According to the German Confederation of Skilled Crafts, there are currently more than 1 million businesses in the sector in Germany, with around 5.6 million employees. If you do not want to be employed as a tradesperson but want to start your own business, you can step into self-employment. This article explains the personal, professional, and legal requirements for independent work and when a master craftsperson’s certificate is required. We also explain step-by-step how to set up your own business, what costs you can expect, and what you can earn as a self-employed individual.

What’s in this article?

- What are the requirements for being self-employed as a tradesperson?

- When is a master craftsperson certificate required?

- How do you start a business in the skilled trades?

- How much does it cost to become self-employed as a tradesperson?

What are the requirements for being self-employed as a tradesperson?

There are numerous professional and legal requirements for becoming self-employed as a tradesperson:

Professional requirements

Work experience is the foundation of professional competence and client trust; it can prove that your skills have been tested in the real world. Several years of work experience not only helps you perfect your craft but also develops a deep understanding of the processes and challenges of the profession. It also helps you solve problems efficiently, cost jobs accurately, and run a successful business.

In addition, commercial knowledge is necessary for independent work. Self-employed tradespeople must calculate expenses, prepare quotes and create invoices, manage budgets, pay taxes, and organise their accounting. These skills help make prices competitive, keep track of income and expenses, and secure long-term profits. With this knowledge, even experienced entrepreneurs can keep their operations financially on track.

Legal requirements

Solid vocational training is the foundation for successful self-employment in the skilled trades, and is important for learning practical and theoretical specialities. However, in some cases, this is not enough to become independent – a master craftsperson certificate is also required.

Self-employed professionals must also comply with certain legal requirements to operate their business in accordance with the law. These include proper registration with authorities such as the trade and tax offices, the relevant professional association, as well as compliance with contract and employment law. In particular, they must follow occupational health and safety regulations to ensure their employees’ safety. Additionally, tradespeople are subject to proper accounting principles (based on the GoBD, or the “principles for the proper management and storage of books, records, and documents in electronic form”).

Tradespeople must also consider appropriate policies to meet legal requirements and financially secure the business. For example, business liability insurance is key to protect against damage claims. Legal and disability coverage are also important options.

When is a master craftsperson certificate required?

In Germany, more than 130 professions are classified as skilled trades, which can be divided into seven areas:

- Construction and expansion

- Clothing, textile, and leather crafts

- Health and personal care trades, chemical and cleaning trades

- Graphic design

- Wood and plastic

- Food crafts

- Metal and electrical

The German Trade and Crafts Code (HwO) divides the various professions into those needing a licence and those that do not. The former requires a master title from the Chamber of Crafts (HWK) to start a business in this field. This builds on vocational training and is an additional qualification in craft, artistic, technical-commercial, and agricultural professions.

Suppose you do not have a master title but would like to form your own business in a trade that needs a licence. In that case, you can employ a master tradesperson full-time in a managerial position or use the so-called journeyperson’s regulation. This requires proof that the founders have at least six years of experience as a journeyperson, including at least four years in a management role.

Crafts that need licensing require a completed master tradesperson examination primarily because they have to meet special quality standards and safety requirements. This applies, for instance, to electricians, roofers, and plumbers. Appendix A of the HwO Code lists the professions that require licensing. Appendix B covers all trades that do not need a licence, including watchmakers, shoemakers, and photographers.

How do you start a business in the skilled trades?

