Las sociedades en comandita simple (société en commandite simple o SCS) son una estructura jurídica relativamente poco común en Francia. Se caracterizan por tener una clara división de funciones, es decir, los socios colectivos tienen responsabilidad ilimitada y los socios comanditarios tienen responsabilidad limitada.

A continuación, te explicamos las ventajas y desventajas de esta estructura, así como los pasos necesarios para constituir una SCS en Francia.

¿Qué contiene este artículo?

- ¿Qué es una SCS?

- ¿Cómo funciona una SCS?

- ¿Por qué optar por constituir una SCS?

- Las ventajas de una SCS

- ¿Cómo transfiero acciones en una SCS?

- ¿Cuáles son las diferencias entre una SCS, una SCA y una SA?

- Cómo constituir una SCS

¿Qué es una SCS?

Una SCS es una sociedad comercial que se caracteriza por tener dos tipos de socios: socios colectivos y socios comanditarios. Las SCS pueden dedicarse a cualquier tipo de actividad comercial, excepto en sectores como la banca, los seguros y ciertas profesiones reguladas.

¿Cómo funciona una SCS?

Para constituir una SCS, se requieren al menos dos socios:

Socio colectivo: gestiona la empresa y es responsable a nivel personal de todas sus deudas.

Socio comanditario: aporta capital y tiene responsabilidad limitada

Los socios pueden ser personas físicas o jurídicas. No hay un límite establecido para el monto de capital que se puede aportar, pero se debe aportar en forma de efectivo o bienes (como equipos o bienes inmuebles). Esta estructura jurídica ofrece una flexibilidad atractiva, pero es importante comprender que los socios colectivos tienen responsabilidad ilimitada.

Funciones

Los socios colectivos desempeñan un papel fundamental en la gestión de una SCS. Como socios activos, asumen las responsabilidades jurídicas de los operadores comerciales y supervisan la gestión diaria de la empresa.

Por lo general, todos los socios generales actúan como socios gerentes. Sin embargo, a través del acuerdo de asociación se puede modificar esto y asignar responsabilidades de gestión a uno o más socios específicos, o a personas ajenas a la sociedad.

Por otro lado, los socios comanditarios desempeñan un papel más pasivo. Supervisan la gestión y el capital necesario para que la empresa crezca. Participan a través de las juntas generales anuales y, si así lo prevé el acta constitutiva de la empresa, a través de una junta directiva.

Sin embargo, la función de los socios comanditarios se limita a la supervisión; no participan en la gestión diaria de la empresa y no firman contratos ni negocian con terceros en nombre de la SCS.

Gestión

En los estatutos de una SCS se definen los procedimientos de toma de decisiones. Un socio colectivo o una cuarta parte de los socios comanditarios pueden convocar una junta general para abordar asuntos rutinarios.

Por otro lado, para modificar los estatutos, se requiere una aprobación más amplia, es decir, el consentimiento unánime de los socios colectivos y de la mayoría de los socios comanditarios.

Responsabilidades financieras

Los socios colectivos tienen responsabilidades ilimitadas con responsabilidades conjuntas. Por lo tanto, los acreedores de la SCS pueden solicitar el reembolso de las deudas a cualquier socio colectivo con responsabilidad personal ilimitada. Deben utilizar sus activos personales para cubrir las obligaciones de la empresa.

La responsabilidad de los socios comanditarios se limita al monto de sus aportes. Esto garantiza que sus activos personales estén protegidos en caso de que la empresa tenga dificultades financieras.

Regímenes fiscales de las SCS

Cada socio colectivo está sujeto al impuesto sobre los ingresos (IR) sobre su participación en las ganancias de la sociedad. Esta participación se calcula en función de sus derechos en la sociedad. Si la SCS ha optado por estar sujeta al impuesto a los ingresos de las sociedades (IS), los socios colectivos tienen derecho a una deducción del 10 % fija para los gastos empresariales.

