La società in accomandita semplice (société en commandite simple o SCS) è una struttura giuridica relativamente rara in Francia. È definita da una chiara divisione dei ruoli, con i soci accomandatari che hanno responsabilità illimitata e i soci accomandanti che hanno responsabilità limitata.

Di seguito, ti aiuteremo a comprendere i vantaggi e gli svantaggi di questa struttura, nonché i passaggi necessari per costituire una SCS in Francia.

Di cosa tratta questo articolo?

- Cos'è una SCS?

- Come funziona una SCS?

- Perché optare per la SCS?

- Vantaggi di una SCS

- Come si trasferiscono le quote di una SCS?

- Quali sono le differenze tra SCS, SCA e SA?

- Come costituire una SCS

Cos'è una SCS?

Una SCS è una partnership commerciale caratterizzata da due categorie di soci: soci accomandatari e soci accomandanti. La SCS può svolgere qualsiasi tipo di attività, ad eccezione di settori come quello bancario o assicurativo e di alcune professioni regolamentate.

Come funziona una SCS?

Per costituire una SCS sono necessari almeno due soci:

Socio accomandatario: Gestisce l'attività ed è personalmente responsabile per tutti i relativi debiti

Socio accomandante: Fornisce capitale e ha responsabilità limitata

I soci possono essere persone fisiche o società. Non c'è limite all'importo del capitale che può essere conferito, ma esso deve consistere in denaro contante o proprietà (quali attrezzature o immobili). Questa struttura legale offre un'interessante flessibilità, ma è importante comprendere che i soci accomandatari hanno una responsabilità illimitata.

Ruoli

I soci accomandatari svolgono un ruolo centrale nella gestione di una SCS. In qualità di partner attivi, si assumono le responsabilità legali degli operatori commerciali e sovrintendono alla gestione quotidiana dell'attività.

Tutti i soci accomandatari sono in genere designati come soci amministratori. Tuttavia, l'accordo di partnership può modificare questa disposizione assegnando le responsabilità di gestione a uno o più soci specifici o a persone esterne alla partnership.

Per contro, i soci accomandanti svolgono un ruolo più passivo. Forniscono la supervisione della gestione e il capitale necessario per far crescere l'attività. Il loro coinvolgimento avviene attraverso assemblee generali annuali e, se previsto dallo statuto della società, un consiglio di amministrazione.

Tuttavia, i soci accomandanti sono limitati a un ruolo di supervisione: non partecipano alla gestione quotidiana della società e non firmano contratti, né negoziano con terzi per conto della SCS.

Gestione

Lo statuto di una SCS definisce le procedure decisionali. Per le questioni ordinarie, un'assemblea generale può essere convocata da un socio accomandatario o da un quarto dei soci accomandanti.

Le modifiche statutarie richiedono un'approvazione più ampia: consenso unanime dei soci accomandatari e della maggioranza dei soci accomandanti.

Passività finanziarie

I soci accomandatari hanno responsabilità illimitate con responsabilità congiunte. Di conseguenza, i creditori della SCS possono chiedere il rimborso dei debiti a qualsiasi socio accomandatario che abbia una responsabilità personale illimitata. Questi ultimi devono utilizzare il loro patrimonio personale per coprire gli obblighi dell'azienda.

La responsabilità dei soci accomandanti è limitata all'importo dei loro contributi. In questo modo si garantisce la protezione del loro patrimonio personale nel caso in cui l'azienda si trovi in difficoltà finanziarie.

Regimi fiscali in una SCS

Ogni socio accomandatario è soggetto all'imposta sul reddito (IR) sulla sua quota di utili della società. Questa quota è calcolata in base ai suoi diritti nella società. Se la SCS ha scelto l'imposta sul reddito delle società (IS), i soci accomandatari hanno diritto a una detrazione forfettaria del 10% per le spese aziendali.