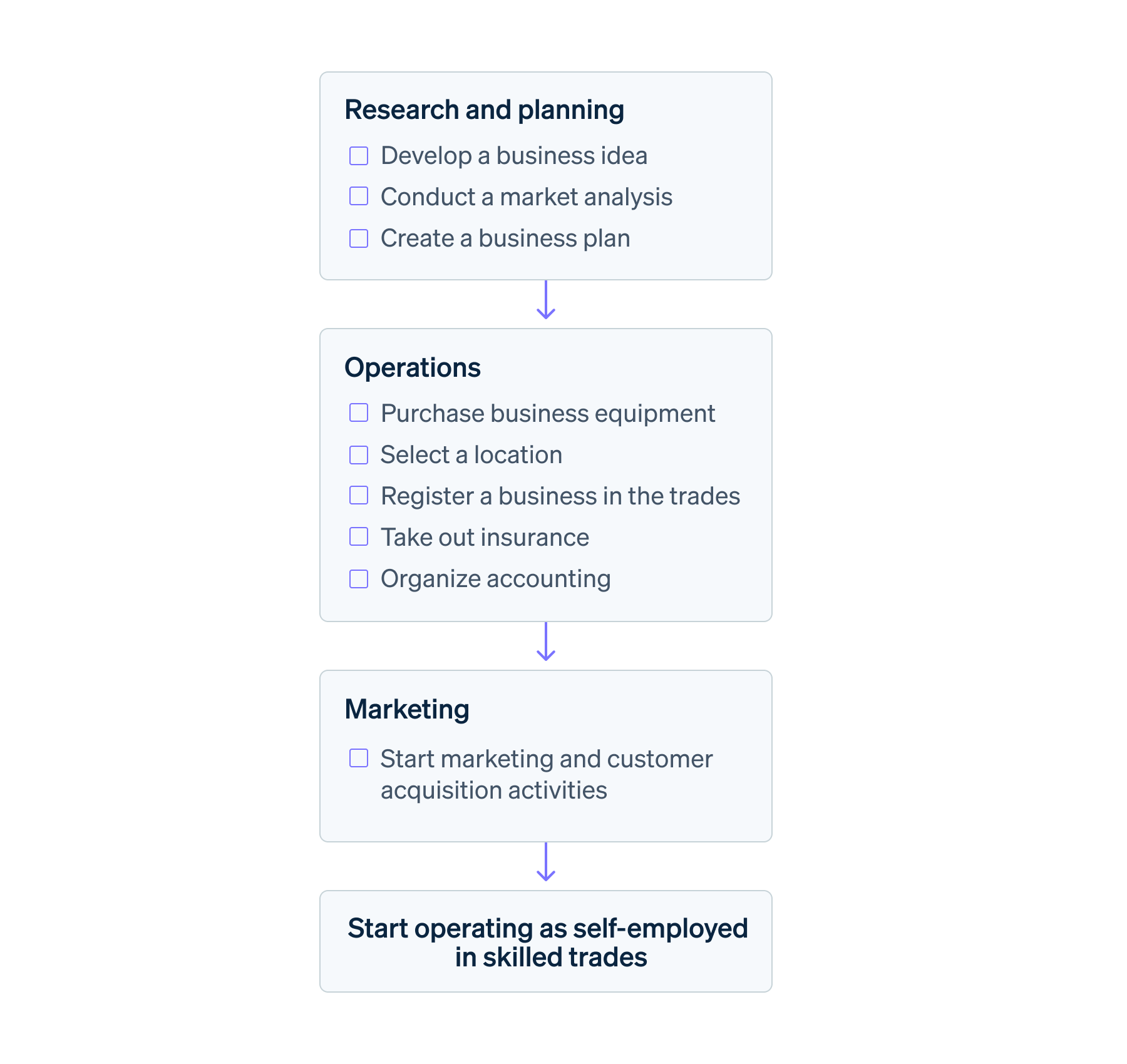

Anyone who wants to start their own business in the trades must do so in a structured manner to meet all legal and organisational requirements. Here are the most important steps in starting this type of venture:

Step 1: Develop a business idea

First, you need to clearly define what products and services you want to offer and to whom. The basis for this is the speciality you have learned and are practising. At the same time, you must check whether your trade requires a licence. It is important that you have the professional qualifications needed to be self-employed in your specific trade. The goal of a well-formulated business idea must be a clear positioning, ideally with a unique selling point.