Los socios comanditarios están sujetos al IS sobre su participación en las ganancias. Si se distribuyen dividendos, también están sujetos al IR de forma individual.

Por ejemplo, si un socio colectivo recauda EUR 10,000 de ganancias, estará sujeto al IR sobre ese monto. Sin embargo, el socio comanditario está sujeto a una doble imposición: en primer lugar, a nivel de la sociedad y en segundo lugar, a nivel personal sobre los ingresos por dividendos. Si la sociedad recauda EUR 100,000 de ganancias y distribuye EUR 10,000 en dividendos a un socio comanditario, la sociedad estará sujeta al IS sobre los EUR 100,000 y el socio comanditario estará sujeto al IR sobre el dividendo de EUR 10,000.

Es importante tener en cuenta que esta distinción no se aplica si la SCS opta por convertirse en una sociedad anónima. En este caso, todos los socios, ya sean colectivos o comanditarios, están sujetos al mismo régimen fiscal. Esto suele ser más favorable porque las ganancias se gravan solo una vez al nivel de la empresa.

Seguro social (SSI) para los socios

El estatus de SSI de los socios de una SCS depende de si son socios colectivos o comanditarios.

Los socios colectivos, independientemente de que participen o no en la gestión, se clasifican como trabajadores autónomos. Por lo tanto, están cubiertos por el sistema general de SSI para trabajadores autónomos. Este estatus les brinda acceso a ciertos beneficios sociales, como el seguro médico, las pensiones de jubilación y la indemnización por pérdida de trabajo.

El estatus de los socios comanditarios depende de su actividad dentro de la SCS. Si realizan tareas de forma activa y regular dentro de la empresa con la supervisión de otro socio, pueden clasificarse como empleados. En tales casos, están cubiertos por el sistema general de SSI y gozan de los mismos derechos y obligaciones que cualquier otro empleado, incluidos los beneficios por enfermedad, jubilación y desempleo. Por otro lado, si no realizan ninguna tarea de forma activa, no estarán inscritos en ningún plan de SSI obligatorio.

¿Por qué optar por constituir una SCS?

A diferencia de otras estructuras jurídicas, la SCS ofrece un equilibrio entre la flexibilidad de la estructura empresarial y la protección de los activos de los inversores. Suele ser la estructura preferida de las startups o las empresas de rápido crecimiento que necesitan capital pero quieren mantener cierta independencia en cuanto a la gestión.

Los fundadores, que suelen ser emprendedores apasionados con recursos limitados, pueden ofrecer su experiencia y habilidades como socios colectivos. Por ejemplo, una startup que esté trabajando en una nueva tecnología de inteligencia artificial (IA) podría optar por una estructura de SCS para aprovechar la experiencia de sus fundadores y, al mismo tiempo, atraer a inversores especializados en el sector.

La SCS también les permite a los miembros de la familia con diferentes funciones y contribuciones trabajar juntos dentro de la misma estructura comercial. Por ejemplo, una empresa familiar de oficios transmitida de generación en generación podría convertirse en una SCS para permitir que los hijos participen en la gestión y proteger los activos de los abuelos al mismo tiempo.

Stripe Payment puede permitirles ahorrar tiempo y recursos técnicos tanto a las startups como a las grandes empresas multinacionales. Una variedad de herramientas facilitan los pagos para las SCS y todo tipo de empresas.

Las ventajas de una SCS

La SCS es una estructura jurídica flexible adecuada para diversos tipos de empresas, desde startups hasta empresas establecidas.

Una de las principales ventajas de la SCS es su organización eficiente con una clara división de funciones: los socios colectivos se encargan de la gestión diaria, mientras que los socios comanditarios aportan recursos financieros. Esta estructura permite que la toma de decisiones se lleve a cabo de forma rápida y eficaz.

La SCS les proporciona a los inversores seguridad garantizada. Su responsabilidad se limita al monto de sus aportes, lo cual garantiza la protección de sus activos personales en caso de que haya dificultades financieras.

