An IBAN is required to enable the clear assignment of payment recipients when making international payments and payments within Europe. But what exactly is an IBAN and how is it structured? This article will explain what you need to know about the structure of an IBAN and where to find the IBAN for your account.

What’s in this article?

- What is an IBAN?

- How is an IBAN structured?

- How many digits does an IBAN have?

- How can you use an IBAN to find an account number?

- How can you tell which bank an IBAN belongs to?

What is an IBAN?

An IBAN is a standardized international bank account number, i.e., a number for your checking account that is valid worldwide. IBAN stands for “International Bank Account Number.” You will need an IBAN if you want to open an account in certain countries such as Germany, and if you want someone to transfer money to one of those countries, you will need to provide the sender with your IBAN. The same goes if you want to receive payouts—most ecommerce platforms will also require an IBAN.

The use of IBANs is now standard practice in more than 70 countries; however, the US, Canada, and Australia do not use the IBAN system. When you make or receive a payment with an IBAN, the numbers are checked by the bank. If the IBAN structure is deemed valid, the payment is received by the recipient bank within a few minutes. An IBAN is also required for payments by direct debit. Instant transfers are also possible, but it may take one or two days for the amount to be credited to the recipient’s account.

If a payment is made to an IBAN that does not exist, it won’t be successful. But if the incorrect IBAN does exist and it belongs to a different person, then that person will receive the money. In this case, you must contact your bank so that they can cancel the transfer as soon as possible. However, the recipient is not required to return the money to you. You can read more about this topic here.

How is an IBAN structured?

