A 2023 study on payments and cash use habits conducted by the Bank of Spain reveals that 40% of Spaniards who purchase products or services in physical stores use digital payment methods. Mobile applications saw significant growth between 2022 and 2023, rising from 4.6% to 8.2%. This increase clearly indicates the rise of digital wallets, also commonly known as “e-wallets” or simply “wallets”.

As noted by El País, since 2012, some Spanish banks, including CaixaBank and BBVA, have been making significant technological changes to adapt to this payment method, which many customers prefer.

What’s in this article?

- What digital wallets are and how they work

- The most popular digital wallets in Spain

- Advantages of digital wallets

- Frequently asked questions about digital wallets

What digital wallets are and how they work

Digital wallets are applications that use mobile payment technology, typically designed for use with smartphones or tablets. To access funds for making payments, customers link their wallet to a credit card, debit card, or bank account.

These digital wallets allow individuals to view their payment history and often store other important documents in digital format. They also provide a quick and easy way to complete online payments, as customers do not need to manually enter card or billing details.

According to the Bank of Spain survey, 72% of respondents stated that ease of use is the primary reason for abandoning cash and opting for digital solutions.

The most popular digital wallets in Spain

These are some of the most widely used e-wallets in Spain:

Apple Pay: A Statista study conducted between July 2023 and June 2024 found that 30% of the respondents reported using Apple Pay for in-person payments during that period.

Google Pay: During Q2 2024, 27% of respondents in Spain reported using Google Pay for in-person payments, while 24% used it for online purchases.

Amazon Pay: Amazon Pay is a popular digital wallet, particularly among Spaniards from “Generation X” (those born between 1965 and 1981), who make up 40% of all users in Spain.

PayPal: In Spain, 80% of respondents reported using PayPal for online purchases between July 2023 and June 2024, making it the leading digital wallet for online payments.

To start accepting payments with these digital wallets on your website, you’ll need a payment gateway from a processor that supports them. Stripe, for example, allows you to accept payments with 10 different digital wallets from Spain, among over a hundred payment methods. Stripe enables Apple Pay and Google Pay by default in Stripe Checkout, but you can easily activate PayPal and Amazon Pay as well. Additionally, if you want to accept these types of payments in person, Stripe Terminal offers state-of-the-art card readers that support digital wallet payments and allow you to integrate your online and in-person payments in one place.

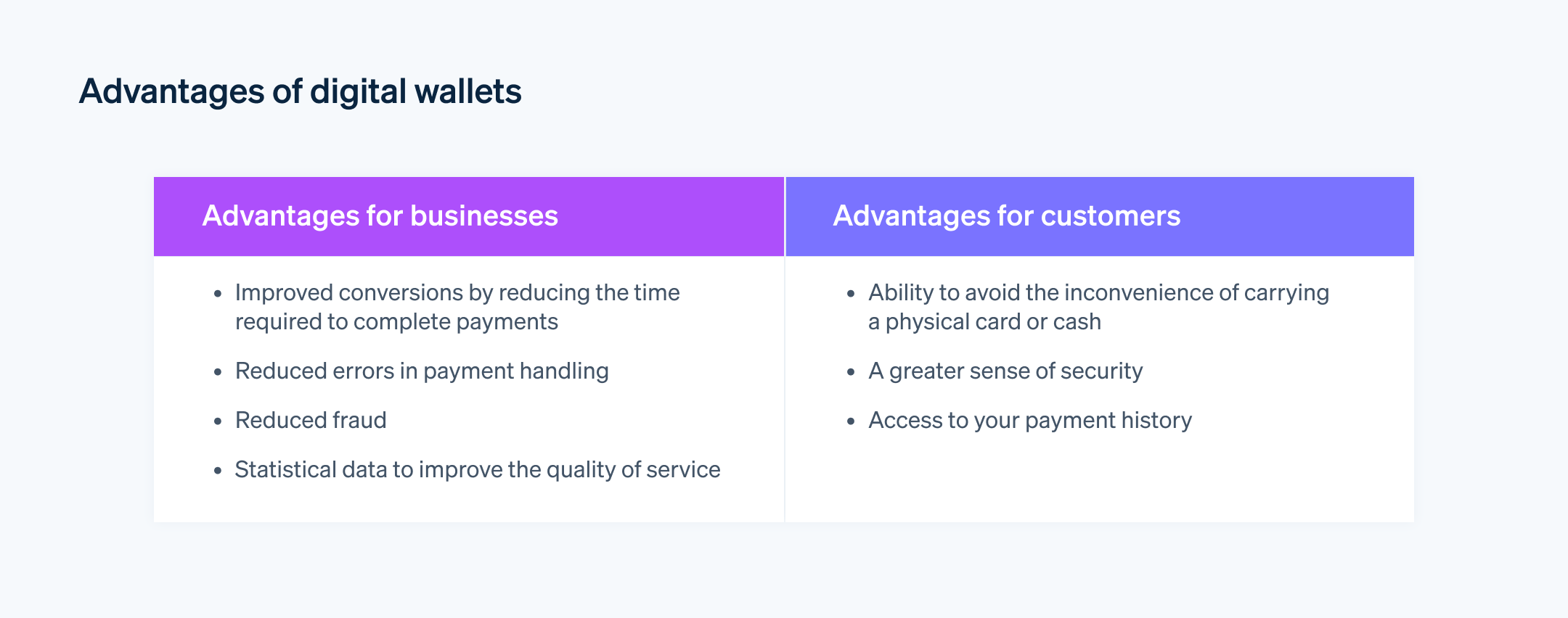

What are the advantages of digital wallets?

Digital wallets provide several advantages:

Given the many advantages for businesses, it’s no surprise that more Spanish companies are choosing to adopt digital wallets and digital payment solutions, such as omnichannel payment platforms. According to Shopify’s 2024 study on the state of commerce in Spain, over 25% of companies will prioritise the implementation of omnichannel payments in the upcoming year.

Shopify’s study also reveals that 57% of Spaniards use mobile apps for shopping, while 36% take advantage of the speed and convenience one-click payments offer.

Frequently asked questions about digital wallets in Spain

Is it safe to pay with digital wallets?

Paying for your purchases with PayPal, Apple Pay, Google Pay, or other digital wallets is secure, as these services use advanced technological systems to encrypt financial data. Thanks to biometrics, one-time passcodes, and other similar methods, the security level for digital wallets is extremely high. However, to maintain this level of security, it’s important to keep both the application and your mobile device updated.

Do digital wallets work without an internet connection?

It depends on the digital wallet, but some wallets function without an internet connection, as you store your banking data on your device in encrypted form. In these cases, the operation is similar to that of a card. When you place your device near a point-of-sale terminal with near-field communication (NFC) technology, your device transmits the contactless payment information.

However, in most cases, there is a daily limit on the number of transactions you can make without a network connection. On the other hand, digital wallets that require internet access must be able to connect to the virtual environment to download security keys (also known as “tokens”) and verify transactions.

Which cards are digital wallets compatible with?

It depends on the e-wallet you use. Some have limited compatibility, while others, such as Apple Pay or Google Pay, support nearly all types of cards from major networks. These include Mastercard and Visa and can be debit, credit, or virtual cards.

Which banks in Spain support Apple Pay?

By activating Apple Pay as a payment method, you will be able to accept payments from customers of 107 banks in Spain.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.