I soci accomandanti sono soggetti all'IS sulla loro quota di utili. Se vengono distribuiti dividendi, sono soggetti anche all'IR a livello del singolo socio.

Ad esempio, se un socio accomandatario guadagna 10.000 € di utili, sarà soggetto all'IR su tale importo. Tuttavia, il socio accomandante si trova ad affrontare una doppia imposizione: prima a livello di società e poi personalmente sul reddito da dividendi. Se la società guadagna 100.000 € di utili e distribuisce 10.000 € di dividendi a un socio accomandante, la società pagherà l'IS sui 100.000 € e il socio accomandante pagherà l'IR sul dividendo di 10.000 €.

È importante tenere presente che questa distinzione smette di essere applicata se la SCS sceglie di essere una società. In questo caso, tutti i soci, siano essi accomandatari o accomandanti, sono soggetti allo stesso regime fiscale. Questo di solito è più favorevole in quanto gli utili vengono tassati una sola volta a livello aziendale.

Previdenza sociale (SSI) per i soci

Lo status SSI dei soci di una SCS dipende dal fatto che siano soci accomandatari o accomandanti.

I soci accomandatari, indipendentemente dal fatto che siano coinvolti o meno nella gestione, sono classificati come lavoratori autonomi. Pertanto, sono coperti dal sistema SSI generale per i lavoratori autonomi. Questo status dà loro accesso a determinate prestazioni sociali, tra cui l'assicurazione sanitaria, le pensioni di vecchiaia e l'indennità per perdita del lavoro.

Lo status dei soci accomandanti dipende dalla loro attività all'interno della SCS. Se svolgono attivamente e regolarmente compiti all'interno dell'azienda sotto l'autorità di un altro socio, possono essere classificati come dipendenti. In tali casi, sono coperti dal sistema SSI generale e godono degli stessi diritti e doveri di qualsiasi altro dipendente, comprese le prestazioni per malattia, pensionamento e disoccupazione. Al contrario, se non svolgono alcuna attività effettiva, non saranno iscritti ad alcun regime SSI obbligatorio.

Perché optare per la SCS?

Rispetto ad altre forme giuridiche, la SCS trova un equilibrio tra la flessibilità di una struttura aziendale e la protezione del patrimonio degli investitori. È spesso l'opzione preferita di start-up o aziende in rapida crescita che hanno bisogno di capitale ma vogliono mantenere una certa indipendenza gestionale.

I fondatori, in genere imprenditori appassionati con risorse limitate, possono offrire la loro esperienza e le loro capacità come soci accomandatari. Ad esempio, una start-up che lavora su una nuova tecnologia nel campo dell'intelligenza artificiale (IA) potrebbe scegliere la struttura della SCS per utilizzare le competenze dei propri fondatori, attirando al contempo investitori specializzati nel settore.

La SCS consente inoltre ai membri di una famiglia con ruoli e contributi diversi di lavorare insieme all'interno della stessa struttura aziendale. Ad esempio, un'attività artigianale familiare tramandata di generazione in generazione potrebbe essere convertita in una SCS, consentendo ai più giovani di partecipare alla gestione proteggendo al contempo i beni dei nonni.

Stripe Payment può far risparmiare tempo e risorse tecniche sia alle start-up che alle grandi multinazionali. Un'ampia gamma di strumenti consente di semplificare i pagamenti per le SCS e per tutti i tipi di attività.

Vantaggi di una SCS

La SCS è una struttura giuridica flessibile adatta a vari tipi di attività, dalle start-up alle aziende consolidate.

Uno dei principali vantaggi della SCS è la sua efficiente organizzazione con una chiara divisione dei ruoli: i soci accomandatari si occupano della gestione quotidiana, mentre i soci accomandanti contribuiscono con risorse finanziarie. Questa struttura consente un processo decisionale rapido ed efficace.

La SCS offre agli investitori una sicurezza garantita. La loro responsabilità è limitata all'importo dei propri contributi, proteggendo il loro patrimonio personale in caso di difficoltà finanziarie.