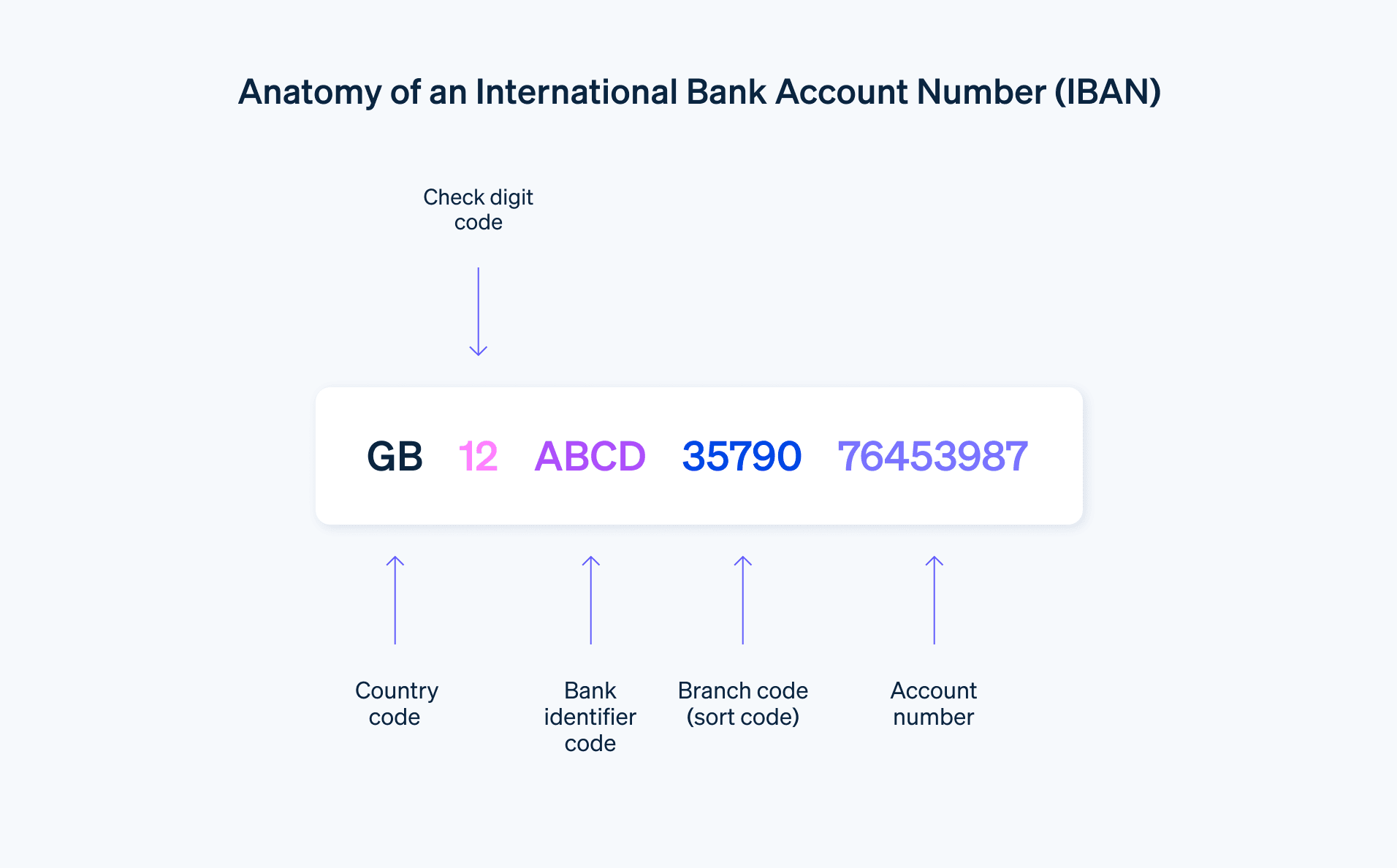

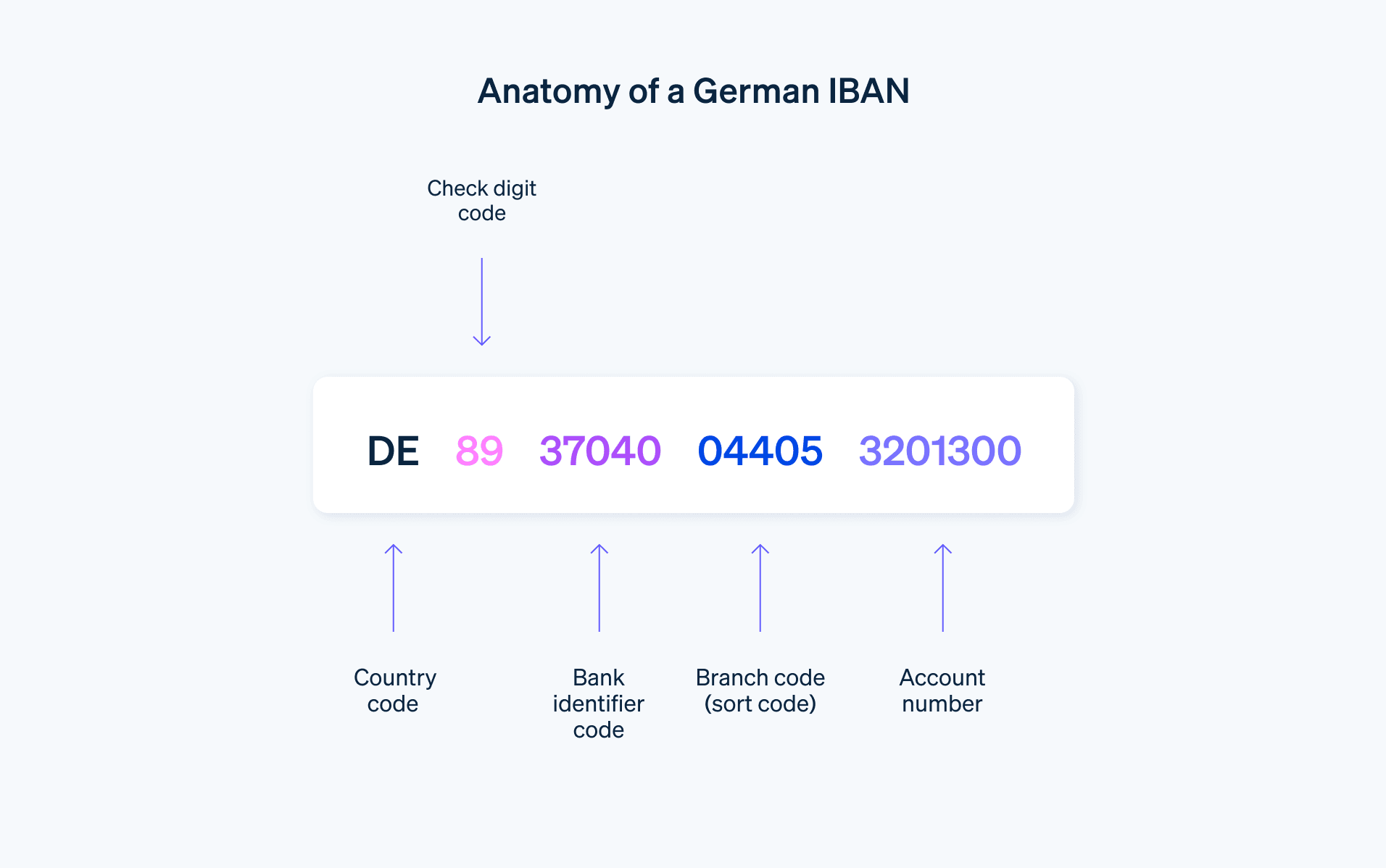

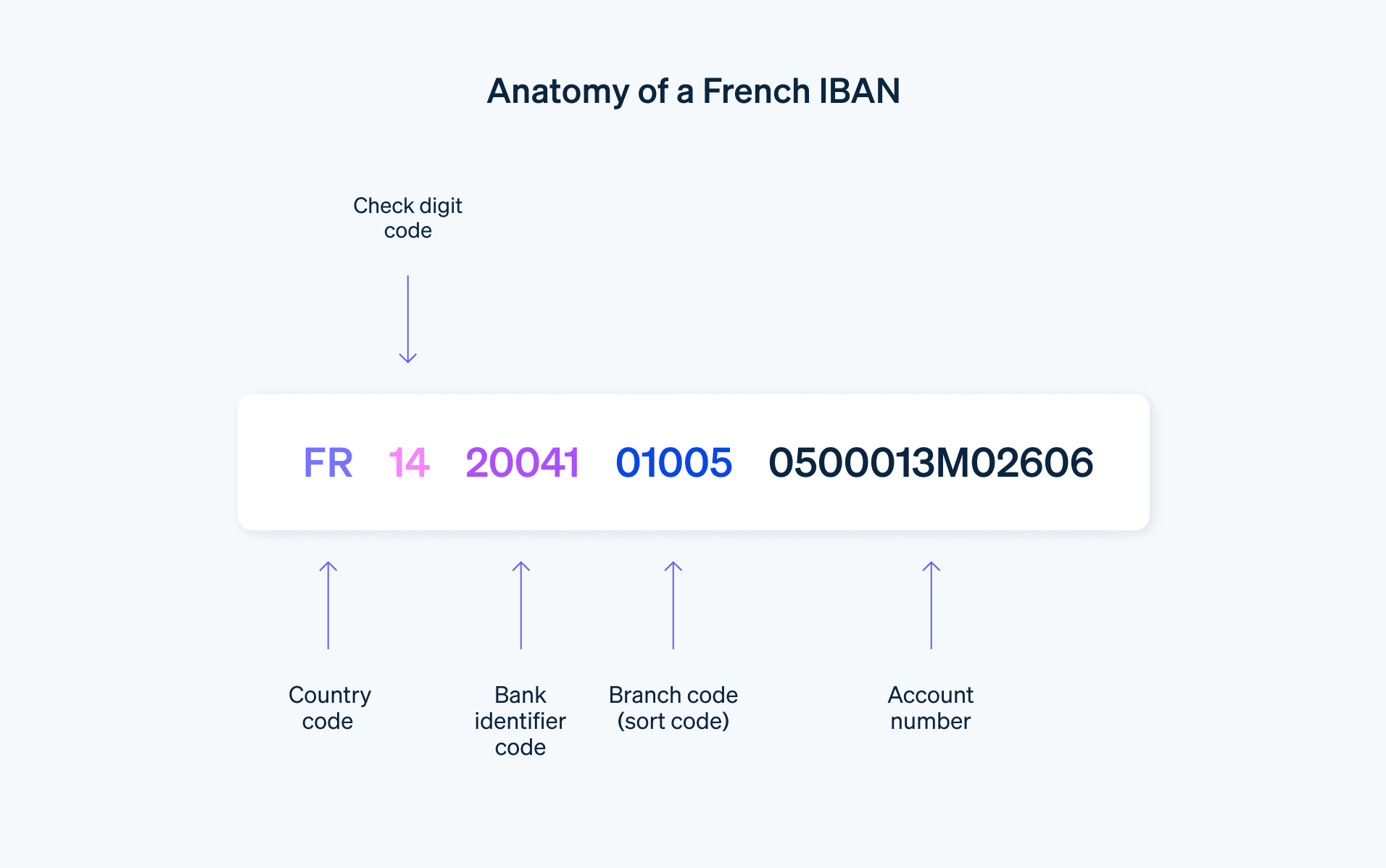

There are set rules for how an IBAN is formatted: the first two digits of the IBAN are the country code (e.g., “DE” for Germany or “FR” for France). This is followed by a two-digit check number and the national account code, the BBAN (Basic Bank Account Number). The check number is used to identify your checking account. It can, for example, prevent incorrect transfers in the event that an incorrect number has been entered elsewhere in the IBAN. The account code itself is composed of the sort code and the account number. These rules for the structure of an IBAN are set by the European Committee for Banking Standards.

Here are two examples of IBAN structures:

- IBAN for Germany: DE89 3704 0044 0532 0130 00

- IBAN for France: FR14 2004 1010 0505 0001 3M02 606

