Businesses using Stripe’s newest checkout optimizations saw 10.5% more revenue

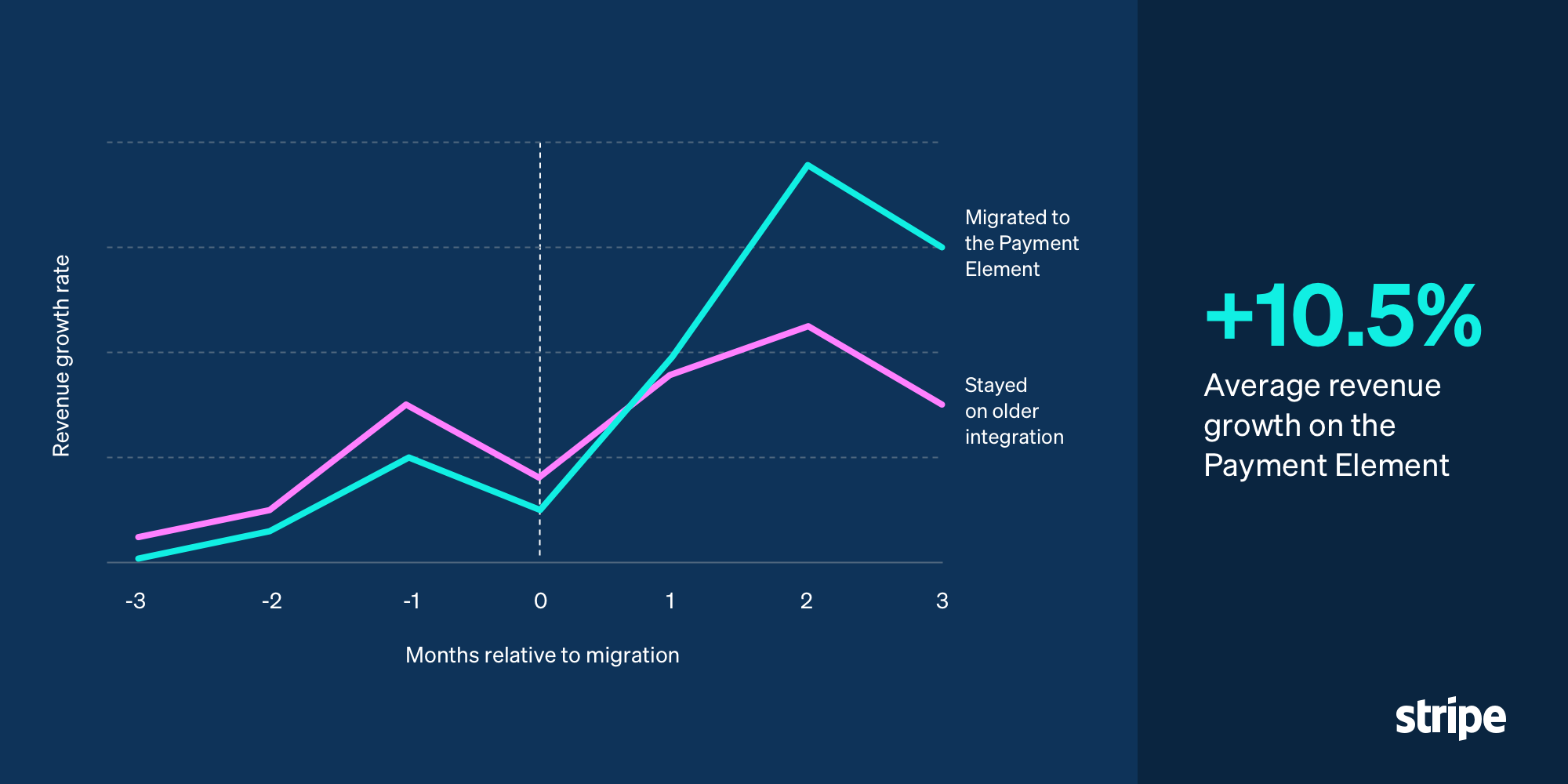

- Businesses that switched to Stripe's newest payments integration—the Stripe Payment Element—saw a 10.5% increase in revenue on average compared to those that did not.

- Stripe now offers more than 100 checkout optimizations as part of the Payment Element and Stripe Checkout, including pre-built payment UIs, more than 40 payment methods, and one-click checkout to increase revenue.

- Last year alone, more than 100,000 businesses including OpenAI, BigCommerce, and Ticket Tailor upgraded to Stripe’s new, highly-optimized checkout products to increase conversion.

SAN FRANCISCO AND DUBLIN—Businesses usually have to fight tooth and nail to increase their revenue by even a few percentage points. A new study from Stripe, however, finds that businesses that switched to the Stripe Payment Element, Stripe’s newest payments integration, saw 10.5% more revenue on average than similar businesses that remained on an older Stripe integration. The results imply that businesses not using the latest payments tools are likely leaving far more money on the table than they realize.