Questa forma giuridica offre anche una grande flessibilità in termini di finanziamento. Mette in contatto gli imprenditori con progetti con investitori interessati a contribuire alla loro crescita. Questa struttura ibrida consente l'accesso a diverse fonti di capitale su misura per le esigenze specifiche dell'azienda.

Come si trasferiscono le quote di una SCS?

Il trasferimento di quote da parte di soci accomandatari e accomandanti è disciplinato da norme diverse. Le quote non possono essere trasferite tra soci, ai loro eredi o beneficiari o a terzi senza il consenso unanime di tutti i soci.

L'accordo di partnership può consentire il trasferimento delle quote di un socio accomandatario se tutti i soci accomandatari e la maggioranza dei soci accomandanti acconsentono. L'accordo di partnership può inoltre consentire il trasferimento di quote di un socio accomandante tra i soci o a terzi con il consenso di tutti i soci accomandatari e della maggioranza dei soci accomandanti.

Il consenso dei soci al trasferimento di quote deve essere ottenuto per iscritto in occasione di un'assemblea generale. Se entro tre mesi dalla richiesta non perviene alcun rifiuto scritto, il consenso si considera concesso.

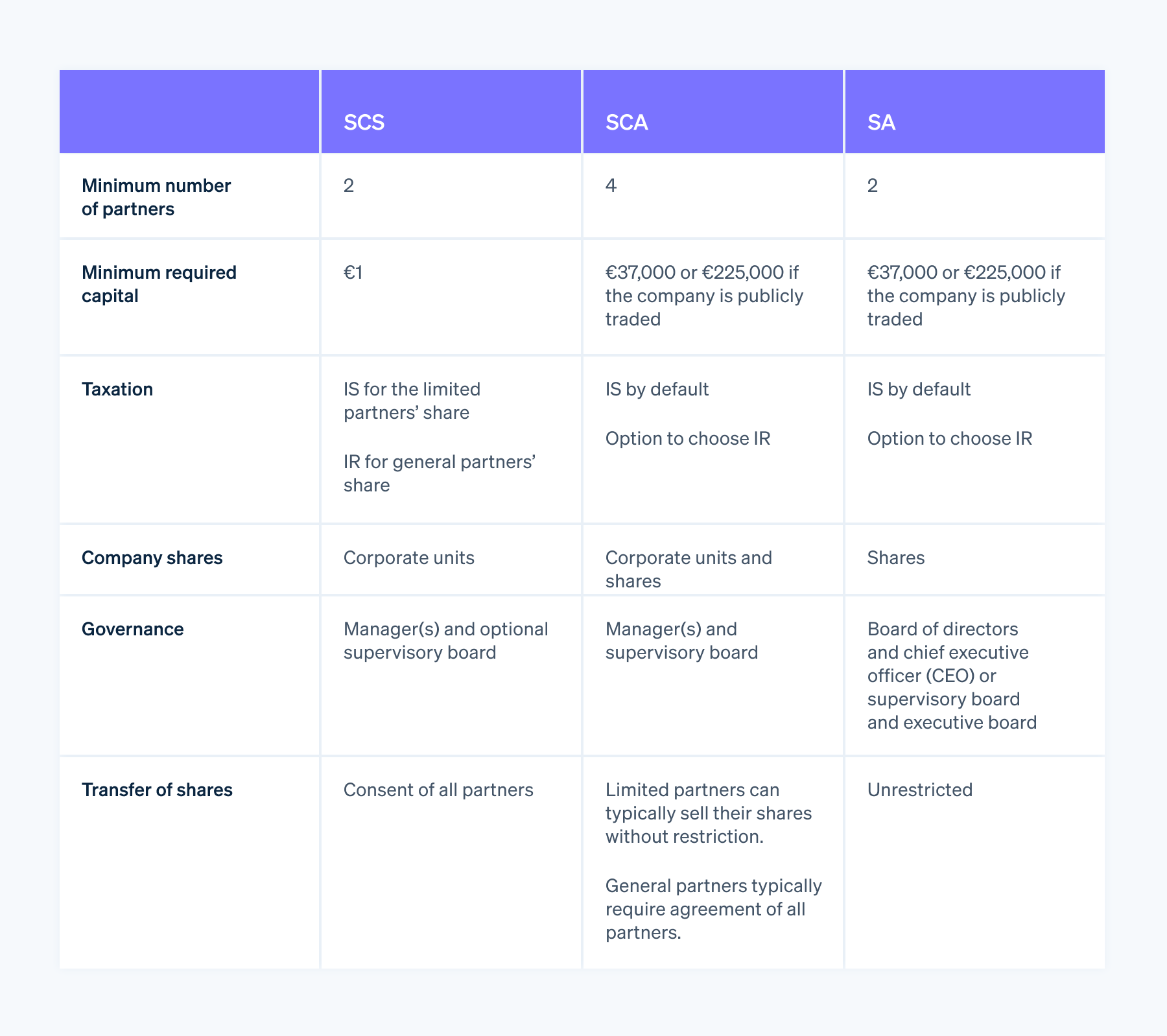

Quali sono le differenze tra SCS, SCA e SA?

La SCS condivide alcune caratteristiche con la società in accomandita semplice per azioni (société en commandite par actions o SCA) e con la società per azioni (société anonyme o SA). Tuttavia, la SCS è generalmente meno rigida.

A differenza della SCA, che può emettere sia azioni che quote societarie, e della SA, che si limita all'emissione di azioni, la SCS può emettere solo quote societarie.

Inoltre, per costituire una SCS è necessario un minimo di due soci, rispetto ai quattro di una SCA. La SCA, analogamente alla SA, richiede un capitale minimo di 37.000 €, mentre la SCS non ha un requisito patrimoniale minimo di questo tipo al di là di un euro simbolico.

