesses covered by the basic VAT exemption regime from paying and declaring VAT. As businesses that are not subject to VAT, it’s not possible to deduct or reclaim VAT on business purchases.

This list details the necessary information for an invoice, and a template is available on the official government information website for businesses.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.