Esta estructura jurídica también ofrece una gran flexibilidad en términos de financiación. Conecta a emprendedores con proyectos e inversores interesados en contribuir a su crecimiento. Esta estructura híbrida permite el acceso a diferentes fuentes de capital que se adaptan a las necesidades específicas de la empresa.

¿Cómo transfiero acciones en una SCS?

La transmisión de acciones por parte de socios colectivos y comanditarios se rige por diferentes normas. Las acciones no pueden transmitirse a otros socios, a herederos o beneficiarios, ni a terceros sin el consentimiento unánime de todos los socios.

A través del acuerdo de asociación, se puede permitir la transferencia de acciones de un socio colectivo si todos los socios colectivos y la mayoría de los socios comanditarios dan su consentimiento. También se puede permitir, mediante dicho acuerdo, la transferencia de acciones de socios comanditarios a otros socios o a terceros, con el consentimiento de todos los socios colectivos y la mayoría de los socios comanditarios.

El consentimiento de los socios para la transmisión de acciones deberá obtenerse por escrito en una junta general. Si no se recibe una denegación por escrito en un plazo de tres meses a partir de la solicitud, el consentimiento se considerará otorgado.

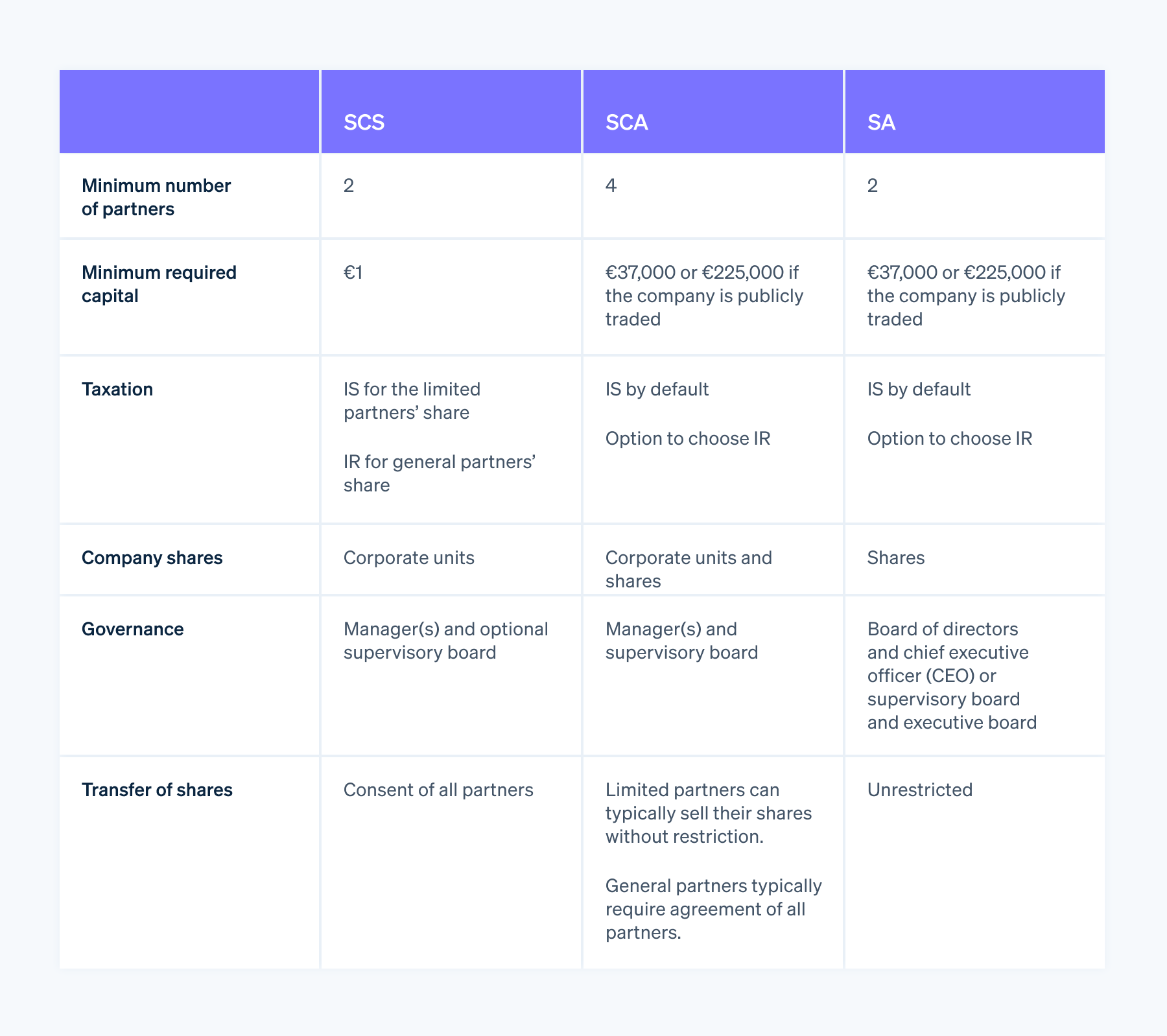

¿Cuáles son las diferencias entre una SCS, una SCA y una SA?

Las SCS comparten determinadas características con las sociedades en comandita por acciones (société en commandite par actions o SCA) y con las sociedades anónimas (société anonyme, o SA). Sin embargo, las SCS suelen ser menos rígidas.

A diferencia de la SCA, que puede emitir tanto acciones como unidades corporativas, y la SA, que solo puede emitir acciones, la SCS solo puede emitir unidades corporativas.

Además, se requiere un mínimo de dos socios para constituir una SCS, a diferencia de los cuatro socios que se requieren para constituir una SCA. La SCA, de forma similar a la SA, requiere un capital mínimo de EUR 37,000, mientras que la SCS no tiene tal requisito de capital mínimo más allá de un monto de euros simbólico.