The study compared the revenue trajectories of two groups of 5,000 businesses: one that remained on Stripe’s older payment integration, the Stripe Card Element, and another that migrated to the newer Payment Element. The Payment Element is an embeddable and customizable UI component that surfaces the most relevant payment methods and supports more than 100 optimizations in a single integration. These optimizations are also available through Stripe Checkout.

The two groups were designed to be as similar as possible along observable dimensions including business size, business type, industry, and geography. In the months before migration, their number of transactions, average order value, and payment volume tracked closely. After switching to the Payment Element, the migrating users on average saw a 10.5% revenue uplift relative to the matched users who did not migrate. The increase in revenue may include the impact of other unobserved changes that businesses made at the same time they upgraded their integration.

The revenue gains, reflecting years of improvements Stripe has incorporated into the Payment Element and Stripe Checkout, surprised even the teams closest to the work.

“For years we’ve been improving our checkout flows. We knew that each tweak independently had a positive impact, but this is the first time we’ve rigorously quantified the accumulated impact of all our checkout optimizations together,” said Alex Vogenthaler, Payments product lead at Stripe. “To be honest, the results were better than we expected: 10.5% is a big deal. There are very few other single upgrades that a business could make that would deliver as much top-line revenue.”

The study also found that when businesses accepted additional payment methods through the Payment Element, the revenue uplift compounded: Businesses that added three additional payment methods—such as wallets, buy now pay later, and bank redirects—saw a bigger revenue lift on average than those that added only one.

Over 100 optimizations to increase conversion

Checkout pages across the internet are riddled with inefficiencies that make it hard for customers to complete transactions and for businesses to earn revenue. Stripe has been focused on fixing this since it launched in 2010, and today features more than 100 optimizations (all of which are supported by the Payment Element and Stripe Checkout) that enhance every aspect of the checkout experience.

In the last 12 months, more than 100,000 businesses—from startups to enterprises—have upgraded to Stripe’s suite of optimized checkout tools to grow their revenue. These optimizations include:

- Pre-built UIs. A range of customizable, pre-built payment user interfaces such as the Payment Element and Stripe Checkout. All of Stripe’s pre-built UIs include mobile-friendly navigation, autofill, error messages, input masking, simplified compliance, mobile SDK support, and more.

- Dynamic payment methods. Stripe recently updated its payment method ordering algorithm, taking the guesswork out of which of the 40+ payment methods to enable, and dynamically surfacing the highest-converting options based on a customer’s device, location, transaction amount, and more. For example, the Payment Element suggests Cartes Bancaires to Parisians buying goods in Japan, but Apple Pay to Tokyoites buying locally.

- One-click checkout. Link, Stripe’s native one-click checkout, autofills saved payment details to help customers complete their transactions faster. A global checkout study showed that Link increases conversion rates by over 7% for logged-in Link customers. For some businesses, the gains are much higher: Luxury goods marketplace Italic found that Link’s expedited checkout increased conversion rates by 34% in the first month.

- Localized experiences. Stripe’s pre-built UIs support 42 languages, 236 regional address formats, dynamic postal code collection, and localized error messages.

- Easy and accurate address collection. Businesses can collect, auto-complete, and validate addresses for billing and shipping using Stripe’s Address Element, to reduce the risk of shipping goods to the wrong location and more accurately apply the right sales taxes.

Ticket Tailor, the world’s largest independent ticketing platform, began using the Payment Element in March 2022 to support its expansion into new markets.

“Stripe has always been great at payments, but their latest payments update, the Payment Element, has been a game changer for our business,” said George Follett, commercial director at Ticket Tailor. “We've had Ticket Tailor users in Belgium and the Netherlands for a while, but we recently used Stripe’s Payment Element to turn on two popular local payment methods—iDEAL and Bancontact—with no code. The results were impressive as we doubled the number of sign-ups and ticket sales in just 12 months.”

There is no additional cost for using the Payment Element or Stripe Checkout. Businesses can integrate in hours using Stripe’s industry-leading documentation.

Behind-the-scenes upgrades to increase authorization

While the study focused exclusively on the benefits of optimizing conversion rates (the fraction of user sessions that complete a purchase), the next step in overall payments performance is authorization rates (the fraction of submitted transactions that actually succeed). Stripe obsesses over both.

Last year, Stripe improved Adaptive Acceptance, network tokens, and card account updater, and launched Enhanced Issuer Network, all with the goal of boosting authorization rates. Enhanced Issuer Network is the culmination of more than a decade of partnership with issuing banks. It feeds Stripe Radar scores directly to the card issuer making an authorization decision, leading to fewer spurious declines and more revenue for Stripe users. On average, large businesses may see a 1–2% authorization rate uplift on eligible volume. Hargreaves Lansdown, the UK’s largest retail investment platform, found that after integrating with Stripe’s payment optimization tools, it reduced failed payments by £540 million annually.