Last updated: 04 July 2023

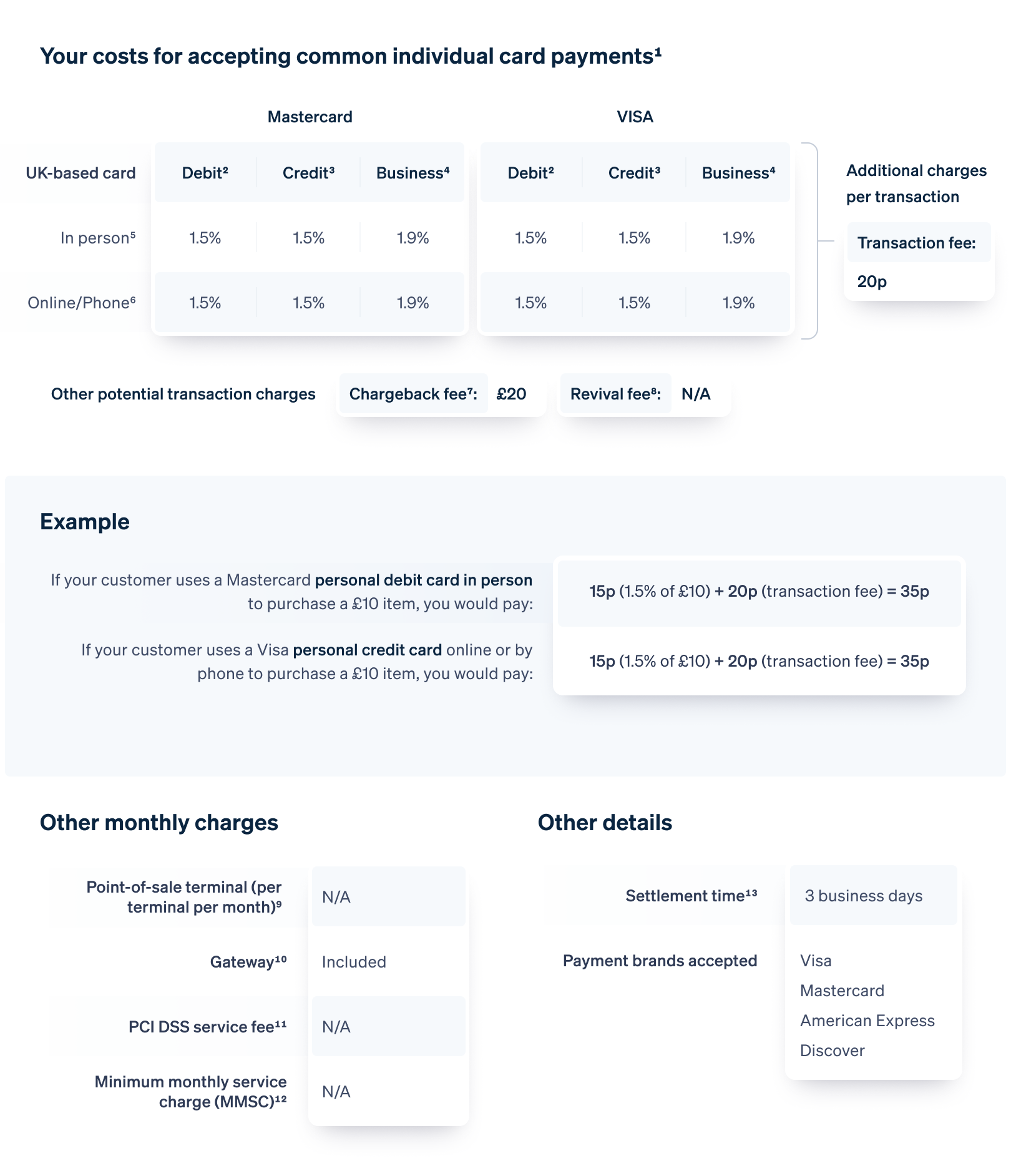

This summary shows our charges for card payments, and other important information about our service. You can use this to compare our service with other providers, to find the best deal for you. We are required to provide this information by the Payment Systems Regulator.

Footnotes

1 These are the most common used cards for most merchants. You pay us a percentage of each card payment you receive. This varies depending on the type of card. You may also accept other card brand and types, which may cost more. You can see the cards you accept in your transaction information.

2 Personal debit cards.

3 Personal credit cards.

4 Business debit cards.

5 A card payment where card, cardholder and merchant are all in the same place.

6 A card payment where card, cardholder and merchant are not all in the same place.

7 A processing fee for transactions disputed by the cardholder.

8 A fee to reactivate an inactive account. Stripe does not charge a revival fee.

9 Stripe does not charge a monthly fee, but sells Terminal devices instead.

10 A service for capturing and transferring payment data.

11 Charges relating to vour compliance with card security and anti-fraud standards.

12 Amount pavable if vour monthly transaction charges do not meet a minimum agreed amount.

13 Settlement time might vary. You can find more information in our docs.

14 Stripe payment processing fees do not differ based on annual card turnover, average order volume or MCC code. Contact Stripe Sales for custom pricing.