Receiving payouts from sales might seem straightforward: Customers pay you in exchange for whatever goods or services your business provides, and those funds are deposited into your bank account. But when you work with a payment processor such as Stripe, sales revenue takes a slightly longer journey from your customer's bank account to yours. That's where payouts come in.

What are payouts and what do you need to know about them, as a business that uses Stripe?

What's in this article?

- What is a payout?

- Stripe payout schedule

- Payout speed

- Currencies and bank accounts for Stripe payouts

- Stripe Instant Payouts

- Who is eligible for Instant Payouts?

- Who is eligible for Instant Payouts?

- Stripe payout limits

- Stripe payout fees

What is a payout?

A payout is the transfer of funds from a merchant account to the business's general bank account. Since Stripe provides merchant account functionality to our users, we issue payouts to the businesses we support. For businesses that use Stripe-powered platforms and marketplaces to sell to customers, the payouts will usually come from those companies rather than Stripe.

Stripe payout schedule

After your first payout, subsequent payouts will take place according to your payout schedule – the cadence at which Stripe sends money to your bank account. In most countries, Stripe defaults to an automatic daily payout schedule, but you can change this setting in the Dashboard to any of the following payout schedules:

- Daily automatic

- Weekly automatic

- Monthly automatic

- Manual

Weekly and monthly automatic payout schedules allow you to choose which day of the week or month you want the payouts to be initiated. You can initiate manual payouts at any time.

While most Stripe account holders are able to specify which payout schedule they prefer, certain countries have restrictions on payout schedules:

- In Brazil and India, payouts are always automatic and daily.

- In Japan, daily payouts are not available.

Payout speed

Your payout schedule refers to how frequently funds from your transactions are paid out to your bank account. Your payout speed refers to how quickly funds from transactions become available to be paid out. Stripe operates at its own payment speed, and other payment processors and merchant account providers will have different payment speeds.

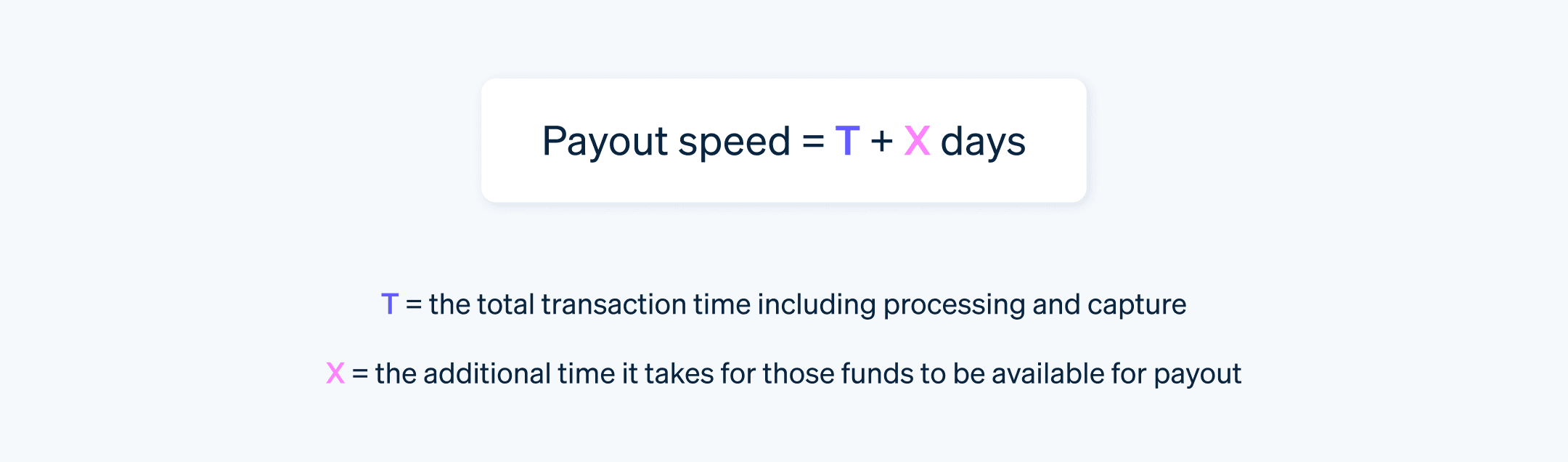

Because payout speed isn’t the same for all businesses, it’s typically expressed as a formula:

Payout speed = T + X days

T is the total transaction time – including processing and capture – and X is the additional time it takes for those funds to be available for payout. For example, if you’ve elected to receive daily payouts, and you’re located in a country where Stripe’s payout speed is T+3 (our most common payout speed worldwide), then your payout on any given day will comprise funds from transactions that occurred at least three business days previously. There is some variation here, because funds from some transactions take longer to capture after authorisation than others.

Stripe’s payout speed varies from country to country. You can find the payout speed for your country here.

For Stripe users, aside from payout frequency, the time it takes to receive a payout from your customer transactions can vary depending on other factors such as which industry you work in and the risk level of your business. High-risk businesses have a payout speed of 14 days, while some lower-risk businesses in the US and Canada are eligible for an accelerated payout speed of 3 days. Different countries are also subject to varying payout speeds. If you use a platform or marketplace, even one that uses Stripe to accept and process payments, there might be additional considerations that will impact your payout speed and cadence.

In most cases, when you begin using Stripe to process live payments from your customers, you’ll receive your first payout 7–14 days after accepting your first customer payment. This first payout usually takes a bit longer than subsequent payouts, especially if you operate in certain countries or work in a high-risk industry.

Currencies and bank accounts for Stripe payouts

Stripe accepts payments in over 135 currencies, and you can choose the currency in which you'd like to receive your payouts. In most cases, your bank account needs to be located in a country where the desired settlement currency is the official currency. It's also possible to get payouts in alternative currencies, for an additional fee.

In some countries, you can add extra bank accounts if you want to enable settlements and payouts in additional currencies. You cannot, however, receive settlements and payouts in multiple currencies to the same bank account. For example, if you're located in Sweden and you want to receive payouts in both EUR and SEK, you will need to open multiple bank accounts and designate one for each currency.

You can manage your bank accounts and settlement currency settings by going to the Bank accounts and scheduling page under Settings in your Stripe Dashboard.

Stripe Instant Payouts

Stripe Instant Payouts offers an alternative to Stripe's normal payout schedule. This type of payout can be requested on any day or at any time, including weekends and holidays, and funds will appear in your bank account within 30 minutes. Using Instant Payouts allows you to send funds to a supported debit card – in the US, Canada and Singapore – or bank account, which is available in the US and the UK.

Who is eligible for Instant Payouts?

Stripe provides Instant Payouts access to businesses that meet eligibility requirements and have been processing on Stripe for at least 60 days. Typically, Stripe offers Instant Payouts in the US, the UK, Canada and Singapore. To check your eligibility, visit your Dashboard.

Stripe payout limits

There are no limits on Stripe payout amounts, but there are required minimums before a payout can be initiated. Typically, the minimum payout amount is one base unit of the local currency. This means that if you're located in the US and you have less than 1¢ in your Stripe account, you'll need to wait until you've accepted more payments and increased your balance before you can receive a payout.

Stripe payout fees

Payouts are included in Stripe's fee structure, meaning Stripe won't charge you anything additional to initiate payouts. There's one exception: if you want to settle your payments and receive a payout to a domestic bank in an alternative currency. That said, Stripe does support some international currencies without an additional fee, but it depends on the country where your bank account is located and the currency in which you want your payout denominated. Here's more detail about various payout currencies and their associated fees.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.