The payments platform behind millions of businesses

We help customers achieve measurable results

$70M

total increase in Postmates’ annual revenue

6 months faster

for Weave to launch a new payments platform

10%

uplift in Twilio’s payment acceptance rate

12 new countries

Noom expansion in one month with Stripe

Customers by size

Companies of all sizes around the world use Stripe

Classy Pay, powered by Stripe, creates best-in-class fundraising experiences for modern non-profits

Substack pens a new distribution model for writers with Stripe

Goodtill partners with Stripe to onboard 400+ new restaurants in under 4 weeks

Slack uses Stripe to process payments and achieve 99% authorisation rate

Zapier sees 4% uplift in auth rates with Stripe, creating $3M+ in additional revenue

Kickstarter extends its global reach and continues to enhance the crowdfunding experience with Stripe

Twilio increases its authorisation rates by 10% with Stripe

Atlassian selects Stripe to create a single platform for global billing and payments

Lightspeed partners with Stripe to accelerate innovation in omnichannel payments and more

Building together

We partner with customers to build breakthrough products

Stripe is the fastest-evolving payments platform and builds market-first functionality specifically for our customers’ needs.

How we built instant payouts with Lyft

Challenge

Lyft’s biggest request from drivers was the ability to get paid more frequently compared to traditional weekly payouts, which meant Lyft needed to find a way to seamlessly pay out drivers at their convenience.

Solution

Lyft worked with Stripe to build Express Pay, providing drivers the ability to decide when they want to get paid out – typically within a few hours of a journey.

Products

How we built multi-party payments with Instacart

Challenge

Instacart facilitates a multi-sided marketplace with complex payment needs. Instacart needed a way to streamline payments and payouts across consumers, grocery stores, shoppers and delivery partners.

Solution

Stripe enabled all aspects of Instacart’s intricate payments infrastructure to function at scale, making it easy for customers to pay the way they want, and using features such as Instant Checkout to speed up payouts to shoppers and retailers.

Products

How we built embedded finance with Shopify

Challenge

Dealing with banking and financial services is an essential part of running a business, yet most of today’s banking services aren’t designed for the needs of Shopify’s independent business owners.

Solution

Shopify built Shopify Balance using Stripe Treasury to offer Shopify merchants a fast, simple and integrated way to obtain critical financial products and oversee their finances – all within Shopify.

Products

Stripe Treasury gives us the flexibility to customise Shopify Balance specifically for our merchants. By building across Stripe’s payments and banking infrastructure, we’ve been able to give Shopify merchants access to critical financial products that meet their needs, such as faster access to funds and rewards, helping them further grow their businesses.

How we launched Stripe Climate with Flexport

Challenge

To prevent the most catastrophic effects of climate change, we need to radically reduce the new emissions we put into the air, and develop new carbon removal technologies to remove carbon already in the atmosphere.

Solution

Stripe partnered with forward-thinking businesses such as Flexport to launch Stripe Climate, which makes it easy for businesses to contribute a fraction of revenue to fund frontier carbon removal technology. So far, more than two thousand businesses have purchased frontier carbon removal with Stripe Climate.

Products

There’s huge potential for Stripe Climate to drive meaningful change in protecting the environment. We're excited to be part of it and to help unlock new solutions to humanitarian and environmental issues.

Customers by use case

We accelerate growth for all types of businesses

Kickstarter extends its global reach and continues to enhance the crowdfunding experience with Stripe

Instacart speeds up grocery delivery with Stripe

SkipTheDishes increases checkout conversion and launches new instant payout feature with Stripe

Postmates boosts authorisation rates with Stripe, adding $70+ million in revenue

Meetup increased trial conversions by 3x with Stripe Billing

Lyft optimises the driver and passenger experience with Stripe

Typeform powers its subscriptions globally with Stripe

Twilio increases its authorisation rates by 10% with Stripe

GitHub Sponsors programme doubles global coverage in a few months on Connect

Salesforce teams up with Stripe to power seamless commerce experiences

Zapier sees 4% uplift in auth rates with Stripe, creating $3M+ in additional revenue

Slack uses Stripe to process payments and achieve 99% authorisation rate

Squarespace allows users to ‘own a piece of the internet’

Classy Pay, powered by Stripe, creates best-in-class fundraising experiences for modern non-profits

Mindbody teams up with Stripe to fuel expansion in North America and Europe

Jobber expands its platform with new financial service products, Stripe Capital and Instant Payouts

