Challenge

In 2022, the automation platform Integromat decided to infuse AI into its platform to give users more powerful ways to manage and streamline workflows. With the new approach came a new name: Make.

The transition also led the company to overhaul its internal systems. Make needed payment and billing support that could easily integrate with its site architecture, and give the company more flexibility as it experimented with different pricing structures for subscribers.

For instance, the company had a few pricing plans that offered a set menu of features for subscribers in each tier. However, each tier gave users a specific monthly allocation of operations. For instance, one operation might be required to process a new batch of data or upload a file.

"If you wanted to have more operations, it wasn't really possible with our existing tiers, so we had to create a tailored plan for you," said Petr Luong, special projects lead at Make. "Eventually, we had hundreds of tailored plans we needed to maintain, and that wasn't scalable."

Make's increasingly global user base also led to a rise in failed transactions, particularly in developing markets with less mature financial infrastructure. "Customers were providing their card information, but because of some external factors, we might be declining that transaction," said Luong.

For subscription-based businesses such as Make, unintentional cancellations can have a major impact on the bottom line. The company was determined to address this involuntary churn, which often stems from insufficient funds in the customer's account, an expired card number or new card details.

Solution

Integromat had launched in 2016 using Stripe for payments and billing. While rebranding as Make, the company's use of Stripe products changed to better manage the new ways customers were using the platform. Make was already using Stripe Payments to accept transactions from its growing subscriber base. Now, Make uses Stripe's Optimized Checkout Suite, which includes a prebuilt payment form and Stripe Elements – a set of UI building blocks for designing a custom payments experience.

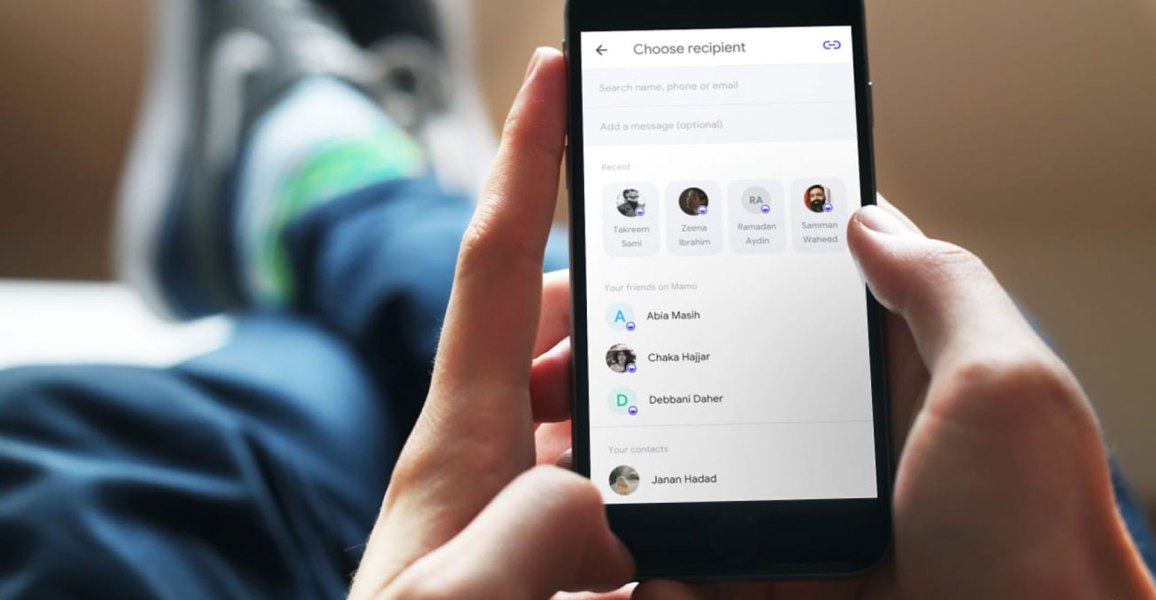

The Optimized Checkout Suite also has enabled Make to accept a range of payment methods, including credit cards, ACH debit, Apple Pay and Google Pay. For users that want to pay with their local currency, the Optimized Checkout Suite's Adaptive Pricing feature automatically converts prices to that currency based on the latest Stripe-provided exchange rates.

About 70% of Make's 350,000 users are subscription-based. Make uses Stripe Billing to manage their payments for its three paid subscription tiers, which range from a basic plan aimed at individual users to the Teams plan designed for small businesses that allow automation across multiple workflows. As part of the Make rebrand, the company implemented Stripe Invoicing to allow subscribers to purchase credits on a one-off, as-needed basis if they exhausted the monthly allotment in their subscription tier.

To address transaction failures, Make implemented Authorisation Boost, including Adaptive Acceptance – which uses AI to optimise initial payment requests, and to automatically identify and retry false declines in real time – as well as Stripe's card account updater and network tokens. All of these features help improve acceptance rates and reduce costs. The company also adopted Smart Retries, which employs smart dunning methods to reduce declines for recurring charges.

Results

Stripe Payments now helps drive growth in annual recurring revenue

With the Checkout prebuilt payment form, Make has streamlined and enhanced the payment process for users – even as its user base has continued to grow rapidly. "Checkout has been very helpful," said Luong. "It's allowed us to not have to build anything from scratch while allowing our customers to pay seamlessly with multiple payment methods."

Thanks in part to the Payments implementation, Make's ARR has grown significantly over the last three years.

Make increased revenue 4.7% with Authorisation Boost

Make's transaction failure issues were especially visible in some developing markets in Latin America and Asia, where locally run payments infrastructure might be less dependable. After implementing Authorisation Boost, Make saw a 4.7% uptick in revenue over three years.

"With Authorisation Boost, it takes milliseconds for Stripe to accept that card and allow us to charge that customer," said Luong. "That's a huge group of transactions we might be losing without that feature."

Smart Retries led to $1.2 million in recovered revenue

Adopting Smart Retries meant Make could take advantage of smart dunning features to notify customers of failed payments and automatically retry transactions based on a variety of data-driven factors. These features helped Make keep thousands of subscriber accounts, and $1.2 million in revenue, that otherwise would have been lost to involuntary churn.

We didn't consider anyone else but Stripe when we needed a payment provider for Make. Stripe is so developer friendly in the eyes of our engineers, and Stripe's documentation is excellent. Those were key factors in leading us to Stripe.