Step 2: Conduct a market analysis

The second step is to analyse the existing market. Is there a need for your product or service? What is the size and potential of the market for your enterprise? In which geographic area will it operate? Who are your customers, and who are your competitors? You also need to know exactly what your competitors offer, their prices, and their market shares. The same goes for possible entry barriers and general and regional trends affecting your venture. The more detailed your assessment, the better prepared you will be for your own business.

Step 3: Select a location

Choosing the right location for your business is closely related to market analysis. The area must be easily accessible to suppliers and potential employees and close to your customers. To illustrate, a bakery with a shop will benefit from a busy environment. On the other hand, a roofing company might need a less central location because the actual work is done on the customer’s premises. The key thing is that the area meets all legal requirements and is suitable for operations.

Step 4: Create a business plan

Steps one to three set the stage for another key step in the startup process: creating a business plan. This incorporates the results of your research and decisions. It must include the idea, market analysis, target audiences, planned marketing, funding, and costing.

This is important for structuring your project, planning financing, and convincing potential investors of your business idea.

Step 5: Purchase business equipment

Another key step in starting a business is purchasing necessary equipment. Specific tools, machines, and materials are required depending on the trade. It could also require vehicles to transport employees and goods. Make sure you follow all safety standards and legal requirements, such as those for storing hazardous materials or setting up machinery.

This equipment also contains hardware and software for handling administrative processes. These include accounting programs, time recording and billing software, and digital tools for customer management and order processing. If you want to accept payments from your customers directly on site, learn more about Stripe Terminal. With Terminal, you can enable on-site payments, for example, with pre-certified card readers such as the Stripe Reader S700 or mobile devices such as the BBPOS WisePad 3. Cashless payments without an additional device are possible with Tap to Pay.

Step 6: Register a business in the trades

The formal requirements vary depending on the legal formation of your business. Most self-employed tradespeople must register with the HWK, trade, and tax offices. In many cases, entry into the commercial register and membership with the relevant professional association are also necessary. Anyone who employs staff must declare them to the social insurance authorities.

Step 7: Take out insurance

Before you start operations, you need to obtain all necessary insurance, especially business liability coverage.

Step 8: Organize accounting

Proper bookkeeping is required by law and helps you keep track of your income, expenses, and taxes. In individual cases, it might be helpful to consult tax advisors. You can also simplify some processes by using tools such as Stripe Invoicing to automate the creation and sending of your invoice, saving you significant time on administrative tasks and helping to prevent billing errors. You need to also set up a business account to separate private and business cash flows.

Step 9: Start marketing and customer acquisition activities

Ideally, your marketing concept is already part of your business plan. This includes a professional website, flyers, submission to relevant industry directories, and possibly a presence on selected social media platforms. The key to attracting customers is to start marketing and prospecting early.

Step 10: Start operation

Your company can accept the first orders as soon as all legal and organisational aspects have been completed.

Starting a business in the trades in 10 steps:

How much does it cost to become self-employed as a tradesperson?

The total cost of starting a business varies greatly, depending on the type of enterprise, size, and individual needs. Nevertheless, you can expect to pay at least several hundred euros; there is no upper limit. Here are some of the most important costs:

- Training, including obtaining a master craftsperson certificate

- Registration with authorities such as the trade office

- Operating equipment, e.g. for tools and machines, vehicles, and IT

- Rent and additional expenses for business premises

- Insurance

- Tax advice

- Marketing and advertising

- Ongoing operating costs for staff, materials, and supplies

How much do self-employed tradespeople earn?

The income of self-employed tradespeople varies as much as the possible costs. It depends primarily on the type of trade, the region, the order situation, the operating charges, and the number of employees. On average, an hour of work in the skilled trades is paid at €50 to €80 net. If you multiply this amount by the expected working hours, you can determine the approximate monthly earnings. However, it would help to keep in mind that you also have to plan working time for administrative tasks. Finally, you must deduct your expenses.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.