WooCommerce partners with Stripe to launch in 17 new countries in 3 months

Xero helps customers speed up the cash flow cycle with Stripe

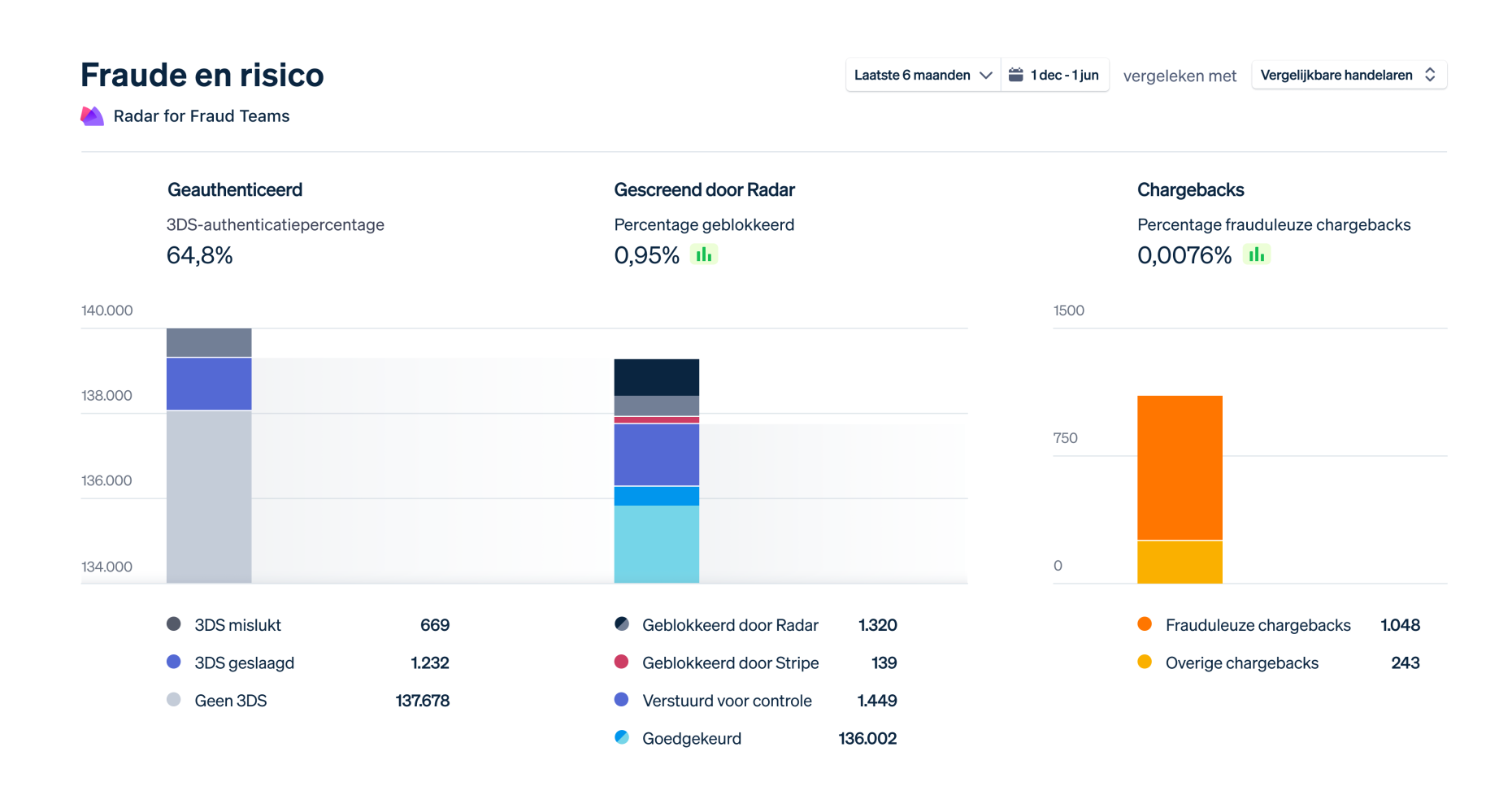

Dermalogica reduces fraud rates by 50% with Stripe

La Redoute replaces legacy systems with Stripe to offer world-class customer experience

KeyMe disrupts the locksmith industry with Stripe

Amazon simplifies cross-border payments with Stripe

We Are Knitters expands into 15 international markets with Stripe

Customers by solution

We obsess over payments so our customers don’t have to

Ready to get started?

Create an account and start accepting payments – no contracts or banking details required. Or, contact us to design a custom package for your business.

Always know what you’ll pay

Integrated per-transaction pricing with no hidden fees

Start your integration

Get up and running with Stripe in as little as 10 minutes