È importante considerare attentamente ogni tipo di entità per selezionare quella più adatta alle proprie esigenze aziendali.

Come costituire una SCS

Analogamente ad altre strutture aziendali, la SCS richiede il rispetto di una procedura specifica e rigorosa. Per costituire una SCS è necessario espletare diverse formalità legali.

I passaggi chiave sono:

- Redazione dello statuto: Questo documento costitutivo delinea l'organizzazione dell'attività. Include i ruoli e le responsabilità di ciascun socio.

- Deposito del capitale sociale: La legge francese non impone un importo minimo per il capitale sociale di una SCS. Ciò consente ai soci di scegliere qualsiasi importo per il capitale sociale, anche un minimo di un euro simbolico.

- Pubblicazione dell'avviso legale: Per informare il pubblico sulla costituzione della SCS, è obbligatoria la pubblicazione di un avviso di costituzione su una gazzetta ufficiale.

- Deposito della registrazione: Occorre inviare il file completo, tra cui l'atto costitutivo, la prova della pubblicazione legale e altri documenti di supporto, alla cancelleria del tribunale commerciale. Tali formalità possono ora essere espletate online attraverso il portale delle formalità commerciali.

- Ottenimento della registrazione: Una volta che la domanda è stata approvata, la SCS riceve un numero di identificazione univoco (SIREN) ed è ufficialmente registrata presso il Registro del Commercio e delle Società (Registre du commerce et des sociétés o RCS).

Per ulteriori informazioni sulle specifiche della costituzione di una SCS, visita il sito ufficiale del governo francese.

I contenuti di questo articolo hanno uno scopo puramente informativo e formativo e non devono essere intesi come consulenza legale o fiscale. Stripe non garantisce l'accuratezza, la completezza, l'adeguatezza o l'attualità delle informazioni contenute nell'articolo. Per assistenza sulla tua situazione specifica, rivolgiti a un avvocato o a un commercialista competente e abilitato all'esercizio della professione nella tua giurisdizione.