In the first example above, the country code “DE” represents Germany, the IBAN check digits are 89, the sort code is 37040044, and the account number is 0532013000.

In the second example, the country code “FR” represents France, the IBAN check digits are 14, followed by five digits for the bank code, five digits for the bank branch, 11 digits for the bank account number, and the last two digits (“06”) are the national code.

How many digits does an IBAN have?

The structure of the IBAN is always the same, but the length can vary depending on the country of origin. In some countries, the IBAN can be as long as 36 digits (the country code and up to 34 digits). In Germany and the UK, an IBAN is composed of 22 digits (the country code followed by 20 digits). A French IBAN is made up of 27 digits, and a Spanish IBAN contains 24 digits. An IBAN is valid worldwide.

How can you use an IBAN to find an account number?

Since the structure of an IBAN is always the same, it is easy to find the account number. If the account number itself is less than 10 digits long, zeros are added at the start to fill in the missing digits.

If you want to find your IBAN, you should be able to locate it from your online banking website. Alternatively, you can check with your bank or use an online calculator to work out your IBAN structure. Your IBAN can now also be found on your bank card.

If you want to make sure your IBAN is correct before making a bank credit transfer, you could try an online validation tool. Many banks perform IBAN verification automatically as part of their online bank credit transfer process, and you can often find IBAN calculators on your bank’s website.

How can you tell which bank an IBAN belongs to?

There is a quick way to decipher which bank is hidden inside the IBAN: the two-digit country code and the two check digits are followed by the sort code, which starts from the fifth digit of the IBAN. The sort code serves as a unique identifier for the bank.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.