Es importante que consideres con atención cada tipo de entidad para que selecciones la que mejor se adapte a las necesidades de tu empresa.

Cómo constituir una SCS

Al igual que lo que sucede en el caso de otras estructuras comerciales, para constituir una SCS se debe cumplir un proceso específico y riguroso. Debes realizar varios trámites legales para constituir una SCS.

Estos son los pasos clave:

- Redacta los estatutos: En este documento fundacional se describe la organización de la empresa. Incluye las funciones y responsabilidades de cada socio.

- Deposita el capital social: La legislación francesa no establece un monto mínimo de capital social para las SCS. Esto permite que los socios puedan elegir cualquier monto de capital social, incluso un monto de euros simbólico.

- Publica un aviso legal: Para informar al público sobre la constitución de la SCS, debes publicar un anuncio de constitución en un boletín oficial.

- Presenta los documentos necesarios para el registro: Envía todos los documentos, incluidos los estatutos constitutivos, la prueba de la publicación oficial y otros documentos de respaldo, a la oficina del secretario del Tribunal de Comercio. Estos trámites ahora se pueden completar en línea a través del portal de trámites comerciales.

- Obtén el registro: Cuando se aprueba la solicitud, la SCS recibe un número de identificación único (SIREN) y se la inscribe oficialmente en el Registro Mercantil y de Sociedades (registre du commerce et des sociétés o RCS).

Para obtener más información específica sobre la constitución de una SCS, visita el sitio web oficial del gobierno francés.

El contenido de este artículo tiene solo fines informativos y educativos generales y no debe interpretarse como asesoramiento legal o fiscal. Stripe no garantiza la exactitud, la integridad, adecuación o vigencia de la información incluida en el artículo. Si necesitas asistencia para tu situación particular, te recomendamos consultar a un abogado o un contador competente con licencia para ejercer en tu jurisdicción.